Daily Market Outlook, November 3, 2023

Daily Market Outlook, November 3, 2023

Munnelly’s Market Commentary…

Asia - stocks experienced gains as they followed the upward movement in global markets. This rise came after the Bank of England (BoE) decided to maintain interest rates and a surprising decrease in US Labour Costs added to a dovish tone. Japan's market was closed for a holiday, and there was a disappointing Caixin Services PMI, but this did not halt the overall positive momentum. The Hang Seng in Hong Kong and the Shanghai Composite in China followed the general optimistic mood, largely ignoring weaker Chinese Caixin PMI data and another significant liquidity drain by the People's Bank of China (PBoC).

Europe - after the Bank of England's recent decision to maintain interest rates, MPC members Pill and Haskel are scheduled to address the public today. Notably, Mr. Haskel was one of the three committee members who dissented from the decision to keep rates at 5.25%, advocating for a quarter-point increase to 5.50%. In contrast, Mr. Pill, the Bank's chief economist, was aligned with the majority, favouring unchanged interest rates. The committee conveyed a resolute message, emphasising the necessity of maintaining a restrictive policy stance for an extended duration. However, this commitment was weighed against inflation forecasts that indicated a potential undershoot of the 2% target over a three-year horizon if interest rates remained at 5.25%, suggesting a heightened probability of a future rate cut. On the data front, markets anticipate that the final October reading of the UK services PMI will remain consistent with the initial 'flash' estimate, marking the third consecutive month below the critical 50 level. The majority of the MPC cited evidence of a slowdown in economic activity as a significant factor underpinning their decision to keep interest rates unaltered.

US - Stateside, later today, the US will release its labour market report, which is expected to reveal another substantial increase in employment (210k), albeit lower than September's figure (336k). The unemployment rate is predicted to edge down slightly to 3.7%, reflecting a tight labour market. Nevertheless, monthly wage data have indicated more modest gains, and this trend is anticipated to persist in the upcoming report. This could provide Federal Reserve policymakers with reassurance that there is no imperative need for further rate hikes. Additionally, the US services ISM is projected to show a slight moderation, slipping from 53.6 to 53.5, which is indicative of weakening demand. Alongside the data releases, several Federal Reserve speakers, including Barr, Barkin, Kashkari, and Bostic, are scheduled to speak today, which could attract market attention throughout the day given the markets reaction toWednesday’s FOMC policy update and the markets perception that the FOMC are now likely on hold.

FX Positioning & Sentiment

FX ptions are indicating the expected FX market reaction to the upcoming Non-Farm Payrolls (NFP) data. The overnight (o/n) expiry options now extend until Monday, November 6, but they still encompass the release of the NFP data on November 3. The initial premium for options that include the NFP data was relatively subdued on Thursday, but it increased slightly on Friday. For instance, the overnight premium for EUR/USD went from 46 USD pips on Thursday to 54 on Friday, while USD/JPY went from 65 JPY pips to 70 JPY pips, and AUD/USD increased from 40 USD pips to 43 USD pips. However, these prices are similar to those observed before the release of NFP data in October and September. The absence of significant additional FX volatility risk premium suggests that the FX market's breakout risk remains low. Nevertheless, FX dealers are not complacent. Recent implied volatility losses for other expiry dates have halted, at least for the time being.

CFTC Data As Of 27-10-23

USD net spec long up a touch in Oct 18-24 period; $IDX rose 0.03% in period

Since period closed ECB dovish hold & Japan CPI may moot period adjustments

EUR$ +0.12% in period, specs -2,843 contracts; weak growth trump inflation

$JPY +0.05%, specs +3,029 contracts now -99,629; pair hovers near 150

GBP$ -0.16% in period specs -18,636 contracts; dovish BoE rate view weighs

AUD, NZD net spec short grew amid low rates, growth view; weak China growth

$CAD +0.67% in period, weak global growth and stagnant BoC rates weigh

BTC +18.2% period, specs sell 781 contracts flip to short, BTC steady since

End of developed mkt hikes and global growth remain key determinants ( Source Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0500 (1.8BLN), 1.0520-30 (1.2BLN), 1.0575-90 (2.1BLN)

1.0600 (2.4BLN), 1.0635 (431M), 1.0660 (700M), 1.0690-1.0700 (1.4BLN)

USD/CHF: 0.9050 (766M).

GBP/USD: 1.2100 (1.1BLN), 1.2130 (400M), 1.2150 (813M), 1.2200 (544M)

1.2300 (545M).

