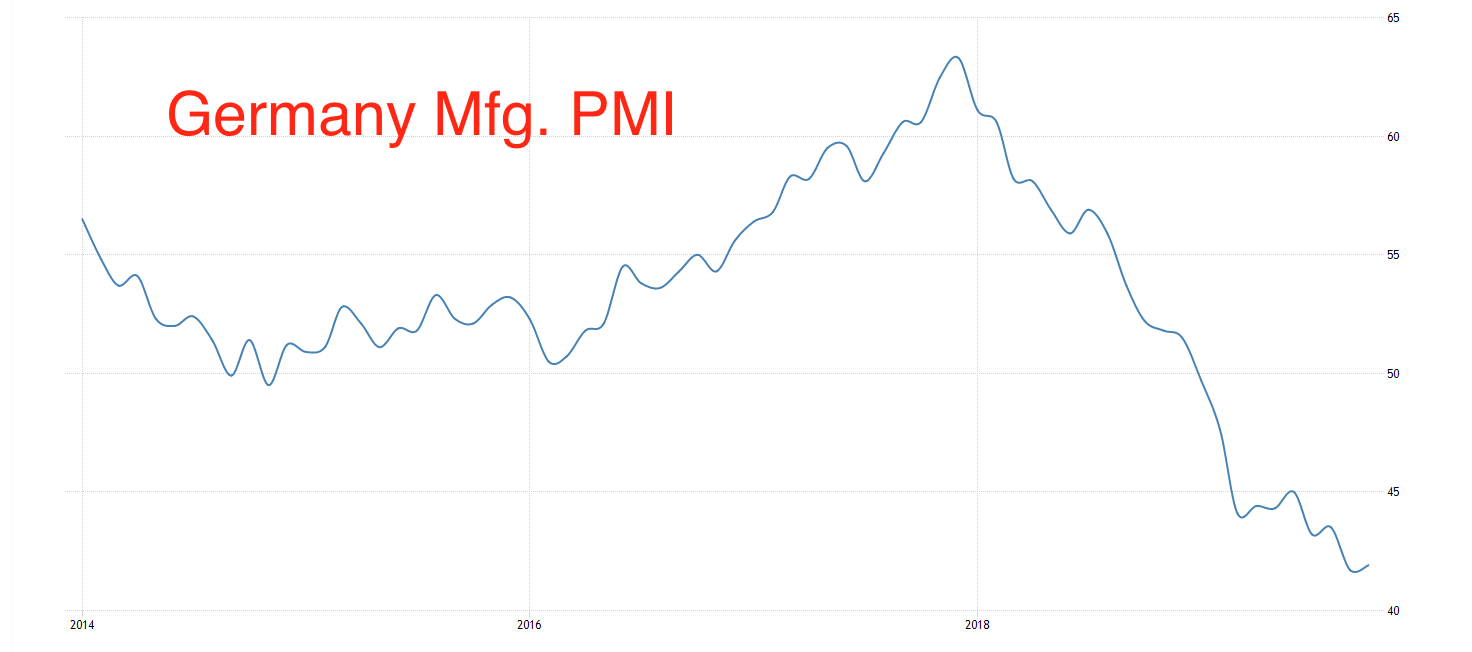

German Mfg. PMI: Years of QE are Down the Drain

Following the slack in manufacturing, employment in Germany showed first cracks - private sector unemployment rose slightly in October, for the first time in six years. The weakness of export sector has finally started to feed into household incomes, but it was only a matter of time. Protracted decline in the jobs market risks sending consumer confidence in robust downtrend, whittling down the years of massive QE and putting a dent on the effectiveness of fresh stimulus measures.

October PMI survey from Markit showed that a slight decrease in employment was mainly due to job cuts in the manufacturing sector, where labor demand is now at its lowest level in 10 years. Germany's export sector has been in recession for some time due to the synergy of sources of trade instability - the trade conflict between the US and China, Brexit and the threat of car tariffs from the US. This synchronized blow has led to excesses of current production capacities while also making it difficult to quickly reorganize supply chains. As we can see it was not possible to smooth out the effects.

In regard to Brexit storm, the destabilizing effect is most felt in the Germany’s services sector. The EU cannot afford now to disrupt a fragile deal with PM Johnson, or to take a passive / tenacious stance with increasing chances of the “No Deal”. This must be taken into account in assessing the prospects for additional delays/ EU concessions, rumors about which will likely begin to surface in the news following the October 31 vote.

The pace of job creation in the services sector has slowed to a minimum of three and a half years, Markit said. Markit chief economist Phil Smith believes that with the latest data, the hope of a “rebound” in the economy in the fourth quarter is virtually lost.

The manufacturing sector remains the main weak link in the economy, however, some of its characteristics either slowed down the decline or improved. The former includes production volumes and new orders, in which the recession slowed, among the latter - business confidence, which rose to a maximum of four months. But so far these are very early and conflicting signals that are usually more volatile than the employment subcomponent.

Activity index in the services and manufacturing sectors rose marginally to 48.6 points in October, falling short of expectations. A value of 50 points divides the zones of contraction and pickup.

Manufacturing activity index also edged up from 41.7 to 41.9 points.

Services index, on the contrary, fell to a 37-month low from 51.4 to 51.2 points in October, as the pace of creating new businesses in the sector fell to the lowest level since 2013.

The German economy is expected to show negative growth in the third quarter, which will mean a transition to a technical recession. Growth in 2020 is expected to be only 0.5%, without taking into account negative outcomes such as exacerbation of tariff tensions with the United States and disorderly Brexit.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.