Daily Market Outlook, September 30th, 2021

Overnight Headlines

- China Factory Activity Contracts First Time Since Feb. 2020

- China Tells Bankers To Shore Up Property Market, Help Homebuyers

- Some Evergrande Bondholders Not Paid Coupon By Wed Deadline

- Japan's Factory Output Extends Declines On Car Production Cuts

- Partying For Football Final Triggers Australia Covid-19 Rise

- New Zealand Home-Building Approvals Rose A Third Month In August

- South Korea To Prepare Measures Against Household Debt In Oct

- US, Chinese Military Officials Hold 'Frank, In-Depth' Talks-Pentagon

- U.S., EU Vow Cooperation On Trade, Technology In Diplomatic First

- US Dollar Near One-Year High As Fed Tightening In Focus

- Oil Falls After U.S. Inventories Post Surprise Gain, Gold Inches Up

- Cotton Has Best Quarter in 10 Years as China Snaps Up US Fiber

- Asian Shares Mostly Gain After Mixed Session On Wall Street

- APAC M&A Deal Value Hits $1.25Tln In Nine Months Of 2021, A Record

- IPOs Slow Down Globally In Q3 After Frenetic 2021 Start

- Utility Stocks Halt Record-Long Rout With Market Bouncing Back

The Day Ahead

- This morning’s Lloyds Business Barometer showed a 10 point increase in business confidence as the reading reached its highest since April 2017. Employment prospects rose to a four and a half year high, while expectations of higher wage growth broadened. The survey also asked some special questions about the current supply challenges facing businesses. These identified the biggest impediments as supply chain disruptions and shortages of raw materials or goods, followed by staffing issues. The readings were taken in the first half of September ahead of the most recent pressures on fuel supplies and prices.

- With inflation concerns to the fore this week’s Eurozone inflation reports seem bound to command market attention. The September CPI data for the region is out early tomorrow but ahead of that updates for France, Germany and Italy will provide indications as to the likely outturn. All are expected to post further rises in annual inflation, which suggests that the Eurozone aggregate will rise further from last month’s decade high. The rise is primarily to do with higher energy prices and as is the case elsewhere is expected to be temporary. However, the increase will likely serve to intensify the debate at the European Central Bank at the appropriateness of its currently very loose policy stance. Eurozone unemployment data will also be released.

- US Q2 GDP is a third reading which is not expected to be revised. More timely will be weekly US initial jobless claims. Despite backing up modestly over the last two weeks they remain close to the pandemic low recorded earlier this month suggesting that the labour market is continuing to improve.

- Today sees more testimony to US Congress by Fed Chair Powell & Treasury Secretary Yellen. In Tuesday’s session testimony Powell once again suggested that asset purchase tapering was close but that the economic improvements required for an interest rate hike were much more stringent. Much of Tuesday’s discussion revolved around imminent fiscal deadlines with both Yellen and Powell urging Senators to act. However, it appears that a government shutdown has been avoided for now. Several other Fed policymakers are also scheduled to speak today.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

- USDJPY - 112.00 530m. 111.00 785m. 110.30/50 1.68bn (1.17bn C). 109.90/110.00 1.67bn (1.26bn C).

- EURUSD - 1.1810/20 602m. 1.1790/1.1800 423m. 1.1760/70 655m. 1.1740/50 484m. 1.1690/1.1700 2.09bn (1.44bn P). 1.1650 794m. 1.1600/10 716m.

- GBPUSD - 1.3640/50 1.16bn (1.11bn P). 1.3620 599m.

- AUDUSD - 0.7340/50 814m. 0.7300/10 516m. 0.7200/10 746m.

- USDCAD - 1.2850 435m. 1.2820 401m. 1.2790/1.2800 606m. 1.2740/50 2.26bn (1.54bn C). 1.2720 450m. 1.2700 585m. 1.2670 520m. 1.2550 972m.

- USDCHF - 0.9150 890m.

- EURCHF - 1.1000 425m. 1.0900 923m. 1.0850 614m. 1.0750 400m.

- EURJPY - 130.40 483m. 126.50 420m.

- EURSEK - 10.25 610m.

- EURNOK - 10.26 640m.

- USDMXN - 20.51 596m.

- USDCNH - 6.44 691m.

