Eurozone Inflation Dips Below Expectations: EURUSD Market Stays Unmoved

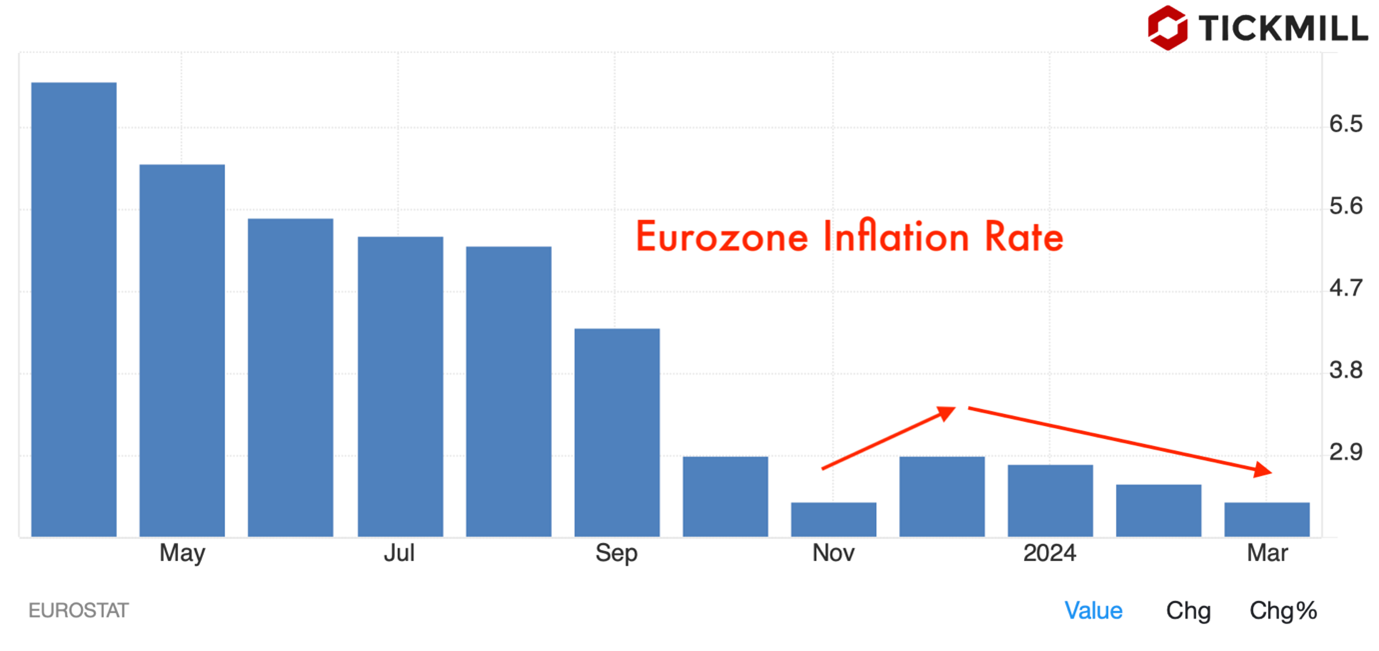

Inflation in the Eurozone seems to be taking a breather, according to the latest figures released by Eurostat. The Harmonized Index of Consumer Prices (HICP) for March revealed a 2.4% rise year-on-year, a slight slowdown from the 2.6% uptick observed in February. While this figure missed the market consensus, it's worth noting that the Core HICP inflation also softened to 2.9% year-on-year, falling short of the estimated 3.0%.

On a monthly basis, the HICP saw a 0.8% increase in March, compared to a 0.6% jump in February. Similarly, core HICP inflation rose by 1.1% month-on-month, showing a slight acceleration from the previous month's 0.7% rebound.

Recent data portrays a somewhat erratic trend in European consumer prices. After hitting an annualized 2.9% in December 2023, inflation receded slightly in the subsequent months, reaching 2.8% and then 2.6%. This mirrors trends observed in other G10 nations as well.

The European Central Bank (ECB), which has a target inflation rate of 2.0%, closely monitors these HICP figures. They play a crucial role in shaping market expectations regarding the ECB's interest rate policies.

