Daily Market Outlook, September 8, 2022

Daily Market Outlook, September 8, 2022

Overnight Headlines

- Japanese MoF, FSA and BoJ will meet at 08:45BST

- Top Japanese currency diplomat to brief media after meeting

- Yen Extends Decline As Traders Eye 145 Level And 1998 Lows

- Biden Delays Decision On China Tariffs Put In Place By Trump

- Fed Officials Reluctant To Call Inflation Peak As Policy Meeting Looms

- Fed Report Shows Weak US Growth Outlook With Inflation Cooling

- Goldman Lifts Forecasts For Fed Hikes In September And November

- WH: Undermining N. Ireland Agreement Will Not Help US-UK Trade Talks

- ECB Poised For Another Big Rate Hike As Inflation Soars

- UK To Scrap Fracking Ban Sept 8; Requests For New Drilling Exp In Weeks

- UK Surveyors Expect Weakest Home Sales Since At Least 2012

- UK Recruiters Say Hiring Slow, Pay Growth Weakest In Over A Year

- Japan's Q2 GDP revised Up To 3.5% Annualised Expansion

- RBA Looks Set To Slow Pace Of Rate Hikes But Peak Is Unclear

- Australia’s Trade Surplus Almost Halves As Coal, Iron Ore Tumble

- Dollar Resumes Climb In Asia As Powell Speech, ECB Loom

- US SEC To Propose New Treasury Market Reforms Next Week

- Oil Edges Up After Plunging Almost 6% On China Demand And Dollar

- Stock Rebound In Asia Is Tempered By A Firm Dollar

- UK Surveyors Expect Weakest Home Sales Since At Least 2012

The Day Ahead

- Investor risk sentiment improved in Asia following the positive close in equity markets on Wall Street. That has been attributed to further declines in the oil price related to weakening global demand which, in turn, has lowered US Treasury yields. Still, Fed policymakers reiterated that tackling inflation remained the priority. In the UK, BoE Chief Economist Huw Pill yesterday said that freezing energy bills may have a downward effect on inflation in the short term, although the support to incomes may result in ‘slightly stronger inflation’ further out.

- The main financial market focus today is the ECB policy announcement at 13:15BST followed by a press conference with President Christine Lagarde at 13:45BST to explain the decision and answer questions. Also today, US Fed Chair Powell will take part in a discussion at a monetary policy conference at 14:10BST as markets continue to speculate on the size of the US central bank’s next hike later this month. In the UK, new PM Truss is expected to set out details in Parliament of a major support package for households and businesses in the face of soaring energy prices.

- The ECB is set to raise interest rates again after lift-off at their last meeting in July when they hiked more than expected by 50bp, bringing the deposit rate up to 0% from -0.5%. This time round, the debate on the Governing Council seems likely to shift to whether to raise policy interest rates by 50bp or a record 75bp. Either way, it would bring interest rates on the deposit facility into positive territory for the first time since 2012. Despite survey evidence pointing to Eurozone GDP growth coming to a near standstill, the ECB’s focus remains on worsening inflation trends. Rate-setters, particularly the ‘hawks’ on the council, will be concerned about potential second-round effects and risks that medium-term inflation expectations are becoming unanchored from the 2% target.

- Informing rate-setters will be a new set of ECB economic forecasts. Policymakers will be mindful that recent forecasts have consistently underestimated near-term inflation. They will also closely focus on the inflation forecast for the final year of the projection period which, in June, was raised to 2.1% for 2024. But there will also be caution among more ‘dovish’ members about the potential side-effects of a larger rate rise this week, including the impact on peripheral bond yields. Hence a 75bp hike today is not a done deal. Perhaps reflecting this uncertainty, the OIS curve is currently pricing in about two-thirds probability for such an outsized move.

