Daily Market Outlook, March 19, 2024

Daily Market Outlook, March 19, 2024

Munnelly’s Macro Minute…

“BoJ Makes Their Move, JPY Buy The Rumour Sell The Fact”

Despite positive cues from Wall Street overnight, Asian stock markets are predominantly lower on Tuesday as traders adopt a cautious stance after monetary policy announcements from the Reserve Bank of Australia and the Bank of Japan. Additionally, anticipation surrounds the US Fed's monetary policy announcement on Wednesday, with investors keen for insights into the outlook for interest rates. Although Asian markets closed mostly higher on Monday, ongoing uncertainty prevails in the current session. The Fed is widely anticipated to maintain interest rates unchanged following recent inflation readings that have tempered optimism regarding a rate cut in June. However, market attention will be directed towards the central bank's accompanying statements and economic projections, which hold the potential to significantly influence rate expectations. Looking ahead, the Bank of England and the Swiss National Bank are also scheduled to announce their monetary policy decisions later in the week, adding to the market's anticipation and volatility.

The Bank of Japan (BoJ) has increased its interest rates for the first time in almost 20 years, making it the last central bank in the world to end negative rates as indications of strengthening inflation emerge. The BoJ Policy Board, led by Governor Kazuo Ueda, voted 7-2 to raise the overnight interest rate from around -0.1 percent to 0 to 0.1 percent. The central bank also decided to terminate its yield curve control policy, which had kept the interest on 10-year Japanese government bonds around zero. Market expectations were high for the BoJ to discontinue its unconventional and extremely loose policy measures implemented in 2016 to combat persistent deflation. This marks the first rate hike since 2007, following recent data showing an increase in inflation. In recent weeks, several BoJ rate-setters have indicated that the 2 percent inflation target is within reach.

Today's German ZEW survey for March marks the beginning of several Eurozone data releases for the month, with the PMI and IFO surveys scheduled for Thursday and Friday, respectively. Unlike the PMI and IFO surveys, the ZEW survey polls analysts rather than companies. The previous reading for February indicated that the current conditions component was at its lowest level since 2020, during the height of Covid concerns. However, the forward-looking expectations part of the survey has seen seven consecutive months of growth, suggesting that analysts anticipate better times ahead. Similar outcomes are expected for March.

Stateside, there are indications of improvement in the housing market. For instance, yesterday's NAHB housing market index for March reached an eight-month high. Although housing starts experienced a nearly 15% decline in January, this could be attributed to adverse weather conditions rather than economic factors such as the recent rise in mortgage rates. Prior to this decline, housing starts had increased for four consecutive months. Additionally, new building permits, which are less susceptible to weather impacts, held up better in January. Therefore, it will be intriguing to observe the extent to which housing starts rebounded in February.

Overnight Newswire Updates of Note

Japan Raises Interest Rates For The First Time In 17 Years

RBA Holds Rates, Drops Explicit Warning Over Further Rises

Japan FinMin Suzuki: Strong Wage Growth Drives Positive Economic Momentum

RBA’s Bullock: Need More Confidence On Inflation Lowering To Consider Cut

Deal Reached To Avoid Shutdown, Negotiators Resolve Homeland Security Bill

Jump In UK Minimum Wage Keeps Bank Of England On Alert

BoJ’s Dovish Tone After First Rate Hike Since 2007 Weighs On Yen

Oil Holds Gain With Russian Refining And OPEC+ Curbs To The Fore

BoJ Rate Hike Unlikely To Derail Stock Rally, Strategists Say

Nvidia Joins Ongoing Race In Quantum-Computing Cloud Services

Israel And Hamas Start Detailed Hostage Negotiations For First Time In Months

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0800 (EU760.6m), 1.0790 (EU680.3m), 1.1100

USD/JPY: 150.00 ($732.8m), 151.50 ($500m), 143.30 ($500m)

AUD/USD: 0.6275 (AUD545m), 0.6800 (AUD412.7m), 0.6575 (AUD371.6m)

USD/CNY: 7.1750 ($336.9m), 7.2100 ($332.9m), 7.2260 ($300m)

USD/CAD: 1.3100 ($602m), 1.3545 ($341.1m)

GBP/USD: 1.2500 (GBP430.4m)

