Volatile Price Action

It’s been a wild start to the week for the gold market today. Gold futures surged higher by more than 4.3% over the Asian session, hitting fresh all-time highs of around $2145 before reversing sharply lower, now back in the red on the session. The move follows a solid rally on Friday which saw the market trading up to test the 2069.41 level.

Shifting Central Bank Expectations

The spike in gold can be attributed to the stark shift in central bank expectations. The Fed and the ECB are now both seen cutting rates early next year. In the US, a sharp drop in both CPI and employment indicators last month has seen traders stripping back their tightening forecasts and instead pegging rates cuts across H1.

NFP on Friday

Looking ahead this week, the main focus will be on the next round of US labour market data. With fears the US economy is slowing down, a further weak print this time around should help cement the view that rate cuts are coming, putting further pressure on USD and allowing gold prices to trade higher near-term. On the other hand, if we see any unexpected strength in Friday’s data, this might fuel some repricing of US rate projections, stalling the USD decline and affecting a reversal lower in gold.

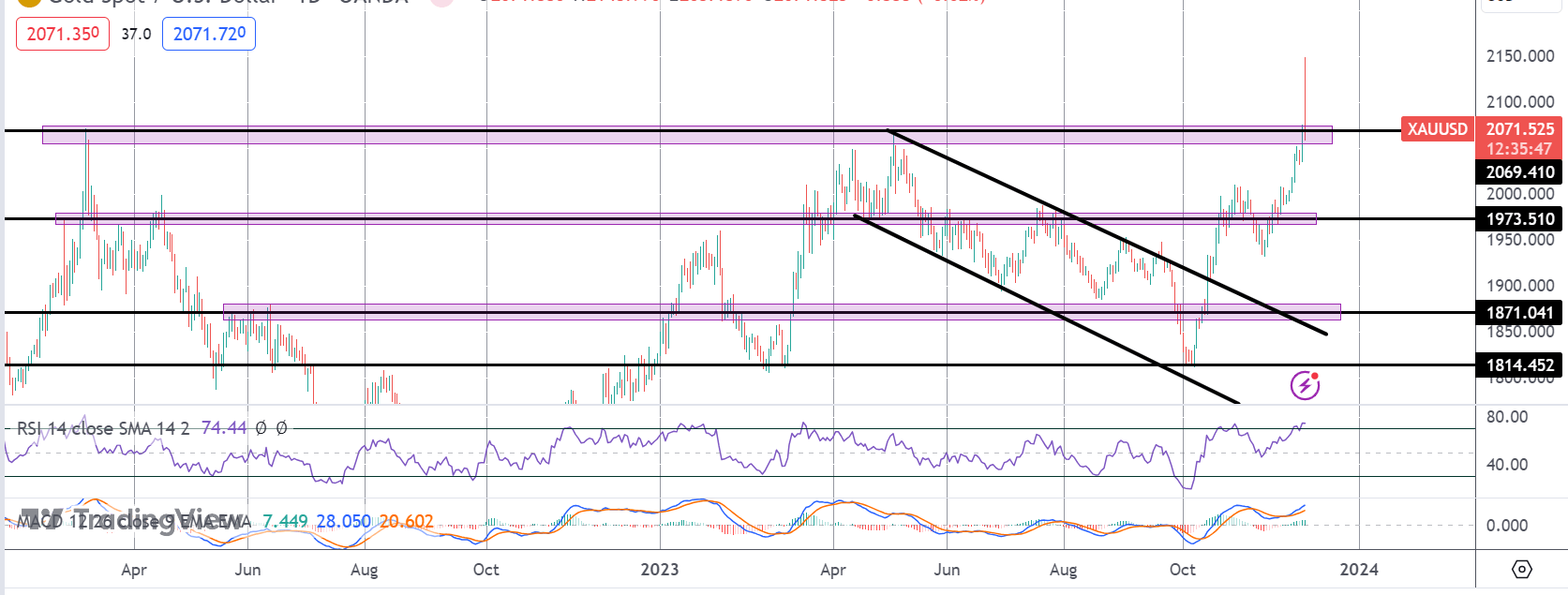

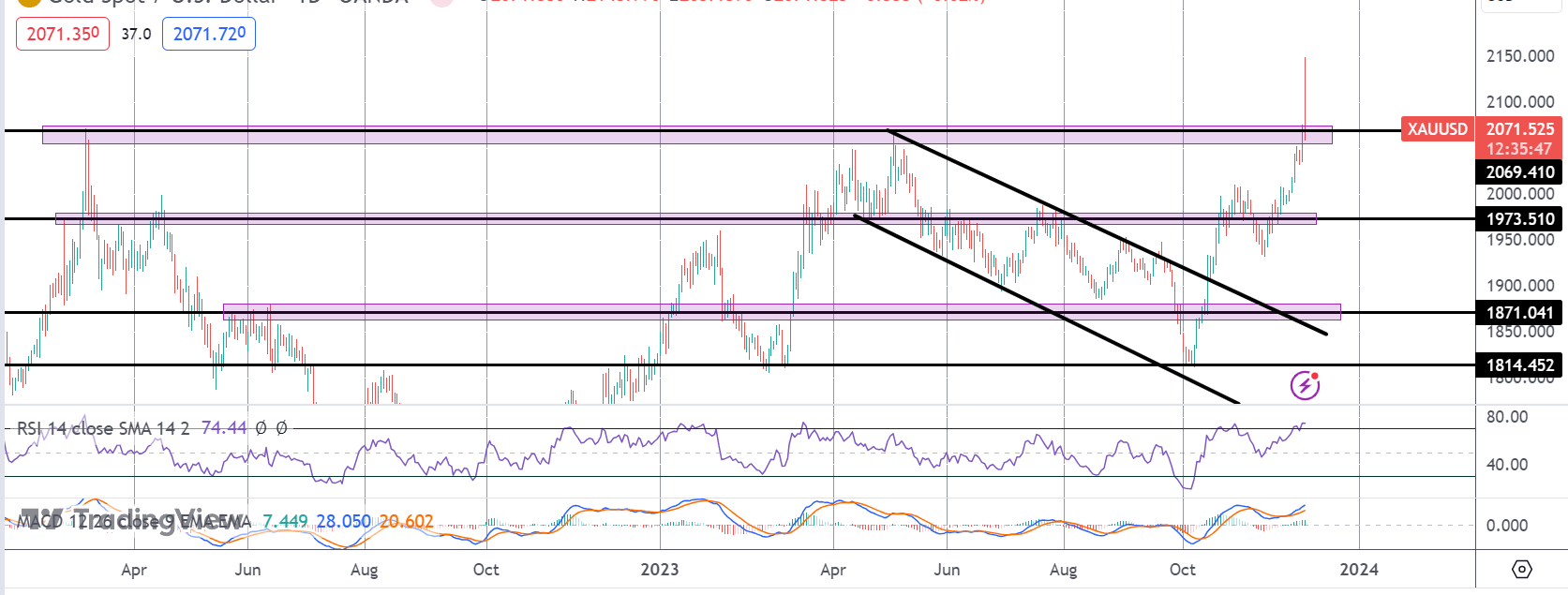

Technical Views

Gold

Despite the bullish outlook, gold is at risk of forming a blow off top here. A bearish close today will mark a large bearish pin-bar candle at higher, with bearish divergence on momentum studies, putting focus on a turn lower back to the 1973.51 level. Back above 2069.41, however, the focus remains on further upside and a continuation higher.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.