Is Fed’s QE4 Inevitable?

One of the reasons for the “bullish” reaction to the Fed meeting last Wednesday (as a result of which the dollar strengthened and bond yields rose) were the unjustified expectations of the new QE hints. The jump in the EFFR-IOER spread (federal funds rate minus the rate on excess reserves in the Fed) to 15 base points and the subsequent interventions via repos was considered sufficient reason to launch QE to return reserves to a level where the Fed has normal control over the market borrowing costs. By the way, for completeness, the reserves of commercial banks in the Fed are essentially the same as our checking accounts in a commercial bank, on which the bank pays an interest to us. Clients (i.e. banks) are presented with two alternatives - lend to other banks in the interbank market or hold a deposit with the Fed. Actually, changing the interest rate on deposits, the Fed in theory, should control the market rate too. Funds always flow where the yield is higher.

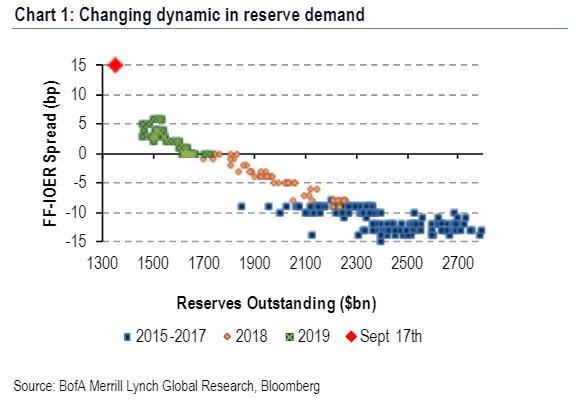

What is curious, if you plot the function, where the reserves is the argument, and the function value is the EFFR- IOER spread, it turns out that the Fed may need a QE at least for $400 billion to normalise the spread:

The chart shows a clear relationship between reserves and the ability to control the market rate (i.e., keep the spread at zero or slightly lower). Obviously, the lower the banks' reserves (due to the rollback of QE), the less will be the opportunity to organise the flow of liquidity to the free market in order to suppress the growth of the market rate in the event of a liquidity shortage. It’s what happened last week when there was an explosive increase in repo rate.

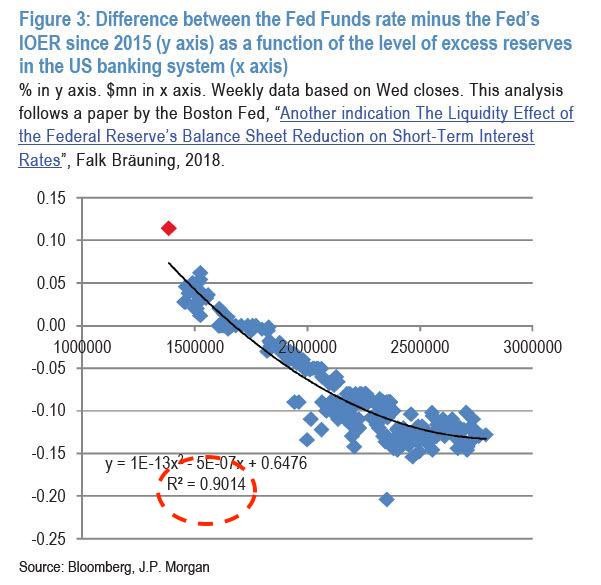

Estimating the regression of the spread on reserves, we can conclude that the sensitivity of the market rate to reserves is econometrically confirmed: R squared of the model is 0.90 (very high explanatory power of the model ), i.e., in order to control the market rate within the current floor system, it will most likely be necessary replenish assets on the balance sheet (what will consequently increase reserves):

Pay attention to the quadratic dependence - control over the market rate “worsens faster” than reserves are reduced.

As a result of the meeting, it became clear that the Fed is not going to return to QE in September, since, on the contrary, IOER and reverse repo rate have been cut. Powell also said the Fed will only use temporary REPO interventions (as was done last week) in the near future to combat interbank deficits. At the same time, Powell encouraged markets with the statement about the need for "organic balance sheet growth, earlier than anticipated," and said that this will be discussed in late October. In other words, even though the QE4 was not announced explicitly in September, and in the process of preparing the Central Bank eases liquidity shortages with temporary repos, it may be inclined to this option in the near future.

Such expectations will likely keep the dollar rally in check, so in the New Year period, the prospects for strengthening the dollar remain very doubtful.

Please note that this material is provided for informational purposes only and should not be considered as investment advice.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.