NZD/USD: 0.5900 (NZD335m)

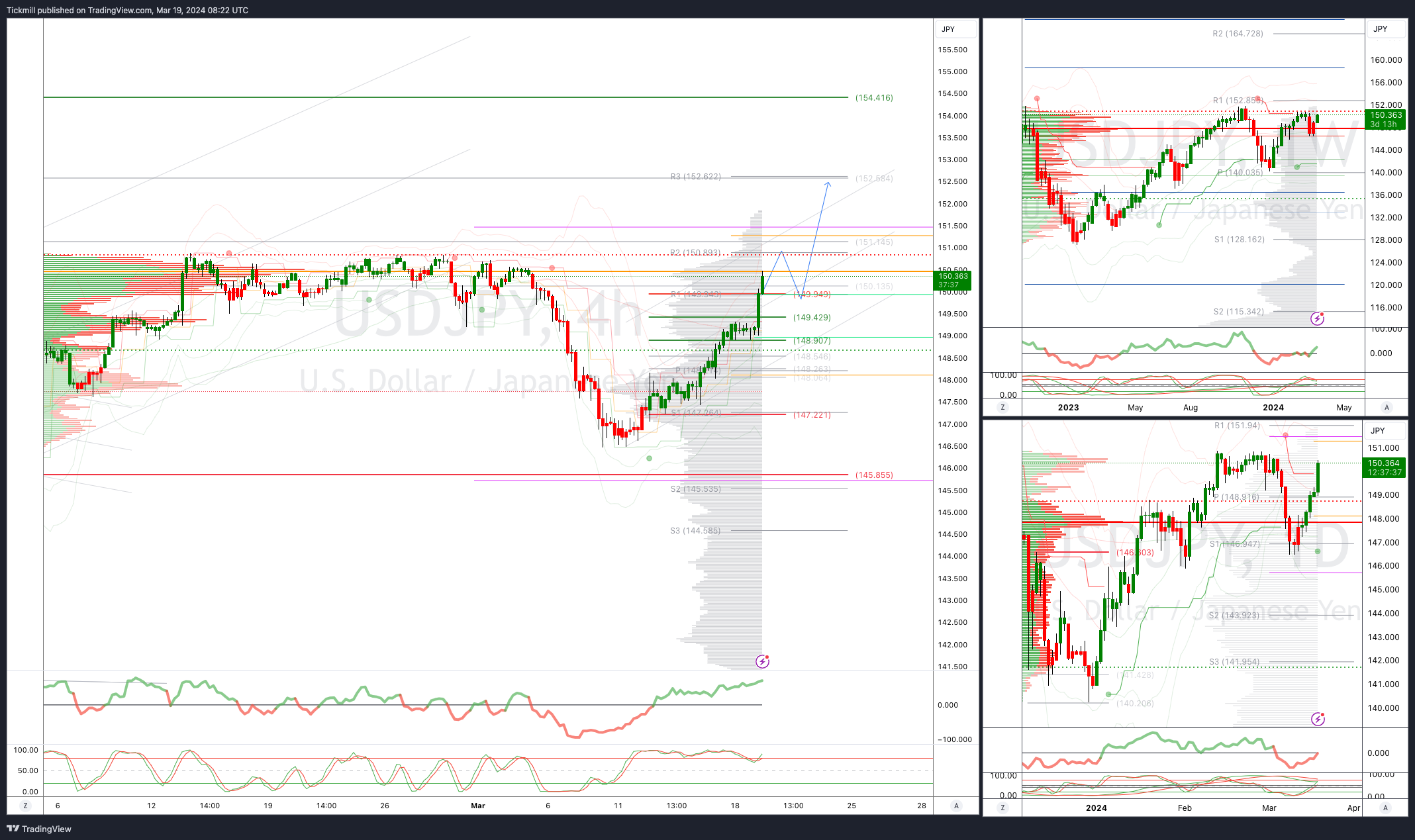

Warnings about USD/JPY gamma positioning have surfaced, indicating potential market dynamics. Following the BoJ announcement, the USD/JPY reaction was subdued, as the outcome had been extensively anticipated. Post-event, there's a marginal decrease in implied volatility and option premiums. Reports suggest the market is holding a long gamma position (short-dated expiry options) below 151.00. However, this gamma positioning is expected to shift to a short gamma position above 151.00, with a notable increase in short gamma positioning above 152.00 and particularly significant levels above 153.00.Short gamma positioning tends to heighten volatility and could drive FX spot rates higher. Given this scenario, USD/JPY bulls may perceive current FX option prices as favorable, especially considering the potential for increased volatility in the market.

