Daily Market Outlook, September 22nd, 2021

Overnight Headlines

- FOMC To Be Scrutinised For Latest Signals On Taper Timing

- Debt-Limit Suspension Passes House, Faces Senate Standoff

- Infrastructure Face Fresh Uncertainty As Democrats Divided

- China Inject $18.6Bln To Banking System, Keeps LPR Steady

- Evergrande To Make Domestic Bond Payment, Easing Fears

- BoJ Holds Steady, Offers Gloomier Exports And Output View

- RBA Bullock: Regulators Closely Watching Home Loan Boom

- EU, US Aim To Pledge More Enforcement To Curb China Risk

- UK Pins Hope On Joining US, Mexico And Canada Trade Pact

- End Of Covid-19 Furlough To Not Solve UK Labour Shortages

- Citi, JPMorgan Seen Evading Evergrande Crisis In China Push

- Chip Crunch Grows Worse, Wait Times Hit Record 21 Weeks

The Day Ahead

- This evening’s Fed policy update is the key market event today. Mixed economic data and uncertainties ahead argue for a largely wait-and-see approach by policymakers. US economic activity appears to have slowed during the summer months after an initial surge when restrictions were eased. The deceleration may have more to do with supply constraints rather than a lack of demand, but nevertheless at least some policymakers will likely see it as arguing for moving very cautiously when considering any change to the current very easy monetary conditions.

- Meanwhile, near-term inflation trends remain a concern. US annual CPI inflation dipped modestly in August, providing some support for Fed policymakers’ views that this year’s rise is largely transitory. Nevertheless, inflation is still well above the Fed’s target. Other factors may also impact monetary policy deliberations. A federal budget for next year is still yet to be passed by Congress, while an imminent breach of the debt ceiling is an additional uncertainty.

- The number one issue for the Fed will be the timing of any ‘tapering’ of its asset purchases. A number of Fed policymakers, including Chair Powell, have suggested that this may be imminent, so it is possible that an announcement may come today. However, given that the August US employment report was so disappointing, it seems more likely that it will come at the meeting in early November with a possible intention of starting tapering from December. Overall, the Fed’s message is likely to remain dovish and, in particular, it will probably continue to insist that any hike in interest rates will be further in the future.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

- USDJPY - 110.00 808m. 109.80 437m. 109.30/40 948m. 109.00 625m.

- EURUSD - 1.1950 524m. 1.1820/30 465m. 1.1740/50 783m. 1.1720/30 499m. 1.1670/80 1.23bn (1.14bn P).

- AUDUSD - 0.7250/60 836m.

- USDCAD - 1.2840/50 884m. 1.2770 725m. 1.2750 1.79bn (1.15bn P). 1.2700 813m.

- AUDNZD - 1.0950 462m. 1.0850 403m.

- EURJPY - 128.50 630m. 127.50/70 720m.

- EURNOK - 10.35 420m. 10.20 680m. 10.15 421m.

- USDZAR - 13.85 545m.

- USDMXN - 20.00 595m.

