Daily Market Outlook, March 10, 2020

Sharp market falls again yesterday, the US benchmark market dipped more than 7% DOD on Monday, inching nearer to bear market territory as oil prices crashed and coronavirus fear engrossed markets, leading traders to flee stocks collectively and piled into safe havens assets.

The VIX Index (+29%), a key volatility gauge shot to an all-time high.

Brent crude and WTI had collapsed by more than 24% DOD to $34.36 and $31.13/barrel in reaction to OPEC+’s broken agreement, their lowest levels since the 2016 oil prices crash.

The Dow fell drastically by more than 2000 points, its largest single-day drop since the global financial crisis in 2008; Notably, the S&P500 dropped 7% just as the market opened triggering a circuit breaker for the first time since 1997 that halted trading across the stock market for 15minutes.

The sell-off was rampant worldwide with European key markets closing down more than 7% and Asian equities losing 3-7% deep in the red.

The bidding for government bonds depressed yields further - German bund yields lost 13-20bps DOD while UST yields lost 13-29bps DOD along the curve; benchmark 10Y UST yield slid to fresh low of 0.54% Gold price added 0.4%; In the currency market, JPY soared nearly 3% to $102.36, leading the gains against the USD; EUR and CHF were the top gainers among the G10 FX..

The global equity market stabilised overnight in Asia. In Japan, the TOPIX index was up around 1.5% on reports that they government was due to announce a second round of countermeasures to the covid19 virus.

US President Trump is reportedly readying a payroll tax cut for workers and other relief measures for corporates affected by the outbreak.

Virus fear hit hard on Eurozone investor confidence: Eurozone investor confidence dropped more than expected this month over deepening uncertainties surrounding the Covid-19 outbreak’s economic impact on an already weak Eurozone growth outlook. The Sentix Investor Confidence Index plunged to -17.1 in March (Feb: 5.2), versus consensus estimate of - 11.4. Sentix said that investors are preparing for a long period of economic weakness.

Downbeat Japan sentiment: The Economy Watcher Survey reported that its Outlook Index plunged to 24.6 in February (Jan: 41.8), the month when the Covid-19 outbreak escalated in Japan. The similar index for current condition also slumped to 27.4 (Jan: 41.9), its lowest level in nine years during the March 2011 earthquake and tsunami that had led to a meltdown of the Fukushima Nuclear Plant. The downbeat sentiment is expected to weigh on already poor business and consumer spending, not a good sign for 1Q2020. The Japanese economy had contracted 1.8% QOQ in 4Q19 due to an October typhoon and a consumption tax hike.

Australia business confidence slipped as outbreak weighed on orders; overseas demand: The NAB Business Confidence Index slipped to -4 in February (Jan: -1), its lowest level since 2013, highlighting battered sentiment among Australian business owners. The lower print was dragged down by poorer than usual forward orders and exports sales, reflecting the sapping in global demand amid Covid-19 outbreak. NAB said that half of the firms it surveyed still reported no impact from the virus, thus expecting the index to deteriorate further.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- USDJPY: 102.10 (USD495mn); 102.15 (USD830mn)

- AUDUSD: 0.6550 (AUD222mn)

- GBPUSD: 1.2950 (GBP221mn)

Technical & Trade Views

EURUSD (Intraday bias: Bullish above 1.13 neutral below)

EURUSD From a technical and trading perspective, prices spiked higher overnight to test 1.15 some initial profit taking and supply have capped the overnight advance for now. As 1.13 now acts as support look for a test of the yearly first resistance pivot point sighted at 1.1560. From these levels we witness some consolidation,corrective action before the next leg higher. Only a close back through 1.12 would concern the bullish bias

