Fed: We Need QE but Think of Another Name for it

The minutes of September FOMC meeting released on Wednesday showed that most members expressed their support for the rate cut in September, but opinions were divided on the future course of monetary policy.

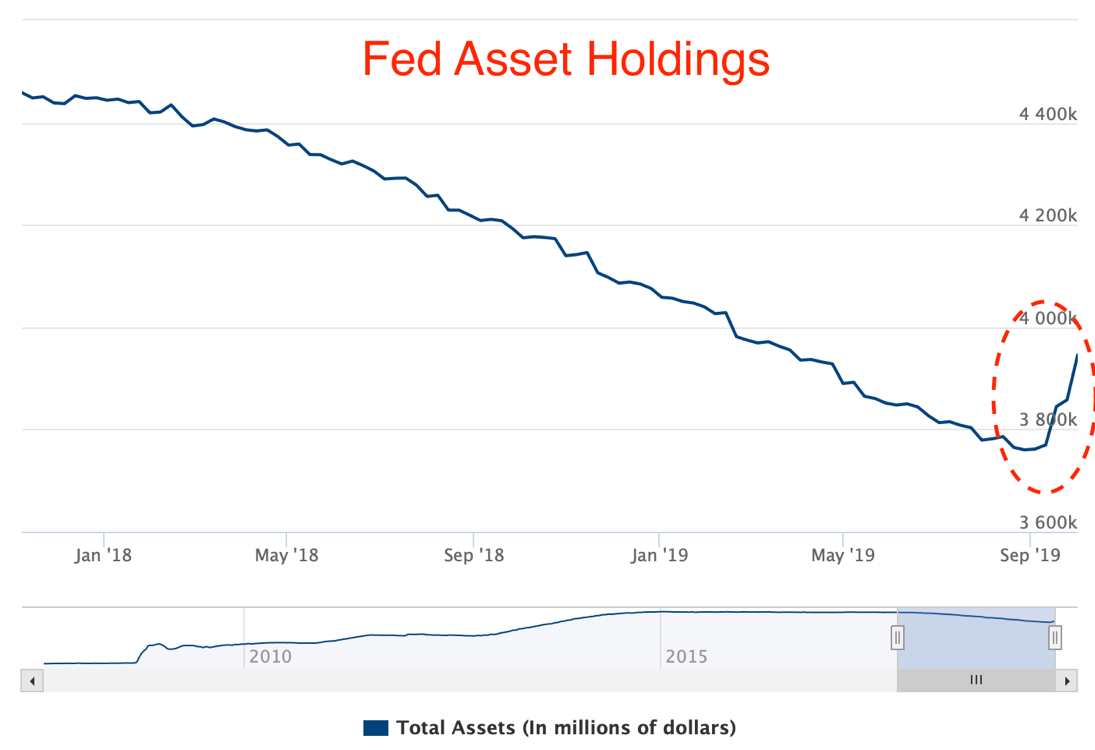

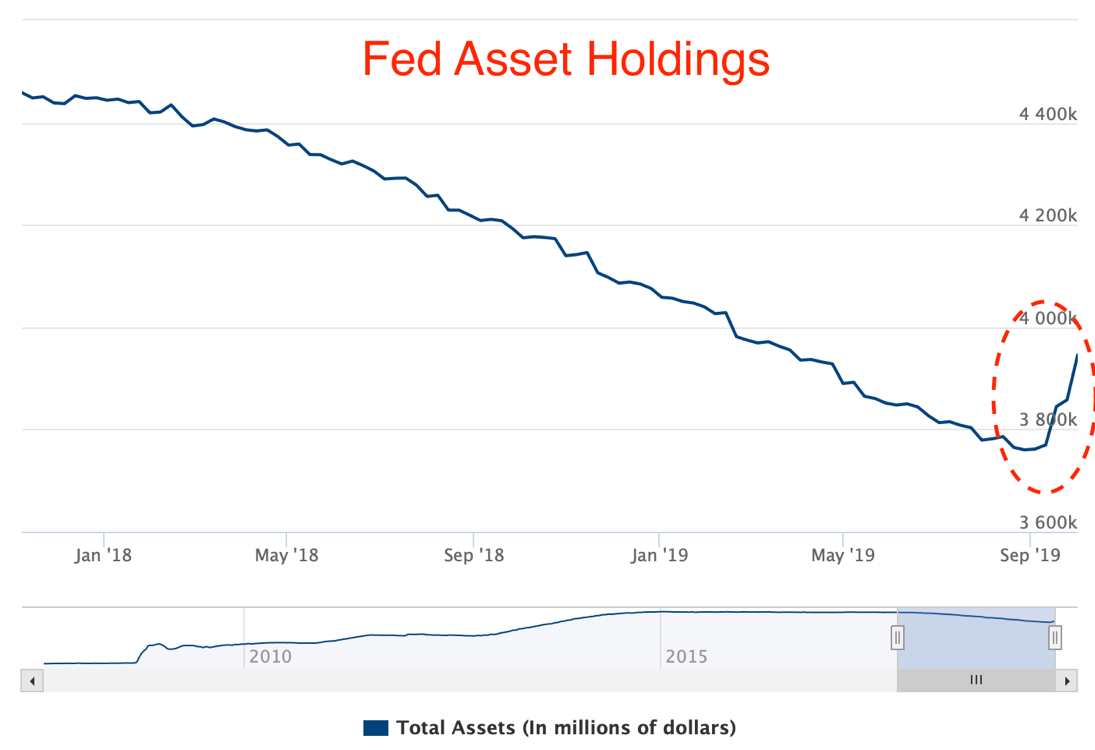

With almost complete certainty, the minutes indicated that the policymakers will have to tackle the issue of balance sheet expansion on the upcoming meeting. A close look at the frequency and the volume of repos after borrowing costs get out of hand in September indicates that these don’t seem like one-time interventions and the Fed seems to be conducting a kind of full-scaled “temporary” QE. Since mid-September, the asset holdings on the Fed’s balance sheet has increased by almost $ 200 billion:

According to the latest data, repos will continue at least until the beginning of November, the size of operations will vary from 35 to 75 billion dollars. This program differs from QE only in the known date of the reverse operation (i.e. liquidity withdrawal), which obviously leads to unwelcome fluctuations in the demand or supply of bank reserves. Powell said on Tuesday that "the increase in assets on the balance sheet will be different from the large-scale asset purchase programs conducted earlier."

7 out of 10 officials spoke out in favor of cutting the rate in September by 25 basis points to a range of 1.75% - 2%. However, a number of economic reports released later indicated a clear slowdown in the economy, and it is unclear whether the Fed has invested in the notion of “preemptiveness” the weakness we observe. We are talking about a fall in activity in the manufacturing sector to a 10-year low and deterioration of business climate in the service sector to the worst level in three years. The market seems to reject such a hypothesis and prices in 85% chance of a rate cut at the meeting in late October.

In September projections, 7 out of 17 policymakers expected another rate cut this year, 5 officials expected a continuation of neutral policy and 5 others predicted a rate hike by the end of 2019.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. The views discussed in the above article are those of our analysts and are not shared by Tickmill. Trading in the financial markets is very risky

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.