Daily Market Outlook, June 28, 2023

Daily Market Outlook, June 28, 2023

Munnelly’s Market Commentary…

Asian equity markets traded in a mixed fashion overnight, failing to fully sustain the momentum from the gains on Wall Street. The Nasdaq outperformed due to strong data and a rebound in the tech sector. The Australian monthly CPI data, which came in softer than expected, further reinforced expectations that the Reserve Bank of Australia (RBA) would keep interest rates unchanged at its upcoming meeting. The Nikkei 225 gained supported by recent currency weakness and indications that Japan is leaning towards extending support measures for gas and electricity bills. These measures are set to expire at the end of September and aim to strengthen the economy. However, the Hang Seng and Shanghai Composite remained subdued as Chinese Industrial Profits continued to contract significantly. Additionally, concerns arose over the US considering new restrictions on AI chip exports to China amid fears of their potential use in weapons development and hacking.

During the ECB's annual forum on central banking in Sintra, Chief Economist Huw Pill and Governor Andrew Bailey of the Bank of England (BoE) will speak. Pill will participate in a panel discussing lessons from recent experiences in macroeconomic forecasting. The focus, however, will be on Governor Bailey's appearance on a panel with counterparts from the Federal Reserve, ECB, and Bank of Japan. They are expected to discuss the challenges of monetary policy in the current high-inflation environment. Unlike his peers, Governor Bailey has been less explicit in providing policy guidance. Notably, the BoE has not opposed market expectations of further policy tightening, which contrasts with its stance last year. Market participants will closely monitor comments from central bank heads, especially Federal Reserve Chair Powell, to determine if there are any indications of an imminent interest rate hike, possibly as early as next month.

Aside from Sintra, datawise investors will parse Italy's Consumer Price Index (CPI) data, which is anticipated to show a cooling trend. This release will offer a glimpse into the inflation situation in Italy and can serve as a preview for other Eurozone countries' inflation data, with Germany's CPI data scheduled for release on Thursday. The harmonised Eurozone CPI data will be released on Friday, which is important for assessing inflation trends across the region.

Stateside, market participants will closely watch for the release of MBA Mortgage Applications data, as the housing market has recently shown positive surprises in various metrics. Additionally, the advanced goods trade balance report is scheduled to be released before the equity market opens. These data releases will provide valuable insights into the current state of the US housing market and trade balance.

Citi Quants Month End Rebalancing Expectations

Citi has published its preliminary estimate for month-end FX rebalancing, indicating a preference for selling USD. According to their model, both hedge and asset FX rebalancing requirements align in this direction. The estimate suggests that negative flows from US equities will have a significant impact on equity rebalancing. It is worth noting that month-end flows typically influence FX markets in the days leading up to the end of the month.

CFTC Data As Of 23-06-23

(USD net spec short grew in Jun 14-20 period; $IDX -0.76%

EUR$ +1.15% in period, specs -7,173 contracts into strength, now +144,649

$JPY +1.31% in period, JPY soft amid rate divergence, specs -3,680 contracts

GBP$ +1.21%, specs get long ahead of CPI/BoE, +39,873 contracts now +46,608

Specs guessed right higher CPI, +50bp BoE but GBP$ -150 pips from weeks high

AUD$ +0.3% in period, specs +12,129 contracts on hawkish RBA, now -33.5k

BTC +8.96%, specs 346 contracts into strength, halved long to +397 contractsSource: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0845-55 (2.3BLN), 1.0875-85 (1BLN), 1.0900-10 (3.2BLN)

1.0970-75 (1.4BLN), 1.1000 (1.2BLN), 1.1055 (678M)

USD/CHF: 0.8880-85 (1.1BLN), 0.8890-08900 (500M)

GBP/USD: 1.2550 (511M), 1.2650-65 (1.1BLN)

AUD/USD: 0.6550 (1BLN), 0.6650 (850M), 0.6705-15 (683M)

