EURJPY Pushing Back to Highs Ahead of ECB

ECB In Focus This Week

EUR will be in focus this week with the October ECB meeting on Thursday the headline event for the week. While the bank is widely expected to hold rates unchanged, there is some likelihood that the bank retains hawkish signalling in its outlook, keeping the door open for a potential December hike dependent on the path of inflation ahead of the final meeting of the year. While the bank signalled last time around a willingness to hold rates at current levels, stickiness in inflation is still a big issue for Lagarde and the recent uptick in energy prices puts this is issue back in prime focus here.

Lagarde On Watch Ahead of Thursday

The single currency has performed better over the last week or so given the pullback we’ve seen in USD. A less hawkish set of comments from Fed chairman Powell last week has created some room for near-term USD weakness which is benefiting EUR here. Ahead of Thursday’s meeting, we have a slew of EZ data as well as comments from ECB’s Lagarde tomorrow which traders hope will give some insight into how the bank is likely to act on Thursday. Given the subdued near-term expectations, there are upside risks for EUR this week should the bank strike a more hawkish tone than traders are currently expecting.

Technical Views

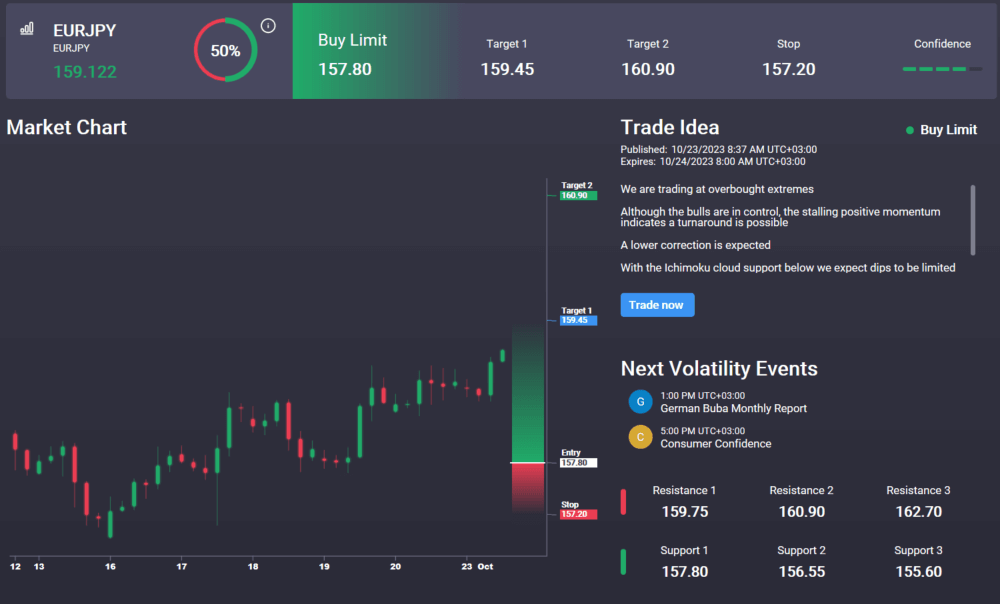

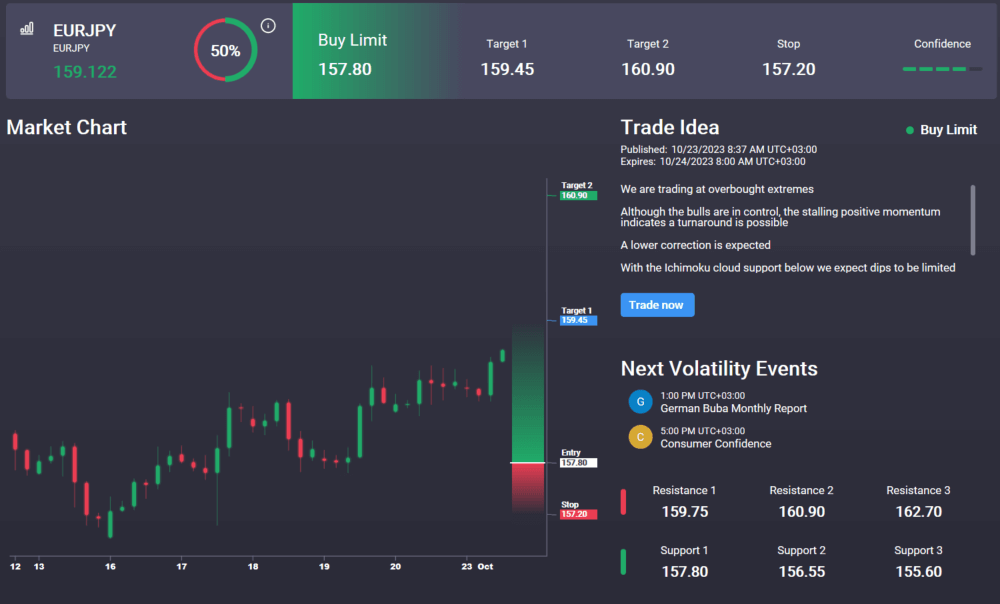

EURJPY

The rally has stalled for now into a test of the 159.71 level with price since trading back under the bull channel lows. However, the correction found solid support into the 155 area and price is now trading back up to retest both the underside of the broken bull channel and the 159.71 level resistance. With momentum studies turning higher, focus is on a fresh breakout here. To the downside mid 155s the key support to watch. Interestingly, we have an active buy signal in the Signal Centre today set below market at 157.80, suggesting a preference to buy and dip from current levels.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.