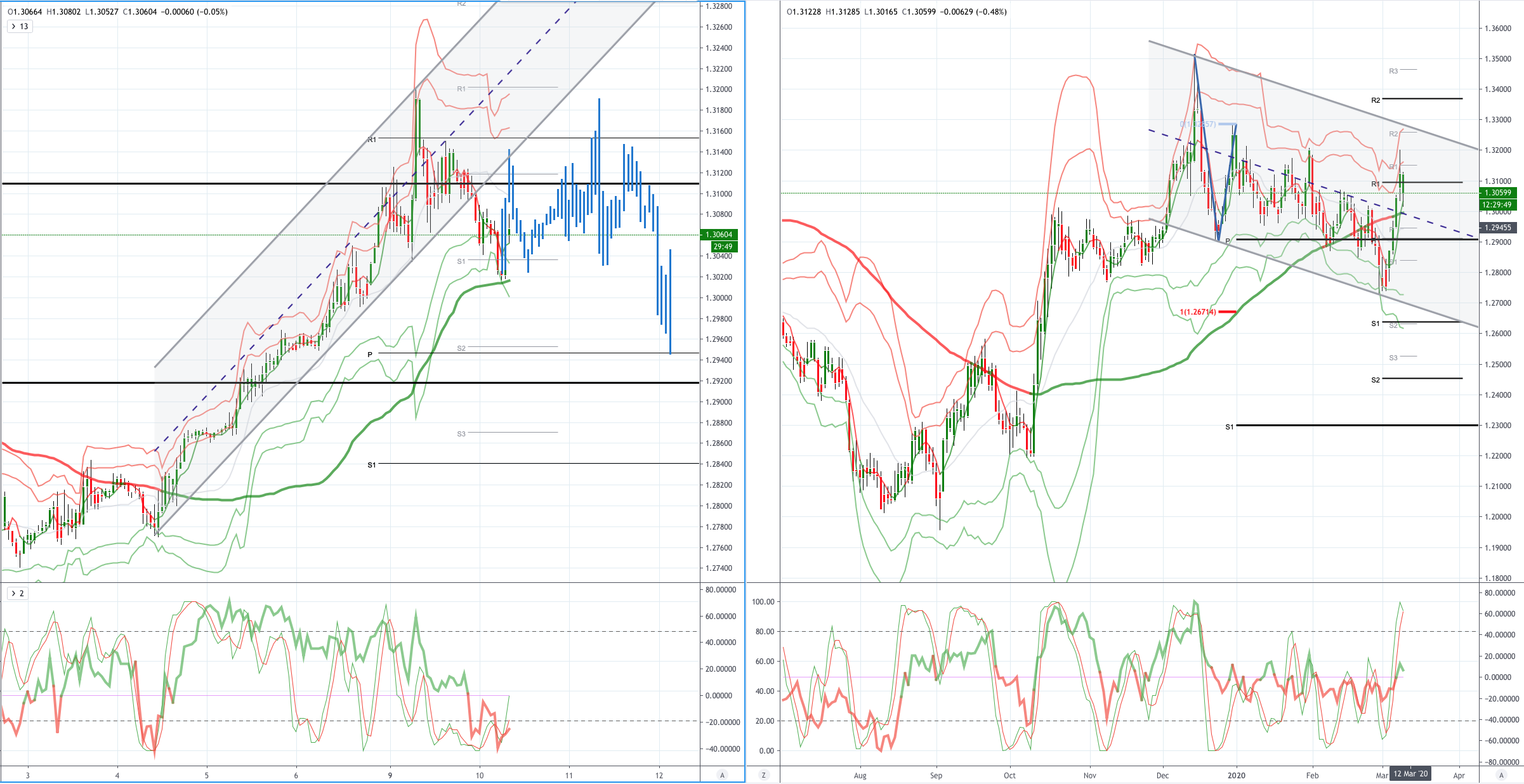

GBPUSD (Intraday bias: Bullish above 1.3130 neutral below)

GBPUSD From a technical and trading perspective, prices have extended to test resistance at 1.32 in a price pattern discussed in the Weekly Market Outlook, intraday look for support at 1.3110 to set up the next leg higher to test descending trendline resistance sighted around 1.3260 this area should cap the current advance. UPDATE initial test towards 1.32 saw decent supply as 1.30 supports intraday there is a window for another run at stops above 1.32 however look for a fade here and a deeper correction to develop to test support back to 1.2950

USDJPY (intraday bias: Bearish below 104.50 neutral above)

USDJPY From a technical and trading perspective, major gap lower in asian trade takes out the 104.50 support, as this level now acts as resistance bears will look to target the psychological 100 level. Only a close back through 105 would suggest a false downside break

AUDUSD (Intraday bias: Bearish below .6650 Bullish above)

AUDUSD From a technical and trading perspective the overnight gap lower found demand on the test of .6350 a close today back through .6650 would suggest a false downside break and set a base for a more meaningful corrective phase to develop. However, a close below .6450 would suggest trend continuation, with the psychological .6000 level coming into view for bears. UPDATE significant reversal in fortunes for the AUDUSD as .6530 continues to attract buyers look for a move to test offers and stops above .6700.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!