Dollar Testing Bull Channel Lows

Dollar Weaker on Thursday

The US Dollar is on watch today as traders brace for the first set of tier-one US data since Powell’s dovish Jackson Hole comments last week. Powell signalled the Fed was on course to begin easing again in light of risks to the jobs market though did express some caution around inflation levels. With that in mind, traders will be closely watching incoming US data ahead of the September meeting, with next Friday’s NFP release set to be a pivotal moment for USD.

US Data Due

Today, traders will be watching prelim GDP and weekly jobless claims. Any weakness in these figures should see easing expectations firming up more, weighing on USD near-term. Any upside surprise should have the opposite impact, dampening easing expectations somewhat and allowing USD to recover. However, unless we see any meaningful upside surprise today it looks unlikely that USD is going to see much upside near-term.

Fed’s Waller to Speak

Looking beyond today’s data, we’ll hear from Fed’s Waller who speaks this evening on monetary policy. Given his dovish leaning his comments are likely to keep USD pressured lower, especially since the July NFP results corroborated his earlier concerns on the jobs market. Against this backdrop, Waller is likely to have turned more dovish. If his remarks follow on from any further data weakness today this could be particularly bearish for USD near-term.

Technical Views

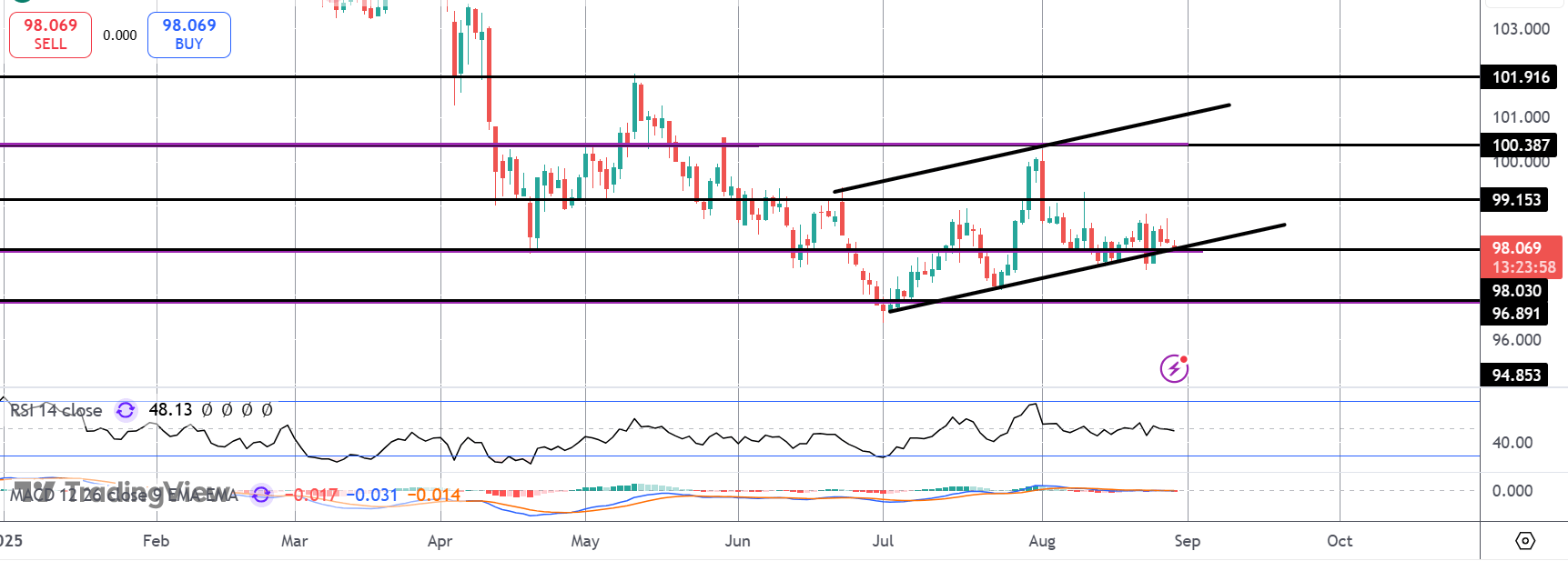

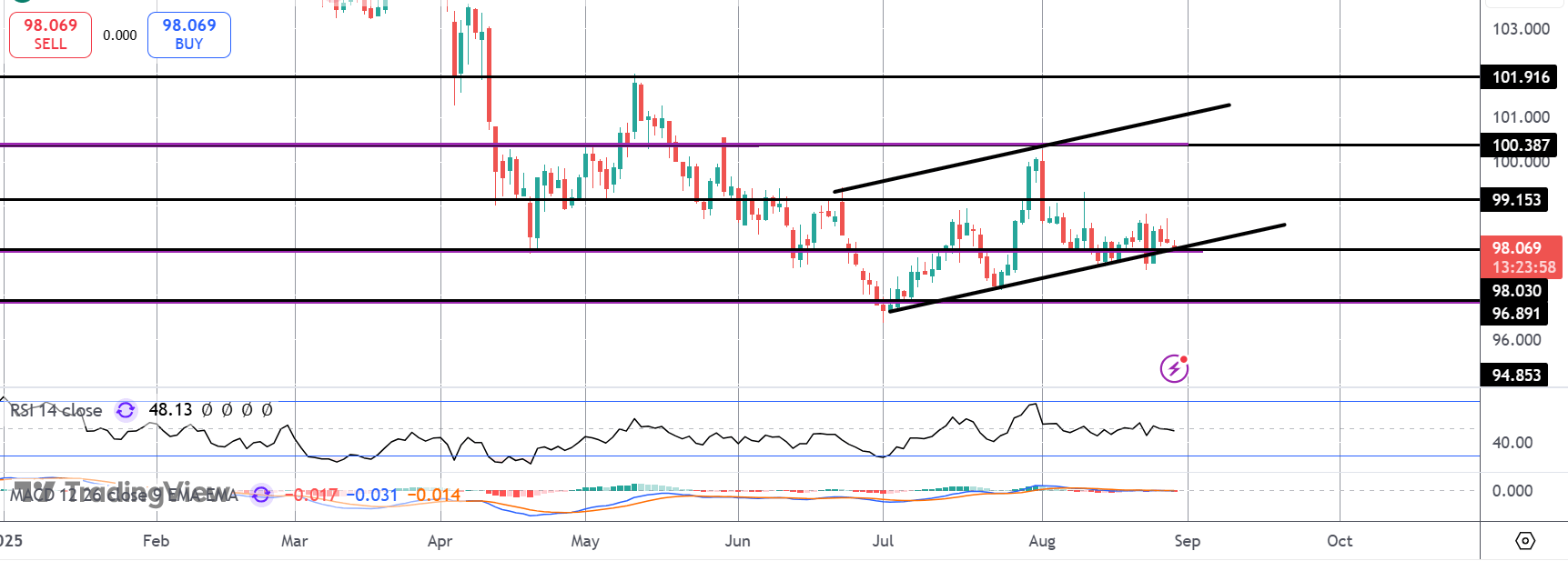

DXY

The Dollar is testing support at the 98 level and bull channel lows. With momentum studies weak, risks of a break lower are seen with 96.89 the level to watch if we do move through this area. Bulls need to break back above 99.15 near-term to alleviate these risks and put focus back on the 100-mark.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.