Daily Market Outlook, October 9, 2020

Risk sentiment in Asia was mostly positive, underpinned by hopes of a fiscal stimulus package in the US after Treasury Secretary Mnuchin indicated the administration is open to a comprehensive deal. Chinese Caixin services PMI also beat expectations, rising to 54.8 in September from 54.0. Meanwhile, President Trump’s doctor has given him the all clear to resume public campaigning from Saturday. The next Presidential debate on 15 October, however, remains in doubt as it will be virtual and Trump has refused to participate as a result.

Figures released earlier this morning showed UK economic growth increased by 2.1% in August, far lower than the consensus forecast for 4.6%. The data indicate that the economy is still some 9% below February (pre-Covid) levels. While accommodation and food services surged as a result of the ‘Eat Out to Help Out’ scheme, activity in other parts of services, as well as in the industrial and construction sectors, was weaker than expected. Overall GDP is still set for a strong bounce-back in Q3, albeit less than previously thought, but the pace of recovery is likely to slow in Q4, partly because of new measures taken to tackle resurgent coronavirus infections.

Aside from UK GDP, a fairly thin calendar ends the week, with the focus remaining on the economic implications of rising global Covid-19 cases, the US election and a potential fiscal stimulus package, and prospects for a deal in UK‑EU negotiations.

The EU’s chief Brexit negotiator Michel Barnier travelled to London last night for a meeting today with his UK counterpart David Frost. PM Johnson has previously indicated that talks may be halted if there are no signs of a breakthrough by 15 October which is the start of the EU leaders’ summit. However, both sides have signalled that a deal is still possible, and negotiations could continue into the second half of the month.

BoE Chief Economist Andy Haldane will speak at an OECD conference this afternoon about Covid-19 and new analytical approaches resulting from the health crisis. The Fed’s Barkin is also scheduled to take part in a discussion at a regional chamber of commerce.

On the data front, France earlier this morning reported the smallest increase in industrial production since the recovery began in May. Output in the sector rose by 1.3% in August. Italian figures are due later this morning. German numbers earlier this week fell unexpectedly. The loss of momentum in industrial output is likely to be reflected in next week’s Eurozone report.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1700 (329M), 1.1725-30 (1BLN), 1.1740 (1.3BLN), 1.1750-60 (600M) 1.1770-80 (1BLN), 1.1785-90 (600M), 1.1795-1.1800 (1.6BLN) 1.1810-20 (1.2BLN), 1.1825-35 (900M), 1.1845-50 (670M)

- USDJPY: 105.40-50 (1.2BL), 105.80-90 (1BLN), 106.00-10 (2BLN), 106.20-25 (1BLN)

- AUDUSD: 0.7100 (782M), 0.7225 (300M), 0.7240-45 (525M)

