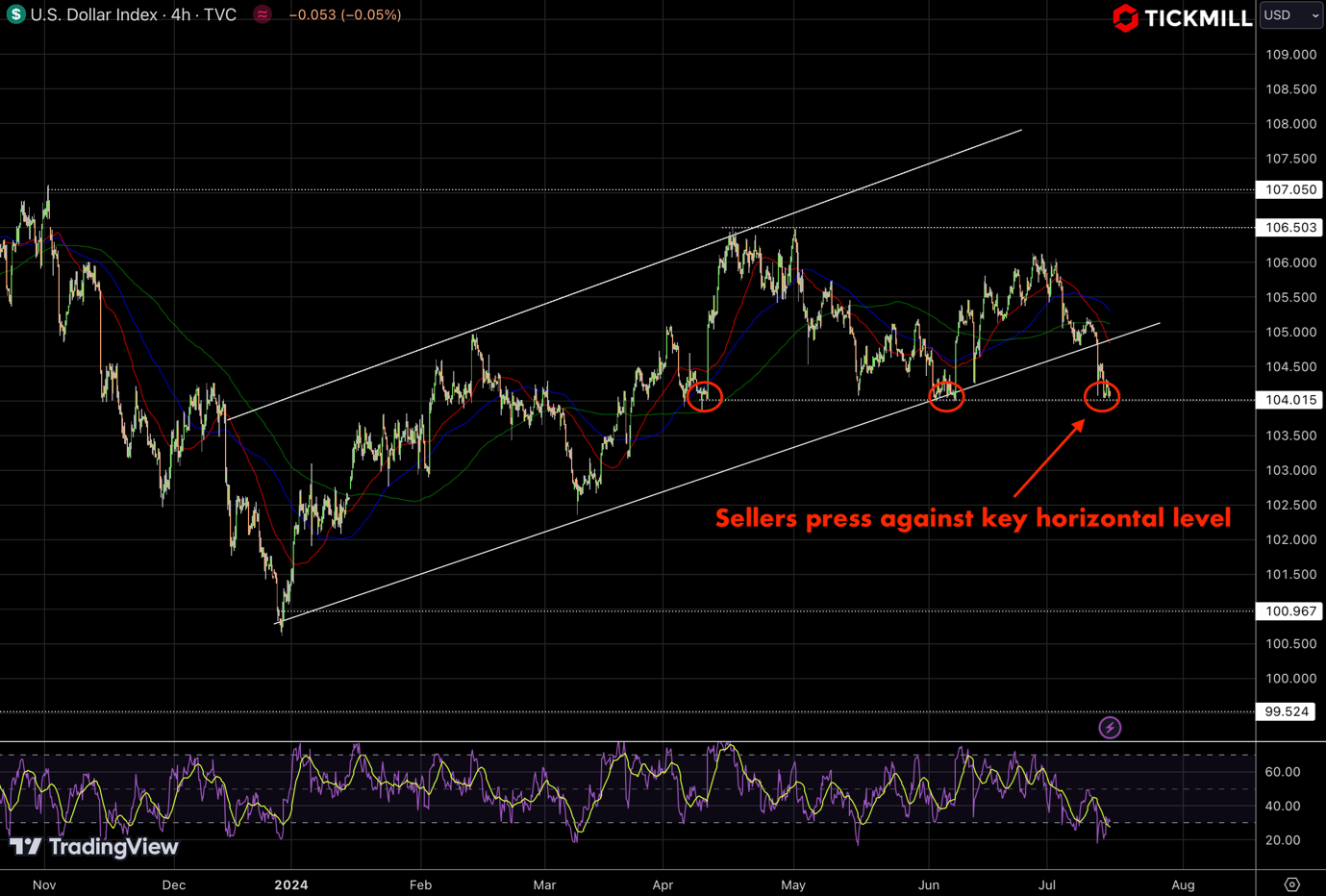

Dollar Looks Set to Test Key Horizontal Level, but a False Breakout is Likely

The US Dollar experienced a retreat today, relinquishing its intraday gains following the shocking news of an assassination attempt on former President Donald Trump. Although Trump sustained an injury to his ear, he is reportedly in good spirits and preparing to address the public later today.

Historically, Trump's presidency bolstered the USD, largely due to his fiscal policies and deregulation efforts. However, the current landscape presents a starkly different scenario. The burgeoning US deficit and escalating national debt raise questions about the sustainability of a strong dollar under renewed fiscal spending initiatives.

The US Dollar Index (DXY) has decisively broken below the key ascending channel following a dovish CPI print, signaling a potential shift in sentiment to the downside. Currently, sellers are pressing against the critical horizontal support level at 104. This level has previously acted as robust support, and given the current US political and economic backdrop, there is a high probability of a false breakdown. Recent events, including political uncertainties and anticipated dovish monetary policies, suggest that the 104 level will likely hold, providing a possible buying opportunity for traders anticipating a rebound:

Amid this political drama, it’s crucial to keep an eye on the economic indicators set to be released this week. US Retail Sales data for June, scheduled for Tuesday, is expected to be a pivotal figure. Retail sales are a key barometer of consumer spending and economic health, and any significant deviation from expectations could further influence the USD's trajectory.

Moreover, we await Federal Reserve Chairman Jerome Powell's interview on Bloomberg later today. Powell's remarks will be scrutinized for hints about the Fed’s future monetary policy stance. Given the dovish Consumer Price Index print last week, which signaled a resumption of the disinflation process, the market is rife with speculation about potential Fed rate cuts.

The US Consumer Price Index for June showed a notable deceleration in inflationary pressures, both on the headline and core fronts. This data has strengthened the market’s conviction that the Fed may reduce its key interest rates, with interest rate futures now pricing in a 90% probability of a 25-basis-point cut in September. This sentiment persists despite Friday's Producer Price Index report, which revealed higher-than-expected price pressures driven by service costs.

The Pound Sterling has been flexing its muscles against major peers. Investors are gravitating towards the UK markets, viewing them as a relatively stable investment haven compared to the politically tumultuous US and European Union. The decisive victory of Keir Starmer’s Labour Party has assured markets of stable fiscal policies, contributing to Sterling's resilience:

Furthermore, the uncertainty surrounding the Bank of England rate cuts has been a significant driver of GBP strength. Financial markets anticipate the BoE to start easing rates at the August meeting, but BoE policymakers remain cautious due to persistent inflationary pressures in the service sector, fueled by robust wage growth.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.