Ethereum Breaks Out As ETF Inflows Soar

ETH Breaks Range Highs

Ethereum prices are trading at their highest levels since July today on the back of news of Trump’s election success yesterday. A broad move higher across the crypto space has seen ETH futures closing their 90-day gap on the CME, moving above the range highs which have capped price action since the summer. The expectation that a Trump presidency will prove supportive for the crypto market has driven a flurry of activity with BTC and ETF inflows hitting record levels. On the back of yesterday’s results, ETH ETFs saw their highest daily inflows for six-weeks.

Bullish Outlook

Looking ahead, the near-term forecast for ETH looks bullish. The Republican party is currently on course to take control of the House as well as the Senate, giving Trump a clean sweep in congress. If confirmed, this should offer crypto assets a further boost, creating an easier path for Trump to execute his policies. The prospect of an easier regulatory environment for the crypto market, greater assess for institutional investors and a wider uptake in the US mainstream is expected to push demand higher in coming months. News that the Michigan State Pension Fund has invested around $10 million in ETH ETFs is a strong indicator that mainstream investors are increasingly embracing crypto and is a good omen for the market near-term with more such investors expected to follow suit.

Technical Views

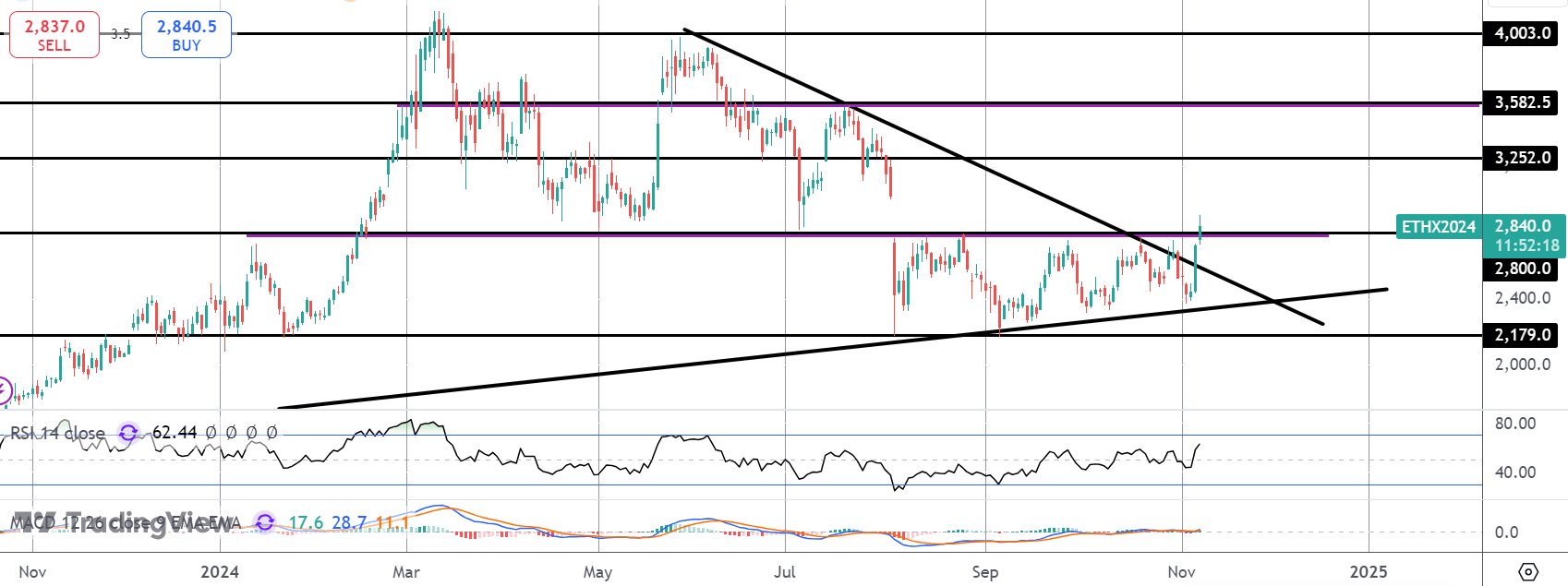

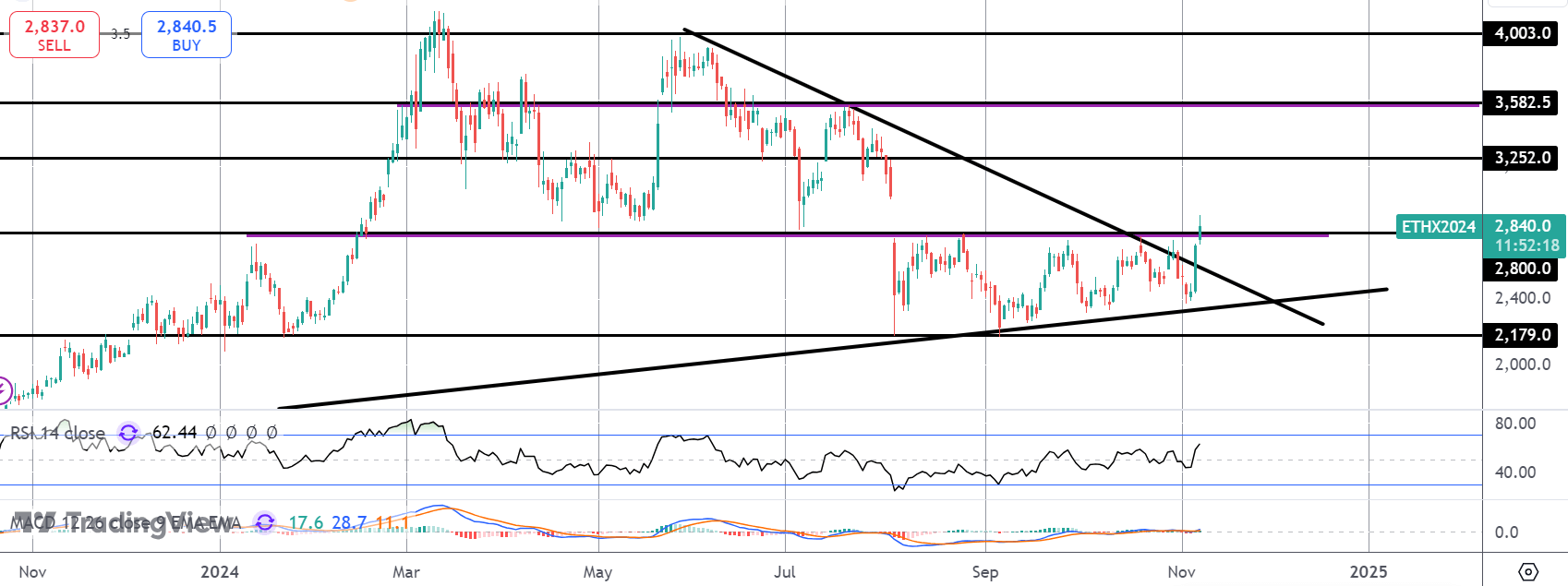

ETH

The rally in ETH has seen the market breaking out above the bear trend line from YTD highs and above the 2,800 level. This is a key pivot for the market and, while above here, focus is on a continued push higher with 3,252 and 3,582 the next bull targets.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.