Technical & Trade Views

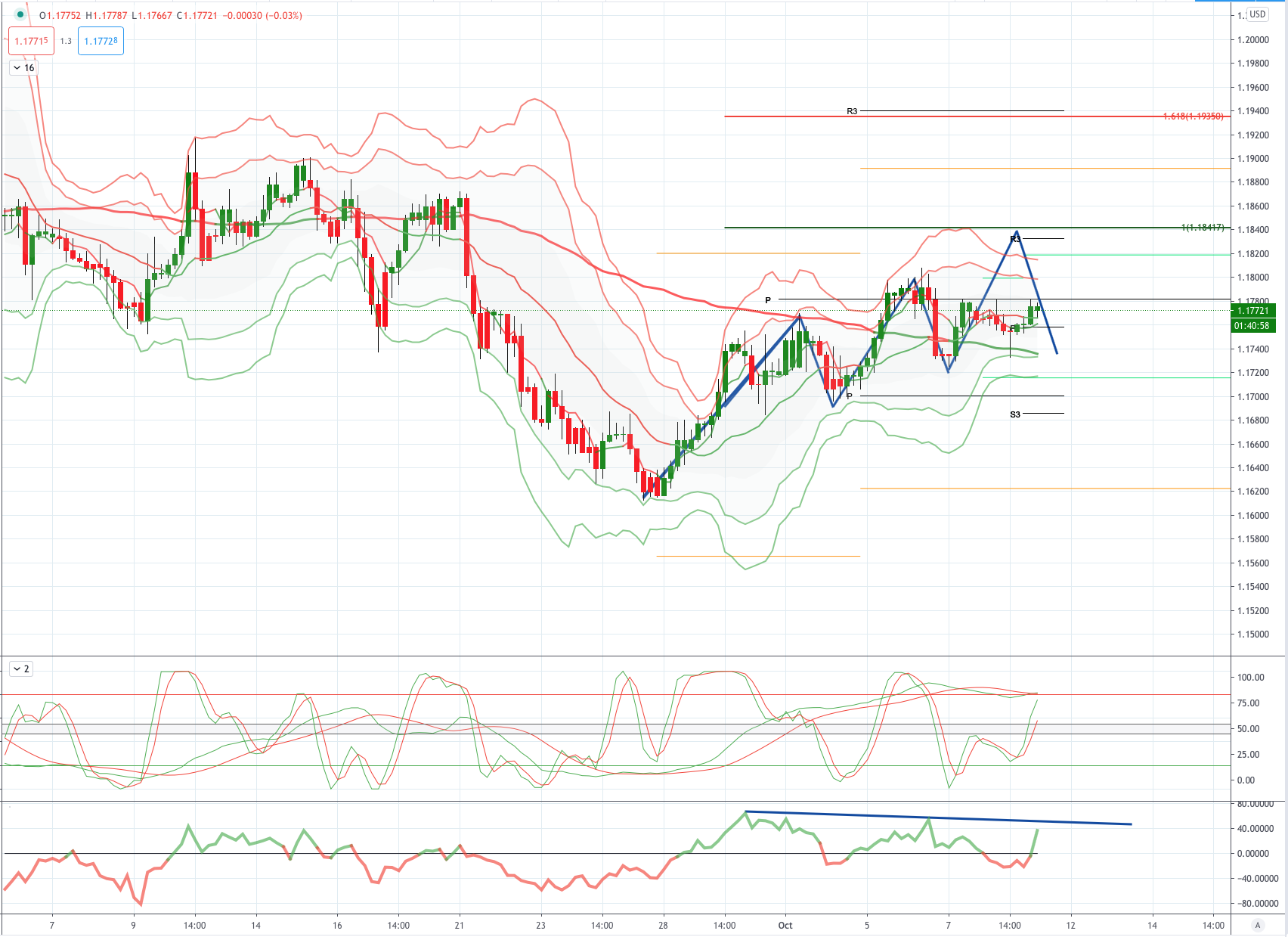

EURUSD Bias: Bearish below 1.1750 Bullish above

EURUSD From a technical and trading perspective,test of 1.1750 trendline attracted fresh bids, as 1.18 now acts as interim support look for a test of offers and stops above 1.1950 UPDATE as 1.1700/50 acts as support expect continued rotation in 1.17/1.19 range, a breach of 1.17 would suggest a deeper correction underway to challenge bids at 1.16. UPDATE as 1.1750 now acts as resistance look a challenge of bids and stops below 1.16 UPDATE 1.18 the line in the sand now through here and bulls target 1.1850 test next

Flow reports suggest topside offers through the 1.1800 levels with weak stops on a push through the 1.1820 level with sentimental offers around the 1.1850 area with increasing offers through to the 1.1900 level, downside bids into the 1.1700 level with weak stops on a break through the 1.1680 level and limited bids through to the 1.1620 area where stronger bids seem to appear however, a break here opens a deeper move through to the 1.1500 area.

GBPUSD Bias: Bearish below 1.2800 Bullish above

GBPUSD From a technical and trading perspective, test of the pivotal primary trendline support at 1.2830/50 stalls downside for now, however as 1.3000 acts as resistance look for renewed downside to target 1.2650 next UPDATE as 1.2850 acts as resistance look for a test of bids to 1.26/1.2570 UPDATE as 1.28 now acts as support lok for a test of 1.30, a breach of 1.2750 would suggest a false upside break and resumption of downtrend UPDATE 1.3030 likely to retain sufficient supply to cap the current cycle, potential for inverse head and shoulders pattern to develop on a pullback to 1.28

Flow reports suggest topside offers light through to stronger offers around the 1.3000 area with strong stops through the level and the market then opening for further gains. Downside bids light through the 1.2800 area with weak stops on a move through likely to be light and quickly absorbed on any dip through to the congested 1.2750 areas with stronger bids into the 1.2700 level.