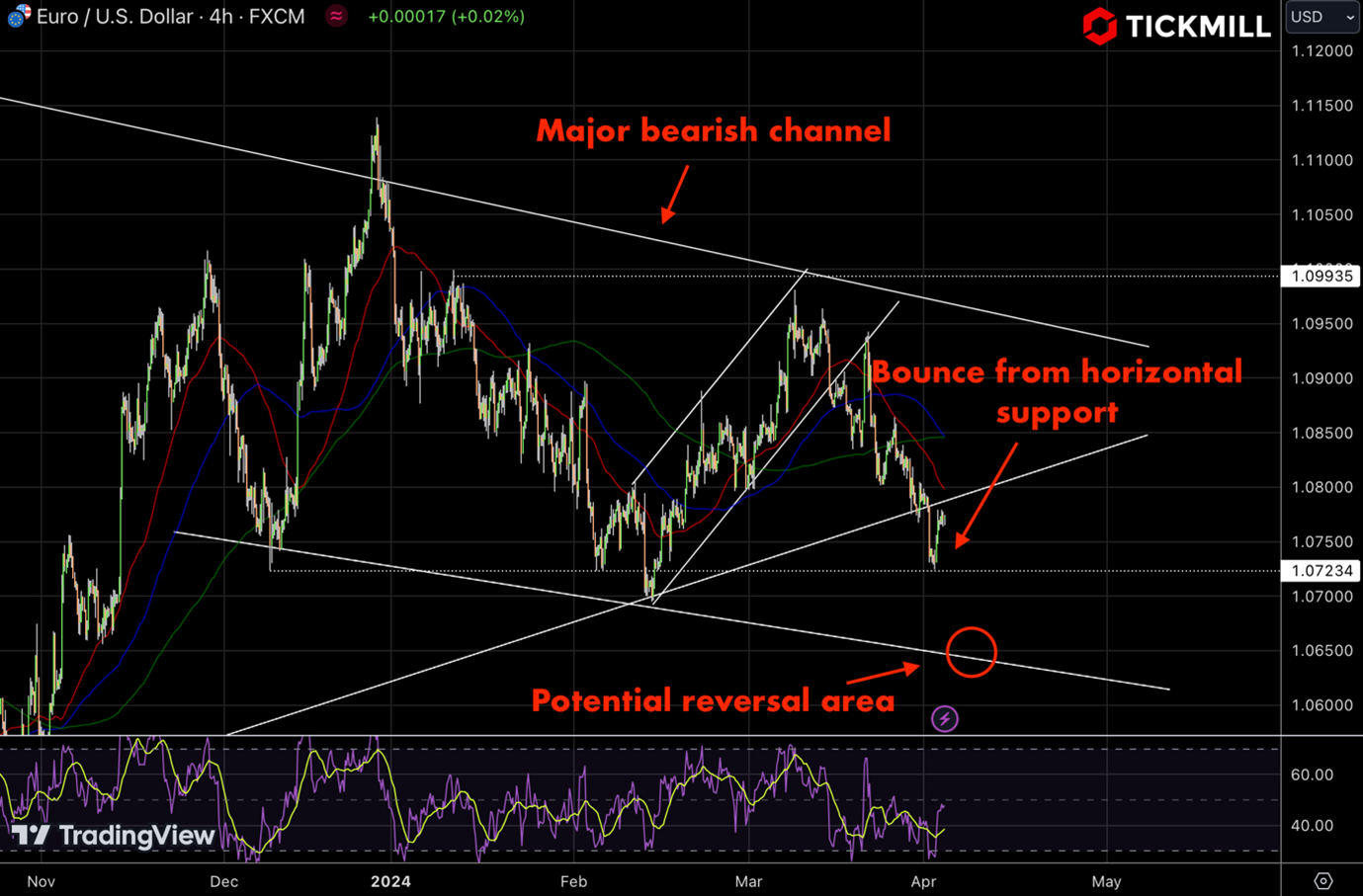

However, despite the softer-than-expected inflation data, EURUSD pairs remained largely unmoved on Wednesday. EUR/USD is trading almost flat at 1.0770 as of the latest update. Looking at it from a technical analysis standpoint, those on the selling side might not feel ready to claim victory just yet. A more probable scenario where both sellers and buyers could anticipate a reversal from the current downward trend is around the lower boundary of the expansive bearish corridor, situated near the 1.0650 mark:

ECB President Christine Lagarde's recent comments highlight the complexity of the current inflationary pressures. Lagarde expressed uncertainty over whether these pressures are merely transitory, stemming from delayed adjustments in wages and services prices combined with cyclical fluctuations in productivity, or if they signal persistent inflationary trends.

Meanwhile, in the realm of commodities, gold prices experienced a pullback after hitting record highs earlier in the day. The incoming strong US macroeconomic data suggests a resilient economy, casting doubts on whether the Federal Reserve (Fed) will proceed with the anticipated three interest rate cuts this year. This shift in outlook has kept US Treasury bond yields elevated and prompted profit-taking in gold, especially following its recent strong performance.

Looking at the US labor market, the Job Openings and Labor Turnover Survey (JOLTS) released by the Labor Department indicates a modest rise in job openings, maintaining a historically high level. Cleveland Fed President Loretta Mester noted substantial progress on inflation but emphasized the need for further evidence before considering interest rate cuts.

These sentiments echo Fed Chair Jerome Powell's recent remarks, suggesting no urgency in cutting interest rates. Market pricing indicates a nearly even chance of rate cuts beginning in June, with a total of 65 basis points expected for 2024, slightly lower than the central bank's projection of 75 bps.

As investors await further cues, all eyes are on the upcoming US economic releases, including the ADP report on private-sector employment and the ISM Services PMI. Additionally, speeches by influential FOMC members will likely provide fresh insights into the Fed's monetary policy trajectory, offering further direction to the market.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.