Daily Market Outlook, September 29th, 2021

Overnight Headlines

- Key House Panel To Advance Debt Limit Extension Bill On Wed.

- Japan's GPIF To Avoid Yuan-Denominated Chinese Sovereign Bonds

- Australia To End Emergency Support Payments As Vaccinations Rise

- N. Korea Says It Tested New Type Of Hypersonic Glide Vehicle

- US Dollar Stands Tall As Trade Price In Tapering And Rate Hikes

- Global Bond Market Set For Worst Month Since Early 2021

- Oil Sinks As Climb In U.S. Stockpiles, Risk-Off Mood Check Rally

- Japan Leads Fall In Asian Equities As Inflation Fears Rattle Markets

- Evergrande Losing Control Of Bank Unit In $1.5 Billion Deal

- Samsung Elec Close To Finalising $17Bln Chip Plant In Texas

- iPhone Delivery Times Lengthen As Covid Hits Suppliers In Vietnam

- Micron Slides After Memory-Chip Maker Delivers Weak Forecast

The Day Ahead

- Today’s highlight is probably the appearance of the US, Eurozone, Japanese and UK central bank heads at an ECB event from 4.45pm. While the predominant view remains that price pressures will ease back next year as economies adjust to current supply-side issues such as raw material and staff shortages, they will be mindful of risks that inflation stays elevated for longer. That latter concern may be greater in the US where CPI inflation remains above 5% and in the UK which the BoE predicts could have an extended period of inflation above 4% (into Q2 2022). In contrast, both the ECB and the Bank of Japan appear more confident about the transitory inflation narrative, perhaps because their economies had struggled to get inflation sufficiently high before the pandemic.

- Data wise, there will be some focus on the BoE August lending data, including the number of mortgage approvals. Tomorrow 7am sees an update of UK Q2 GDP which is expected to be unrevised at 4.8%q/q. Latest PMIs, however, reaffirm the likelihood of softer growth heading into H2, partly reflecting the impact of supply constraints. The Lloyds Business Barometer for September will be released overnight, and it will be interesting to see if sentiment tracks the PMIs lower.

- Global investors will pay attention to the Chinese September PMIs, also due overnight. Economic activity has been weighed down by measures to tackle the delta variant. The crisis in China Evergrande Group continues to be a focus for markets, as authorities move to limit financial market and wider economic contagion.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

- USDJPY - 111.00 558m. 110.40/50 436m. 109.90/110.00 1.38bn (820m C).

- EURUSD - 1.1930 1.86bn (1.59bn C). 1.1860 532m. 1.1810/20 499m. 1.1790/1.1800 539m. 1.1740/50 1.36bn (787m C). 1.1700 1.06bn (899m P). 1.1650/70 512m. 1.1600/10 537m. 1.1490 660m.

- GBPUSD - 1.3670/80 1.10bn (868m C).

- USDCAD - 1.2950 630m. 1.2900 2.18bn (2.15bn C). 1.2800 480m. 1.2740/50 635m. 1.2630/40 539m. 1.2610/20 1.61bn (1.28bn P).

- USDCHF - 0.9320 800m. 0.9120 800m.

- USDTRY - 10.00 404m.

- USDMXN - 20.45 750m. 20.25 670m.

- USDCNH - 6.56 601m. 6.49 761m. 6.47 1.46bn (923m C). 6.45 559m. 6.44 1.21bn (1.16bn P)

Technical & Trade Views

EURUSD Bias: Bearish below 1.19 Bullish above

- Consolidates above key support in quiet Asia

- EUR/USD opened -0.1% at 1.1683 after falling as low as 1.1668 on higher US yields...

