Daily Market Outlook, October 22, 2021

-1634908131.png)

Daily Market Outlook, October 22, 2021

Overnight Headlines

- Biden Backs Down On Corporate Tax, Open To Altering Filibuster

- Manchin: To Miss Friday Target For Deal On Reconciliation Bill

- Fed's Williams: Rising Home Prices Don't Pose Financial Risks

- Fed’s Bostic: The Fed Could Raise Rates As Soon As Q3 2022

- USTR Tai Optimistic On EU Tariff Dispute, Seeks Steel Alliance

- BoE Chief Economist Pill Warns UK Inflation Likely To Hit 5%

- UK Public's Inflation Expectations Rocket To Record High: GfK

- China Hints Crackdown On Tech Giants Is Coming To An End

- Japan’s Prices Rise For First Time In 18 Months On Energy

- RBA Defends Bond Target For The First Time In Eight Months

- China Evergrande Makes Overdue Interest Payment On Bonds

- Intel Falls After Component Shortages Hurt Chip Business

- Snap Craters Post Earnings, Facebook And Twitter Follow

The Day Ahead

- Asian equity markets were mostly higher heading into the weekend, supported by reports of payment of a bond coupon by Evergrande, the indebted Chinese property company. In the UK, GfK consumer confidence in October fell 4 points to -17, a third monthly decline which the survey compiler said reflected concerns about the cost of living. Yesterday, the BoE’s chief economist Pill said that the November policy meeting is ‘live’ and ‘finely balanced’. Markets are fully priced for a 15bps increase in Bank Rate to 0.25%.

- Official figures just released showed UK headline retail sales falling slightly in September by 0.2%m/m, contrary to forecasts for a rise. It was the fourth consecutive monthly decline, although sales remain above pre-pandemic levels. The stockpiling of automotive fuel due to the panic over shortages provided some support for sales. Excluding fuel, retail sales fell by 0.6%m/m, led by weaker non-food store sales (although clothing & footwear was up).

- Ahead today, the ‘flash’ PMI releases will provide an early indication of activity and price pressures at the start of Q4. We look for a slight decline in the UK manufacturing PMI to 56.5 in October from 57.1, although the backlog of work is expected to support activity even if new order flows are slowing. Look for a bigger fall in the UK services PMI to 54.5 from 55.4. Overall the survey is expected to signal continued expansion, but with supply constraints contributing to a further softening in momentum.

- For the Eurozone, look for the manufacturing PMI to move down to 57.0 from 58.6 and for the services PMI to fall to 55.0 from 56.2. These levels would remain well above the 50 level separating expansion and contraction, but supply issues are having an impact on the pace of growth. The German manufacturing PMI may receive particular attention after latest official industrial production figures revealed a slump in output due to shortages of intermediate goods, including semiconductors, hitting areas such as car production.

- Markit PMIs will also be released for the US, which have edged lower recently but remain in expansion territory. There will also be particular attention on Fed Chair Powell who will take part in a policy panel discussion on post-Covid monetary and financial stability challenges.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

- USDJPY - 114.90/115.00 1.05bn (C). 114.60/70 460m. 114.20/40 1.63bn (1.03bn C). 113.50 585m. 113.00 472m. 111.50 750m.

- EURUSD - 1.1940/50 731m. 1.1850 1.05bn (P). 1.1640/60 1.09bn (563m P). 1.1600/10 1.39bn (945m P).

- GBPUSD - 1.3700 768m.

- AUDUSD - 0.7170 680m.

- USDCAD - 1.2520/30 722m. 1.2480/1.2500 686m. 1.2350/60 666m.

- EURGBP - 0.8430 440m.

- USDCNH - 6.51 410m.