CFTC Data As Of 15/03/24

Bitcoin net short position is -994 contracts

Euro net long position is 74,407 contracts

Japanese Yen net short position is -102,322 contracts

Swiss Franc posts net short position of -17,870

British Pound net long position is 70,451 contracts

Equity fund managers cut S&P 500 CME net long position by 3.983 contracts to 913,990

Equity fund speculators increase S&P 500 CME net short position by 71,149 contracts to 474,044

Technical & Trade Views

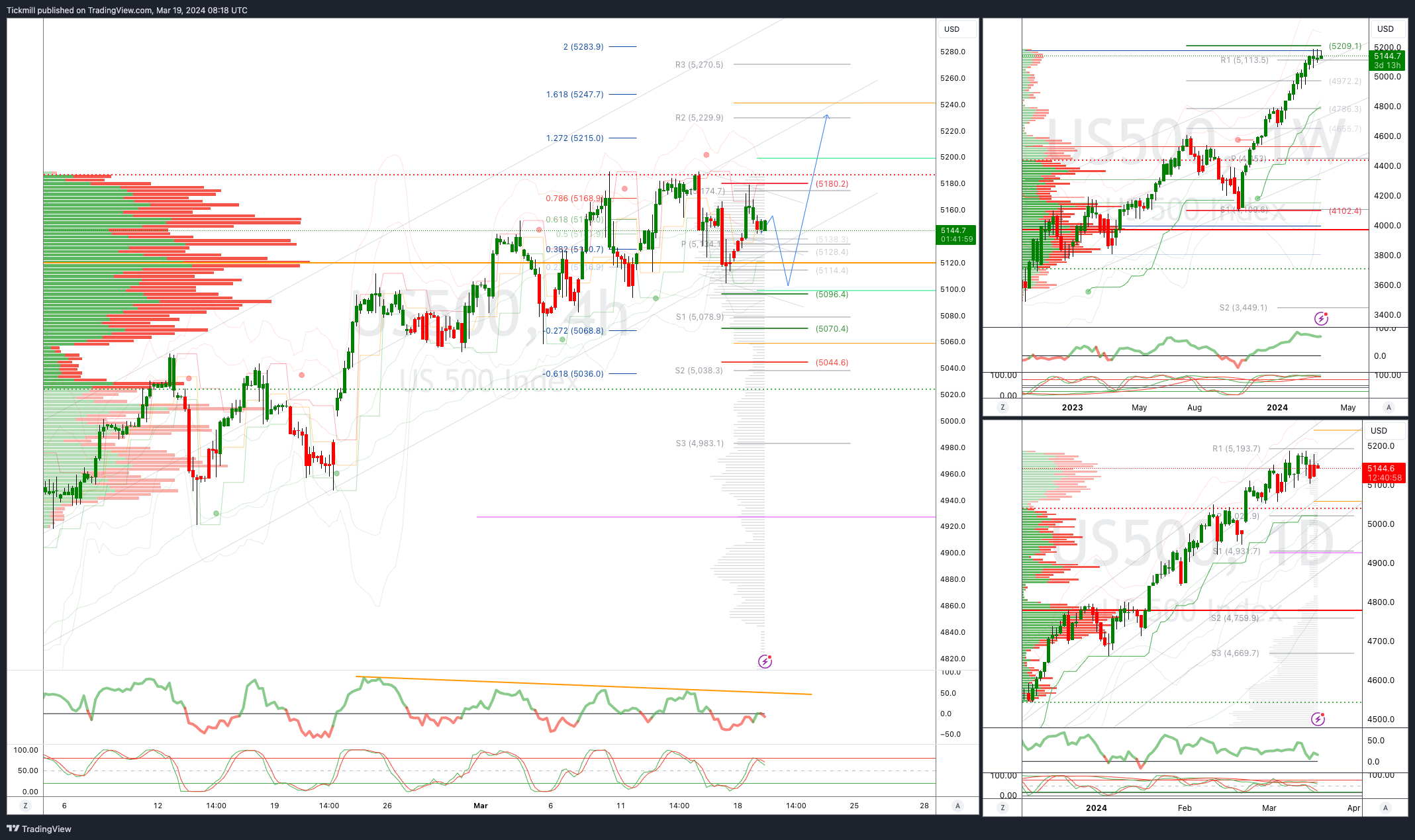

SP500 Bullish Above Bearish Below 5150

Daily VWAP bearish

Weekly VWAP bullish

Below 5090 opens 5060

Primary support 5096

Primary objective is 5220

