Dollar Eyeing Breakout After Hawkish FOMC Mins

Hawkish FOMC Minutes

The US Dollar is pushing higher today on the back of a hawkish set of FOMC minutes yesterday. The DXY is testing the 100.39 level resistance and with momentum studies bullish, focus is on a break higher. The minutes showed considerable resistance to furtehr easing, as expected. Several members expressed opposition to cutting rates last month and many signalled they expected rates to remain unchanged at the December meeting. While the minutes were well-expected to be hawkish, other developments have conspired against doves this week also.

Further Data Delays

The BLS announced yesterday that the delayed October jobs report, and the November jobs report, will be released together on December 16th. Given that this is after the December 10th FOMC meeting, rate cut expectations have now plunged again. The one remaining hope that doves had was that incoming data, including delayed data from the shutdown period, would show fresh weakness, giving the Fed ammunition to ease again. However, with the data now delayed until after the meeting, the likelihood of the Fed cutting before seeing that data is seen as very low, fuelling a fresh bid in USD.

Today’s NFP Data

Looking ahead today focus will be on the delayed September NFP data due this afternoon. If we see an uptick in the headline reading as expected (55k vs 22k prior) this should keep USD supported. If we see an upside surprise, this should be firmly bullish for USD into next week. A downside surprise, on the other hand, should help cap the rally for now but shouldn’t impact December easing prospects.

Technical Views

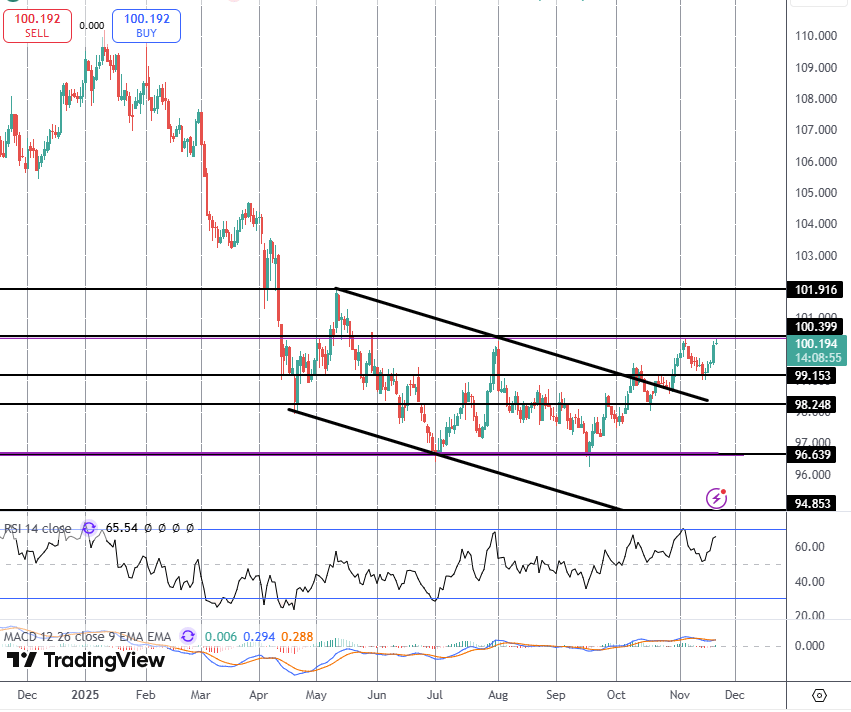

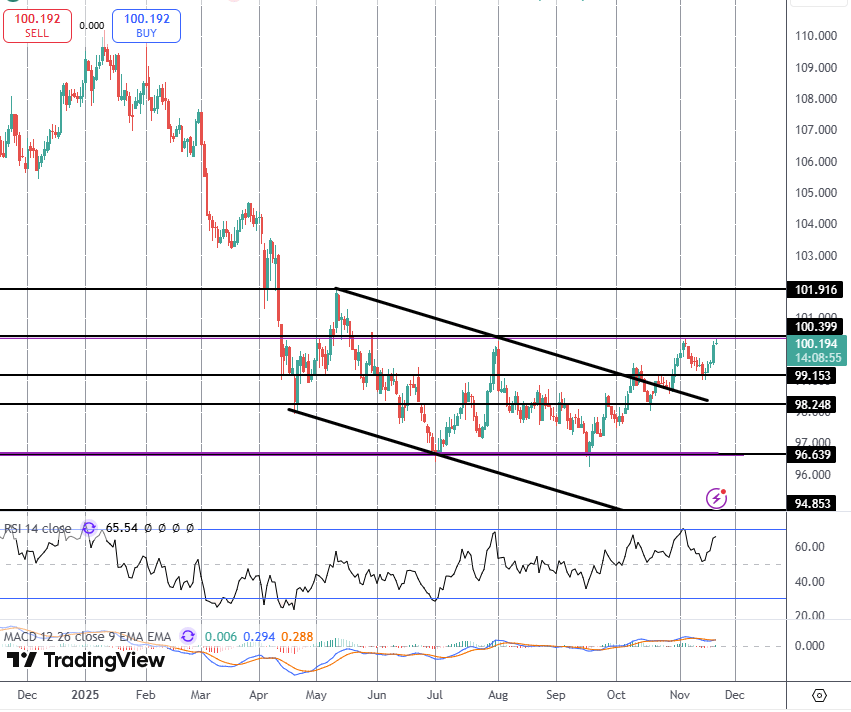

DXY

Following a correction lower, DXY has rallied off the 99.15 level and is now once again testing the 100.29 resistance. With momentum studies bullish, focus is on a breakout here with, confirming a rounded bottom reversal which puts focus initially on 101.91 as the next bull target to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.