FOMO Fridays: DAX Breaks Out

US CPI Shock Ignites Equities

As we round out another week in financial markets we’re certainly not short of interesting price moves to comment on. This week has seen a slew of key trading developments on the back of the US midterms, US CPI release and changes in China’s COVID policy. Talking with traders ahead of the week, it seems the big move that everyone is focused on is the breakout in equities. While US markets have certainly benefited from the drop in the Dollar, the star of the show this week has been the DAX. So, let’s take a look at what’s caused the move and, as always, if you caught it? Well done! If you missed it? There’s always next week!

What Caused the Move?

Dollar Drop

The big driver behind the breakout in the DAX this week has been the improvement in risk sentiment linked to a weaker US Dollar. With US inflation having dropped by .5% in October, falling back to 7.7% annually from 8.2% prior, the US Dollar fell sharply as traders began pricing in a smaller .5% hike from the Fed in December. The impact of this shift has been clearly visible across markets this week with risk assets soaring as USD fell.

Gas Prices Falling

Along with the drop in the US Dollar, the DAX has also been boosted by the ongoing drop in European gas prices. The spike in gas prices over the summer was one of the key economic threats to the eurozone and with those prices now subsiding quickly, the outlook for eurozone businesses and households is improving somewhat. There are hopes that lower energy prices will help tame rampant inflation and, on the back of US inflation softening, traders are anticipating a similar cooling of consumer prices in the single market in coming months which should allow scope for the ECB to hit the brakes on its tightening program, or at least slow its pace.

Technical Views

DAX

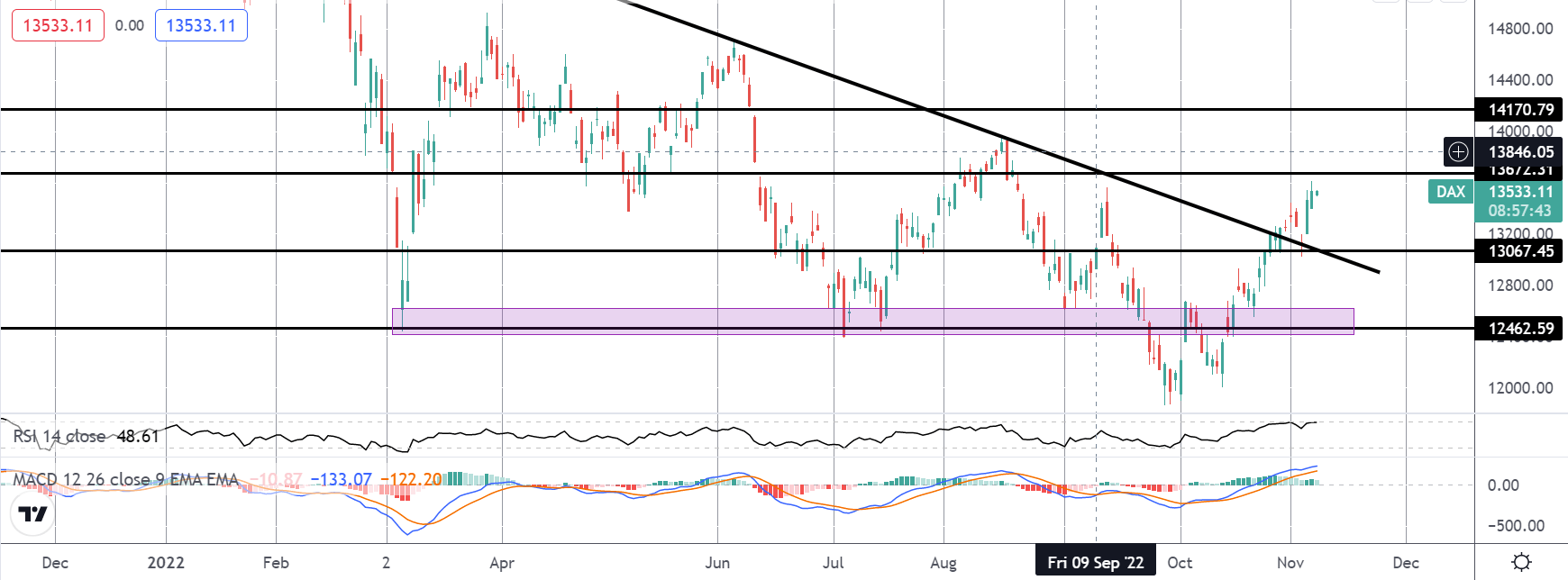

The rally in the DAX this week has seen the market breaking out above the 13672.31 level. The index is now pushing above the 14170.79 level and, with both MACD and RSI bullish here, the focus is on a continuation higher towards the 14703.98 level next. The near-term view remains bullish while 14170.79 holds as support with the index now looking to carve out a fuller bullish reversal.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.