Daily Market Outlook, October 10, 2023

Daily Market Outlook, October 10, 2023

Munnelly’s Market Commentary…

Asian equity markets opened the week on a mostly positive note as markets returned from the long weekend. This positive sentiment was influenced by the recovery seen on Wall Street, partly due to dovish-leaning comments from Federal Reserve officials. The Nikkei 225, returning from the holiday closure, outperformed. It had the chance to react to key market themes, including last week's US jobs data, the Israel-Hamas conflict, and recent Fed rhetoric.

In contrast, the Hang Seng and Shanghai Composite had mixed performances. Hong Kong's market was lifted by strength in the technology and property sectors, while the mainland market lagged. Concerns over holiday spending and lingering debt issues arose after Country Garden announced its inability to meet offshore obligations on time.

Regarding the economic data docket, the calendar for the day is relatively light. Italian industrial production for August is expected to show a second consecutive monthly decline, consistent with similar trends in Germany, France, and Spain reported last week. The overall Eurozone aggregate data is due later in the week.

In the UK, the Bank of England released the minutes of its late September Financial Policy Committee meeting. The minutes might not fully reflect recent developments, including those at Metro Bank. Concerns about financial strains arising from a series of interest rate rises were being closely monitored.Labour Party leader Starmer was scheduled to speak at their annual conference, where he was expected to emphasize prudence in managing public finances if the party forms the next government.

At the semi-annual IMF-World Bank conference, the IMF released an update of its global economic forecasts. The IMF's Managing Director had suggested a higher probability of a soft landing for the global economy in prior comments. However, the forecasts might reveal an uneven outlook, with expectations of increased US growth alongside downgrades in other major economies.

Stateside, the NFIB small business index was anticipated to reflect a second successive monthly fall in optimism for September. Recent labor market readings indicated a mixed picture, with a rising number of businesses struggling to fill job openings while wage expectations edged down. Fed Governor Waller, Fed's Kashkari, and 2024 voters Bostic and Daly are scheduled to speak today. These speeches will be closely watched for insights into the Federal Reserve's stance on monetary policy and the possibility of a November interest rate hike.

FX Positioning & Sentiment

EUR/USD has rebounded from recent lows but still faces downside risks, as indicated by the strong implied volatility premium for downside strikes in FX options. Benchmark 1-month 25 delta risk reversals show this premium, with 6-month implied volatility favoring USD calls over puts. Traders appear to have a preference for buying and holding downside positions for now. Those concerned about renewed EUR/USD losses may consider using Reverse Knock Out (RKO) options, which have knock-out triggers below the strike level and can significantly reduce the premium.

CFTC Data As Of 3-10-23

EUR net spec long falls to 78,943 in week to Tues from 98,399

Smallest EUR long since October

JPY short increases to 113,988 contracts from 109,512

AUD short 81,987 versus 86,815 previous week

GBP flips to short 6,680 from long of 15,669

First sterling short since April

CHF short jumps to 16,742 -- biggest since November -- from 9,115. (Source Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0420 (568M), 1.0540 (694M), 1.0590-1.0600 (612M) , 1.0605-10 (323M)

USD/CHF: 0.9100 (300M), 0.9150 (550M)

USD/SEK: 11.00 (860M)

GBP/USD: 1.2170 (297M)

EUR/GBP: 0.8595 (226M), 0.8760 (396M)

AUD/USD: 0.6350 (1.3BN), 0.6400 (257M), 0.6420 (300M), 0.6460 (440M)

NZD/USD: 0.5910 (895M), 0.5950 (330M), 0.5975 (501M)

USD/JPY: 148.50-60 (1.2BN), 148.75 (345M), 150.00-05 (912M)

Overnight Newswire Updates of Note

Concerns mount among investors about a potential spike in oil prices due to ongoing turmoil in the Middle East.

Israel is on high alert and Hamas has issued threats, adding to regional tensions.

Treasuries experience a rally as investors seek safety, partly influenced by a dovish stance from the Federal Reserve.

Japan is set to take the chair at the G7 finance ministers meeting during the upcoming IMF conference scheduled for October 12.

Japan's Finance Minister Suzuki attributes the recent weakening of the yen, in part, to differences in interest rates.

A technical glitch in Japan's clearing system disrupts transfers at 11 banks.

Kokusai Electric adjusts its indicative IPO pricing, now valuing the top end at $2.85 billion.

A survey reveals that Australian business conditions remained robust in September, with cost pressures showing signs of easing.

