Daily Market Outlook, October 4th, 2021

Overnight Headlines

- Progressive Lawmakers Offer To Cut Spending Short To Save Biden Plan

- House Speaker Pelosi Sets Revised Oct 31 Target To Pass Infrastructure Bill

- Jayapal Rejects Manchin's USD 1.5T Price Tag For Biden's Spending Plan

- US State Dept. Condemns 'Provocative' Chinese Activities Near Taiwan

- German Liberals And Social Democrats Hold "Constructive" Coalition Talks

- SPD Co-Leader: Three Way SPD-Led German Coalition Doable By Year End

- Britain Will Threaten To Scrap Some Of The Northern Ireland Brexit Terms

- Japan's Kishida Set To Take Office, Form Government; Elections On Oct 31

- New Zealand Reveals Three-Step 'Roadmap' Out Of Lockdown In Auckland

- China Evergrande Trading Halt In Hong Kong Spurs Asset Sale Speculation

- Oil Prices Falls Ahead Of OPEC+ Policy Meeting; Gold Near Two-Week High

- Asian Shares Slip As Evergrande And Inflation Worries Sap Positive Mood

The Week Ahead

- Week Ahead-U.S. jobs report dominates, RBA and RBNZ to meet The U.S. labor report is a big focus for global markets this week as it could determine whether the Federal Reserve begins tapering asset purchases in November. Comments by Fed and other G7 central bank officials, an OPEC+ meeting, the progress of President Biden's infrastructure and social agenda and monetary policy bank decisions in Australia and New Zealand will also be watched. Ahead of Friday's September non-farm payrolls, key U.S. releases include factory orders, trade, ISM non-manufacturing, final Markit PMIs, ADP employment and weekly jobless claims. The euro zone has a lighter calendar dominated by final services PMIs, retail sales, German industrial orders, output and trade. The UK's main release is services PMI but fuel shortages remain a broader concern. In Japan, investors will watch incoming prime minister Fumio Kishida's cabinet announcements. The data calendar includes Tokyo CPI, services PMI, household spending, current account and trade data. Chinese markets are closed until Friday, when the Caixin services PMI is due, but investors will monitor developments in the Evergrande saga and the Biden administration's China trade review. Australia has trade data, but Tuesday's RBA meeting will dominate interest; no change in policy is expected. By contrast, the Reserve Bank of New Zealand is widely expected to raise rates by 25 basis points from a record low of 0.25% on Wednesday. Canada has trade and employment data due

CFTC Data

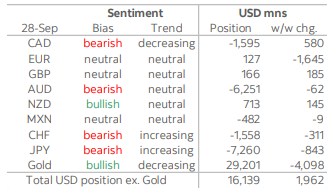

- The aggregate USD long position in the currencies that we track rose by nearly USD2bn in the week to Tuesday according to CFTC data published today. Net bullish positioning in the dollar now sits at USD16.1bn and is nearing the pandemic-shock high of USD18.2bn in February 2020. Just twelve weeks ago, accounts still held a USD short position.

- Speculative positioning in the EUR is quickly closing in on bearish as investors once again trimmed the shared currency’s net long. The weekly decline of USD1.65bn took the EUR’s aggregate position to USD127mn, its lowest point since March 2020. On the cutoff date for the CFTC’s data, the EUR closed in on its weakest level against the dollar since November. Yesterday, it fell to a new low since July 2020. The shift in sentiment in the EUR was the result of an increase in short contracts that was roughly three times as large as the increase in long contracts.

- The CHF and JPY short positions also saw notable increases over the week. The former’s rose by USD311mn to USD1.56bn while the latter climbed by USD843mn to USD7.26bn. While the JPY short is merely back to the levels seen a month ago, bearish positioning in the CHF has not been this large since late-2019. The move likely reflects these currencies high sensitivity to US interest rates as the yield on 10-yr Treasurys jumped by over 20bps in the week to Tuesday.

