EURUSD Attempting to Break Higher As GDP Jumps

CPI Stalls at 2.4%

The eurozone flash CPI estimate, released this morning, showed that headline inflation in the single currency bloc remains unchanged at 2.4% last month. Additionally, the core reading was seen slowing to 2.7% from 2.9% prior, though slightly above the 2.6% the market was looking for. The ECB recently signalled that it is getting closer to the point where easing will be appropriate, with the market currently looking for a rate cut at the June meeting. Given the data today, this projection looks likely to hold, keeping June easing chances alive. The key will be whether we see a fresh downturn in inflation at the next meeting with the risk that the recent stagnation in CPI presents a bottom rather than a consolidation before a fresh fall.

GDP Rises Above Forecasts

Along with the CPI data today, we also got a first look at quarterly growth data. The eurozone flash GDP reading for Q1 was seen rising to 0.3% from the prior quarter’s 0% reading, above the 0.1% the market was looking for. This data presents hawkish risks for the ECB. Signs that the economy is growing above forecasts while inflation has stalled, seems to support recent warnings from ECB’s de Guindo who warned that inflation risks remain this year, pushing back against calls for near-term rate cuts. Traders will now be closely monitoring incoming ECB commentary ahead of the June meeting with the risk that easing expectations are pushed out if we hear any further hawkish sentiment.

Technical Views

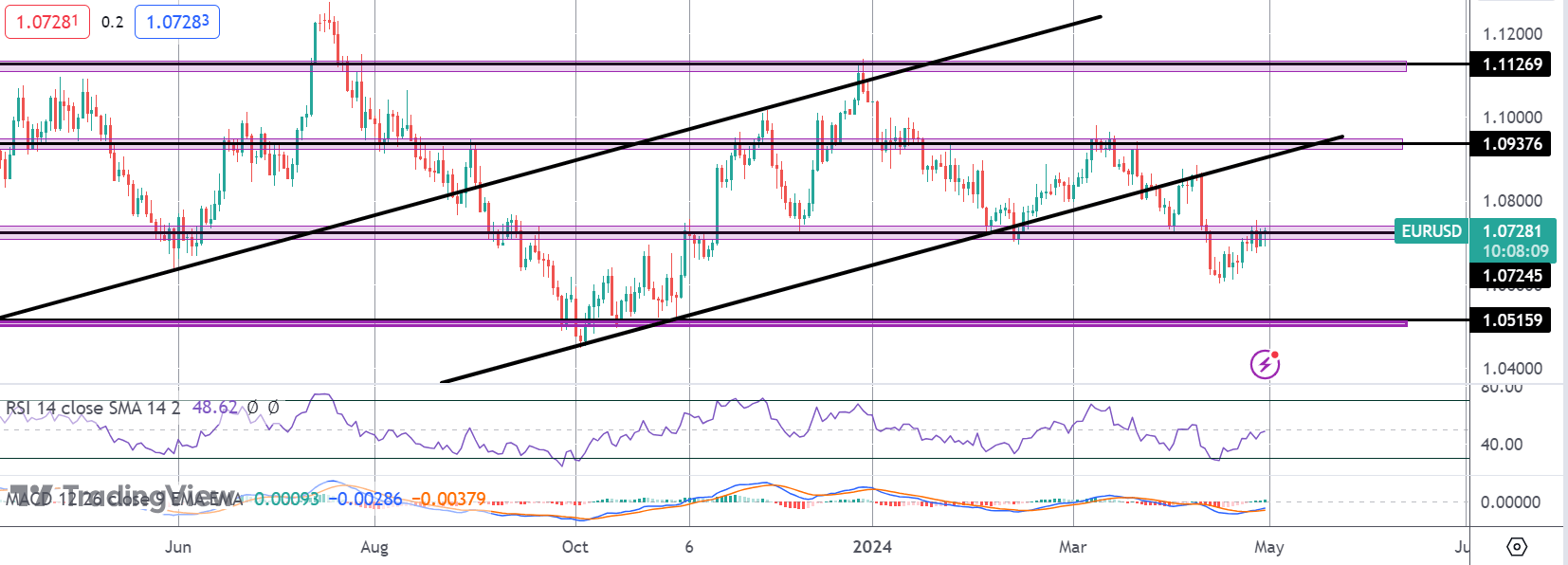

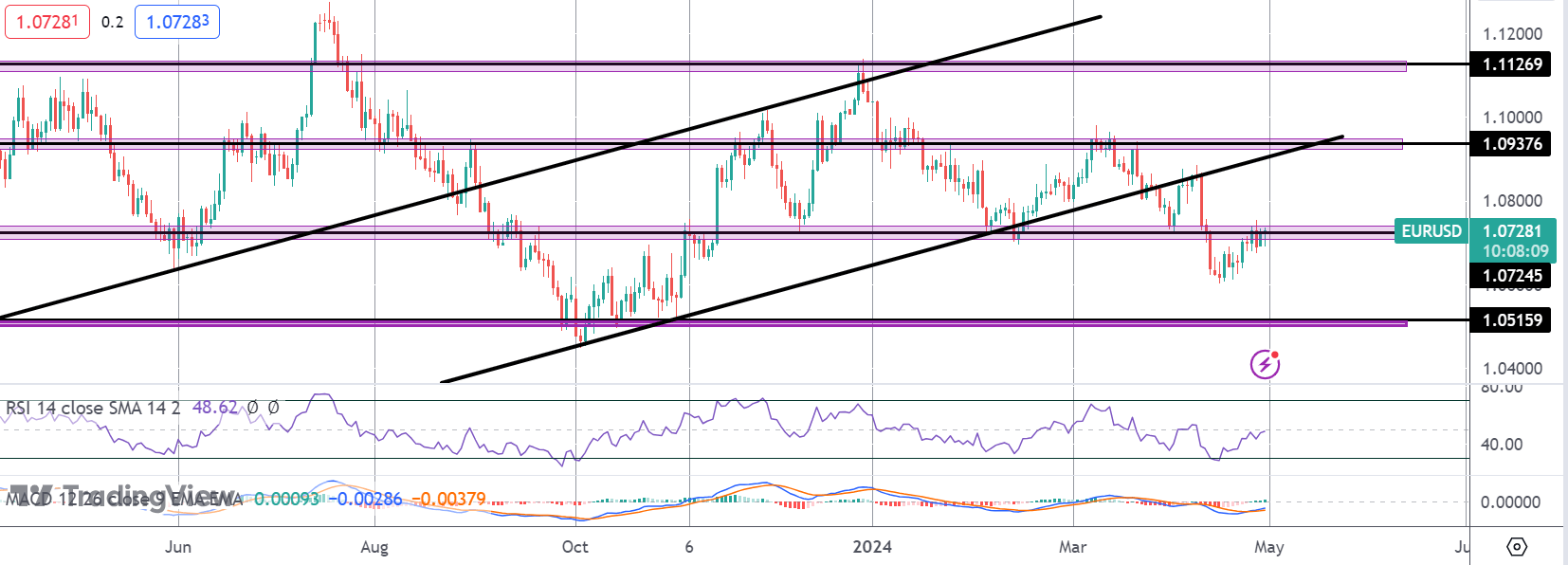

EURUSD

The sell off in EURUSD has stalled for now with price rebounding off the 1.07 lows. The market is currently rebounding and attempting to break back above the 1.0724 level. Back above here, focus will be on a fresh test of 1.0937, in line with bullish momentum studies readings. If we fail here, however, focus will turn back to next support at 1.0515.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.