An Australian unlisted commercial property fund imposes significant restrictions on withdrawals.

China's Country Garden issues a warning that it may struggle to meet its offshore debt obligations.

Chinese developer Kaisa informs creditors that they may receive less than 5% of their claims if the company is liquidated.

China's commerce minister engages in "rational and pragmatic" discussions with US senators.

The World Bank's chief economist cautions that the increasing levels of debt in Asia could potentially dampen economic growth.

Bank of England's Mann highlights the potential for a "drift" in inflation expectations and suggests a more assertive policy approach may be needed.

UK's September BRC total sales rise by 2.7%, with like-for-like sales increasing by 2.8%, reflecting consumer behavior amid current conditions.

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

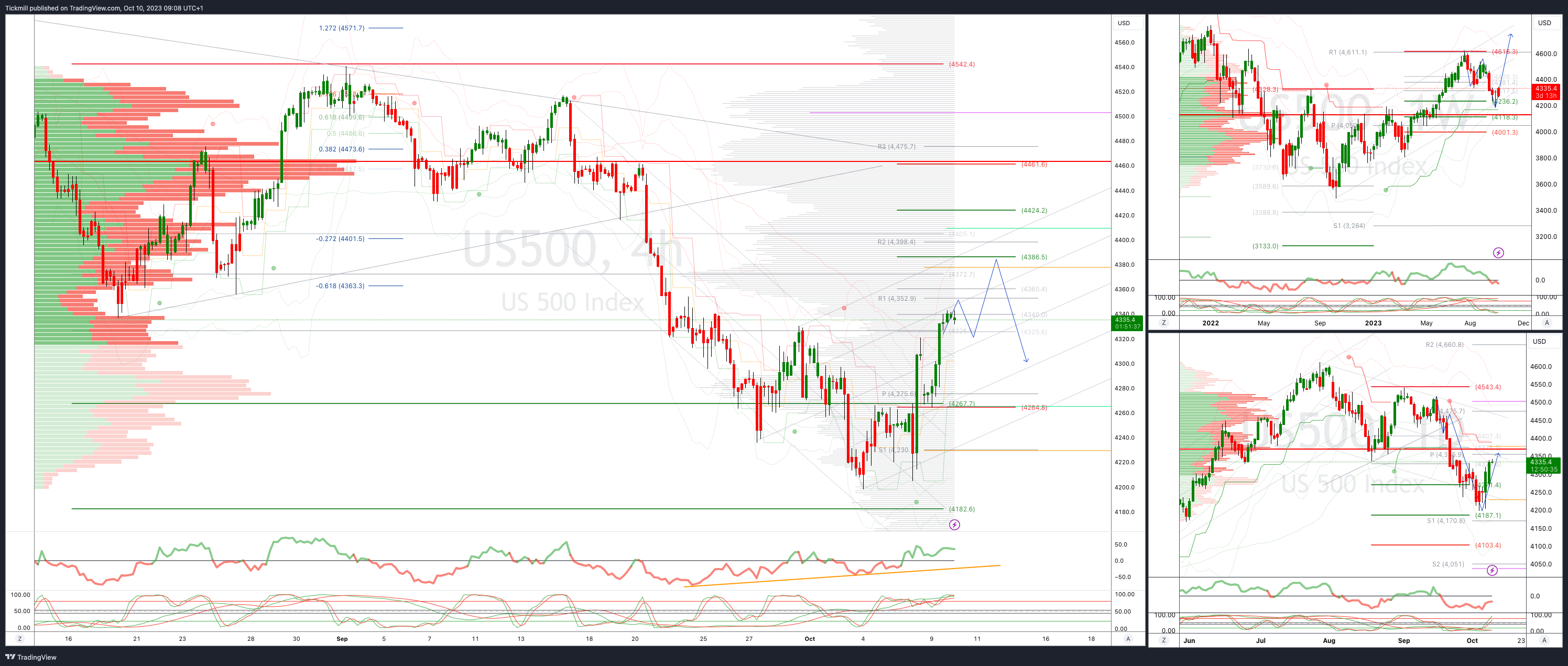

SP500 Bias: Bullish Above Bearish Below 4300

Above 4280 opens 4330

Primary resistance is 4450

Primary objective is 4386

20 Day VWAP bearish, 5 Day VWAP bullish

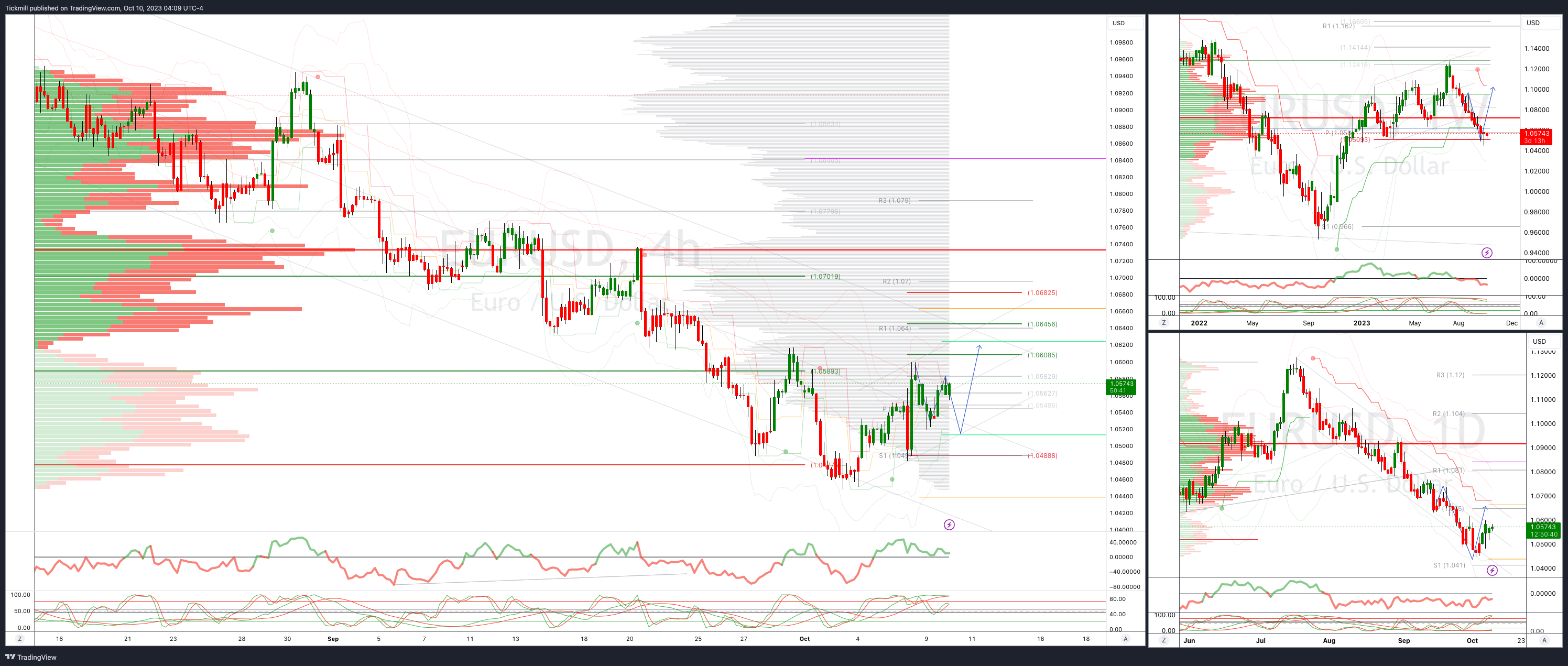

EURUSD Bias: Bullish Above Bearish Below 1.0488

Above 1.0610 opens 1.0650

Primary resistance is 1.0760

Primary objective is 1.0605

20 Day VWAP bearish, 5 Day VWAP bullish