Overnight News of Note

Biden Says Thinks US Economy Will Avoid Potential Recession

US Considering New Restrictions On AI Chip Exports To China

Chinese Industrial Profits Slump On Weak Demand, Deflation

Japan FX Tsar: Take Appropriate Steps If Weak Yen Excessive

Australian Cooler Inflation Bolsters RBA Case To Stand Steady

Pimco Load Up On Aussie Bonds On Inevitable Recession Call

ECB's Wunsch: Rate Pause Needs 'Clear' Sign Of Core Easing

Discounts Jump As Rising Mortgages ‘Spook’ UK Housebuyers

UK House Price Cuts Point To Start Of Downturn, Zoopla Says

German Bond Market Signals Deep Eurozone Recession Fear

Google Violated Its Standards On Ad Deals, Research Reports

UBS Plans To Cut More Than Half Of Credit Suisse Workforce

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

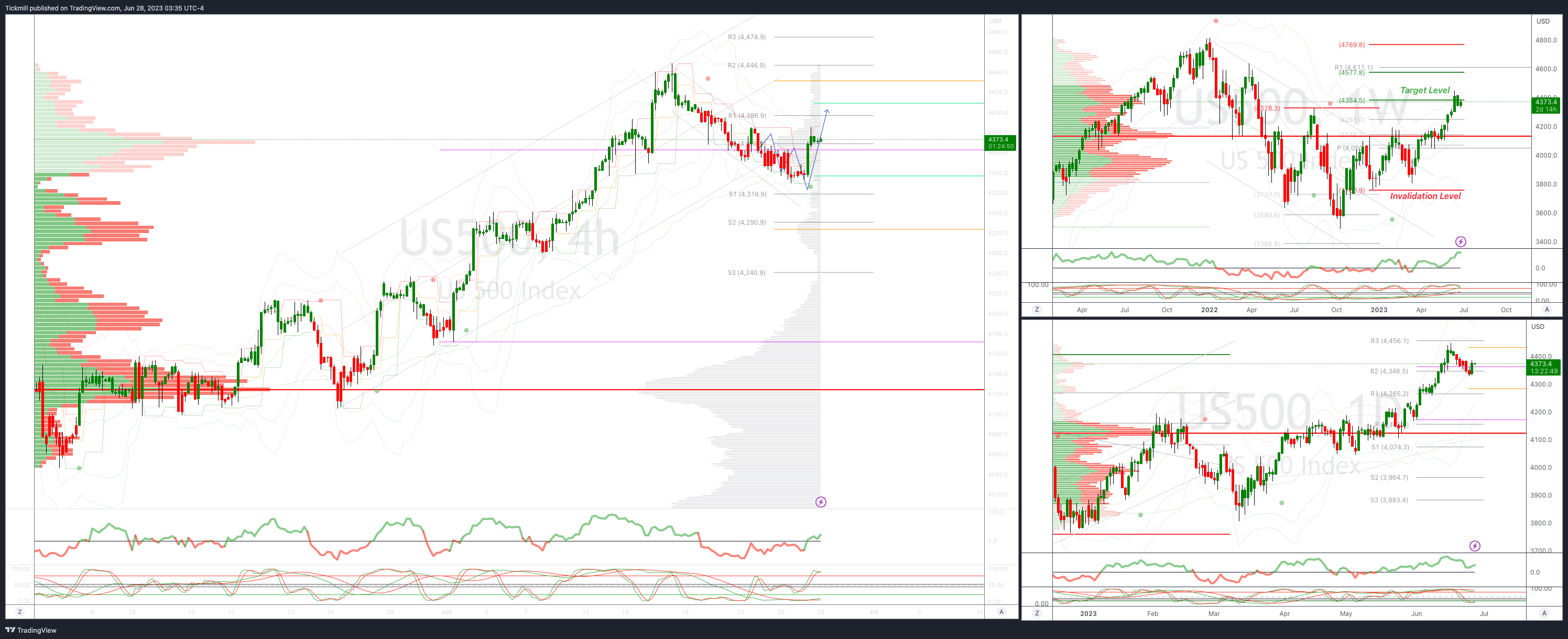

SP500 Bias: Intraday Bullish Above Bearish Below 4340

Below 4330 opens 4300

Primary support is 4300

