FX Options Insights 23/09/24

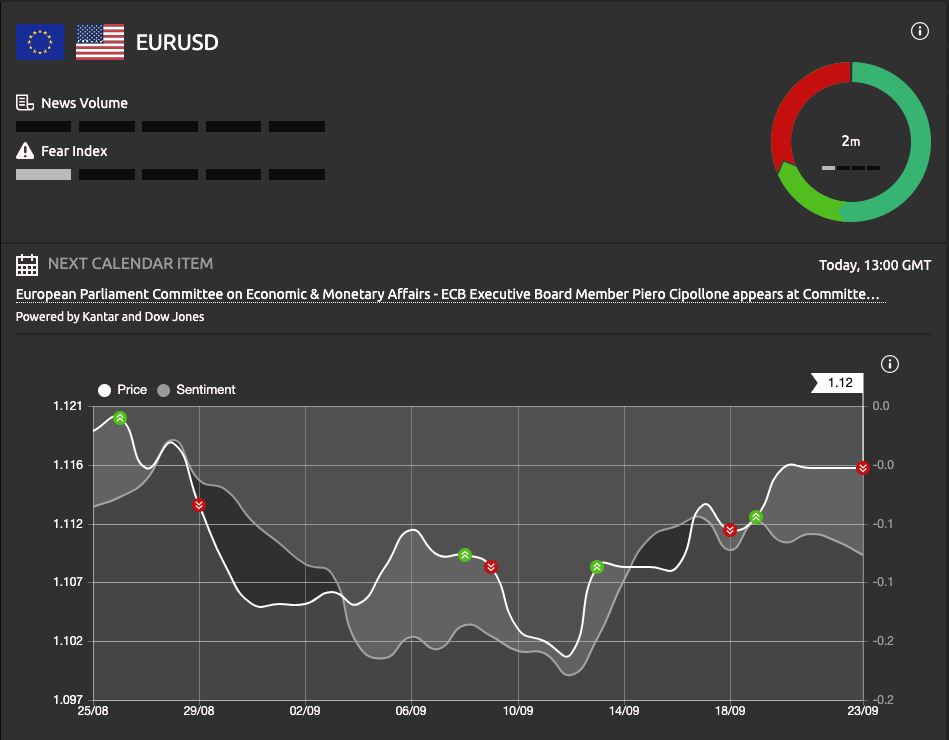

The price action in the foreign exchange options market suggests a subdued outlook for the EUR/USD currency pair. The implied volatility, which reflects the market's perception of risk, has declined after the U.S. Federal Reserve's rate cut on Wednesday. Hedge funds have been active sellers of implied volatility, indicating a low-volatility environment and a range-trading scenario. The limited demand for upside strikes suggests a lack of urgency to cover the risk of further gains in the EUR/USD. The benchmark one-month 25-delta risk reversals are capped at 0.2 EUR calls, and the market has flipped from EUR puts to trade 0.3 EUR calls, reflecting the current market sentiment. Additionally, the presence of large expiries and hedging at the 1.1150 strike level is helping to contain the upside in the EUR/USD.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!