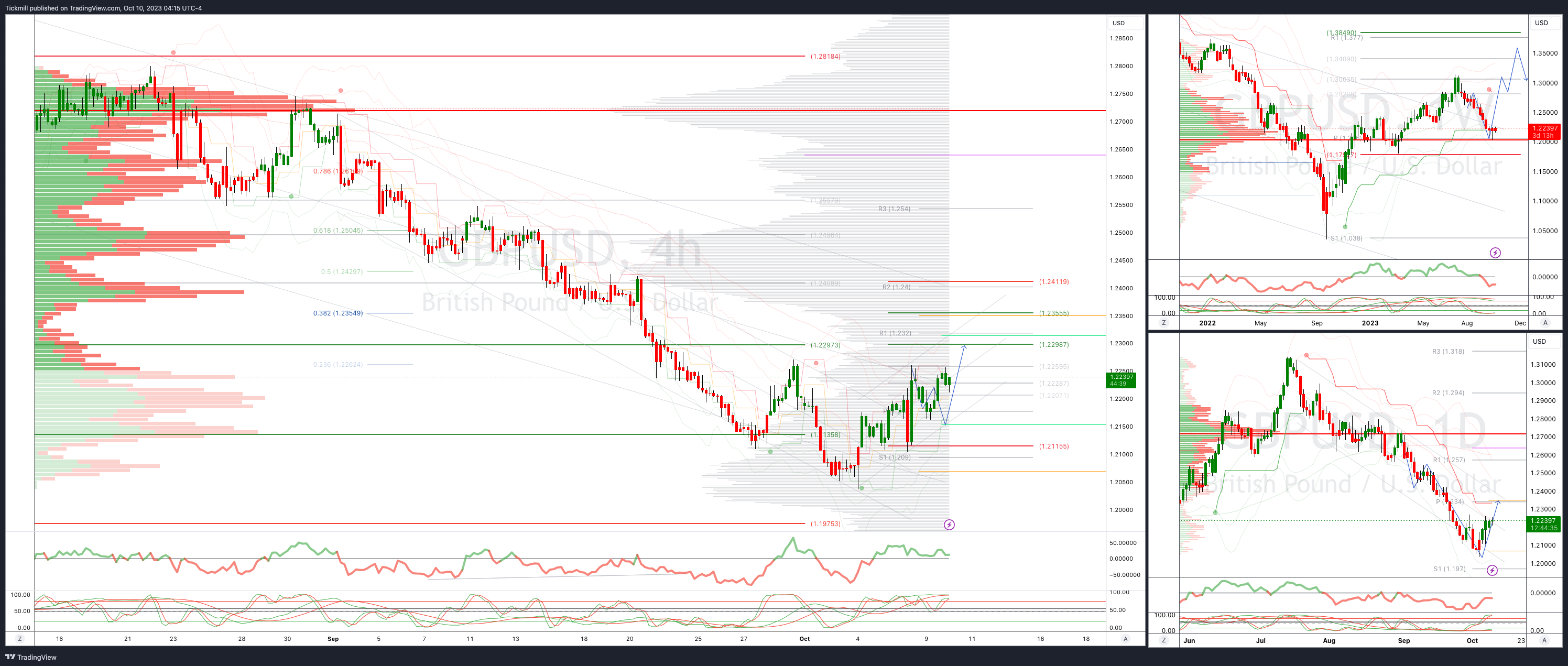

GBPUSD Bias: Bullish Above Bearish Below 1.2115

Below 1.21 opens 1.2037

Primary resistance is 1.2410

Primary objective 1.2298

20 Day VWAP bearish, 5 Day VWAP bullish

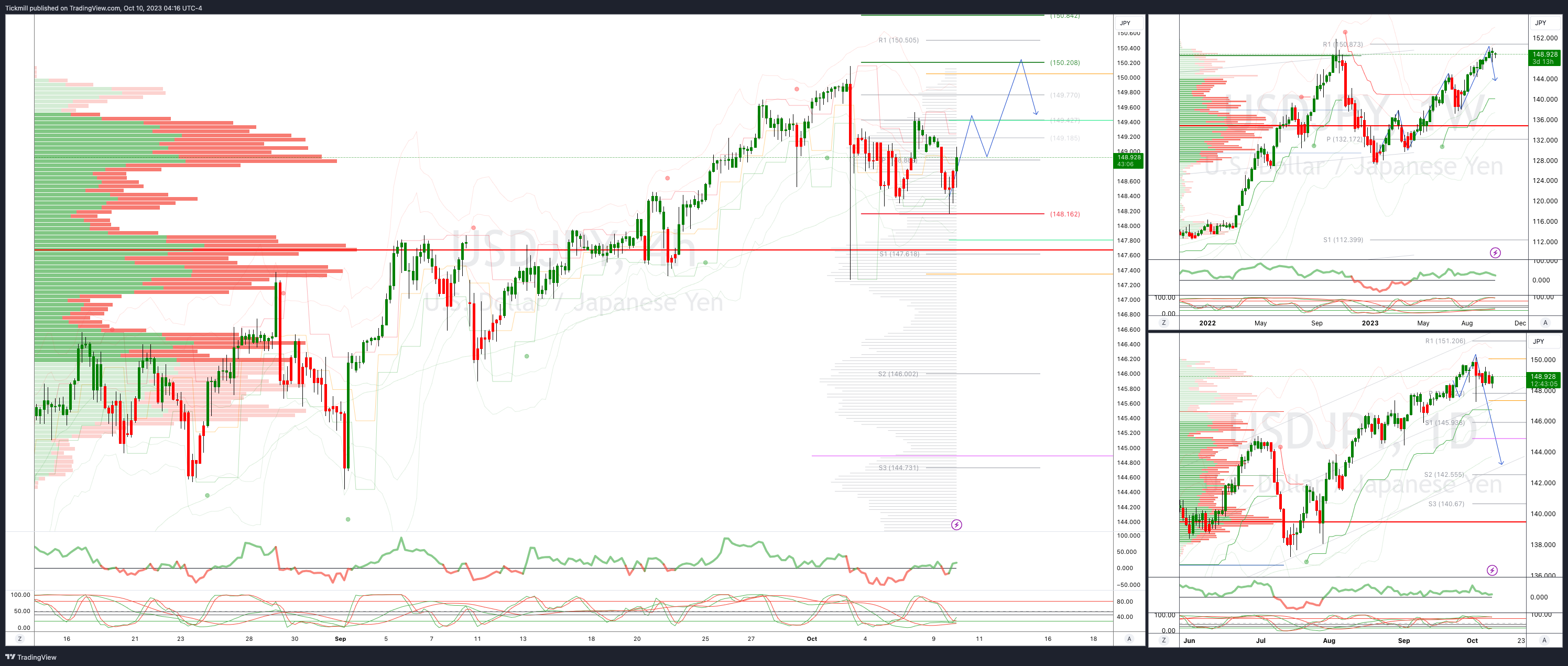

USDJPY Bias: Bullish Above Bearish Below 148.25

Below 148 opens 147.50

Primary support 144.50

Primary objective is 150.30

20 Day VWAP bullish, 5 Day VWAP bullish

