EUR Under Pressure

EURUSD fell sharply on Friday in response to the latest UoM consumer data. Consumer inflation expectations were seen soaring to 12-year highs of 3.2% last month. The rise comes despite CPI heading lower and reflects the view that consumers now believe inflation will remain entrenched around higher levels. Against this backdrop, traders are losing some conviction in the view that the Fed will cut rates later this year.

Fed Pushes Back Against Rate Cut Calls

Indeed, recent Fed commentary has seen various members pushing back against this view also. Fed’s Jefferson cited concerns over stickiness in core inflation while Fed’s Bowman was seen arguing that the Fed would need to see more evidence of inflation falling sustainably before it could support a rate cut. Looking ahead today, Fed’s Kashkari will also speak and is widely expected to reiterate recent comments in favour of keeping US rates higher for longer against a backdrop of still-high inflation.

The rise in USD has weighed sharply on EUR in particular. With EUR longs extended ahead of the recent ECB meeting, the single currency was vulnerable to an order book clear-out. With this in mind, the current correction might push deeper before the bull trend resumes.

Technical Views

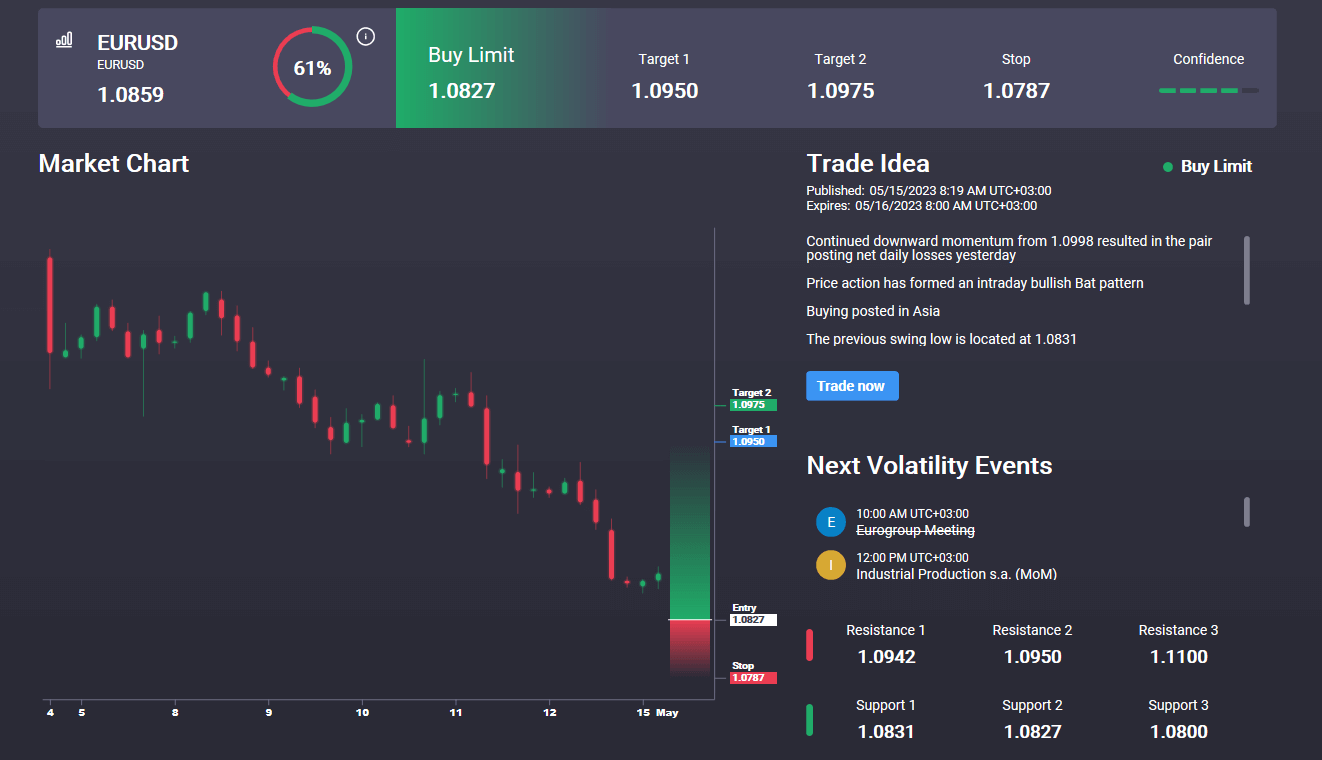

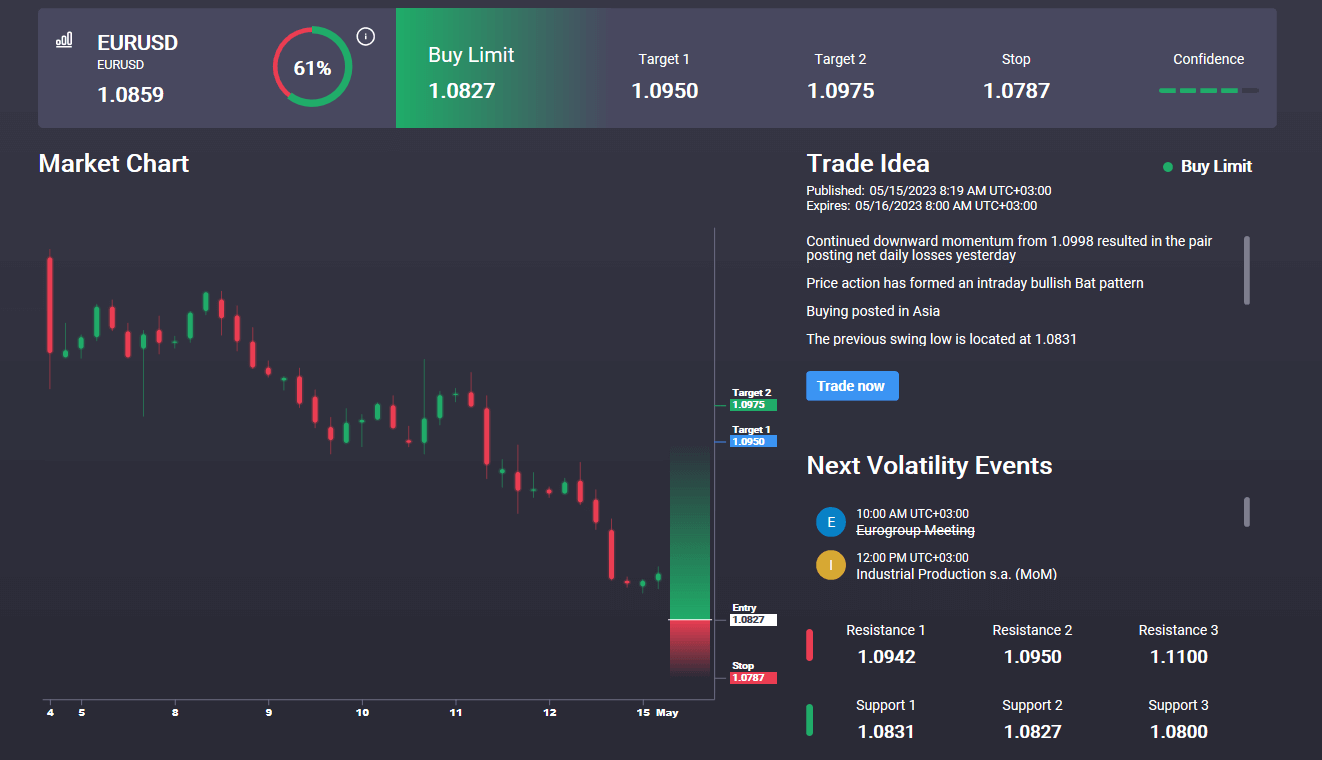

EURUSD

The reversal from around the 1.1126 highs has seen EURUSD head lower within the bull channel which has framed the recovery off last year’s lows. Price is now sitting just above the channel lows and the 1.0785 level. While this area holds, the focus remains on a further move higher. For bears, a break of the channel will be needed to negate this bias. Notably, there is a bullish signal in today’s Signal Centre for EURUSD at 1.0827 targeting 1.0950.

.png)

Signal Centre is a proprietary trading-signal suite offered to all Tickmill traders. Signal Centre combines human and AI driven analysis to offer traders actionable entry and exit points that they can use for their trading strategies. Signals are offered across a range of asset classes including Forex, Stocks, Commodities and Crypto.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.