FX Options Expiring 10am New York Cut

- EUR/USD: 0.9800 (1.35B), 0.9850 (965M), 0.9865 (558M), 0.9900 (909M)

- EUR/USD: 0.9950 (648M), 1.0000 (2.22B), 1.0050 (756M), 1.0075 (619M)

- USD/JPY: 140.00 (1.87B), 142.00 (502M), 143.00 (561M)

- GBP/USD: 1.1400 (593M). EUR/GBP: 0.8650 (422M)

- USD/CAD: 1.3200 (650M)

Technical & Trade Views

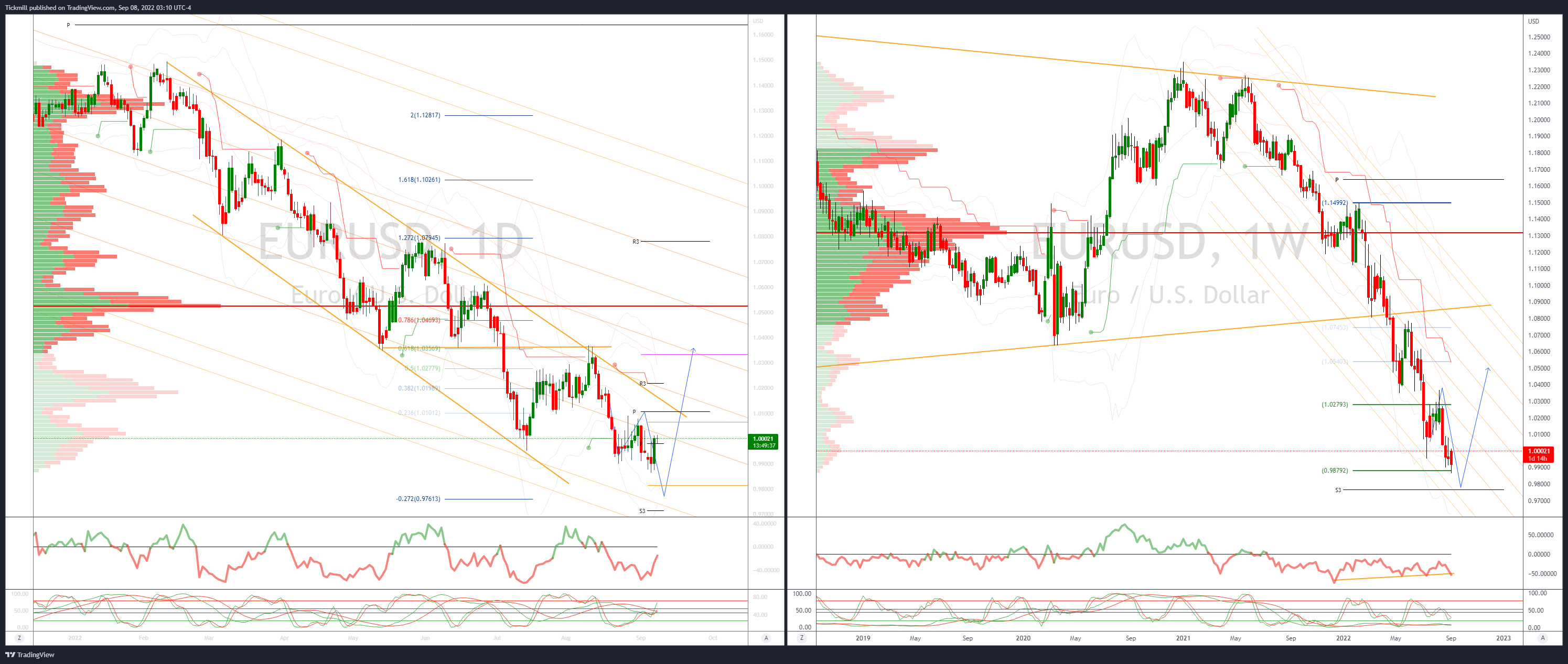

EURUSD Bias: Bearish below 1.0250

- Bounces ahead of ECB as US yields ease

- EUR/USD gained 1.0% as fall in US yields and slide in oil price underpinned