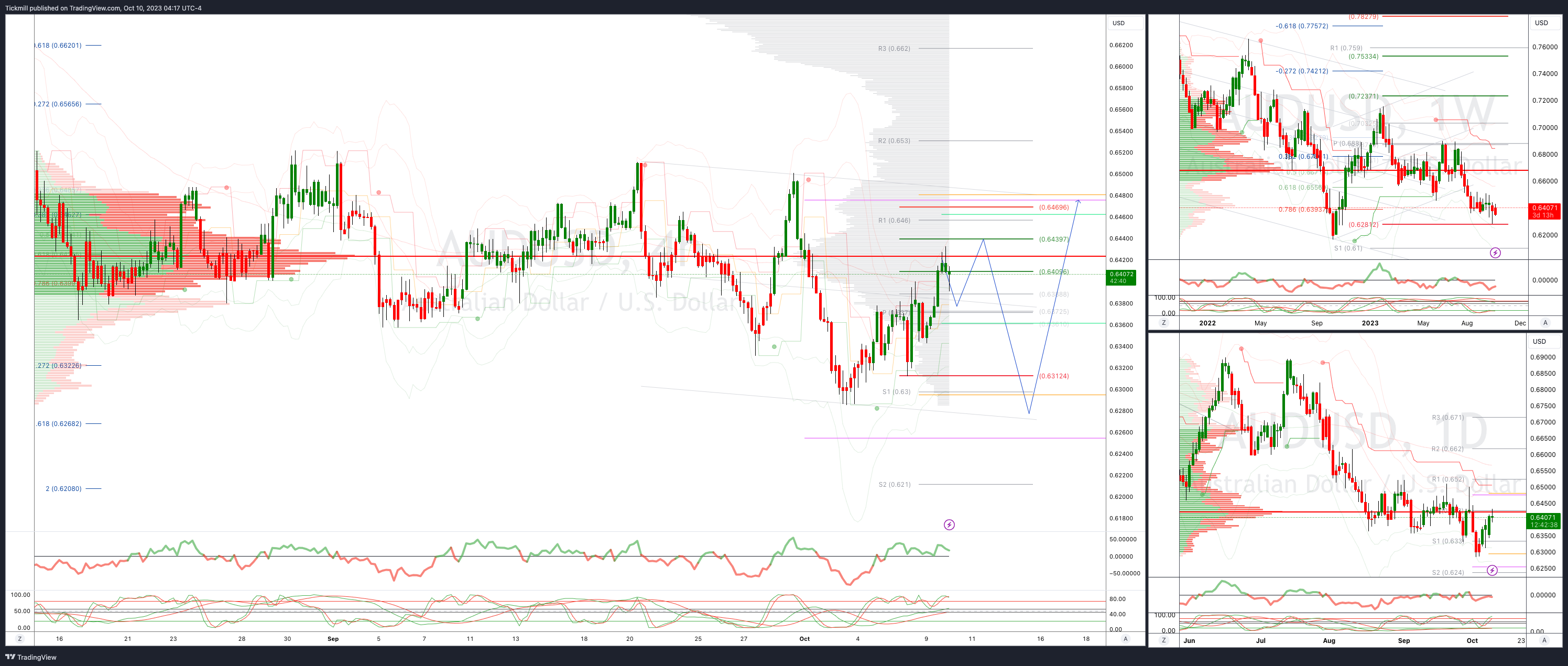

AUDUSD Bias: Bullish Above Bearish Below .6312

Above .6475 opens .6525

Primary resistance is .6620

Primary objective is .6270

20 Day VWAP bearish, 5 Day VWAP bullish

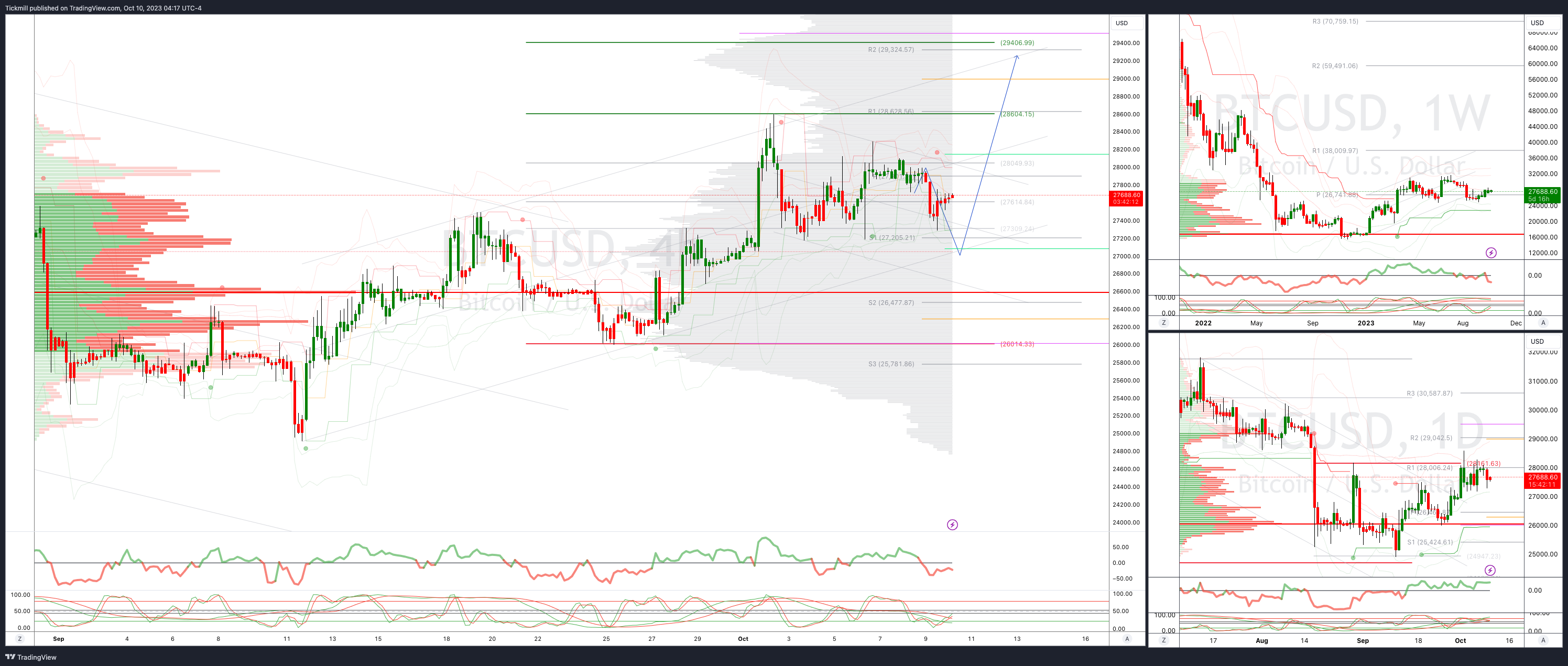

BTCUSD Bias: Bullish Above Bearish below 27500

Above 28600 opens 30000

Primary resistance is 28175

Primary objective is 30000

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!