Downbeat US Retail Sales Could Make the Fed more Cautious in its Tapering Plans

The US Dollar index stabilised after Tuesday rally attempting to gain foothold above the 93 level as investors eye the July FOMC meeting minutes. The report is expected to reveal technical details on tapering of the asset-buying program, which in itself will be a signal that the Fed prepares to make an important announcement regarding QE at the upcoming meetings.

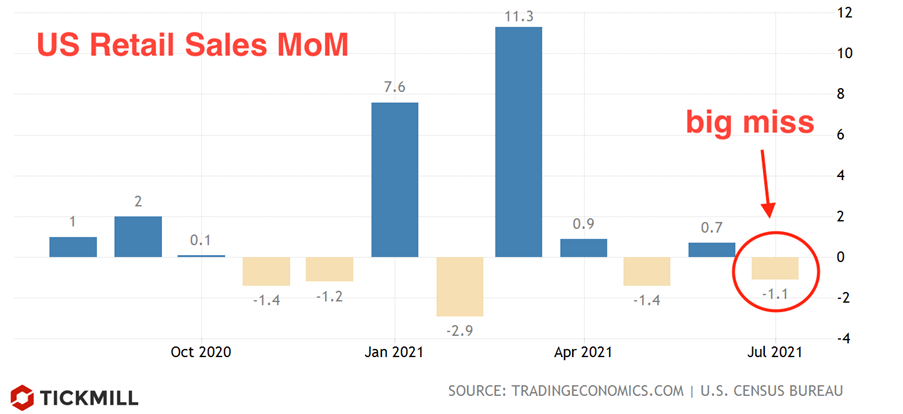

Retail sales was a big miss yesterday which nevertheless couldn’t prevent greenback from going up. The decline in sales was stronger than expected (-1.1% versus -0.4% forecast). At the same time, core retail sales (which exclude cars and fuel) declined by 0.4% against the forecast of +0.1%, which indicates a more persistent than expected weakening of consumer activity in the United States:

The signal from retail sales that consumer boom could be topping out was supported by the data from U. Michigan – consumer sentiment index tumbled by 11 points in August. However, markets seem to believe that signs of easing momentum in consumption won’t shake position of the Fed and preparations for QE tapering are in full swing. Nevertheless, the risk of disappointment from the US Central Bank has risen.

Long-term bond yields in the US, which recently rebounded on inflation expectations, have been quiet this week. The yield on the 10-year Treasuries has declined since the beginning of the week from 1.30% to 1.22%, which indicates an increase in demand for long-term securities ahead of the Fed-related updates. Deteriorating US economic data also contributed to strength of US long-dated bonds: investors expect that as economic outlook becomes less rosy, upside trajectory of US interest rates may be less steep, therefore, current long-term bond yields become more attractive.

Considering the technical position on DXY, it can be seen that the index breached upper border of a medium-term wedge pattern on Tuesday:

It makes sense to view this breakout as fake since we got really strange USD reaction to deteriorating US fundamentals: weak July retail sales report, in my view, increases the chance that the Fed will not rush to reduce monetary stimulus and may be willing to leave room for a possible extension of the period of low rates. The prospects of lower interest rates have negative implications for USD as investors tend to flock in places where central banks have already embarked on the tightening path.

In addition, surprising RBNZ move to leave interest rate unchanged showed virus-related uncertainty is still high and could affect central bank decisions. The Fed may not be an exception, it all depends on their reaction to incoming data, in particular from the labour market, which is gradually becoming alarming. The commodity market also halted growth, in particular, oil prices have been testing support at $67.50 for Brent for about a month. Therefore, yesterday breakout of USD should be treated with caution, since today's Fed protocol, and possibly the Jackson Hole conference, may disappoint investors who are betting on QE tapering.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.