- It closed above 0.9977 and that is now support

- Resistance is at 1.0040 and break would suggest bottom forming

- ECB decision later today is a key event with market pricing in a 75 BP hike

- If ECB opts for 50 BP hike instead - it will likely see EUR/USD sell off

- Fed Chair Powell speaks later today and will likely reiterate hawkish view

- Sustained 0.9900 break would target 0.9608 base in September 2002

- 20 Day VWAP bearish, 5 Day bullish

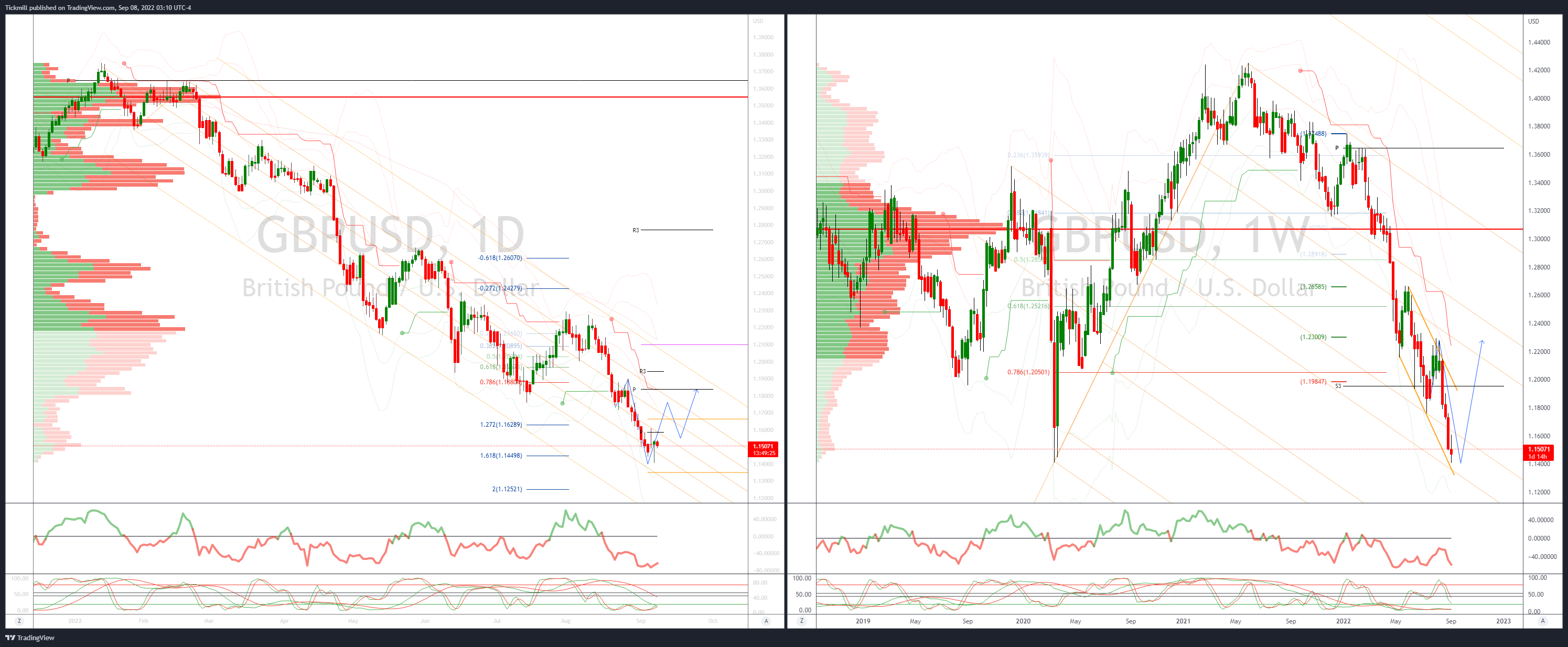

GBPUSD Bias: Bearish below 1.19

- At pivotal levels, as government policy unfolds