- In a very quiet Asian session the EUR/USD traded in a 1.1678/89 range

- Heading into the afternoon it was unchanged at 1.1680/85

- Key support is at the 2021 low at 1.1664 after it held again yesterday

- A break below 1.1660 initially targets 1.1600/15 window

- Resistance is at the 10-day MA at 1.1715 and break eases pressure

- EUR/USD at risk while US yields firm and Fed expectations remain hawkish

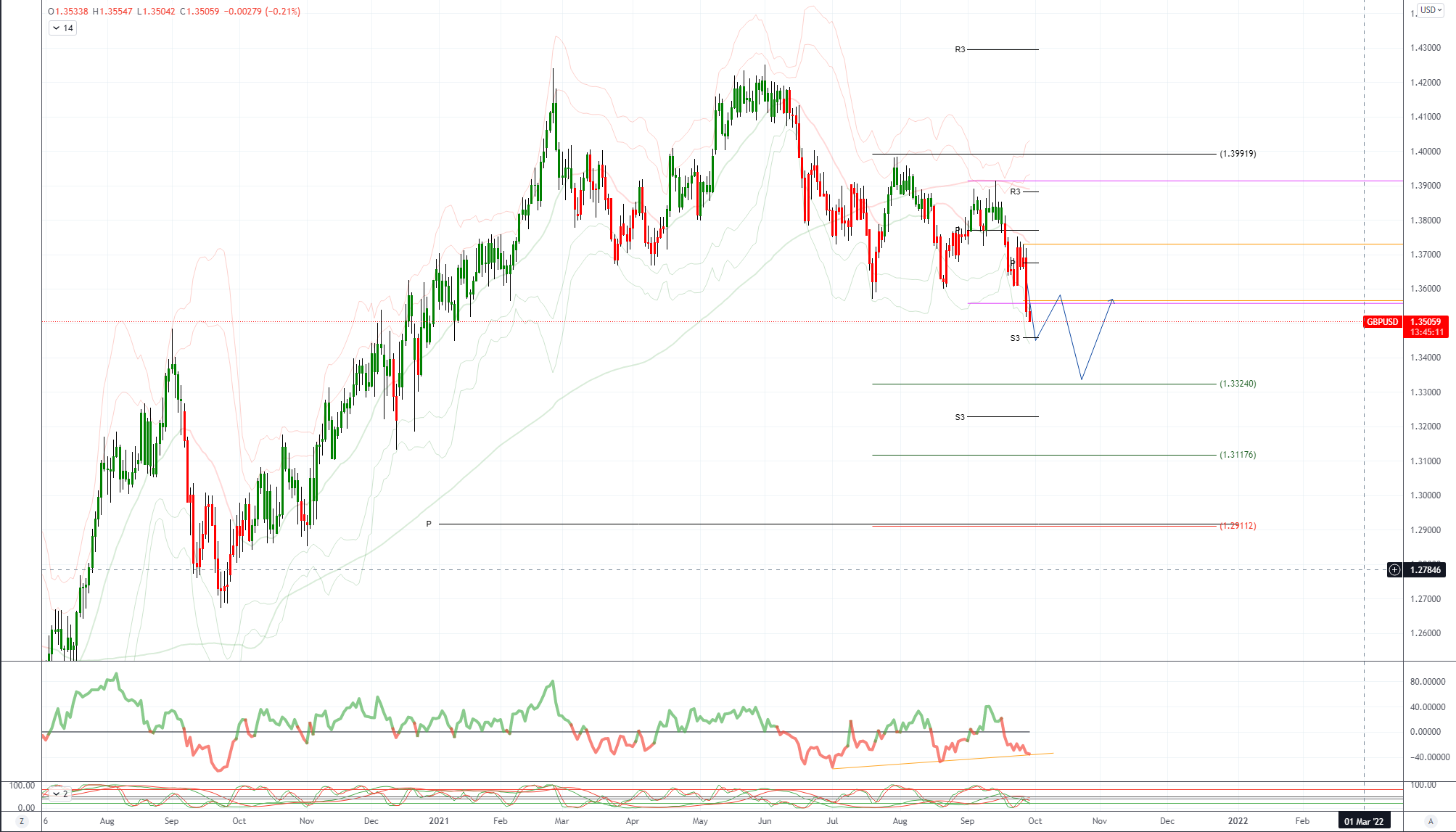

GBPUSD Bias: Bearish below 1.39 Bullish above.