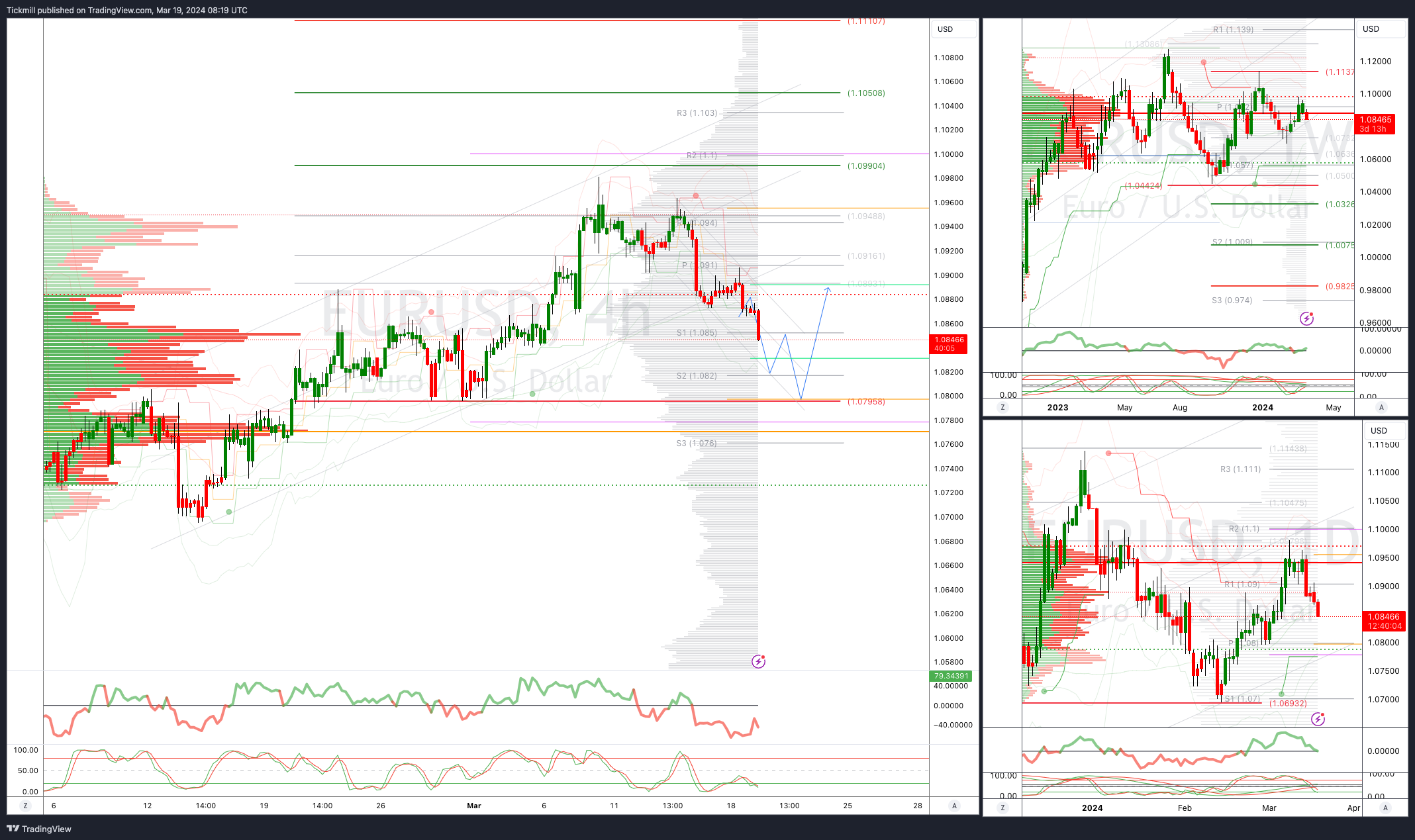

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bearish

Weekly VWAP bullish

Below 1.0840 opens 1.0795

Primary support 1.08

Primary objective is 1.10

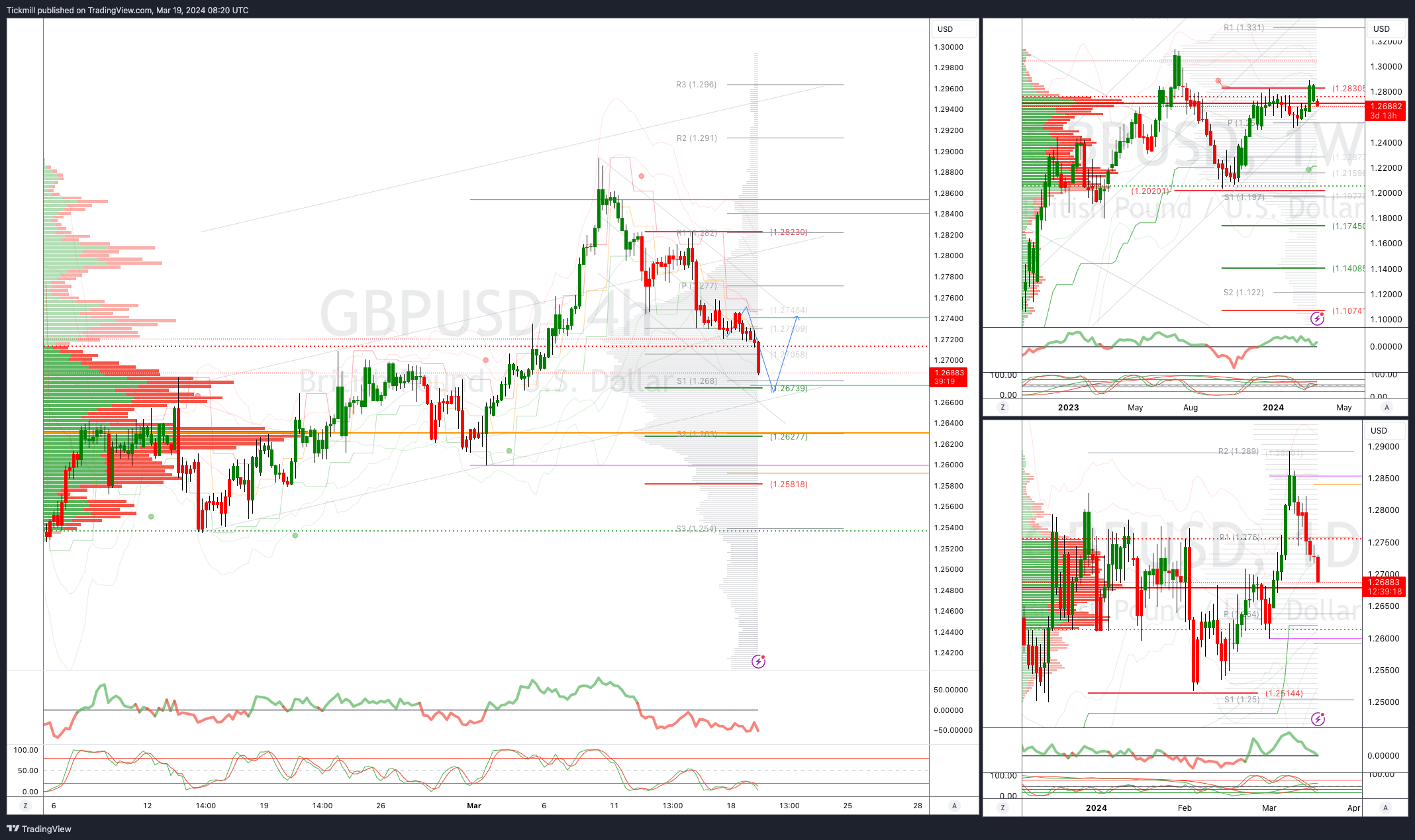

GBPUSD Bullish Above Bearish Below 1.2770

Daily VWAP bearish

Weekly VWAP bullish