Technical & Trade Views

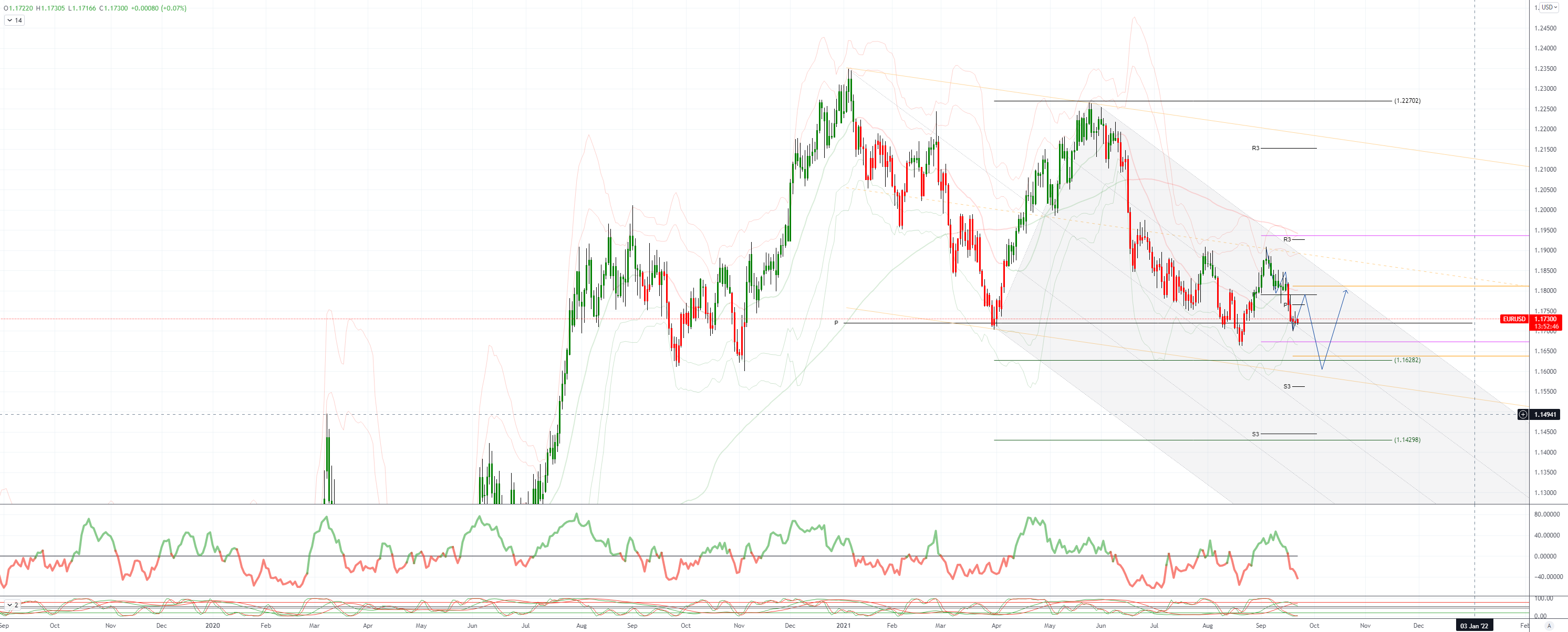

EURUSD Bias: Bearish below 1.19 Bullish above

- EUR/USD 1.1450 is the target should Fed trigger downside break

- EUR/USD has traded ranges mainly within 1.17-1.20 since June Fed

- Aug's brief drop to 1.1664 followed by swift bounce to 1.1909

- Should a change in Fed policy lead to break lower 1.1450 is possible

- Drop into a lower range more likely than a sustained decline

- Very low option vol suggests little chance big move in any direction

- EUR/USD has traded a series of steadily declining ranges in 2021

- Good chance lower range evolves close 1.15-18 and holds rest 2021

- Close in relation to 100-MMA 1.1746 telling for l-term direction

- 100-MMA which capped 2018's rally has underpinned EUR/USD since May

GBPUSD Bias: Bearish below 1.39 Bullish above.

- GBP/USD close to four – week low before Fed steps up to plate

- Positive European/U.S. equity futures are helping to keep cable above 1.3640

- 1.3640 was Monday's 4-week low. 1.3641 was Tuesday's low. 1.3647 = Asia low

- GBP is a risk-sensitive currency, while USD is a safer-haven

- Bids expected near 1.3600 if GBP/USD breaks below 1.3640 (1.3602 = Aug low)

- Fed policy statement and dot plots due at 1800GMT

- UK to pay to get carbon dioxide pumping again

USDJPY Bias: Bullish above 109 Bearish below

- Bid with risk – BoJ policy as expected

- Trades toward the top of a 109.12-109.48 range, as risk firmed in Asia

- BoJ kept policy steady with a cautious outlook - muted response

- Risk firmer on Evergrande to make domestic bond coupon payment

- Charts; daily cloud remains major September resistance, 109.86-110.19 today

- Falling 109.63 Tenkan line, horizontal 109.78 Kijun line initial resistance

- 109.11 has survived four tests since mid August, so significant support

- Trading 109.00 110.20 range with tight stops provides value

- Focus swings to the FOMC - likely cautious - dot plots key

AUDUSD Bias: Bearish below 0.75 Bullish above

- Firms after report Evergrande to make bond payment

- AUD/USD opened -0.29% at 0.7232 after weighed down by AUD/JPY sales

- It eased to 0.7224 before reports that Evergrande will make bond payment

- Equities bounced and AUD/USD spiked to 0.7268 on the report

- Heading into the afternoon the AUD/USD settled around 0.7250/55

- The FOMC later today looms as a risk to AUD resiliency

- Resistance is at yesterday's 0.7283 high and 10-day MA at 0.7305

- Support is at 76.4 of 0.7106/0.7477 move at 0.7194 with buyers at 0.722

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!

.png)