Why Should we Expect Weak NFP Data in September?

After an unexpectedly weak rise in the number of vacancies in the United States in August, when the US economy added only 139K jobs, September is also likely to be below the trend with a forecast of only 145K, a 0.3% MoM increase in salaries and 3.7% unemployment.

Some of the factors indicating a weak September in the labour market:

- Payrolls estimate from the private agency ADP came at 135K against expectations at 140K, the previous reading was revised lower at 157K.

- The long favorable downtrend in the initial unemployment claims ceased, showing signs of stabilization;

- The components of employment in the ISM activity index collapsed (the situation in the US manufacturing sector looks especially alarming, which interrupted the dollar offensive);

- The optimism of consumers began to fade, although it remains at a fairly high level.

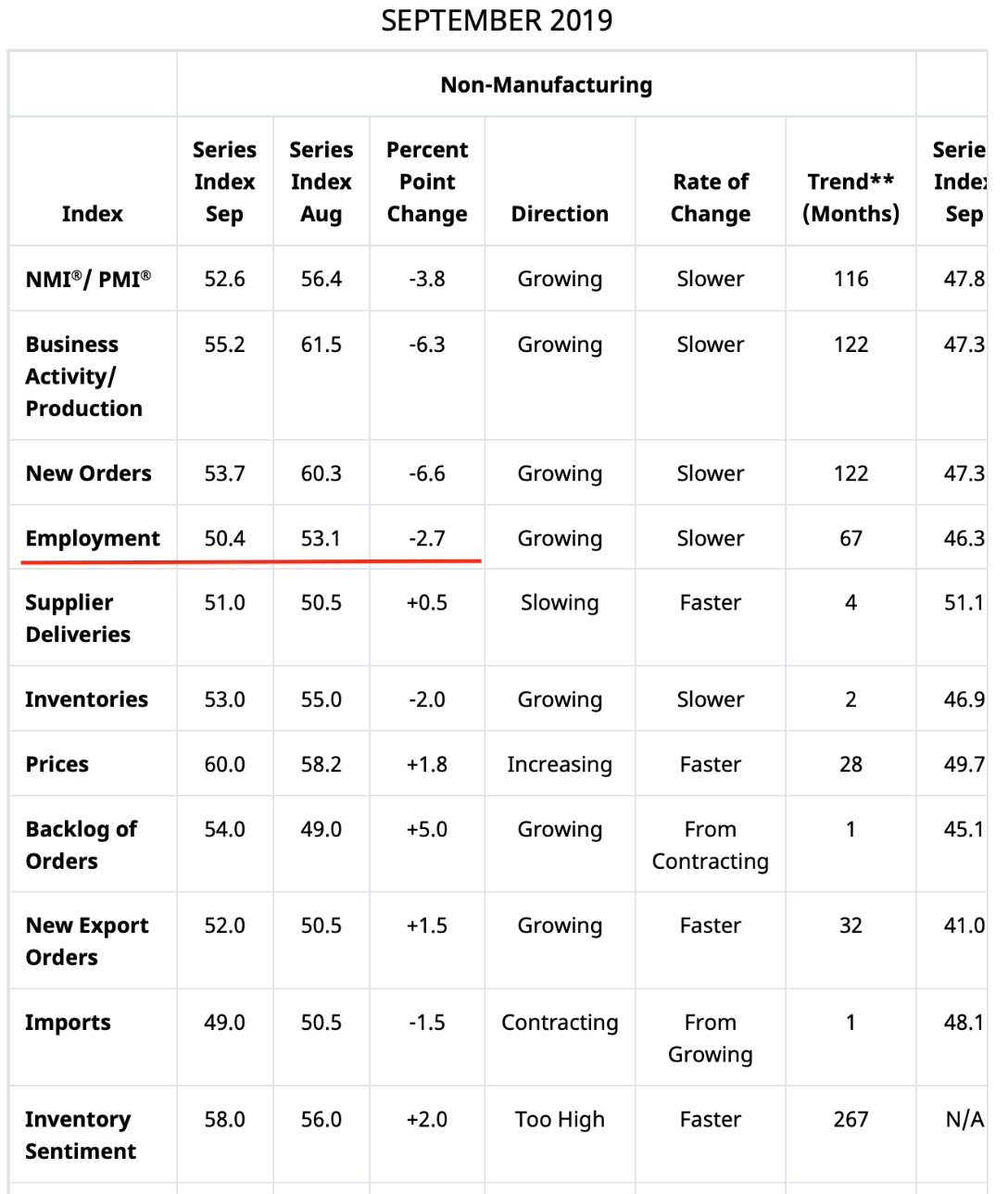

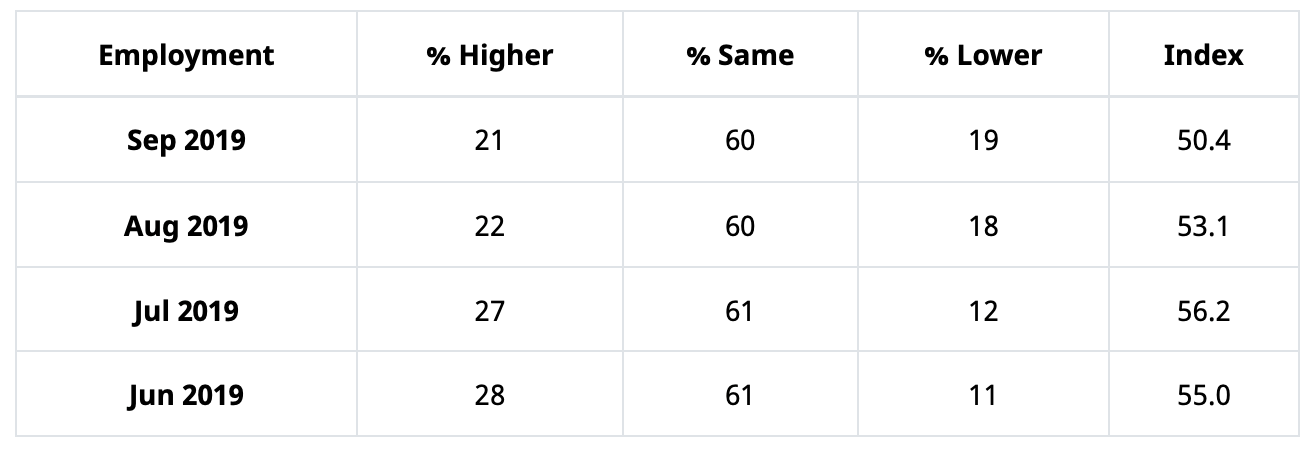

Among the data that caught our eye (including on the basis of a strong market response to it), it is worth to poke under the hood of the ISM activity index in the non-Mfg sector. Looking at the employment subcomponent, we can notice that compared with August, the reading dropped by 2.7 points to 50.4 points, closely approaching the contraction territory:

Meanwhile, the downtrend arose somewhere in July and tensions in the labour market are growing rapidly. In just two months, the index fell from 56.2 to 50.4 points:

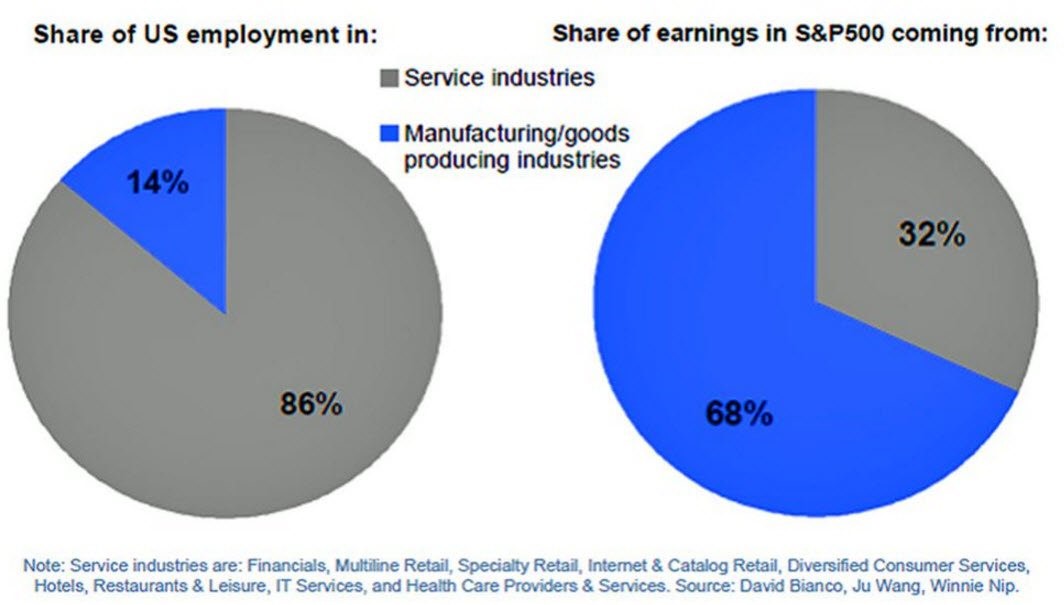

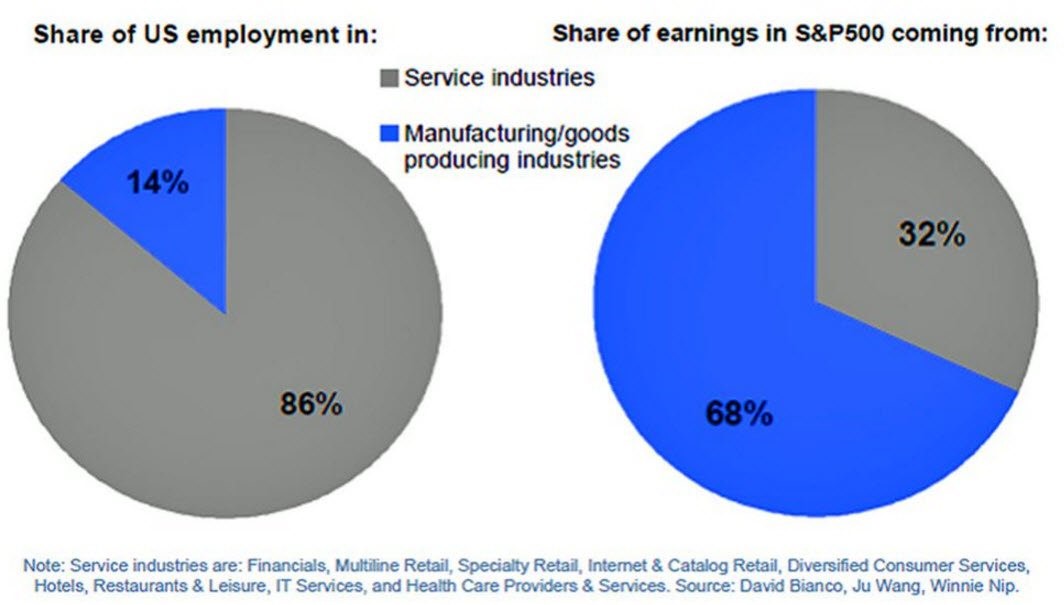

These changes look especially worrying if we take into account that 86% of the workers is employed in the service sector. At the same time, stock indices reacted more strongly to a decline in the manufacturing sector earlier this week, as 68% of the earnings from the S&P 500 come from manufacturing companies.

Let’s recap we have the classic situation “bad news is good news”, as the deterioration in economic data pushes the Fed to ramp up credit expansion (i.e. cut interest rates). Regarding the September NFP, expectations are very likely to be set even lower than public consensus (based on the reasoning above), so if the data coincides with or exceeds the consensus, the stock market will likely go lower.

Please note that this material is provided for informational purposes only and should not be considered as investment advice.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.