Euro Slides As ECB Easing Expectations Soar On Weak PMIs

PMI Misses Hit Sentiment

The Euro is under pressure today on the back of a slew of weaker-than-forecast PMI data this morning. French, German and overall eurozone PMIs were seen flashing a sea of red today, highlighting fresh weakness in the single market economy. German manufacturing data was seen plunging deeper into contractionary territory last month, as was eurozone manufacturing data. The decline in German data last month means that the composite PMI is now back below the neutral 50 level, pointing to a forthcoming GDP contraction. Given the softening risk environment we’re seeing, the near-term risks certainly look skewed to the downside.

ECB Easing Expectations

With both eurozone manufacturing and service sector readings seen falling further last month, the HCOB composite PMI now sits at 50.1, barely in positive territory. Marking its lowest level for five months, the decline in eurozone private sector data makes for troubling reading for the ECB. Indeed, September rate cut pricings have jumped on the back of the release, now sitting above 65%. Given Lagarde’s recent reaffirmation that any further rate moves will be data dependent, traders are looking at today’s data as a strong signal that further easing will be announced at the next meeting. Traders will now be paying close attention to Lagarde, who speaks on Thursday, for any dovish signals in response to this data which will drive EUR deeper down, if seen.

Technical Views

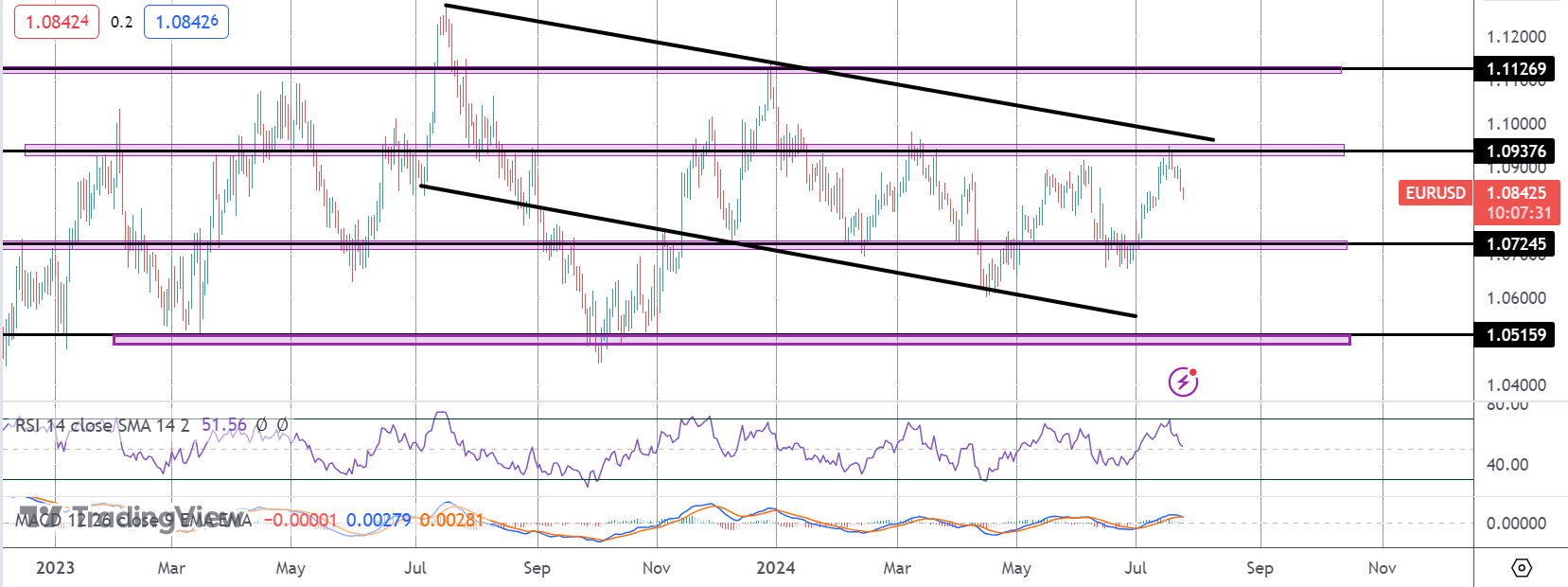

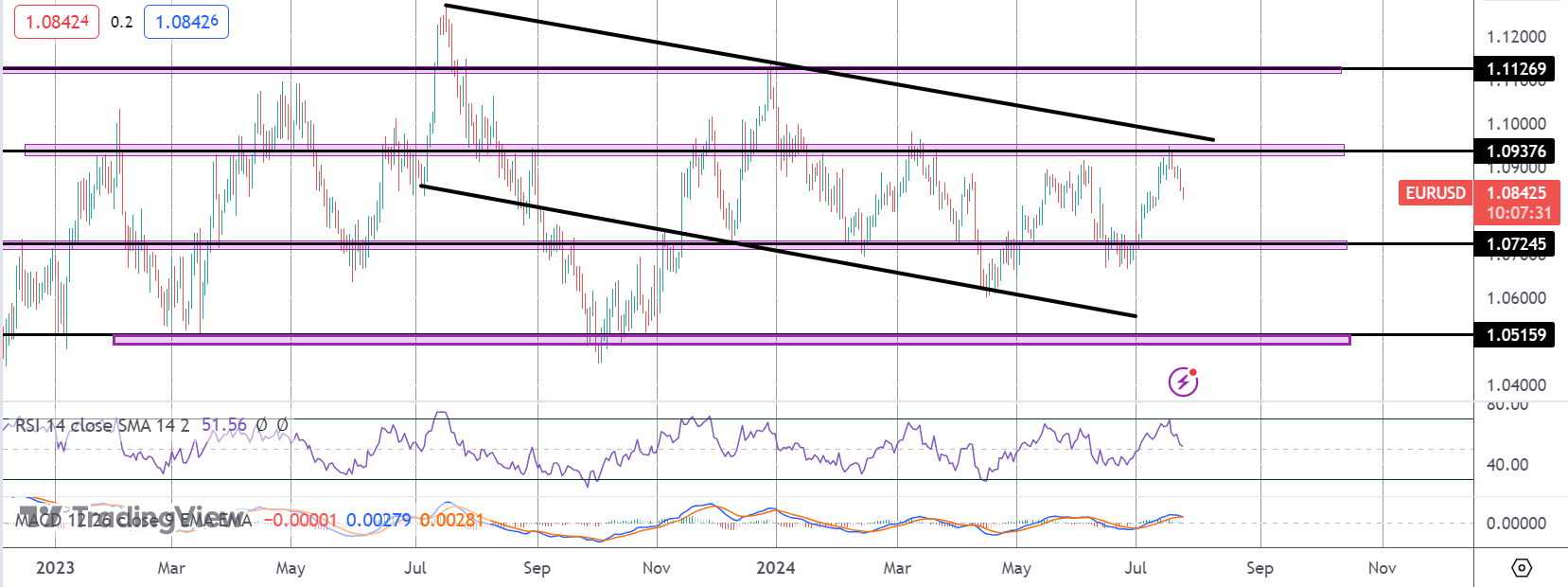

EURUSD

The rally in EURUSD has stalled for now into a test of the 1.0937 level resistance, capped by the bear channel highs just above. With momentum studies weakening, a further correction looks likely with 1.0724 the next support level to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.