Daily Market Outlook, September 20th, 2021

Overnight Headlines

- Yellen Renews Call To Raise Debt Limit To Avoid Catastrophe

- Dems Press Ahead With Debt-Limit Vote Amid GOP Standoff

- Senior Dems Concede Likely Scale-Back $3.5Tln Spending Bill

- Sen Manchin Plan To Delay Biden Spending Bill Vote To 2022

- Canadian PM Trudeau Warn Against Vote Split In Tight Race

- Putin’s Ruling Party Wins Russia Voting, Loses Some Ground

- Energy Prices To Push Up Europe Inflation, Economists Warn

- UK PM Johnson Calls Surge In Gas Prices Temporary Problem

- SPD Scholz Wins TV Debate As German Election Draws Close

- China Defends Tech Crackdown In Wall Street Chiefs Meeting

- HK Stocks Sink As Evergrande Woes Spread, Ping An Tumbles

- Lufthansa To Raise $2.5 Billion To Repay State Bailout Funds

The Day Ahead

- Ahead of a number of major central bank meetings later in the week – including the US Federal Reserve and the Bank of England – today’s calendar offers very little distraction. The BoE and Fed meetings take place against a background of mixed economic data. Economic activity in both the US and the UK appears to have slowed during the summer months after an initial surge when restrictions were eased.

- The deceleration may have more to do with supply constraints rather than a lack of demand but at least some policymakers will likely see it as arguing for moving very cautiously when considering any change to the current very easy monetary conditions. Meanwhile, near-term inflation trends remain a concern. In the US, annual CPI inflation dipped modestly in August, providing some support for Fed policymaker’s views that this year’s rise is largely transitory. Nevertheless, inflation is still well above the Fed’s target. In the UK, CPI inflation jumped sharply in August to 3.2%, a near 10-year high.

- However, a number of uncertainties – including the fiscal outlooks in both the US and UK, along with the impact of the ending of the furlough scheme this month – argue for a largely wait-and-see approach by both the Fed and the BoE. Consequently, this week’s updates will probably be light on immediate policy action, but there may be some clues about future moves.

- For today, the latest US NAHB survey of house builders is expected to show a further moderation in sentiment. Despite high levels of demand, supply issues – including those linked to raw material shortages – are expected to see the headline survey measure fall to 74 in September from 75 previously. Meanwhile, ECB members Schnabel and Villeroy are due to speak at separate events today.

- Elsewhere, amid the surge in wholesale energy prices, UK energy suppliers were set to continue talks with the UK government. Media reports suggest that a number of energy companies were seeking emergency financial support from the government.

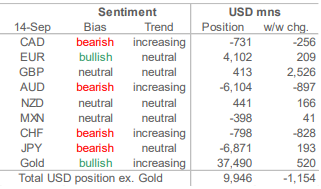

CFTC Data

- IMM data for the past week reveal another, slight moderation in the aggregate USD long position that has been developing over the past two months, the third consecutive pairing in the net long reflected in overall exposures to the major currencies we cover in this report. The aggregate dropped a little over USD1.1bn to USD9.9bn. As in the past few weeks, the trends among exposures remain highly differentiated.

- There are two stand-out features in this CFTC report. Firstly, speculative accounts have turned significantly less bearish—and modestly bullish on the GBP. The net GBP short that developed over the past month has disappeared and has been replaced by a small net long; gross GBP shorts have been in covering mode for the past three weeks but short covering accelerated this week. At the same time gross GBP longs rebounded sharply. The net effect was a USD2.5bn swing in positioning, the largest 1-week improvement in sentiment since 2017. Net EUR longs were little changed on the week (up USD209mn), ditto for neutrally positioned NZD traders lifted net longs USD166mn.

- The second key development this week is the USD897mn increase in AUD net shorts, taking the bearish position to USD6.1bn, or 83.3k contracts, the biggest, bearish bet on the AUD ever and the second-largest single currency position across the majors. AUD bears have been persistent and may yet be rewarded by renewed pressure on the currency resulting from the wash out in iron ore prices. Bearish sentiment increased in the case of the CAD, slightly with a USD256mn increase in net shorts—and the CHF, where flat positioning last week has developed into a modest net short of USD798mn.