- Off 0.15% after closing + 0.15% amid USD weakness, EUR/GBP closed +0.85%

- UK PM Liz Truss to set out 'bold' plan to tackle energy crisis

- Cost and economic impact of Truss's plans will be key for gilts and sterling

- Bearish trending setup while 1.1586 caps on the close

- Wednesday's 1.1407 failure leaves a 'hammer' reversal daily candles

- Close above Wednesday's 1.1535 high would suggest a 1.1407 base in place

- 20 Day VWAP is bearish, 5 Day bearish

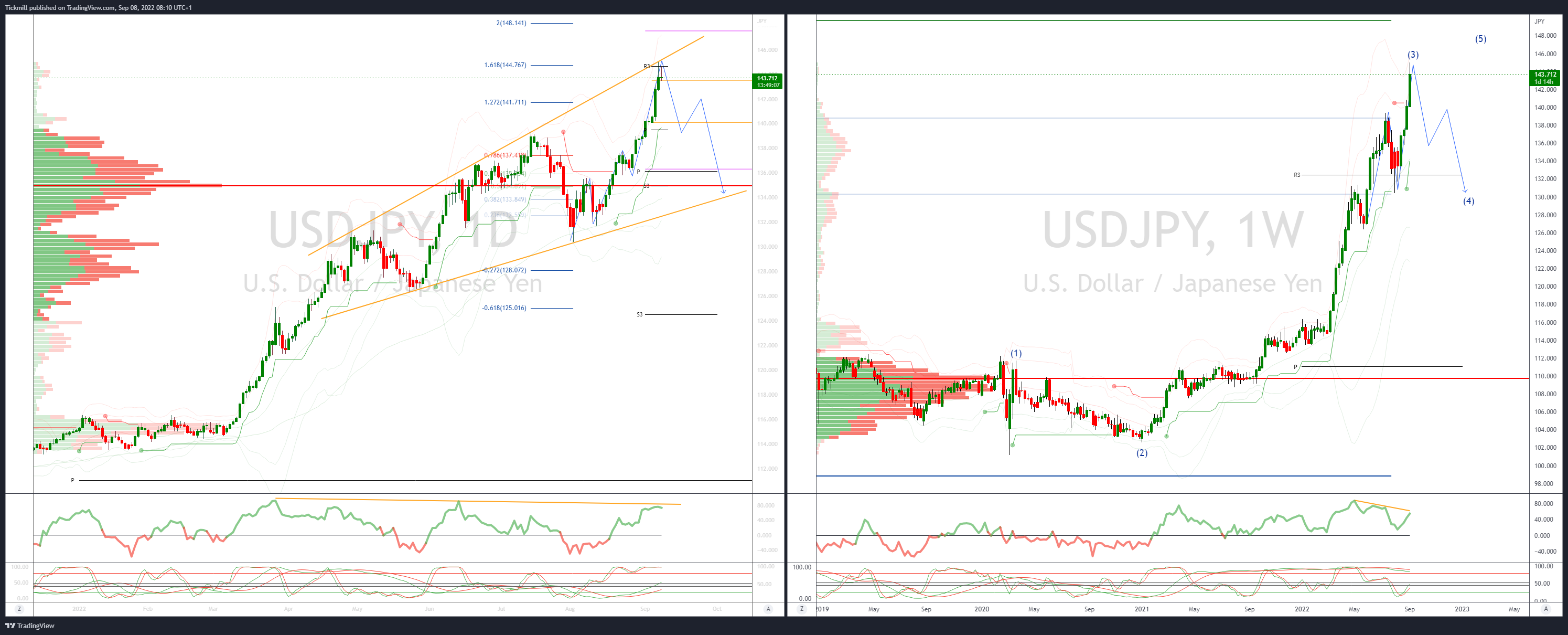

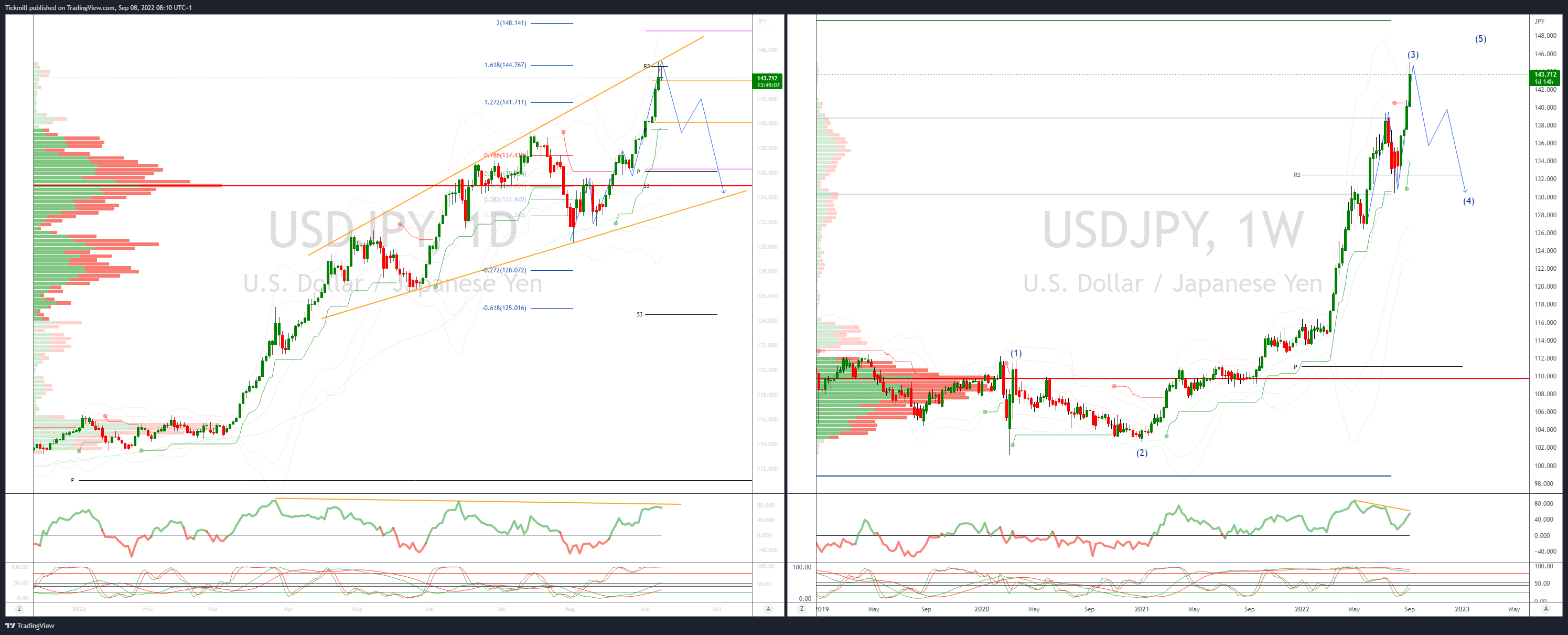

USDJPY Bias: Bullish above 139

