Daily Market Outlook, September 27th, 2021

Overnight Headlines

- German Election Final Count Shows SPD Beating Merkel’s Union Bloc

- Chinese Cities Seize Evergrande Presales To Block Misuse Of Funds

- China To Inspect Top Financial Organizations Including Huarong

- China’s Growth Forecasts Downgraded As Power Crunch Worsens

- UK PM Boris Johnson To Consider Using Army To Supply Petrol

- Pelosi Sets Thursday Vote On Passage Of $1 Trillion Infrastructure Bill

- Cargo Piles Up As California Ports Jostle Over How To Resolve Delays

- Corporate-Buyout Loans Near Highs Of 2007 Fuelled By Easy Money

- Australia, NZ Dollars Bounce As Global Risk Mood Swings To Positive

- Crude Oil Extends Rally As WTI Tops $75 On Global Energy Crunch

- China Stocks Rise As Liquor Firms Surge To Offset Power-Cut Woes

- DBS CEO: Evergrande Doesn’t Pose Systemic Risk To Asia Banks

- Key Apple, Tesla Suppliers Halt Production Amid China Power Crunch

The Week Ahead

- Evergrande uncertainty, Federal Reserve in focus The China Evergrande saga and the Federal Open Market Committee meeting last week created a decent amount of volatility and both remain in focus in the week ahead. Evergrande missed an interest payment on a dollar bond and its electric car unit said it faced an uncertain future without a swift cash injection. China's central bank has been injecting cash into the banking system, but authorities have not provided any clarity on how they will deal with the possible fallout of an Evergrande collapse. There will be a slew of Federal Reserve speakers in the week ahead – headlined by Chair Jerome Powell who will testify twice before Congress on the Fed's policy response to the pandemic. Germany's Social Democrats narrowly won Sunday's national election, beating Chancellor Angela Merkel's CDU/CSU bloc according to projected results. But with neither group commanding a majority, the most likely outcome is a three-way alliance. There is unlikely to be a lasting impact on markets, as it could take months before a new government is formed.

- U.S. ISM, China PMIs, EZ inflation lead global data There is limited top-tier global economic data due this week, but with U.S. Treasury yields climbing and euro zone inflation concerns in the spotlight, all related data may have an impact on markets. U.S final Q2 GDP will be released, but investors will most likely focus on forward-looking data to shape Fed expectations. U.S. durable goods, consumer confidence, manufacturing ISM and the core PCE price index will be watched. Housing data, Chicago PMI, weekly jobless claims and University of Michigan sentiment are also due. Flash euro zone HICP inflation for September will be the key data event in Europe, as it could impact ECB expectations. Other EZ data includes final manufacturing PMI, consumer confidence, unemployment, sentiment indices and German retail sales. UK data includes Q2 GDP and final manufacturing PMI. China's September PMIs will be a key event in Asia as concerns over the trajectory of Chinese growth continue to intensify. Japan has a busy week, with the Q2 Tankan report on Friday the main event. Industrial production, retail sales and unemployment data are due before that. Australia's main release is August retail sales – expected to be very weak due to the lockdowns in Sydney and Melbourne. No major data is due in New Zealand, while Canada has July GDP and September manufacturing PMI.

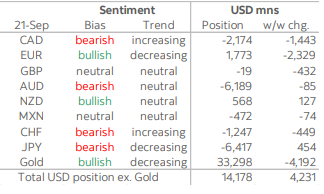

CFTC Data

- Following two consecutive weeks of declines, the aggregate USD long rose in the week to Tuesday by USD4.2bn with the move undoing the previous two weeks’ decline and exceeding its recent high in late-August to sit at USD14.2bn (its highest mark since March since 2021) according to IMM data published today. The move likely reflected preparations ahead of the Fed’s policy announcement on Wednesday as well as market angst related to China’s property sector.

- The highlight of this week’s positioning changes was a USD2.23bn reduction in the EUR long to USD1.77bn as investors resumed the trimming of the shared currency’s bullish position—amid the largest increase in EUR short contracts since mid-June. The EUR’s net long has been on a clear downward trajectory over the past three months—and more broadly, since August 2020.

