Fed's Shifting Winds and Uncertain Rate Hike Prospects Shake the Market

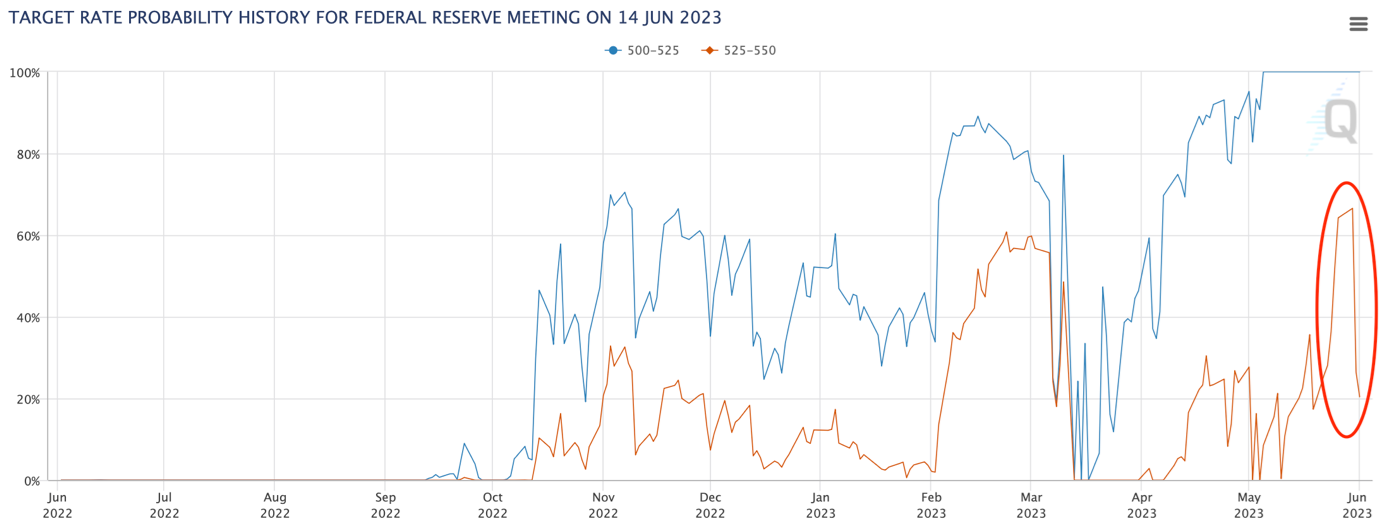

"The winds of change" in the Federal Reserve's policy have sharply shifted direction once again: in a matter of days, the chances of a rate hike on June 14th have decreased from 65% to 26%:

The dramatic ups and downs in the likelihood of a rate increase can be attributed to the "back-and-forth" approach taken by Fed officials in their communication with the market. Last week, they advocated for a rate hike, citing high inflation as the reason. However, this week, the discussion has subtly shifted towards a small pause, with the possibility of resuming tightening measures in the future. Jefferson and Parker made comments on Wednesday and Thursday, stating:

Keeping rates unchanged in June does not mean the Fed is ending its tightening policy.

One meeting without a rate hike would provide more time to assess the state of the economy.

Retail sector data shows that consumers are not spending as they did before.

A sharp deterioration in the labor market would be cause for concern.

The dollar fell below a short-term support level and stabilized around 103.50 on Friday:

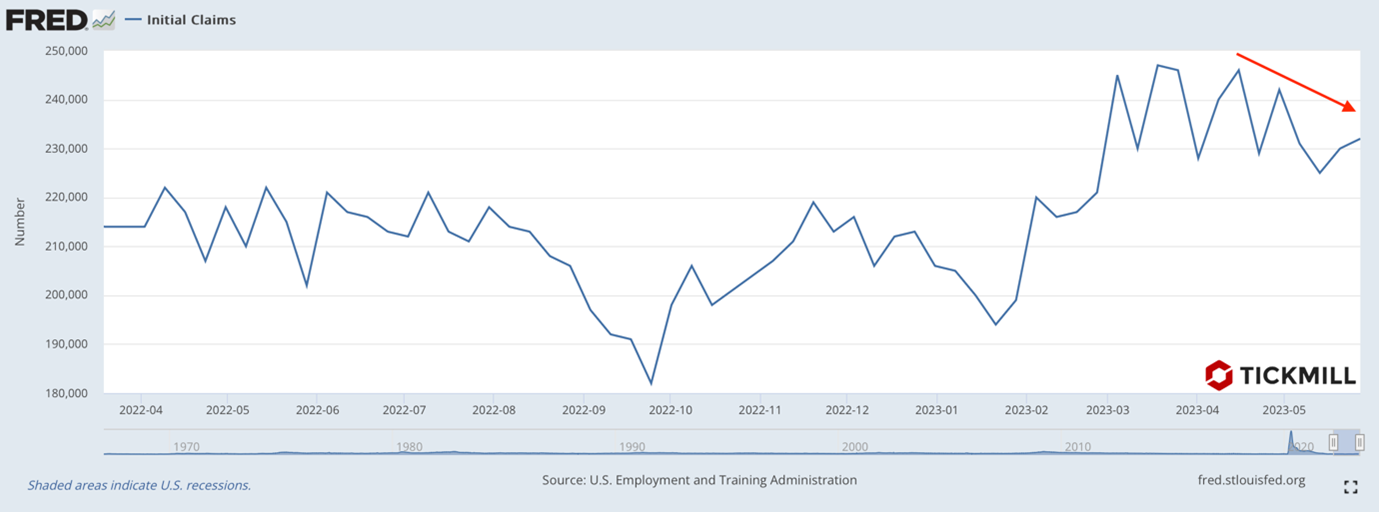

The ADP report exceeded expectations, with the agency estimating a 278,000 increase in jobs compared to the forecasted 170,000. An important signal in the context of the upcoming NFP report was sent by weekly initial jobless claims, which have been below expectations for the third consecutive week. The trend has been downward since mid-April:

On Wednesday, JOLTS data showed an increase in the number of job openings, surpassing expectations.

Considering the preliminary indicators, I believe the risks for the NFP report are skewed towards higher values. This will introduce significant uncertainty into the short-term forecast of the Fed's policy, as the "cost of waiting" mentioned by Fed officials will increase once again. The dollar is likely to return to levels above 104, while risk assets may enter a bearish correction.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.