Dogecoin Testing Make-Or-Break Level

Doge Rally Continues

Dogecoin is testing a make-or-break level in the market today following a rally off the YTD lows. The largest of the so called alt-coins ( crypto outside of BTC, ETH and LTC) has been heavily sold from the YTD highs printed in January. However, the selling has stalled recently and price looks to be forming a potential base. News of massive accumulation by whales (accounts holding over 1000 DOGE units) over the recent lows (around $200 million) suggest that the market could be on the cusp of a recovery higher. However, bulls need to see a break back above the 0.21 level resistance. If the market fails here, a fresh leg lower could be seen instead.

Fed Impact

Crypto prices have been higher over the last week or so following the March FOMC which saw the Fed lowering its dot plot forecast. The bank now sees two rate cuts this year, down from one prior. The shift in outlook prompted a recovery in risk markets. However, upside momentum is fading a little through the back of the week as uncertainty over a fresh wave of US tariffs takes the shine away from that dovish Fed outlook.

Near-Term Risks

Near-term, risks of a drop lower in crypto prices are seen unless Trump announces softer-than-expected tariffs next week. If some countries are exempt and some receive lower tariff amounts than previously signalled, this should fuel a fresh wave higher in crypto prices. However, if Trump pushes ahead with aggressive action, especially following measures announced this week, crypto prices could plunge again.

Technical Views

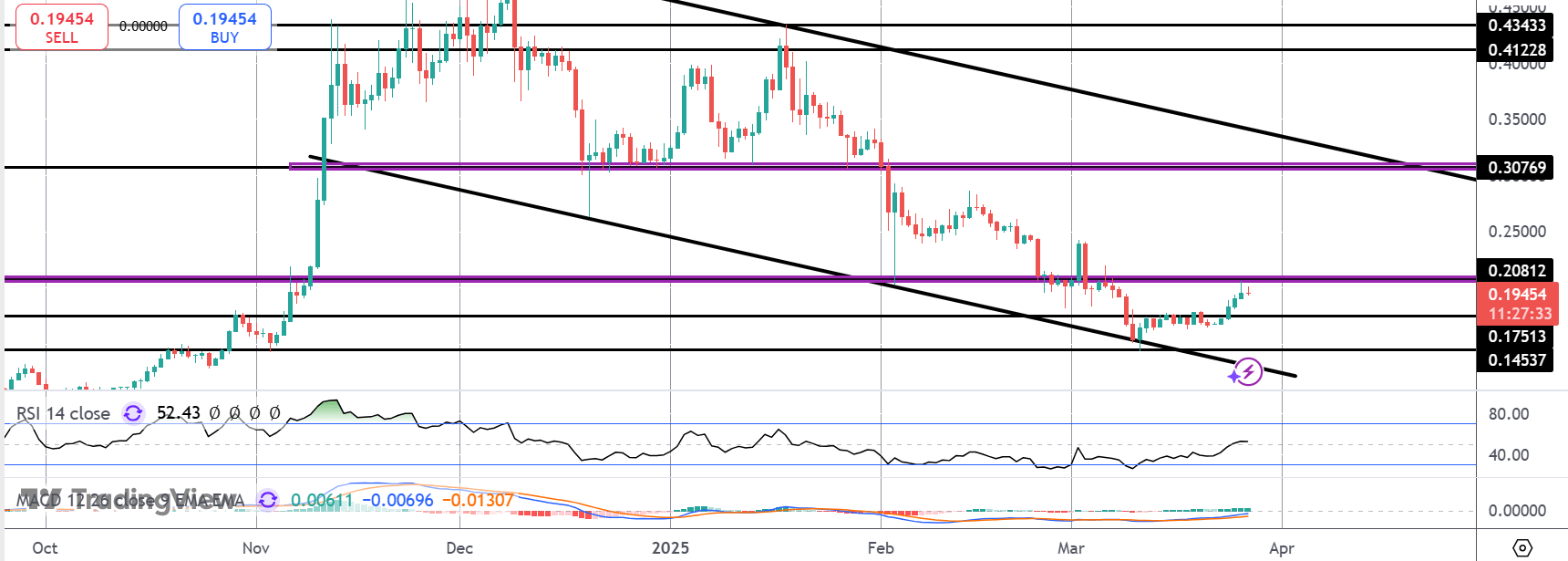

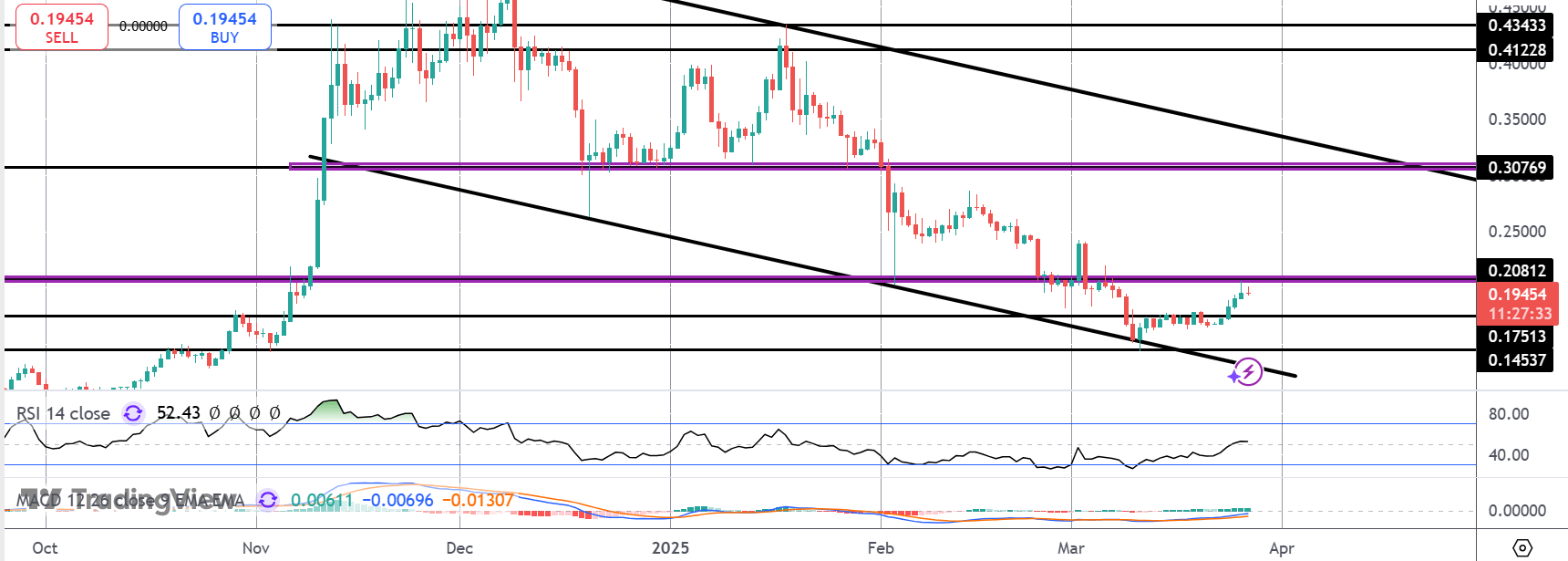

Dogecoin

The sell off in Dogecoin has stalled for now into the bear channel lows and the .1751 level. Price is now retesting the broken .2081 level. This is a key pivot for the market and a break higher here will put focus on a recovery back up towards the .3076 level and the bear channel highs. If price fails here, however, focus will shift back to a continuation of the channel lower with .1453 the next bear target.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.