EU “Addiction” to QE puts a dent on its Efficiency

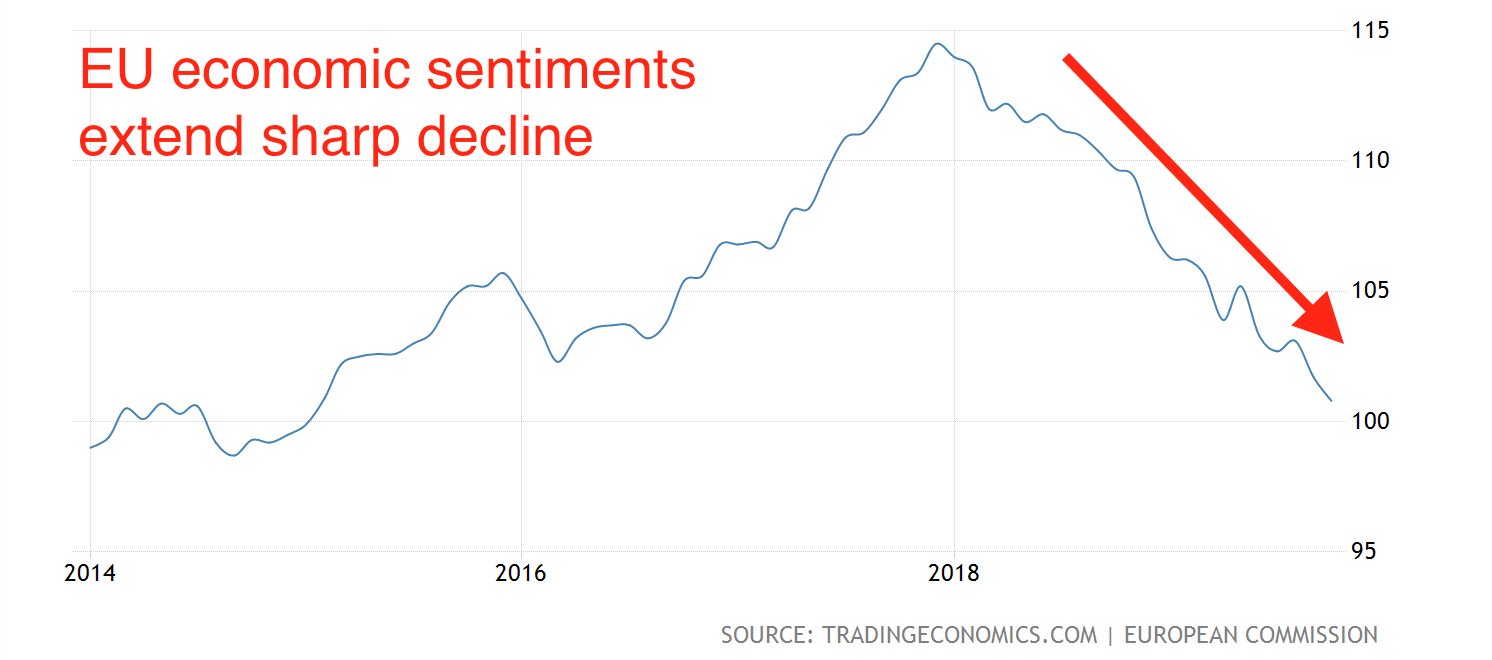

Economic confidence in the Eurozone declined in October for a second consecutive month, data showed on Wednesday, as the low spirits in manufacturing spread to services and consumption, which became a bad sign in the growth prospects of the block.

The European Commission reported that the main indicator of economic sentiment in the bloc, which has 19 countries, fell from 101.7 points in September to 100.8 points in October. In August, this indicator was 103.1 points. The decrease was stronger than the market expected (101.1 points) and brought the reading to the lowest level since January 2015, when QE of the ECB was in full swing.

The level of pessimism exceeded the long-term average, primarily due to weak export prospects, which are feeling the pressure of trade wars. In October, the gloom spread to the service sector, which has a much larger size than the manufacturing sector. Next in line to confirm the crisis will be indicators such as unemployment and consumer optimism. There is growing belief that large-scale QE turned out to be nothing more than symptomatic treatment, since the economy has not yet gained independence of growth.

The deterioration of sentiments should also affect the potential volume of fiscal stimulus, which is likely to be revised upwards which is a dovish signal for the Euro.

Eurozone output growth in the third quarter is expected to be only 0.1% compared with 0.2% in the second quarter. Eurostat, the European statistical agency, will release its official growth forecast on Thursday.

The mood in the service sector, which accounts for two-thirds of the Eurozone economy, was positive in September despite overall woes, but the level of optimism fell in October to 9.0 points from 9.5 in September. Concerns among consumers regarding income growth rates and certainty in employment prospects led to a reduction in purchases, which was reflected in the decline in sentiment in the retail sector in the negative area, also for the first time since 2015. According to the report, consumers expected retail prices to accelerate in October, which partially explained the deterioration in sentiment. This is positive news for the ECB, which is trying to trigger inflationary expectations. However, on the supply side, inflationary expectations remain depressed.

In another release, the commission said that the business climate indicator, which reflects the stage of the economic cycle, rose from -0.23 to -0.19 points, contrary to the forecast of -0.24 points.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.