Dollar Hits Two-Year High as Eurozone and UK Economies Show Signs of Strain

The greenback has surged to a fresh two-year peak today in an extremely volatile move, with the DXY Dollar Index testing the 108.00 level. This surge comes on the heels of disappointing soft data readings from the Eurozone and the UK, which have dampened market sentiment and underscored mounting concerns about slowdown in these economies.

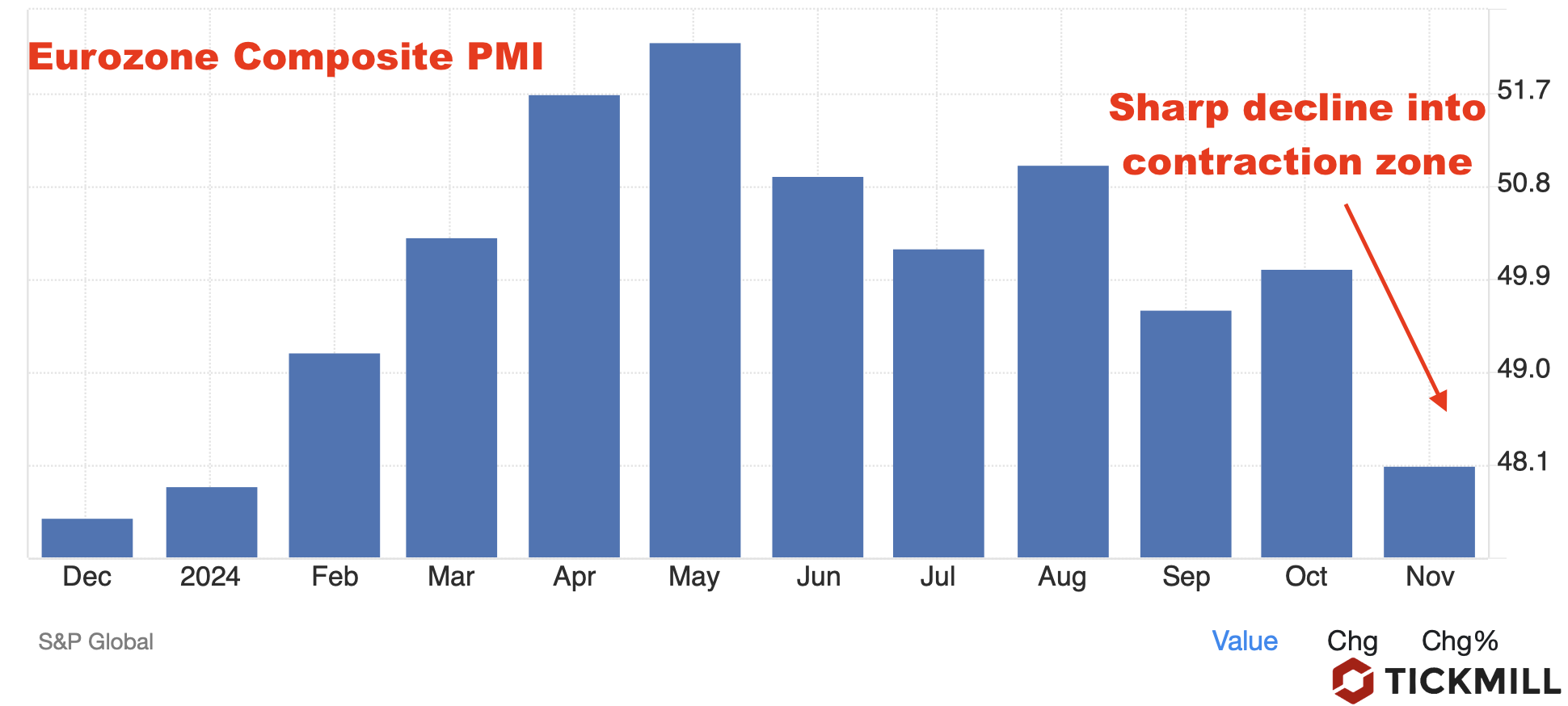

In the Eurozone, the Composite PMI slipped to 48.1 in November from 50, falling below the critical 50.0 threshold that separates expansion from contraction. Both the services and manufacturing sectors are feeling the pinch, with the former dipping into contraction and the latter's downturn gaining momentum. Germany and France, the bloc's heavy hitters, also missed the mark, posting PMI figures that point to their steepest contractions in months:

Germany's economy, in particular, is barely keeping its head above water. The third-quarter GDP growth was revised down to a meager 0.1%, highlighting the fragility of Europe's largest economy. This lackluster performance has weighed heavily on the euro, fueling speculation that the ECB might have to cut interest rates further to prop up growth.