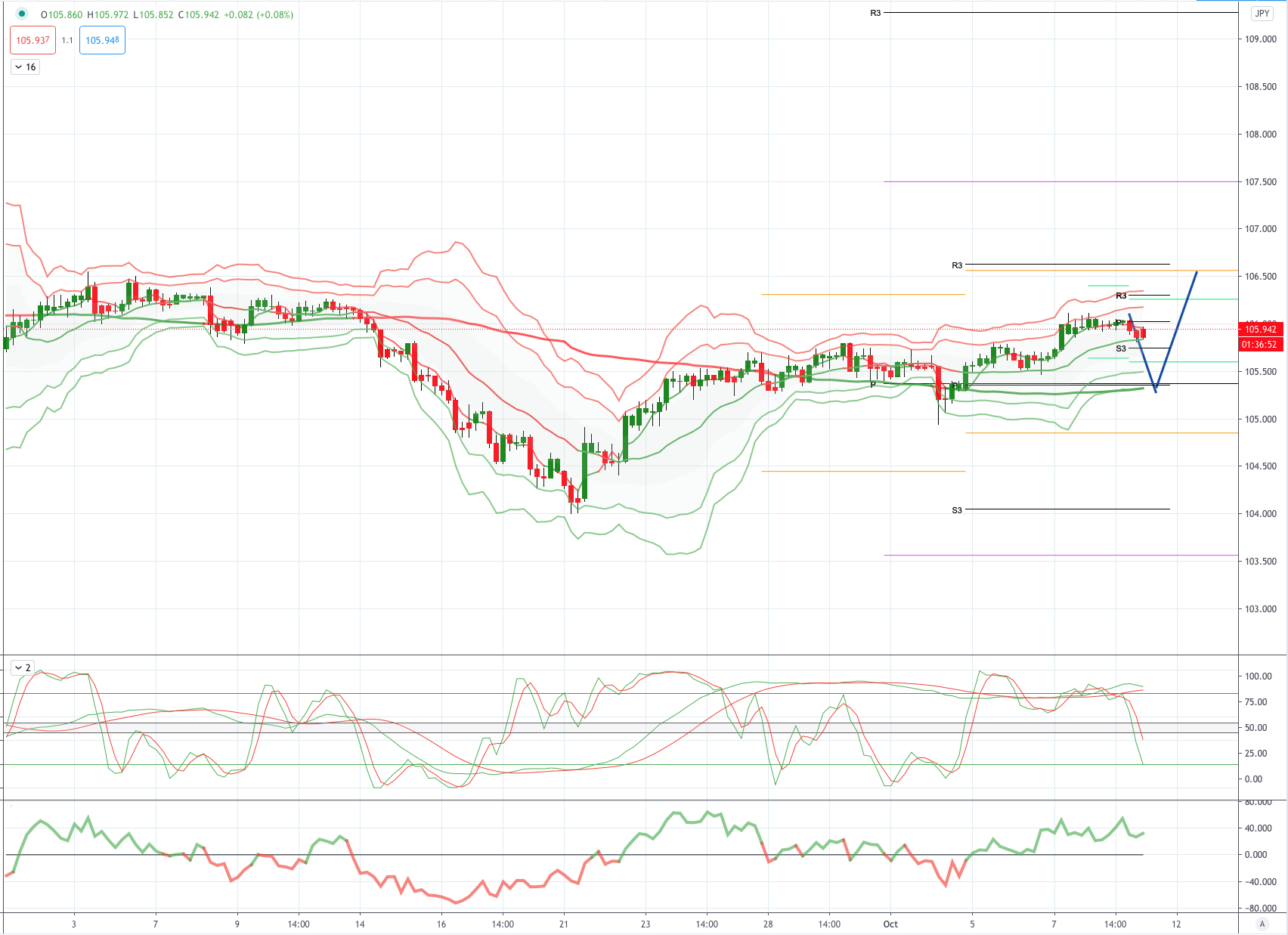

USDJPY Bias: Bearish below 105.50 Bullish above

USDJPY From a technical and trading perspective, as 106.50 acts as resistance look for another test of support at 105.50 failure to find sufficient bids here will expose 104.18 again. UPDATE as 105.50 now acts as resistance look for a test of bids towards 103.80 as the next downside objective. UPDATE continued rotation around 105.50, as 105.10 supports look for a test of 106.00

Flow reports suggest offers strong into 106.00 area with stops on a break through the 106.20-30 area, offers remain into the 107.00-20 area with congestion likely to be mixed with weak stops on a break of the level and that congestion likely to continue on any move into the 107.60 area where stronger offers are likely to appear, maybe another round of stops before stronger offers then appearing through to the 108.00 level. Downside bids into the 104.20 light and then increasing on any dips to the 104.00 level and stronger stops through the 103.80 level, any break here opens the chance of a deeper move through to the 103.00 level before stronger bids start to appear with possible option related buyers.

AUDUSD Bias: Bullish above .7100 Bearish below

AUDUSD From a technical and trading perspective, as .7220 now acts as support, look for a test of psychological .7500. Only a daily closing breach of .7220 would concern the bullish thesis opening a retest of .7100. UPDATE as .7220 now acts as resistance look for a test of bids to .7050 UPDATE as .7150 acts as resistance look for a test of bids and stops below .7000 UPDATE breach of .7150 opens a retest of .7220 from below UPDATE .7200 caps for now look for retet of bids and stops to .7100 UPDATE buyers stepped in at .7100, as supply at .7200/30 look for attest of .7100

Flow reports suggest downside light bids through to the 0.7020 area with stronger bids starting to make an appearance and possible option related bids coming into play, a push through the 0.6980 level should see weak stops appearing and the market running into congestion on any push to the sentimental 0.6950 area and likely to continue through to 69 cents area, Topside through to the 0.7220 level with some of the area cleared but immediately filling up again however, that weakness exposes the market through to the 0.7250 area with likely strong offers again into the level with congestive offers likely continuing through to the 0.7300 levels.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!