- Investors trimmed the aggregate CAD short by USD580mn, or about a quarter of its total, to USD1.6bn; outstanding shorts fell to a six-week low while longs held relatively steady. Among the currencies in this report, only the CAD and AUD appreciated versus the dollar over the week. The AUD short, however, increased slightly by USD62mn to USD6.25bn, which represents the largest bearish position on the AUD as far back as CFTC records go.. Four months ago, the AUD position was neutral.

- Elsewhere, adjustments were smaller with the GBP’s now net long rising by USD185mn to USD166mn and the NZD’s net long climbing by 145mn to USD713mn. The latter represents the largest bullish position of the currencies in this report as the NZD takes the EUR’s place at the top of the sentiment leaderboard.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

- EUR/USD: 1.1535-40 (801M), 1.1560 (461M), 1.1570-75 (441M), 1.1600 (1BLN)

1.1625 (315M), 1.1640-50 (1BLN)

- GBP/USD: 1.3490 (218M), 1.3650 (404M).

- EUR/GBP: 0.8525 (300M)

- AUD/USD: 0.7250 (1BLN).

- USD/CAD: 1.2650 (260M)

- USD/JPY: 110.80 (389M), 111.25-30 (710M), 111.45-50 (570M), 112.20 (450M)

- EUR/JPY: 129.60 (410M).

- AUD/JPY: 78.75 (410M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.17 Bullish above

- EUR/USD heavy in Asia again after early gains, 1.1590 to 1.1614 and back

- Support at 1.1563/64 double bottom September 30/October 1

- Option expiries today - 1.1530-75 E1.7 bln, 1.1590-1.1600 E1.2 bln

- Option expiries to keep pair sandwiched for now? E1.6 bln more 1.1610-50

- EUR/JPY 128.70-82 EBS, quiet and holding just above 128.57 low Friday

- EUR/CHF indicated 1.0792-93 and EUR/GBP 0.8562, very quiet

- China and Australia holidays today leaving market thin

GBPUSD Bias: Bearish below 1.36 Bullish above.

- Two-day rebound out of a new 2021 low, 1.3412, now struggling

- Price pulling up just shy of 1.3590, 10DMA, and 1.3603 Fibo

- Retracement readings off 1.3913-1.3412: 38.2% 1.3603, 50% 1.3663

- The minimum correction off the 1.4250 to 1.3412 drop just above at 1.3610

- Frid-Mon highs of 1.3575-76 initial resistance

- To the downside and the 30DMA lower Bolli at 1.3494

- Underlying bear run alive while below 1.3663, 50% Fibo 1.3913-1.3412

USDJPY Bias: Bullish above 109 Bearish below

- USD/JPY and most JPY crosses steady after large JPY buy-backs Friday

- USD/JPY 110.87-111.11 EBS, lower US yields weigh, Tsy 10s @1.475%

- Holding above ascending 200-DMA at 110.86, 110.59/60 daily kijun/tenkan

- Fibo 38.2% retracement of 109.12-112.08 9/22-30 111.01, 50% at 110.64

- Total $1.3 bln or so in option expiries today between 111.25-50 to help cap

- EUR/JPY 128.70-82 EBS, GBP/JPY 150.10-64

- AUD/JPY 80.41-80, NZD/JPY 76.83-77.15, CAD/JPY best bid, 87.65-88.00

- Nikkei -0.95% @28,497.57, disillusionment with Kishida regime?.

AUDUSD Bias: Bearish below 0.75 Bullish above

- AUD/USD rally fizzles just as it begins, due to Evergrande

- AUD/USD stumbles to 0.7261, reversing initial spike to 0.7283

- Evergrande shares in HK suspended without explanation...

- HSI dives as much as 2.7% on renewed fears for China property sector

- AUD/USD breakout from Bollinger downtrend channel looks shaky

- Mon closing below 0.7232 will reinstate bearish channel

- New South Wales among Australian states on holiday Monday

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!