- GBP options send warning signals

- GBP/USD option premiums shot higher as GBP/USD fell through major levels

- Erasing big 1.3550 barriers fuelled the rise, more so if 1.35 barriers go

- Benchmark 1-month implied volatility 5.9 to 7.0 since last week, holds firm

- 7.25 is July 20 peak and has held on multiple occasions since April

- 1-month 25D risk reversals demand 0.6 premium for GBP puts over calls

- That's their highest downside premium since March

- More premium gains would signal more worries of volatility and GBP losses

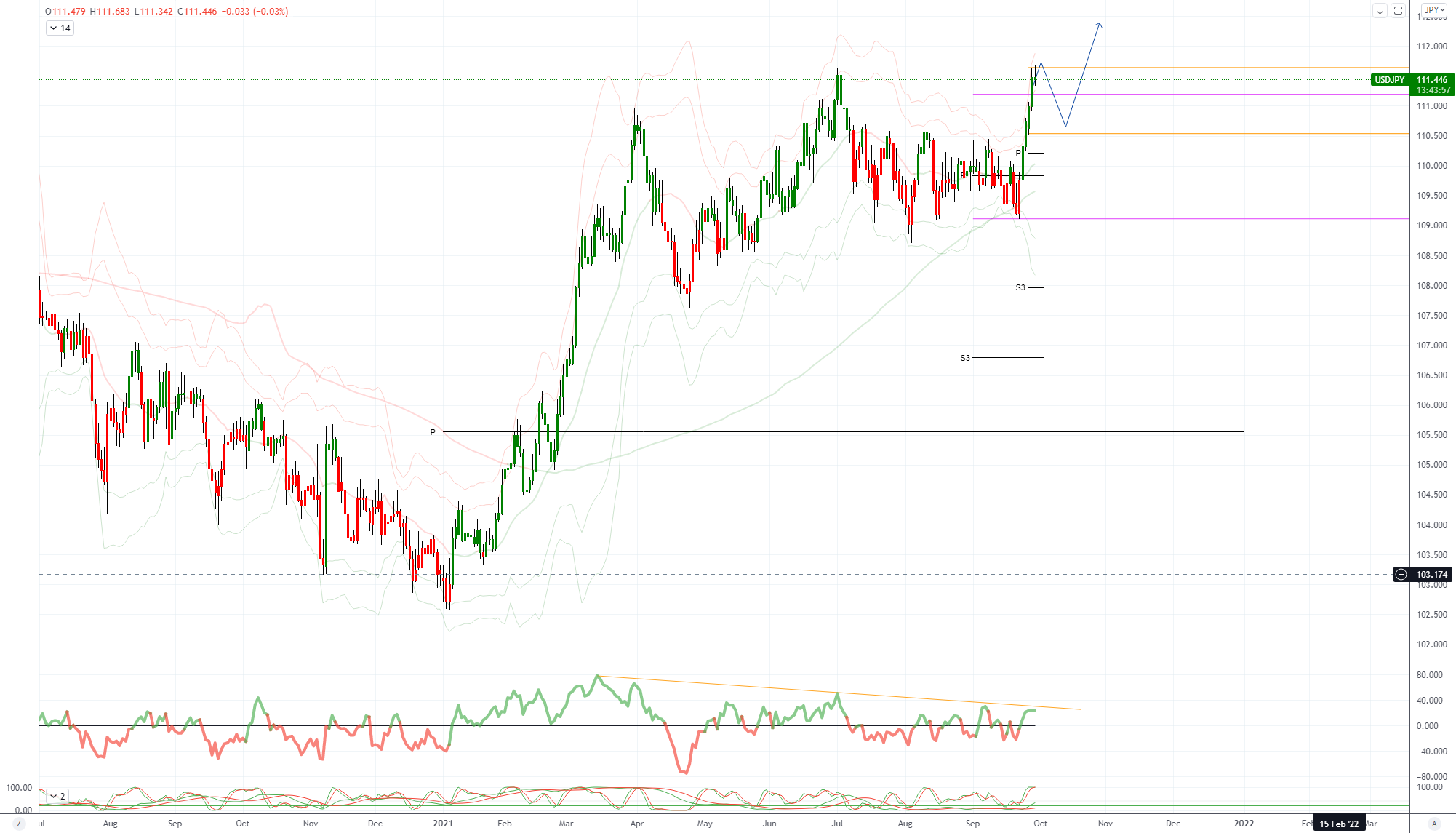

USDJPY Bias: Bullish above 109 Bearish below

- USD/JPY to 111.68 before easing back, crosses mostly soft

- USD/JPY up to fresh high of year of 111.68 EBS into Tokyo fix, eases later

- Low limited to 111.35 however, ease alongside with US yields

- Yield on US Treasury 10s off from 1.560% early to 1.525%, now @1.532%

- Triple, maybe quadruple top between 111.65-70 now - today, o/n, July 1-2

- Specs seen locking in profits on longs up early uptick, exporters quieter

- Japanese players in general hunkering down for H1 end tom, LDP vote today

- JPY crosses mostly soft with risk off, Nikkei -2.5% @29,442 today pre-H1 end

- EUR/JPY 130.46 to 130.15 EBS, GBP/JPY 150.77-151.19 after plunge o/n

- AUD/JPY 80.58-89, NZD/JPY 77.30-65, CAD/JPY more buoyant, 87.70-88.10

AUDUSD Bias: Bearish below 0.75 Bullish above

- Steady around 0.7245 as bounce in E – minis underpins

- AUD/USD opened -0.63% at 0.7240 after USD strengthened and Wall Street fell

- It moved up to 0.7250 early Asia before coming under pressure again

- The low was 0.7227 before a 0.5% move up in E-minis steadied risk assets

- Heading into the afternoon the AUD/USD is steady around 0.7245

- Support is at 0.7220/25 where it has bottomed over past 2 weeks

- More support is at the 76.4 of the 0.7106/0.7477 move at 0.7194

- Rise in risk aversion and increased downside risks weighing on AUD

- Bias is for lower while resistance at 0.7320/25 caps rallies

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!