Early General Elections to Become the Next big Thread in Pound Trading

The UK currency successfully weathered through a series of fateful political decisions, managing to retain gains and slide cautiously during Wednesday trading. On Tuesday GBPUSD marked the longest roller coaster ride since the referendum - for nine consecutive days, daily volatility exceeded 1%. The width of daily range from October 10 to 21 was on average 1.6%, which is almost twice the historical average for three decades.

Short-term forecasts of the currency with “cryptocurrency-like” volatility will burn both shorts and longs with tight stop loss targets. However, in the medium term, as PM Johnson “conquers” Brexit from uncertainty through small but confident victories, market expectations is likely to exaggerate optimism in the possible outcomes and downplay risks. Goldman supports this point of view with its BTFD outlook (“buy the f*cking dip”). The US bank raised its medium-term forecast of the exchange rate from 1.30 to 1.35 dollars per pound.

Despite the fact that Johnson’s deal with the EU was approved in the House of Commons, the Prime Minister lost the vote on the implementation of the accelerated timetable from the EU withdrawal, i.e. “before Halloween”. If the EU provides a delay (which it is inclined to do as hinted by Donald Tusk), the next major uncertainty will be the early general parliamentary elections. Johnson's opponents are already trying to discourage the market, saying that the unpopular measures and protracted Brexit talks have led to a decrease in nationalist views among the British, which is not positive for Tories. According to rumors, the Scots are beginning to turn away from Johnson's party too.

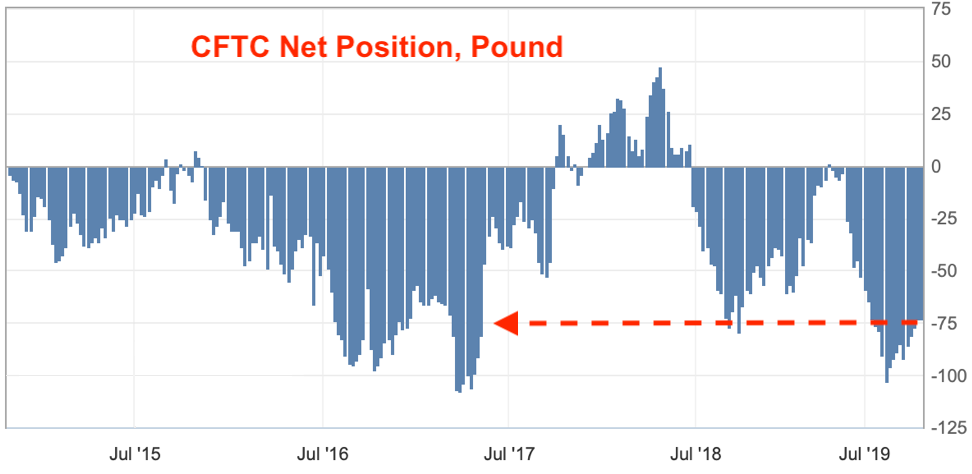

Futures on UK currency are in no hurry to reflect the optimism of the spot market. Despite the recent appreciation almost to the level of 1.30, the net position on GBP, according to the CFTC, remains significantly negative similar to two-year lows. At the same time, the change in net position in the last week compared to the previous one is not consistent with rapid growth of the exchange rate (from -77.1K to -73.0K):

Therefore, in the medium term, significant pessimism remains regarding the value of the pound, but it is mainly associated with uncertainty of the early elections.

So, in the short-term weeklong perspective, we should focus on the following key points:

- There is likely a slight rise in the pound from current levels on speculation that Parliament will approve a quick exit on October 31;

- The pound may decrease on the results of voting within the framework of the classic rule “sell facts”. As the EU will likely grant a delay, market focus will switch to rumors about Tories potential electorate as the market begins to discuss possible early parliamentary elections;

- If parliament approves a quick exit, the pound target is 1.35;

- If the parliament votes for “No deal” (earthy chance), the goal becomes 1.15 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.