EUR/USD Rebounds from Key Support; GBP/USD Defies Weak UK GDP

The EUR/USD pair staged a recovery on Friday, rebounding from the critical technical support level of 1.0500 reached the previous day. The Euro managed to erase Thursday's losses, climbing back to the 1.0600 range after enduring a five-day losing streak against the Dollar. As anticipated in our earlier discussion, this pullback was a plausible scenario.

The recovery seems to be fueled primarily by profit-taking, as traders lock in gains following the Euro’s recent slide. Additionally, the market appears to have fully digested and priced in the key developments of recent weeks, including President-elect Trump’s victory, the "Red Wave" in U.S. politics, the CPI report, and Powell’s comments. This confluence of factors has contributed to a temporary stabilization in the pair:

Economic data from France contributed modestly to the Euro's recovery. The Harmonized Consumer Price Index rose to 1.6% year-over-year in October, slightly higher than both the preliminary reading and market expectations. Despite this uptick, the increase is unlikely to prompt a shift in the ECB dovish monetary policy stance. The ECB is expected to proceed with a policy rate cut at its upcoming meeting in December, a move that could limit potential of Euro recovery in the medium-term.

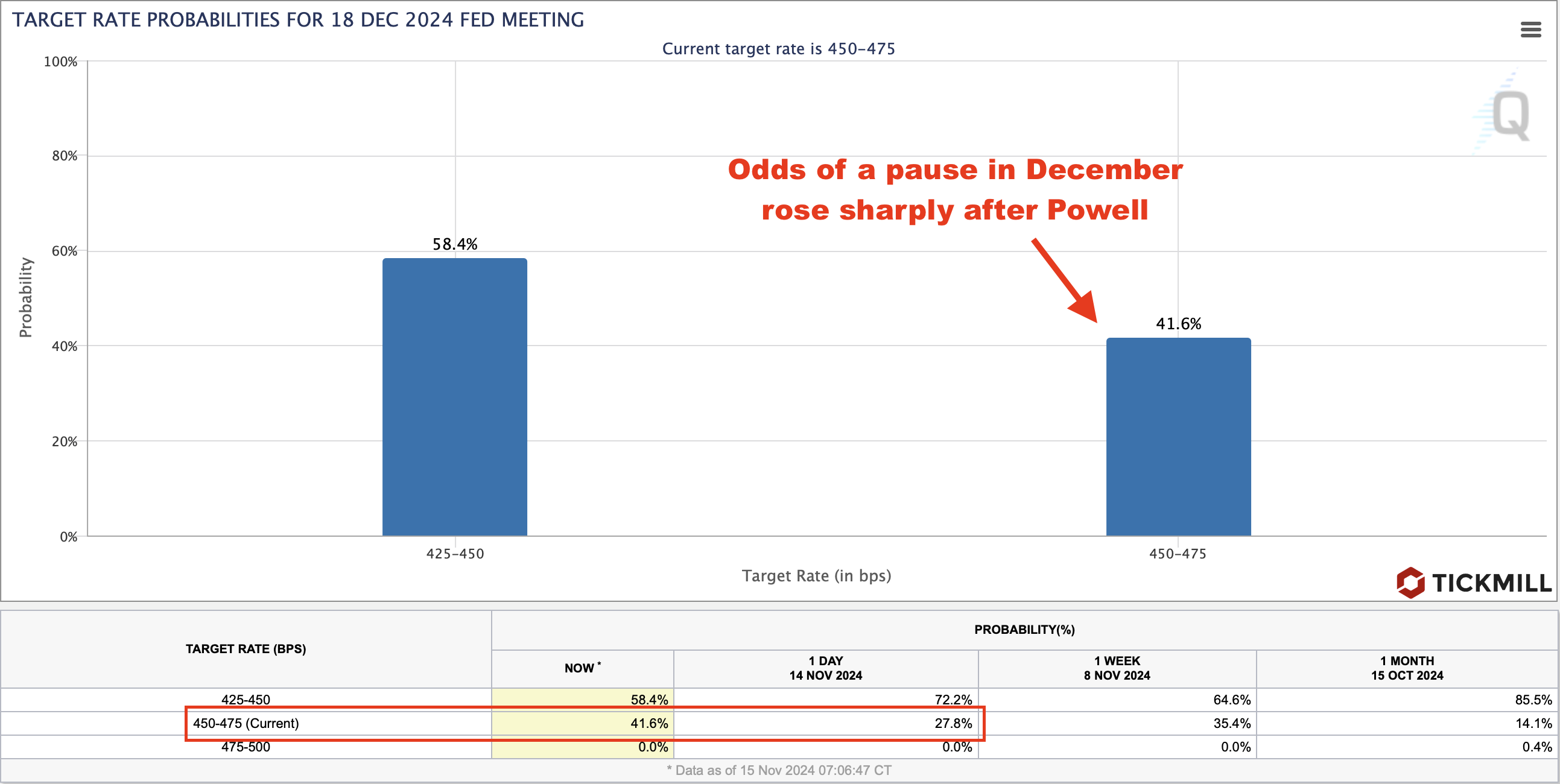

In the United States, Federal Reserve Chairman Jerome Powell indicated a cautious approach toward additional rate cuts. While acknowledging the continued strength of the US economy and labor markets, he suggested that another rate cut in December is not a certainty. This tempered expectation has bolstered the US Dollar recently. However, markets are concerned about potential inflationary pressures resulting from President-elect Trump's proposed fiscal stimulus measures and possible tariffs on China and Europe. Such policies could lead to higher inflation rates, which might compel the Fed to adjust its monetary policy outlook.

Interestingly, Powell's comments triggered a notable drop in the implied odds of a December rate cut. Fed funds futures now reflect a 58.4% probability of a cut, down sharply from 72.2%. Despite this shift, the Dollar's reaction has been surprisingly muted, or even contradictory, as its major peers gained ground today. This suggests that traders may have already factored in a recalibrated Fed rate path, influenced by the inflationary implications of President-elect Trump's policy agenda:

The GBP/USD pair has defied expectations of a decline following disappointing economic data, trading in positive territory instead. This unexpected recovery comes despite weaker-than-anticipated UK GDP figures, which would typically weigh on the Pound. The UK economy contracted by 0.1% in September, while preliminary GDP growth for the third quarter was a subdued 0.1% quarter-over-quarter, falling short of the 0.2% forecast and marking a slowdown from the 0.5% expansion seen in the second quarter.

Under normal circumstances, such figures would prompt a sell-off in the Pound Sterling. However, the currency's resilience suggests that market participants are shifting their focus toward evaluating the sustainability of the recent sharp rise in the US Dollar. This recalibration may reflect a reassessment of whether the Dollar's bullish trend has become overheated, prompting traders to unwind positions and temper expectations for further parabolic gains in the Greenback.

Technically speaking, GBP/USD pair has reached a key support trendline, a level that's likely to catch the attention of many traders given its prominence on the daily chart. The timing of this touch, right before the weekend close, could amplify the potential for a rebound as market participants prepare for the upcoming week. Despite weak UK GDP data, the Pound has shown resilience, suggesting that selling momentum may be waning. This setup increases the likelihood of a technical pullback toward the 1.28 level in the near term:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.