- At USD1.4bn, the shift in positioning against the CAD follows the EUR’s as the largest in this report and takes the overall CAD short position to USD2.2bn, its most bearish standing since August of last year. In the week to Tuesday, the CAD fell by 1% against the dollar, in line with the move seen in the AUD and NZD where positioning was relatively unchanged and mixed; the Aussie short rose by USD85mn and the Kiwi long rose by USD 127mn. On Monday and Tuesday, USDCAD closed above 1.28 before retreating to the mid 1.26s today. Their commodity peer, the MXN, experienced a small USD74mn increase in its short to near half a billion dollars.

- There was not a clear risk-on/risk-off undertone to today’s data as positioning in the CHF and the JPY moved in the opposite direction. The JPY’s short was trimmed by USD454mn and the CHF’s short rose by USD449mn; the cut to the yen’s short is in line with the fact that it was the only currency that gained against the USD over the week.

- Finally, the GBP’s net long was trimmed to practically neutral on the back of a USD432mn move against sterling caused by a large increase in short contracts.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

- USDJPY - 110.00 880m. 109.70/80 562m. 109.50/60. 484m.

- EURUSD - 1.1820/30 401m. 1.1790/1.1800 923m. 1.1750/60 1.55bn (813m P). 1.1720/30 672m. 1.1700/10 538m.

- GBPUSD - 1.3740 454m.

- AUDUSD - 0.7360/80 611m. 0.7330/40 632m.

- USDCAD - 1.2870 750m. 1.2700 670m. 1.2570 489m

- USDCNH - 6.45 460m.

Technical & Trade Views

EURUSD Bias: Bearish below 1.19 Bullish above

- Trades in narrow range in muted reaction to German elections

- EUR/USD traded 1.1717/30 and is unchanged @ 1.1720 into the afternoon

- There wasn't any reaction to the German election results

- Risk assets moved higher in Asia and weighed on USD against some currencies

- EUR/USD support is at Friday's 1.1701 low and double bottom at 1.1680/85

- Resistance is at the 10-day MA at 1.1743 with sellers 1.1750/60

- EUR/USD leaning lower, but range trading likely while risk assets firm

GBPUSD Bias: Bearish below 1.39 Bullish above.