- USD/JPY capped ahead of 145 option KOs, as US yields ease

- Japan MoF, FSA, and BoJ will meet at 08:45BST

- FX diplomat to brief media after meeting

- USD/JPY as high as 144.99 EBS overnight, capped just ahead of 145.00

- 145.00 strike sight of large option barriers, defensive sales noted

- US yields easier too, retracement ahead of Powell-speech

- Treasury 2s from 3.522% to 3.431%, 10s from 3.365% to 3.250%

- USD/JPY is seeing some bounce in early Asia trade, 143.68 to 144.29

- Consolidation in low 144-area Tokyo prognosis ahead of Powell

- Japanese importers, some investors, specs likely buyers sub-144.00

- Option expiries today include 143.00 $561 mln, smaller 144.00-85

- 20 Day VWAP is bullish, 5 Day bullish

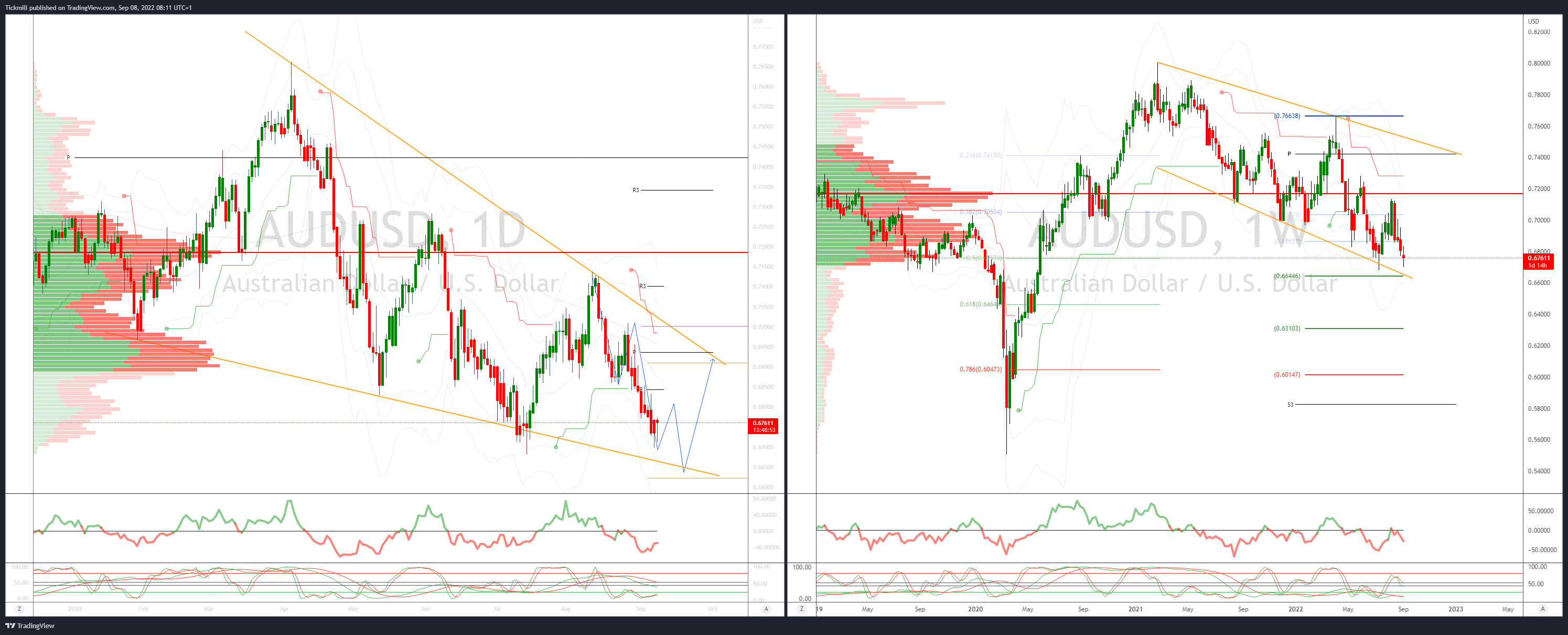

AUDUSD Bias: Bearish below .70

- Falls to session low after Lowe hints at slower hiking pace

- AUD/USD dips below 0.6720 from 0.6745 after comments from RBA Governor Lowe

- Lowe said rapid tightening makes the case for slower pace in future hikes

- Many analysts polled by Reuters expect the RBA to hike by only 25 BPs in October