Below 1.2670 opens 1.2630

Primary support is 1.2660

Primary objective 1.29

USDJPY Bullish Above Bearish Below 149

Daily VWAP bullish

Weekly VWAP bearish

Above 151 opens 152

Primary support 145.85

Primary objective is 152

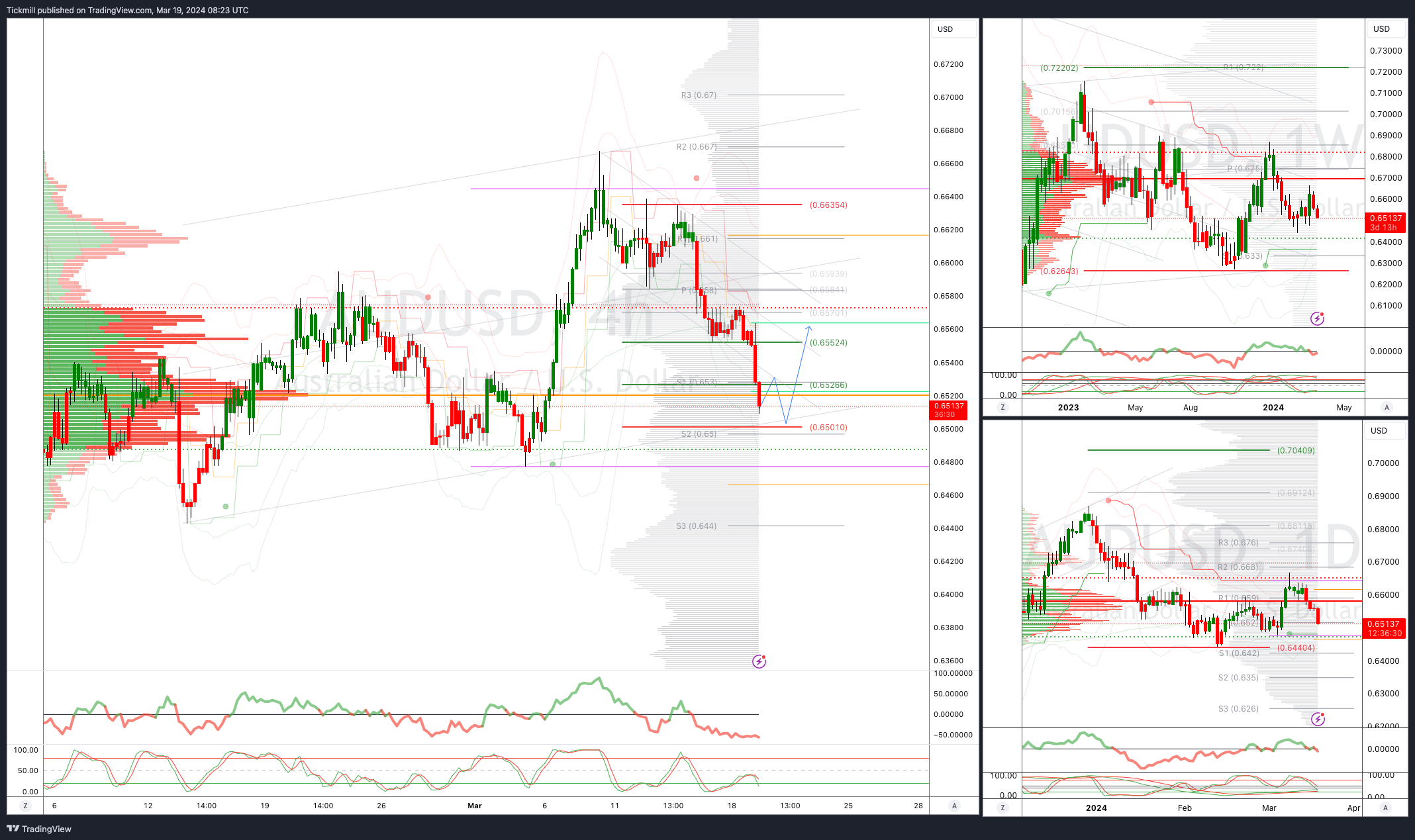

AUDUSD Bullish Above Bearish Below .6600

Daily VWAP bearish