ECB officials are already on edge about weak growth prospects and the looming threat of a trade war with the United States. Chief Economist Philip Lane sounded the alarm, warning that escalating trade tensions could take a sizable bite out of global output. His remarks underscore the tightrope the ECB is walking as it tries to navigate through these economic headwinds.

Investors are keeping a close eye on the US preliminary S&P Global PMI readings for November. If the numbers come in strong, it could give the dollar another leg up and widen the gap in growth rates between the US and Europe. The final reading of the University of Michigan Consumer Sentiment survey is also on the docket, offering further clues about the health of the US economy.

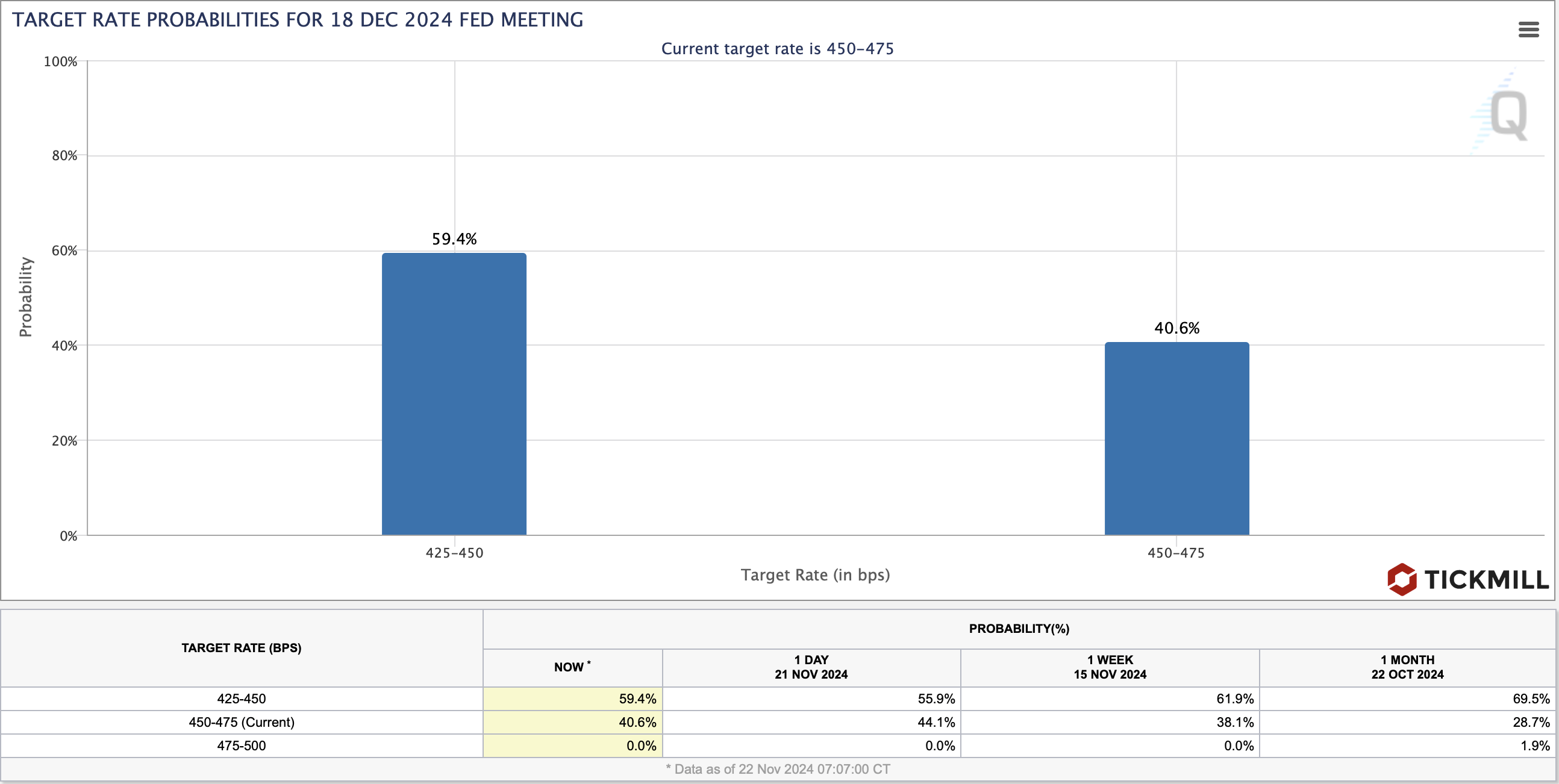

Fed funds rate futures suggest that the odds of a pause in the Federal Reserve's rate-cutting cycle in December have slipped slightly, somewhat reversing its rising trend:

