GBP Shrugs Off Fresh BOE Rate Cut

BOE Cuts Rates Again

GBPUSD ended the day higher yesterday despite the BOE cutting rates by a further .25%, taking the headline UK interest rate down to 4%. Support for the move was less enthusiastic than expected, however, with the voting split shifting from 0 – 3 – 6 to 0 – 5 – 4, less dovish than the 0 – 8 – 1 split the market was anticipating. Indeed, the bank struck a far less dovish tone in its guidance, warning that upside inflationary pressures remained a key threat. With this in mind, the bank signalled that it was nearing the end of its easing cycle. Speaking at the post-meeting presser, BOE governor Bailey said that yesterday’s cut was a finely balanced decision and while rates remain on a downward path for now, any further rate cuts would need to be gradual and made carefully.

BOE Outlook

Looking ahead, expectations are now heavily divided over whether the bank will cut again this year. In its updated economic forecasts, the BOE now projects inflation to top 5.5% this year, driven by a surge in food prices. Against this backdrop, a further cut looks hard to back. As such, GBPUSD has room to continue higher near-term, particularly if current USD weakness extends into the September FOMC.

Technical Views

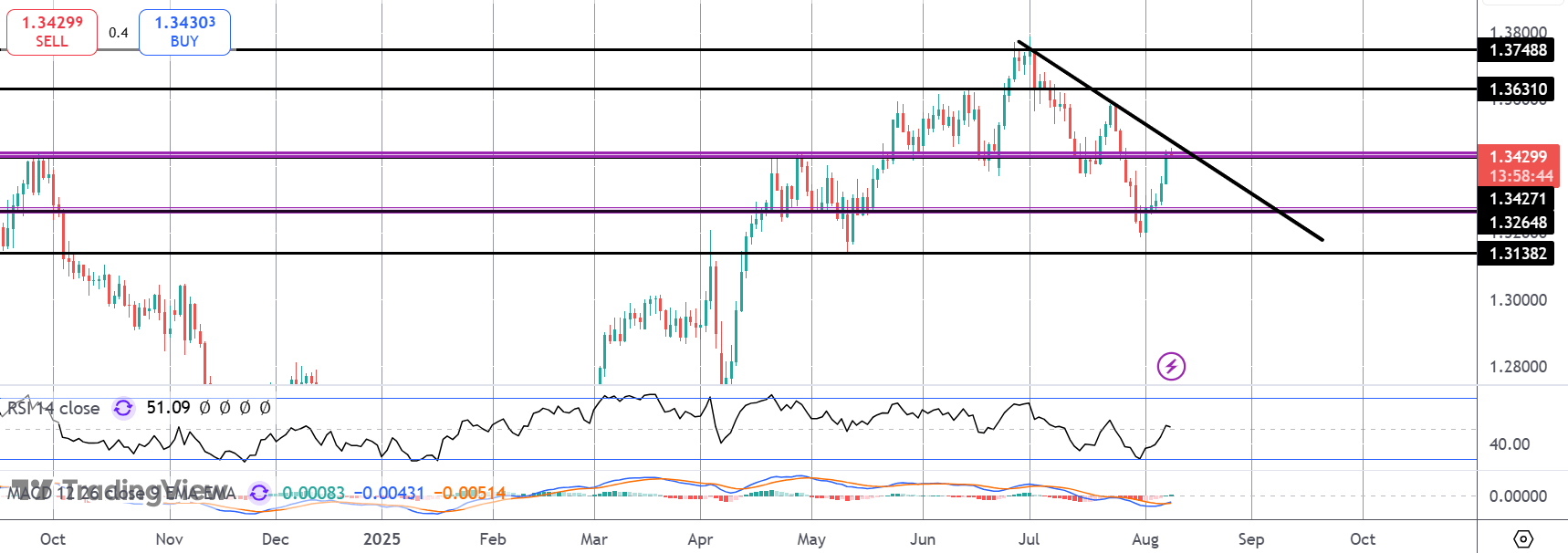

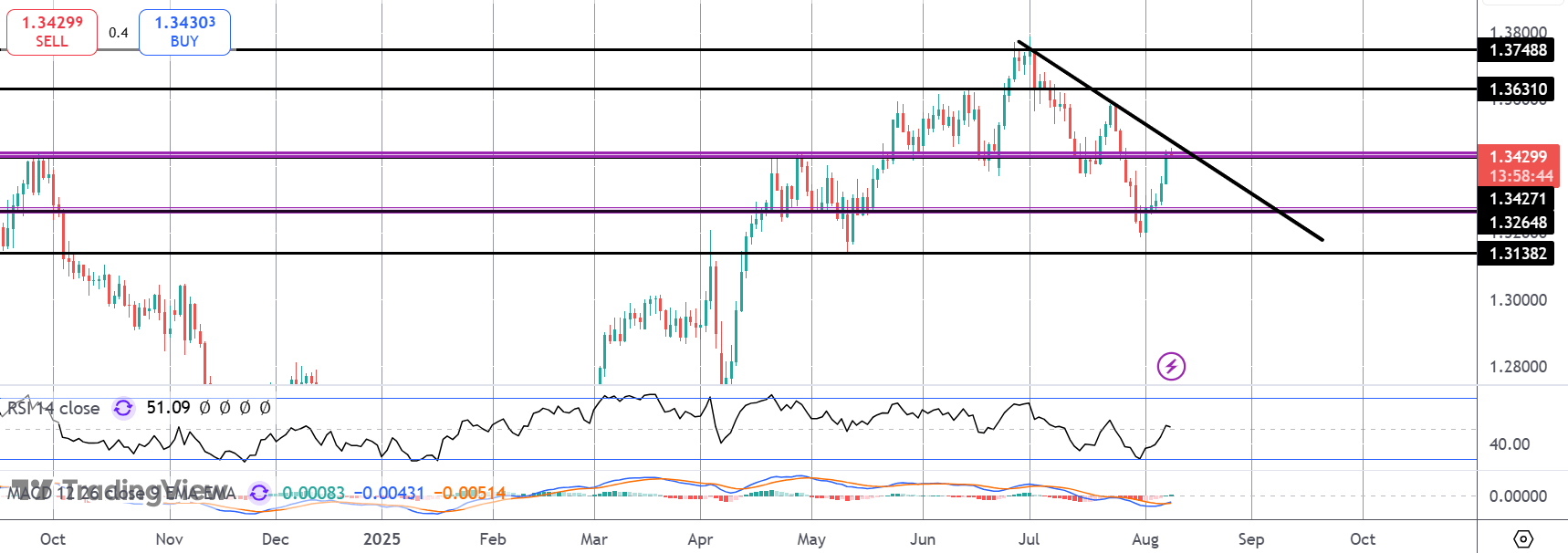

GBPUSD

The rally in GBPUSD has seen the market trading back up to test resistance at the 1.3427 level as well as the bear trend line from YTD highs. With momentum studies turning higher, if bulls can break above this level, focus turns to the 1.3631 level as the next bull target.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.