- Bid in a busy start to the week, charts point south

- +0.05% in a 1.3663-1.3680 range with plenty of interest throughout the day

- BP says nearly a third of its UK fuel stations running on empty

- Sterling approaches a potential tough winter as Brexit bites

- Charts; momentum studies conflict, 5, 10 & 21 DMAs fall - mixed signals

- 21 day Bollinger bands expand - bias still lower while 1.3764 21 DMA holds

- Double bottom support above 1.3600 - 1.3602 August low held last week

- NY 1.3659-1.3695 range is initial support resistance

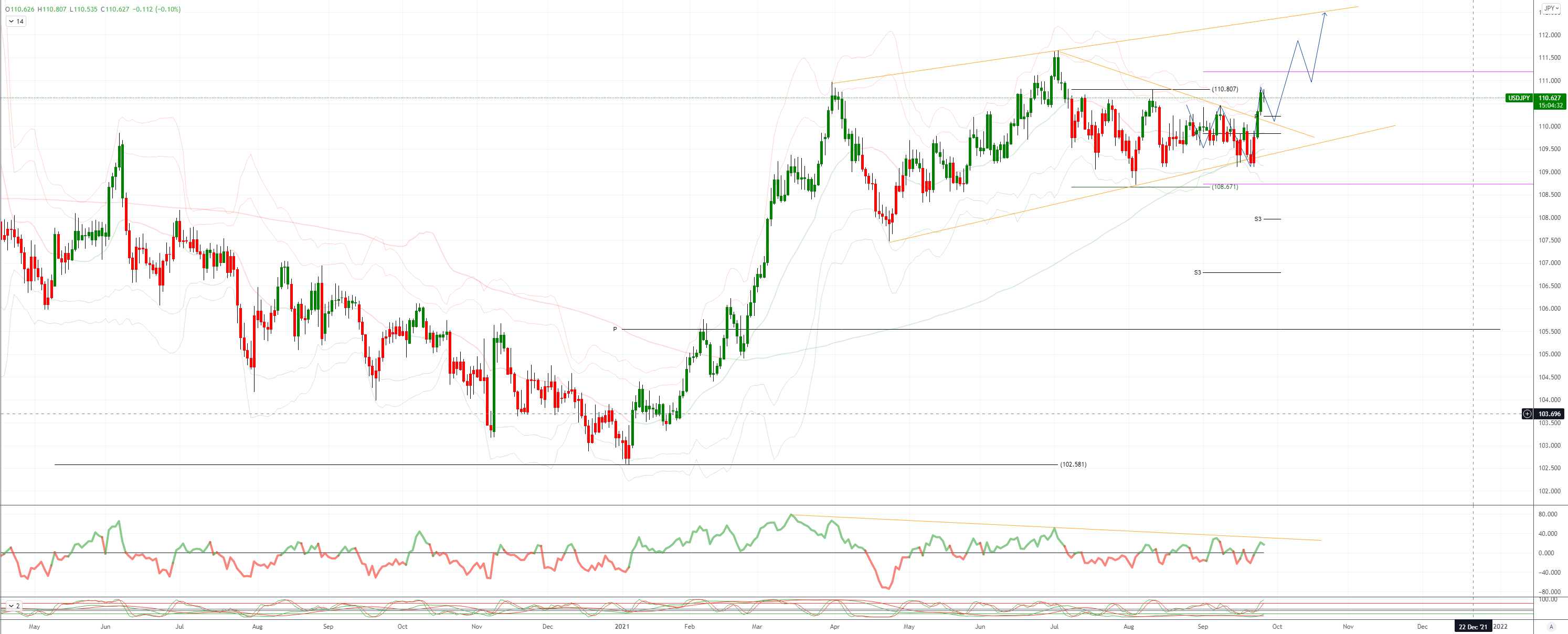

USDJPY Bias: Bullish above 109 Bearish below

- USD/JPY upside limited to 110.80 for now, Fed – speak eyed

- USD/JPY up to 110.81 EBS early before easing back to 110.56

- Japanese exporters good sellers from 110.81, still on offer up top

- Stops tipped 110.85+, 111.00+, 111.20+ - 111.19 high July 5

- Bids look to come back from ahead of 110.50 though, some option-related

- US$1.1 bln in option expiries at 110.50 strike tom, today 110.00 $880 mln

- US yields main focus again with China Evergrande caution abating

- Treasury 10s to 1.466% early before easing back, now @1.447%

- Nikkei bounces some more after rally Thursday-Friday, +0.4% @30,358

- JPY crosses mostly mirror USD/JPY moves, bid early, off some since

- EUR/JPY 129.86 to 129.60 EBS, GBP/JPY 151.47 to 151.10

- AUD/JPY 80.16-66, more buoyant, NZD/JPY too between 77.43-82

- Japan Aug corporate service prices -0.1% m/m, +1.0% y/y, July +0.3%, +1.1%

AUDUSD Bias: Bearish below 0.75 Bullish above

- Stand – out gains as risk rally encourages buying

- AUD/USD opened 0.7250 after falling 0.53% Friday to 0.7257

- Equities and commodities pushed higher in Asia and underpinned AUD

- E-minis +0.44% while AXJ index rose 0.33% and Dalian iron ore gained 2.8%

- AUD/USD traded to 0.7291 before settling around 0.7285

- Resistance is at the double top at 0.7315/20 and 21-day MA at 0.7328

- Support has formed at multiple daily lows at 0.7220/25

- AUD moved higher against all major currencies in Asia

- Investors are not reacting to uncertainty surrounding Evergrande for now

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!