Weekly VWAP bearish

Below .6550 opens .6520/00

Primary support .6477

Primary objective is .6700

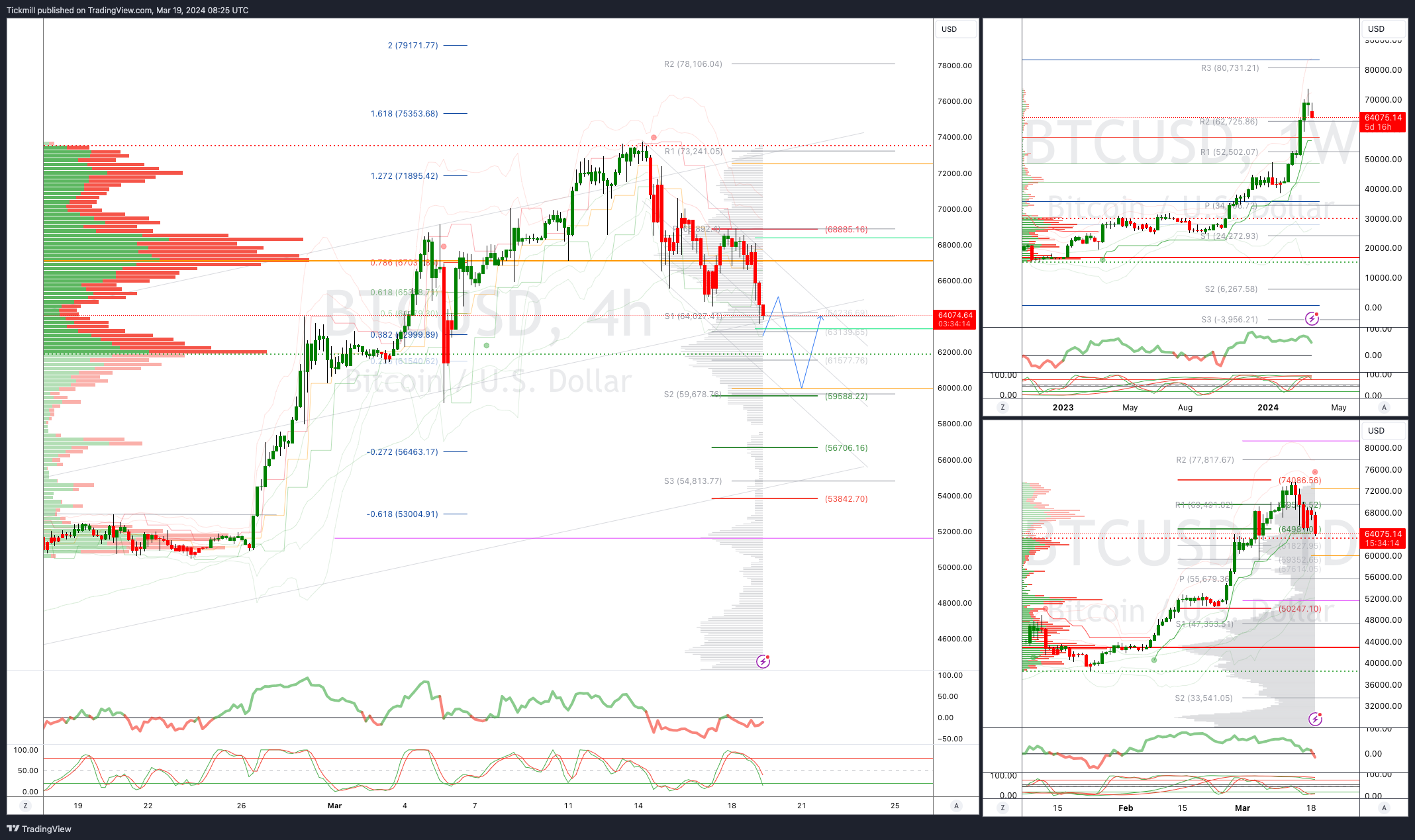

BTCUSD Bullish Above Bearish below 68000

Daily VWAP bearish

Weekly VWAP bullish

Below 64000 opens 59588

Primary support is 52800

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!