EUR/GBP: 0.8635-45 (800M), 0.8815 (400M). EUR/SEK: 11.80 (358M)

AUD/USD: 0.6450 (1.9BLN), 0.6500 (755M) . NZD/USD: 0.5880 (203M)

USD/CAD: 1.3700-05 (2.7BLN), 1.3720 (409M), 1.3750 (1.1BLN), 1.3765 (406M)

USD/JPY: 149.00 (1.5BLN), 149.50 (1.25BLN), 150.00 (1.5BLN), 150.50 (1.1BLN)

151.00 (2.6BLN), 151.50 (526M), 151.75 (400M), 152.00 (435M)

Overnight Newswire Updates of Note

NZ’s Final Election Count Means Incoming Premier Luxon Needs Broader Support

ECB's Schnabel: ECB Can’t Close Door To Further Rate Hikes

UK PM Sunak Says UK Election Probably Next Year, Making 2025 Unlikely

Sam Bankman-Fried Convicted Of Fraud Over FTX’s Collapse

Dollar Eases As Traders Bet Fed Done With Rate Hikes

Oil Heads For Second Weekly Drop As Israel War Still Contained

Apple Stock Falls After Cautious Outlook Overshadows Record iPhone Quarter

Paramount Global Sees Q3 Profit Rise, Despite TV Headwinds

SocGen Q3 Earnings Beat Estimates As Investment Bank Offsets French Slump

UAW-Stellantis Deal Includes $18.9 Bln In Investments, New Truck For Idled Plant

UAW President Is Ready To Take On Tesla And Beat Elon Musk

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

SP500 Bias: Bullish Above Bearish Below 4260

Below 4200 opens 4180

Primary support 4200

Primary objective is 4400

20 Day VWAP bearish, 5 Day VWAP bullish

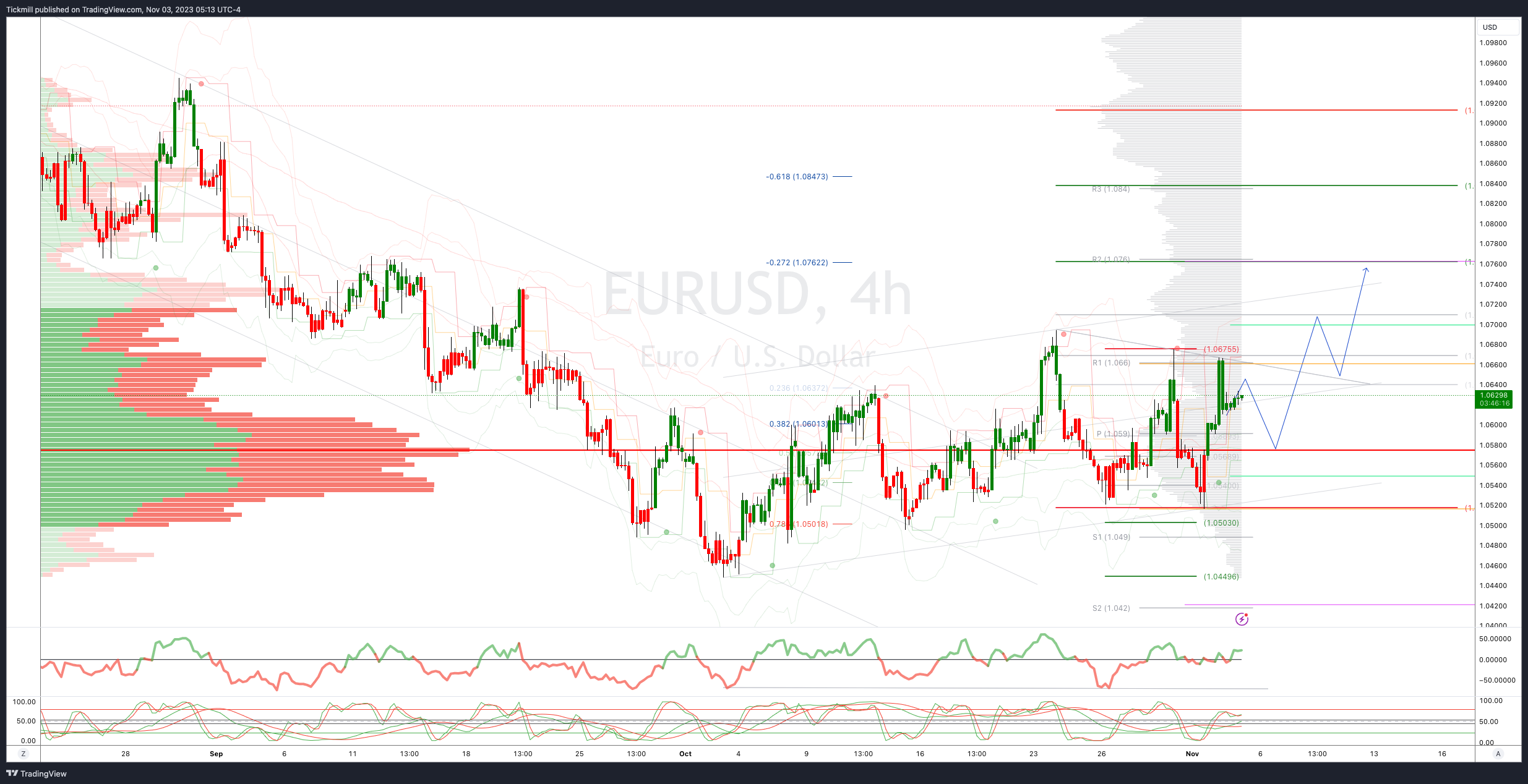

EURUSD Bias: Bullish Above Bearish Below 1.0580

Below 1.05 opens 1.04

Primary support 1.05

Primary objective is 1.07

20 Day VWAP bearish, 5 Day VWAP bullish