- Net JPY shorts remain significant (USD6.9bn) but were little changed on the week. Net MXN shorts were little changed, reflecting flat trading in the peso

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

- EUR/USD: 1.1725 (EU562m), 1.1800 (EU513.5m), 1.2900 (EU445.8m)

- Upcoming notable strikes: 1.1700 (EU2.76b Sept. 23), 1.1750 (EU1.53b Sept. 23), 1.2000 (EU1.16b Sept. 23)

- USD/CAD: 1.3160 ($390m), 1.2900 ($360m), 1.2000 ($300m)

- Upcoming notable strikes: 1.2600 ($1.71b Sept. 23), 1.2800 ($1.22b Sept. 21), 1.2750 ($955m Sept. 22)

- USD/JPY: 109.00 ($1.09b), 111.00 ($400m), 110.05 ($375m)

- Upcoming notable strikes: 109.00 ($1.28b Sept. 21), 110.00 ($798.3m Sept. 22), 111.00 ($665m Sept. 23)

- AUD/USD: No large nearby strikes Mon.

- Upcoming notable strikes: 0.7240 (AUD828.7m Sept. 23), 0.7100 (AUD576.1m Sept. 21), 0.7265 (AUD485.9m Sept. 22)

- GBP/USD: 1.3750 (GBP401.5m), 1.3650 (GBP389.3m)

- Upcoming notable strikes: 1.3800 (GBP718.3m Sept. 23), 1.3700 (GBP532.6m Sept. 23), 1.3900 (GBP381m Sept. 23)

- EUR/GBP: 0.8475 (EU410m)NZD/USD: No large nearby strikes Mon.

- Upcoming notable strikes: 0.6950 (NZD397.1m Sept. 23)

Technical & Trade Views

EURUSD Bias: Bearish below 1.19 Bullish above

- Drifts lower as risk – off Asia underpins USD

- EUR/USD opened at 1.1730 and after it traded 1.1734, it tracked lower

- Equity markets fell with E-minis -0.75% and AXJ index -1.85%

- The falls helped to underpin the USD and the JPY through the Asian session

- The EUR/USD eased below the 76.4 fibo of 1.1664/1.1909 move at 1.1721

- The low so far is 1.1710 and it is trading there into the afternoon

- Bids are tipped ahead of 1.1700 with next support at 2021 low at 1.1664

- Resistance is at the 10-day M at 1.1793 and break would ease pressure

GBPUSD Bias: Bearish below 1.39 Bullish above.

- Heavy, as safe haven USD weighs, with markets lower

- -0.1% with the USD firmer in 1.3702-1.3733 range with consistent interest

- Risk appetite under pressure in Asia with Brent -0.65% and E-mini S&P -0.8%

- UK set for most widespread pay rises in over a decade - CBI

- Technical and fundamentals weigh on sterling into BoE meeting

- Charts; momentum studies slip, 5, 10 & 21 DMAs coil - net negative setup

- Last weeks upper 21 day Bolli rejection targets upcoming 1.3687 lower band

- Soft close today would likely turn the daily signals negative

- Close above 1.3782 21 day moving average would end the downside bias

USDJPY Bias: Bullish above 109 Bearish below

- Risk 'off' cross selling caps, as markets slide

- -0.05%, with the safe-haven USD firmer, and FX risk crosses under pressure

- AUD/JPY off 0.5%, Brent oil -0.6%, E-mini S&P futures down 0.8%

- Caution ahead of a big week for risk, with Japan, U.S. U.K. rate decisions

- Charts; last week's 109.11 dip proved short lived - back just below 110.00

- Within the daily cloud with parameters today at 109.76 and 110.19

- Cloud, Tenkan and Kijun lines are all horizontal - suggests range trading

- Last week's 110.16 high, 109.78 Tenkan and Kijun lines support resistance

AUDUSD Bias: Bearish below 0.75 Bullish above

- Moves lower as Asian equity markets buckle

- AUD/USD opened 0.7262 and traded to 0.7268 in early Asia

- It came under pressure once Asian equity markets opened lower

- Equity selling accelerated and the AUD/USD fell below support at 0.7248

- E-minis fell 0.80% while the AXJ index slid 1.85%...

- AUD/USD traded down to 0.7227 before bids at 0.7225 discouraged sellers

- Heading into the afternoon it is trading around 0.7235

- The break below the 61.8 of 0.7106/0.7477 targets year's low at 0.7106

- Key today will be whether European and Wall Street follows Asia lead

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!

.png)