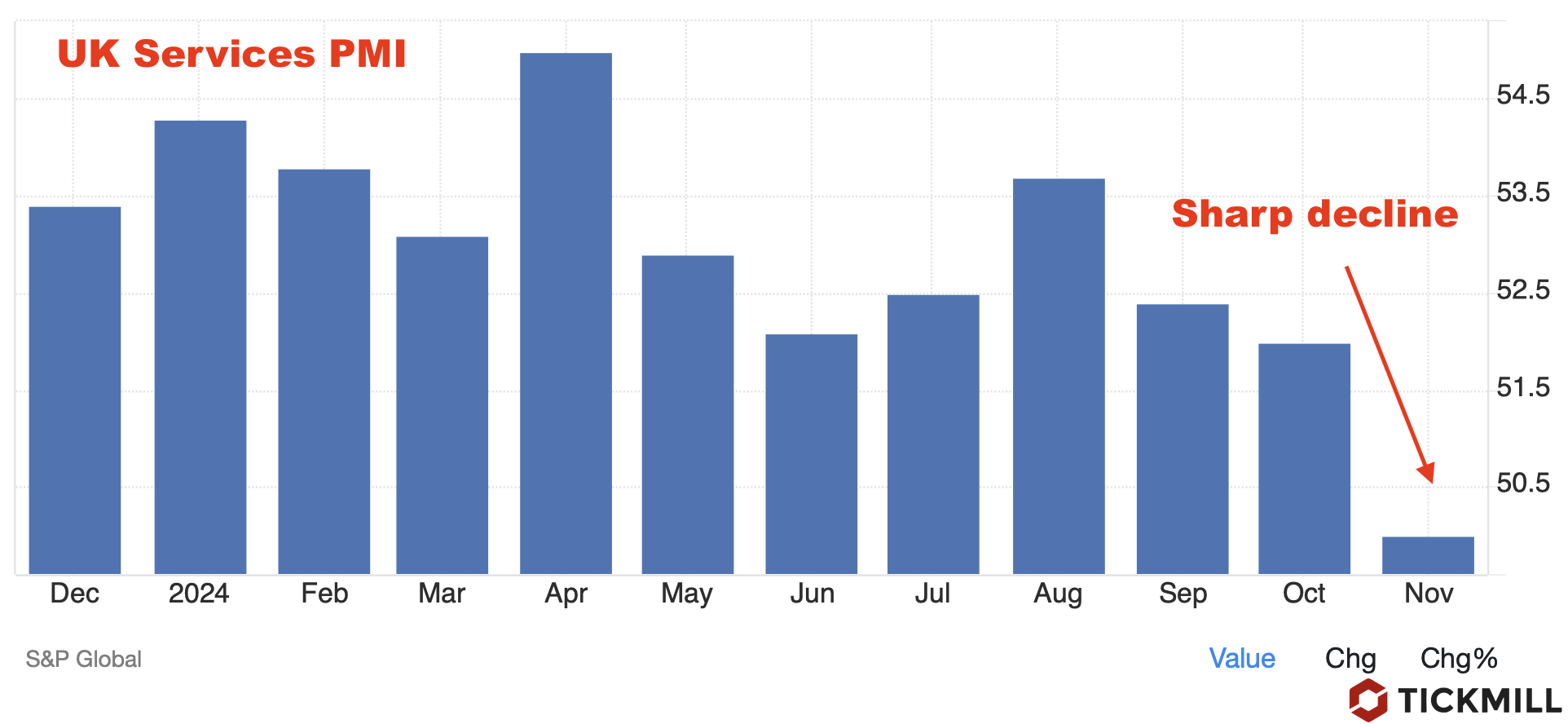

The British pound isn't faring much better, weakening against most major currencies except the euro. This comes after the UK's flash PMI data for November took an unexpected nosedive, and retail sales for October contracted more than anticipated. The Composite PMI fell to 49.9, marking its first dip into contraction territory in over a year. Manufacturing is losing steam, and the services sector is just barely holding on:

Despite these red flags, market participants are betting that the BoE will keep interest rates on hold at 4.75% in December and February. The reasoning? Inflation is still running hot, with October's data showing services inflation—a key gauge for the BoE—rising to 5%. The central bank finds itself between a rock and a hard place, trying to balance slowing growth with stubbornly high inflation.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.