- AUD buyers tipped around 0.6700 with support at 2022 low at 0.6682

- AUD/USD trending lower and break below 0.6680 could see trend accelerate

- 20 Day VWAP is bearish, 5 Day bearish

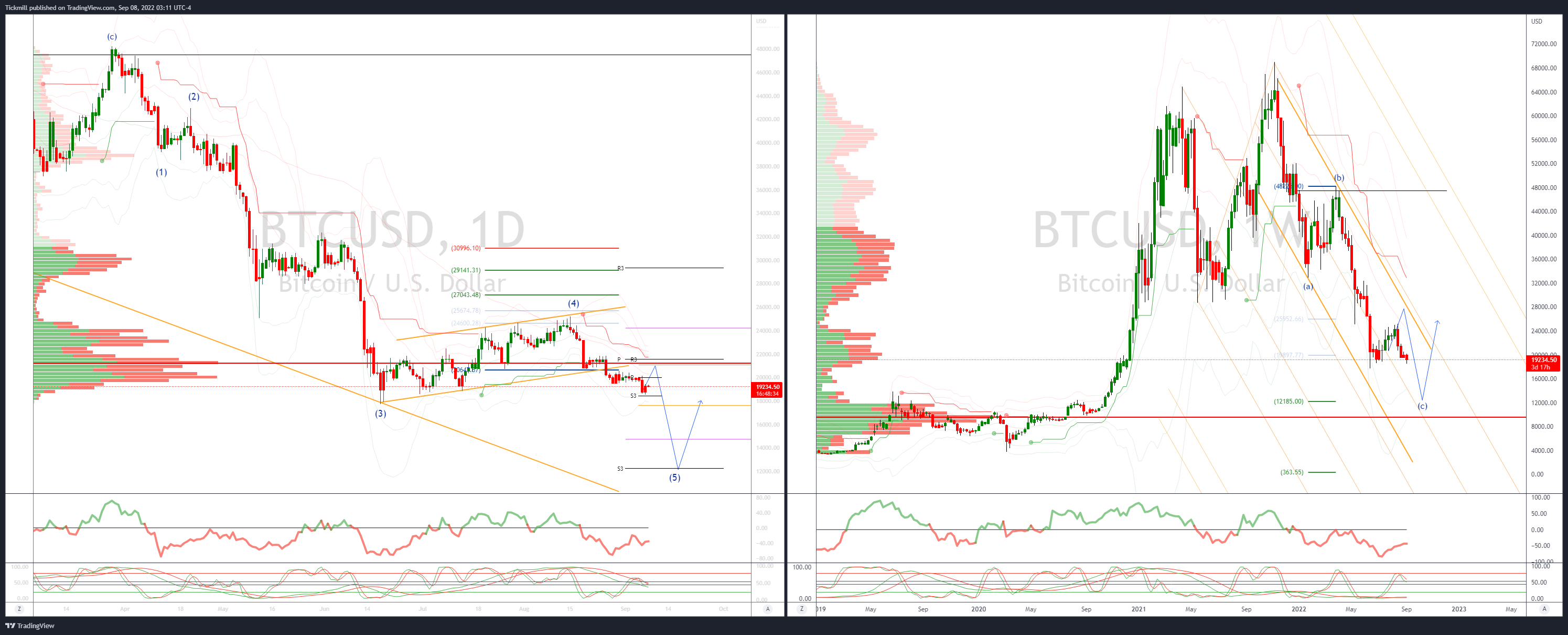

BTCUSD Bias: Bearish below 25.3K

- BTC targeting test of 20k from below

- GameStop Partners With Crypto Marketplace FTX, Posts Smaller-Than-Exp Loss

- Crypto Lender Celsius Looked A Lot Like A Ponzi, Says State Regulator - FT

- KMPG report suggests Crypto investment to remain depressed remainder of 2022

- BTC supported by Jul 13 low 18.9k

- Aug 28's 22.2k may pull BTC higher

- 20 Day VWAP is bearish, 5 Day bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!