Technical & Trade Views

EURUSD Bias: Bearish below 1.17 Bullish above

- EUR/USD and EUR complex in general steady after moves lower yesterday

- EUR/USD 1.1621-31 EBS, holding above 1.1600, 1.1619 low yesterday

- Some recent EUR shorts likely pared in tries higher this week

- More meaningful upside still seen unlikely on Fed-ECB discrepancy

- Option expiries help contain, today 1.1600-10 E1.4 bln 1.1620-75 E1.4 bln

- Tech resistance from ascending 100-HMA at 1.163

- Tech support at 1.1596

- EUR/JPY 132.31-77, consolidating below recent highs, high Wed 133.48

- EUR/GBP 0.8425-32, heavy, today E440 mln 0.8435 option expiries

- EUR/CHF marginally below 1.0672 low yesterday, Asia 1.0670-76

- Falling EUR/USD implied volatility makes options cheaper

- Pricing suggests less expected actual volatility/break-out risk

- Benchmark 1-month 4.8 vs 5.3 last week, recent pandemic-era low is 4.5

- Additional risk premium for downside strikes vs topside, is also falling

- Reflects lower risk of well touted 1.1500 barriers breaking anytime soon

- 1-2-week expiry options slower to fall - 1-week gets ECB, and 2-week FOMC

- However, those premiums not excessive, but recognise event volatility risk

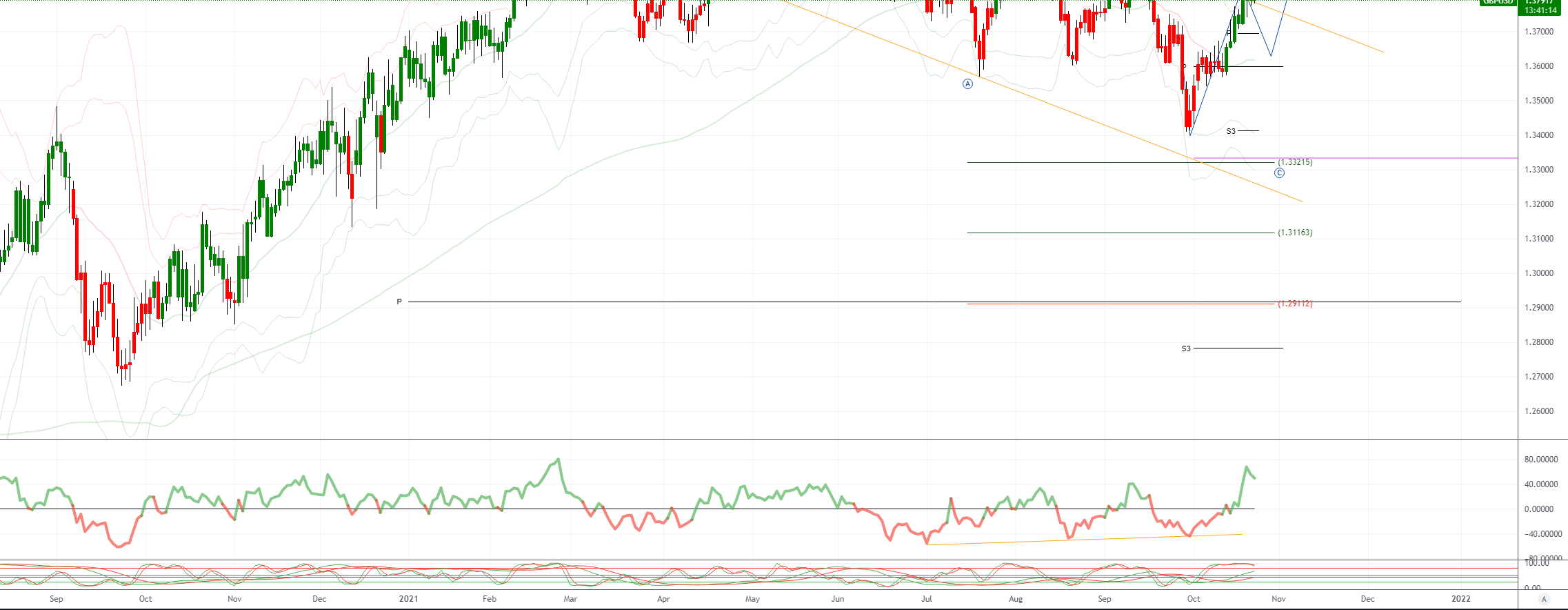

GBPUSD Bias: Bearish below 1.37 Bullish above.

- 1.3830 resistance vulnerable as inflation fears grow

- Steady in the middle of a 1.3783-1.3810 range - busy once Asia in full swing

- UK PM ready to compromise on EU court for N Ireland - The Times

- If true this would be a real breakthrough in solving post Brexit dispute

- UK public's inflation expectations rocket to record high: GfK

- Charts; 5, 10 & 21 day moving averages climb, 21 day Bollinger bands expand

- Net positive daily momentum studies - bullish trending setup continues

- 1.3831, 50% of 2021 fall is resilient, but 1.3913 September high beckons

- Close below 1.3719 rising 10 DMA needed to undermine the topside bias

USDJPY Bias: Bullish above 112.50 Bearish below

- USD/JPY, JPY crosses see some bounce with Tokyo risk on

- USD/JPY, JPY crosses up in Asia, risk back on in Tokyo, as US yields firm

- USD/JPY 113.82 early to 114.20 EBS, tracking away from 113.65 low in NY

- Still essentially consolidating in core 114.00-50 range

- Firm US yields supportive, more Japan asset hedging on way?

- Caution however with market still short JPY, risk mood iffy

- Tokyo risk on, Nikkei +0.75% @28,934, but many AXJ bourses down however

- Also $1.6 bln in option expiries above between 114.20-45, to help cap USD?

- EUR/JPY 132.31 to 132.77, GBP/JPY 156.93 to 157.66, CAD/JPY 91.97 to 92.48

- AUD/JPY 84.86 to 85.49 before steadying, NZD/JPY 81.39 to 81.87

AUDUSD Bias: Bearish below 0.75 Bullish above

- Touch firmer – RBA defends 0.1% target – trend is up

- +0.1% in the middle of a 0.7454-0.7489 range with consistent interest

- RBA bought AUD 1BLN targeted April 2024 bonds- yields slipped 5.6BP to 0.14%

- Still above 0.1% RBA target - widely expected - no AUD impact

- Early losses recovered as China Evergrande avoided default

- Early days but optimism on Evergrande restructure broadly risk positive

- Charts; 5, 10 & 21 day moving averages, 21 day Bollinger bands climb

- Strong trending setup - bias higher while 0.7425 10 day moving average holds

- Targets a test of 0.7556-63 50% 2021 fall and the 200 DMA, capped since June

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!