Primary objective is 4580

20 Day VWAP bullish, 5 Day VWAP bullish

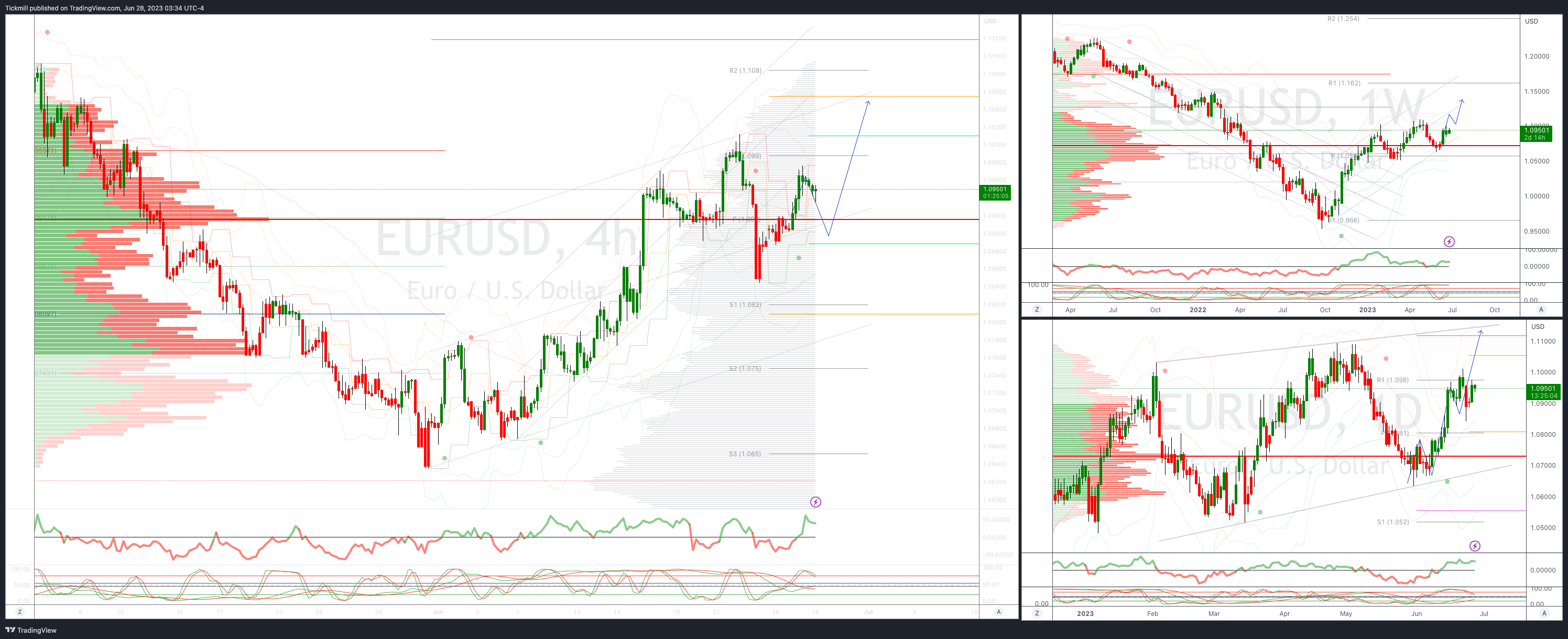

EURUSD Intraday Bullish Above Bearsih Below 1.0920

Below 1.0880 opens 1.0830

Primary support is 1.0666

Primary objective is 1.1050

20 Day VWAP bullish, 5 Day VWAP bullish

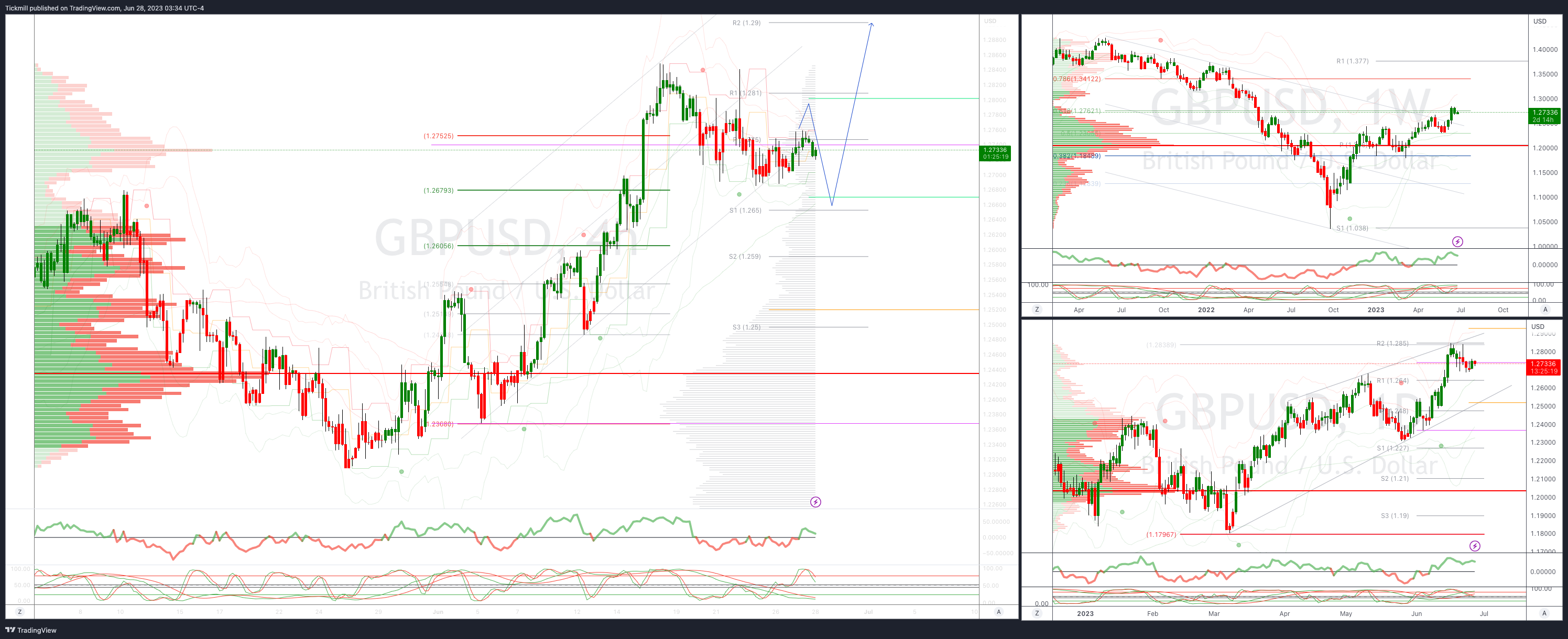

GBPUSD Bias: Intraday Bullish Above Bearish Below 1.2750

Below 1.27 opens 1.2650

Primary support is 1.2680

Primary objective 1.2880

20 Day VWAP bullish, 5 Day VWAP bullish