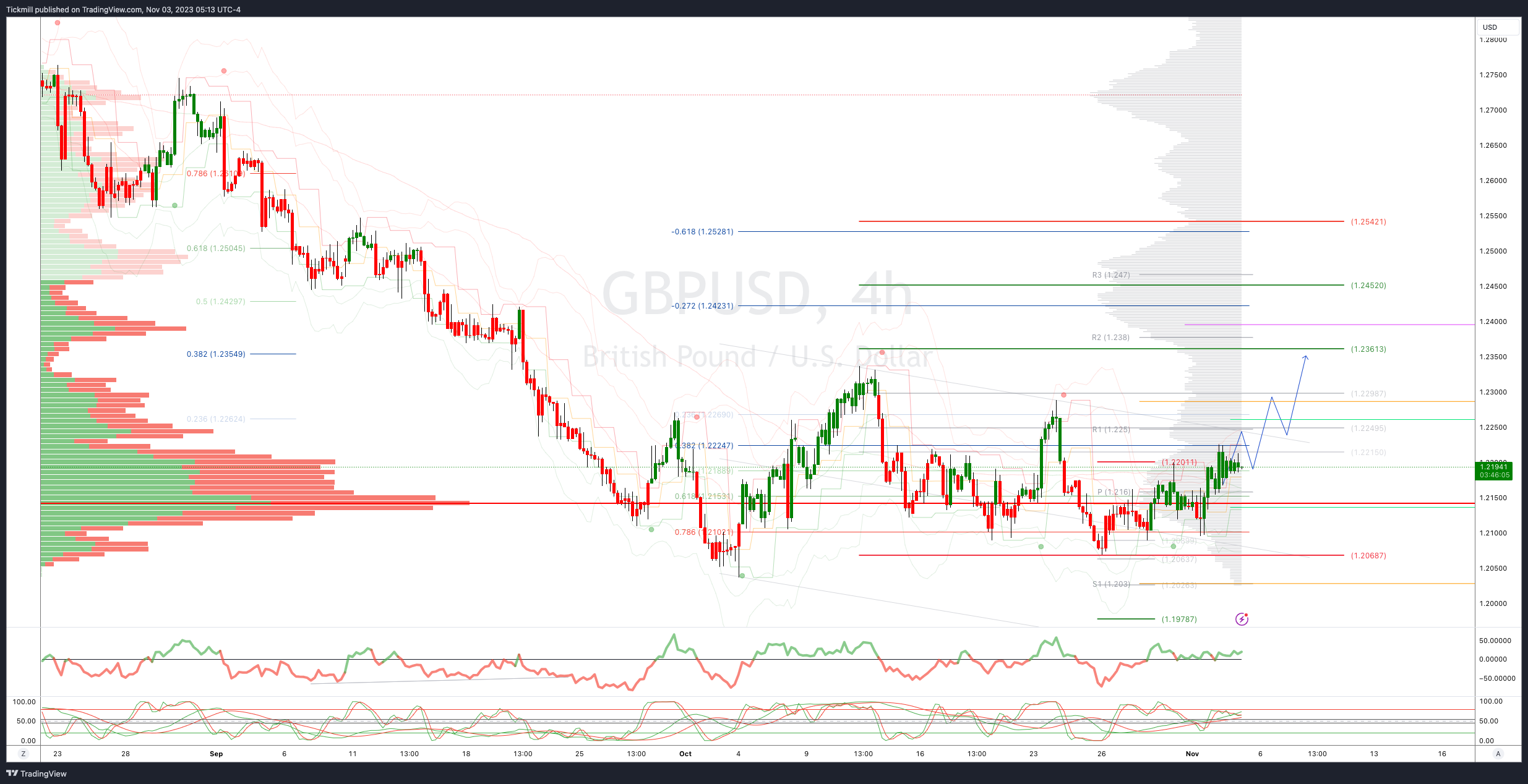

GBPUSD Bias: Bullish Above Bearish Below 1.22

Below 1.21 opens 1.1950

Primary support is 1.2069

Primary objective 1.2360

20 Day VWAP bearish, 5 Day VWAP bullish

USDJPY Bias: Bullish Above Bearish Below 150

Below 149 opens 148.50

Primary support 147.30

Primary objective is 152.50

20 Day VWAP bullish, 5 Day VWAP bullish

AUDUSD Bias: Bullish Above Bearish Below .6400

Above .6475 opens .6525

Primary support .6280

Primary objective is .6620

20 Day VWAP bearish, 5 Day VWAP bullish

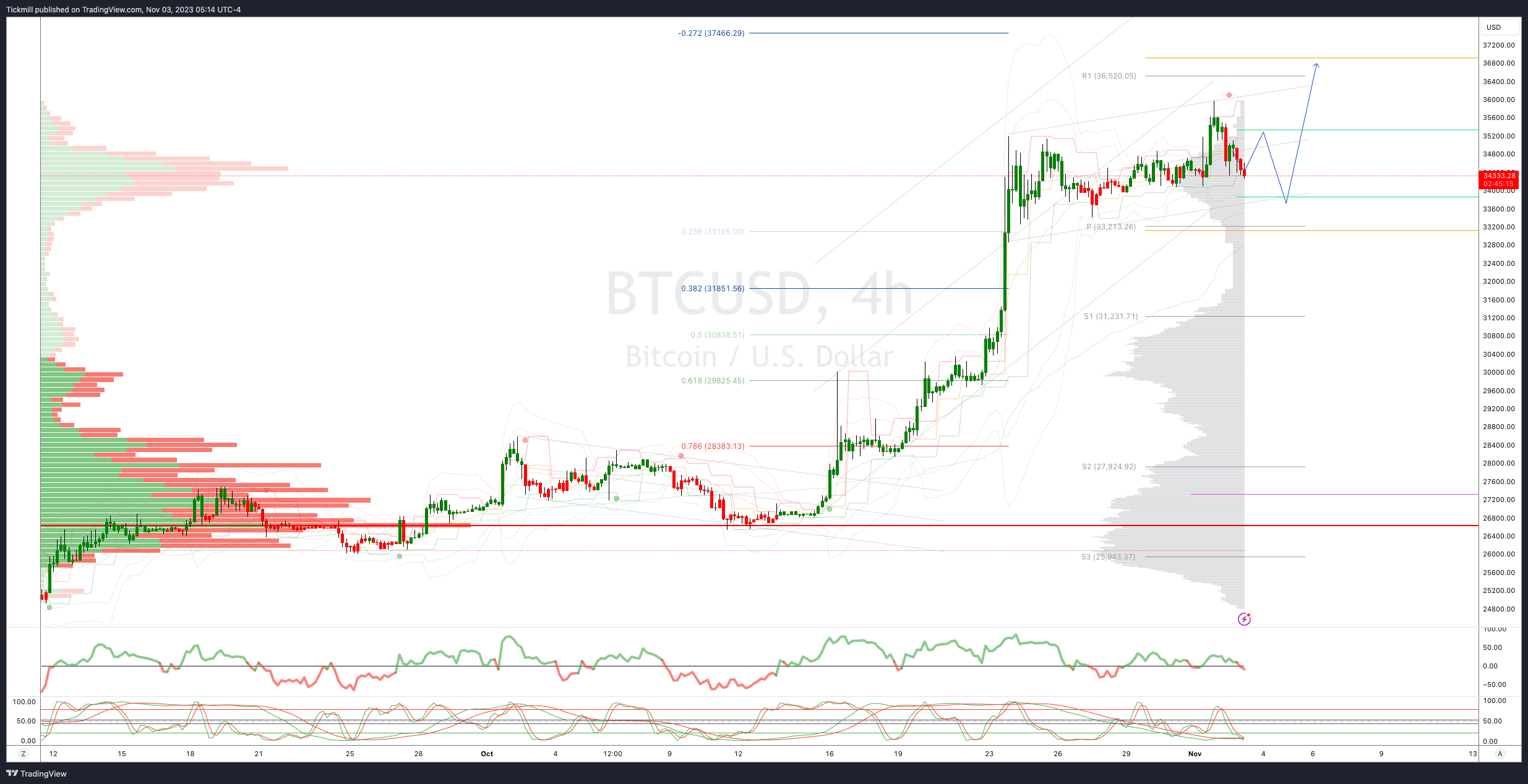

BTCUSD Bias: Bullish Above Bearish below 32000

Below 27100 opens 26500

Primary support is 30000

Primary objective is 37000

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!