Technical & Trade Views

EURUSD Bias: Bearish below 1.19 Bullish above

- Edges higher as risk appetite improves in Asia

- EUR/USD opened -0.73% at 1.1598 after USD rallied across the board

- It edged higher in Asia, as E-minis gained around 0.50%

- EUR/USD is trading at the session high at 1.1605/10 into the afternoon

- Resistance is at former support at 1.1660/65 where sellers are tipped

- The 10-day MA is at 1.1690 and break would ease downward pressure

- There isn't any significant support until the 50% of 1.0636/1.2349 at 1.1492

- EUR/USD will likely remain pressured while markets remain volatile

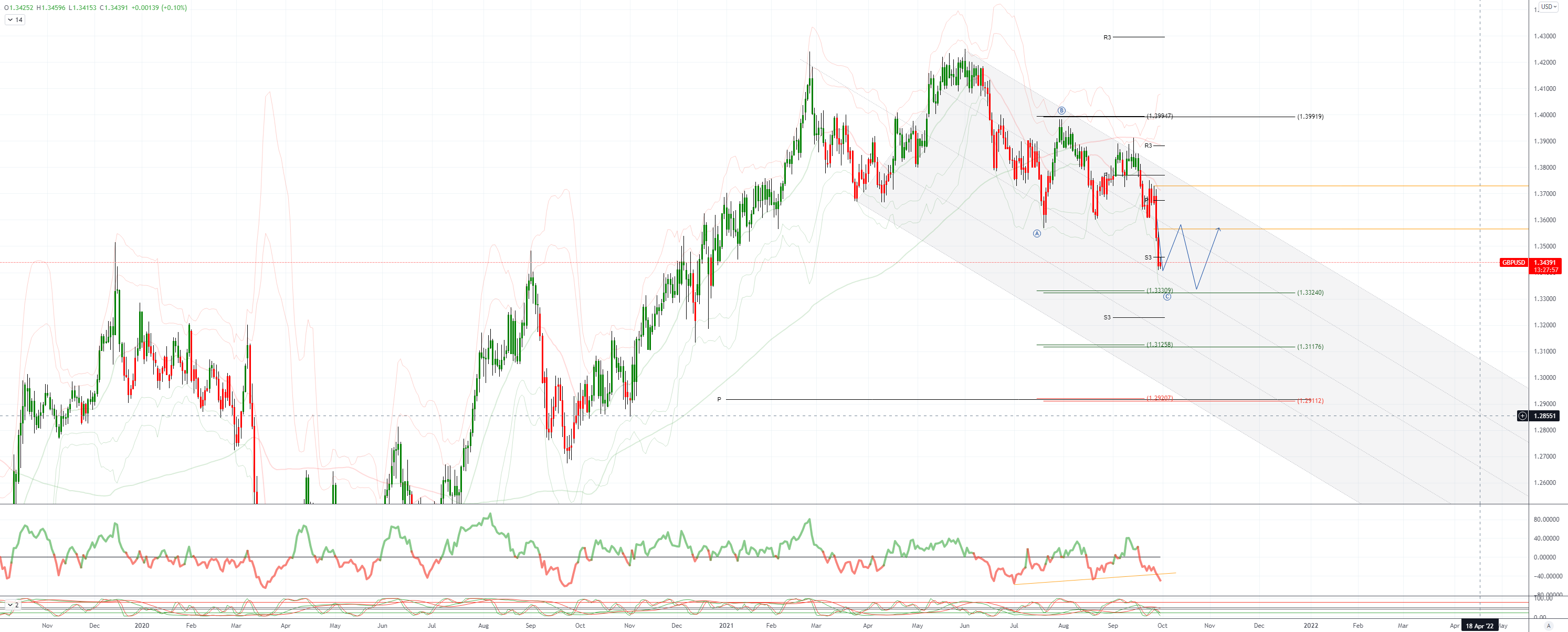

GBPUSD Bias: Bearish below 1.39 Bullish above.

- Bid with a softer USD and risk bid at month end

- +0.2% - USD softer as risk appetite bounces - E-mini S&P +0.5% - month end

- Trades towards the top of a 1.3425-1.3453 range with plenty of interest

- Britons turn more pessimistic about outlook for economy

- UK financial sector calls for six-month specialist staff visa

- Charts; momentum studies, 5, 10 & 21 daily and weekly moving averages slide

- 21 day Bollinger bands expand - strong bearish trending setup

- 1.3419 38.2% May-Jun rise proves resilient, 1.3166 38.2% 2020-21 rise below

- Close above 1.3617 falling 10 DMA needed to end downside bias

USDJPY Bias: Bullish above 109 Bearish below

- USD/JPY off some from 112.05 EBS high overnight, Asia 111.80-98

- Market heavy 112.00+ still, concerns incl US debt ceiling, Biden agenda

- Market eyeing fresh moves higher alongside US yields into October

- 112.23 pre-pandemic Feb 2020 high, 114.55 Oct 2018 high targeted by specs

- Japanese exporters likely to return in October 112.00+ however

- Bidding interest eyed from @111.70, 111.63 flat hourly Ichi kijun

- Option expiries - today 110.00-50 $3 bln+, 111.00 $785 mln, 112.00 $530 mln

- Tomorrow to see $1.9 bln+ between 110.00-70, $1 bln at 111.00 strike

- Yield on US Treasuries off highs but consolidating, 10s above 1.50% @1.512%

- Nikkei -0.4% @29,430 on month-end position adjustments

- JPY crosses steady, EUR/JPY 129.74-88, GBP/JPY 150.21-53

- AUD/JPY 80.27-59, NZD/JPY 76.78-77.01, CAD/JPY 86.69-87.85, best of lot

- Option expiries - EUR/JPY 128.90-129.00 E365 mln, 129.90 238, 130.40-50 514

- Also GBP/JPY 149.50 GBP230 mln, AUD/JPY 80.00-25 A$335 mln today

AUDUSD Bias: Bearish below 0.75 Bullish above

- Sharp rebound in iron ore underpins AUD/USD rally

- AUD/USD opened -0.91% at 0.7174 after USD soared and key commodities wilted

- It was gently bid from the open, as E-minis rallied around 0.50%

- AUD/USD traded up to 0.7190/95 with sellers tipped around 0.7200

- China PMI was mixed and there wasn't an immediate reaction...

- Dalian iron ore rallied 8.5% at one stage and AUD/USD moved up to 0.7205

- Heading into the afternoon the AUD/USD is trading just below the 0.7205 high

- More selling orders tipped at former support at 0.7220/25

- Resistance is at the 10-day MA at 0.7244 and break eases downward pressure

- The next level of support is at the 2021 low at 0.7106

- Key will be whether equities can stage a sustainable rebound

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!