EURUSD Correcting or Reversing?

Euro Falling from Highs

EURUSD is attempting to stabilise today following a sharp move lower yesterday. The sell off was driven in part by a bullish move in USD in response to hotter-than-forecast US inflation. However, there were also euro-centric factors at play. The correction lower comes on the back of a strong rally over recent months with traders now questioning whether the pullback will prove temporary, or the start of a deeper push lower?

French Political Turmoil

The French PM announced that two public holidays would be removed from the calendar in a bid to help improve the French national deficit. In response, however, the leader of the National Rally (French far-right) Marine Le Pen threatened to bring down the French government if it pushes ahead with the proposal. This development has once again shone a light on the growing rift in French politics given the rising support for the National Rally, which aims to take government in 2027. Additionally, a soaring French national deficit has also been a downward drag on EUR and this week’s news has likely reminded traders of that issue.

US Data Due

Looking ahead, traders will be watching further incoming US data today with PPI and the Fed beige book both due. On the back of the upside surprise in yesterday’s CPI print, any further data strength today should be firmly bullish for USD, putting fresh pressure on EURUSD through the back end of the week.

Technical Views

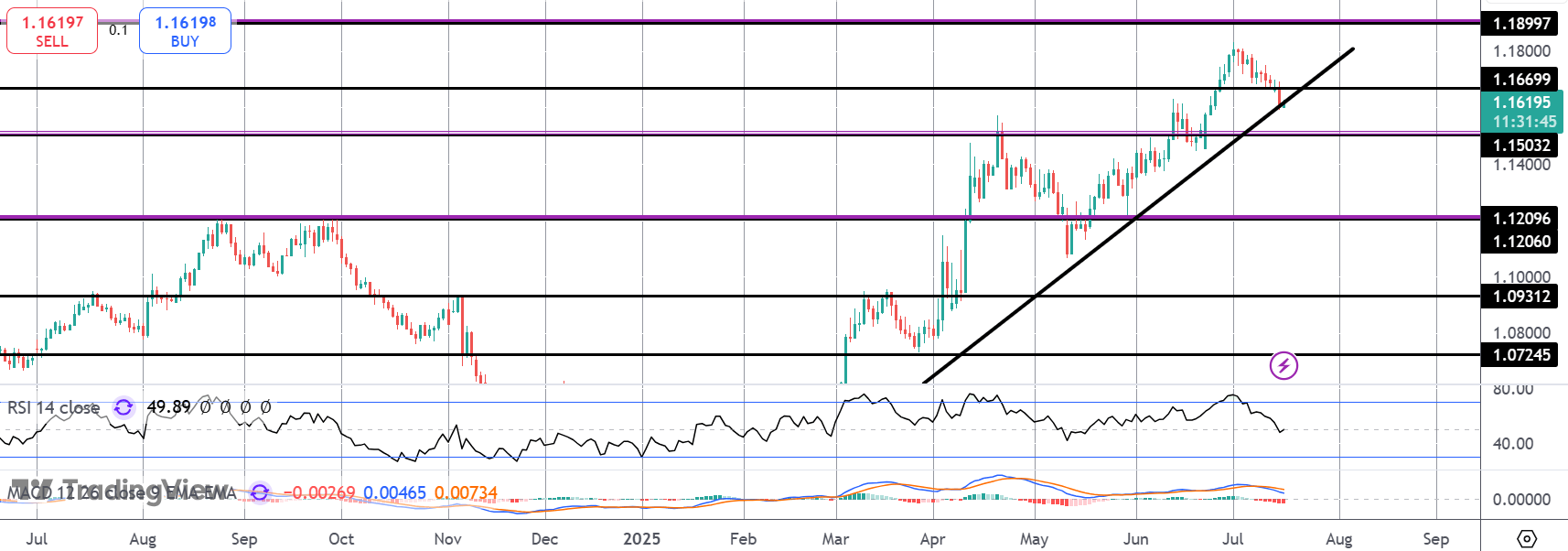

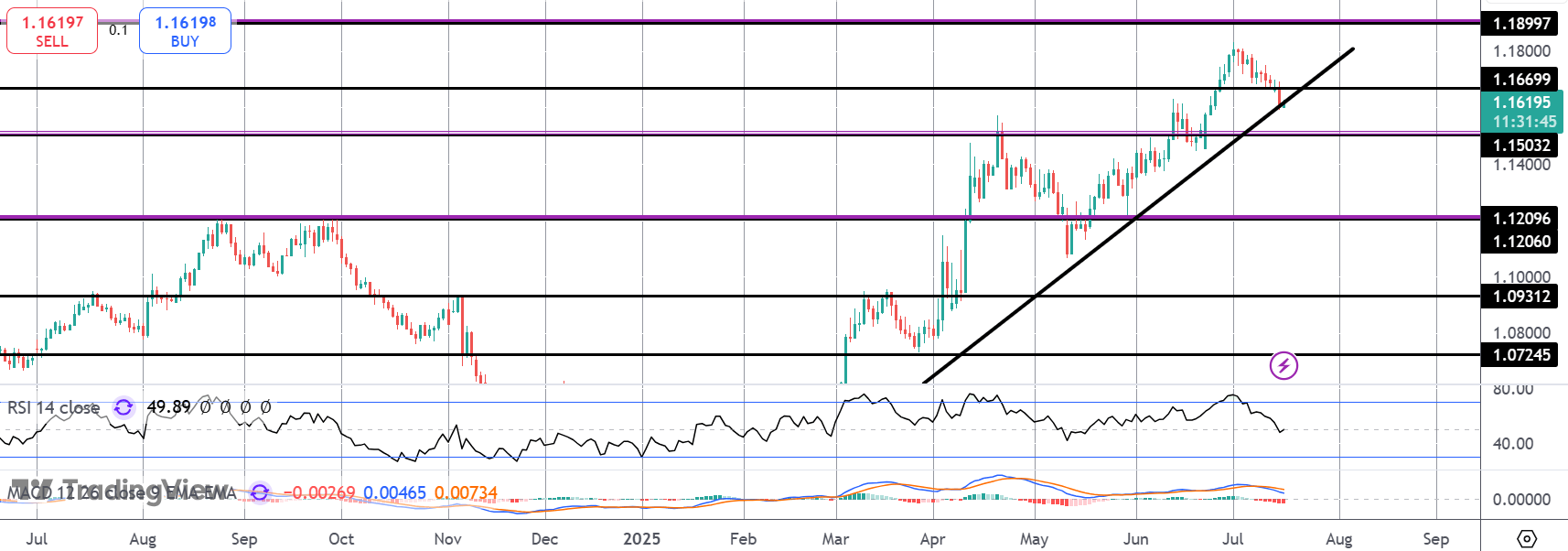

EURUSD

The sell off in EURUSD has seen the market breaking back below the 1.1669 level, now testing the bull trend line off YTD lows. If we break below this level, 1.1503 will be the next support to watch which, if broken, will open the way for a much deeper run down towards 1.1209 next, in line with bearish momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.