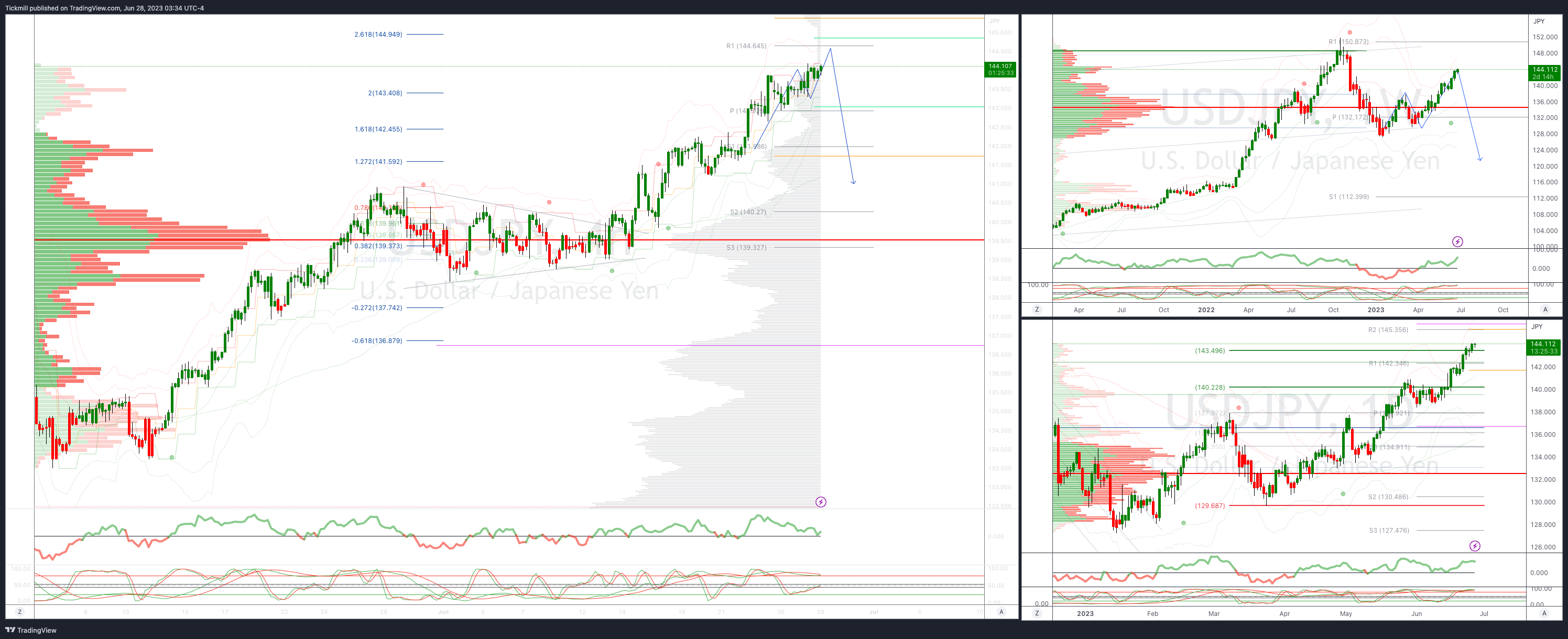

USDJPY Bullish Above Bearish Below 142.40 Target Hit, New Pattern Emerging

Below 141.90 opens 140.90

Primary support is 139.50

Primary objective is 144.50

20 Day VWAP bullish, 5 Day VWAP bullish

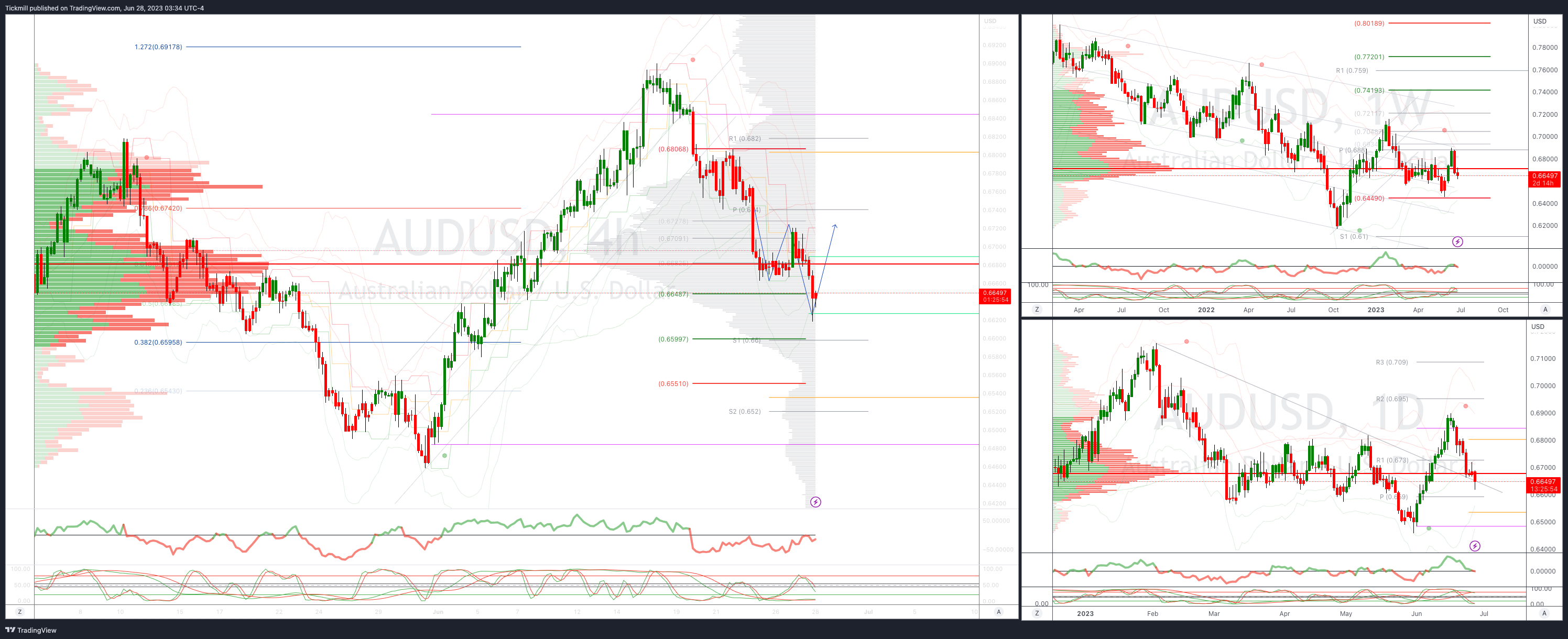

AUDUSD Bias:Intraday Bullish Above Bearish Below .6740

Below .6600 opens .6550

Primary support is .6648

Primary objective is .6917

20 Day VWAP bullish, 5 Day VWAP bearish

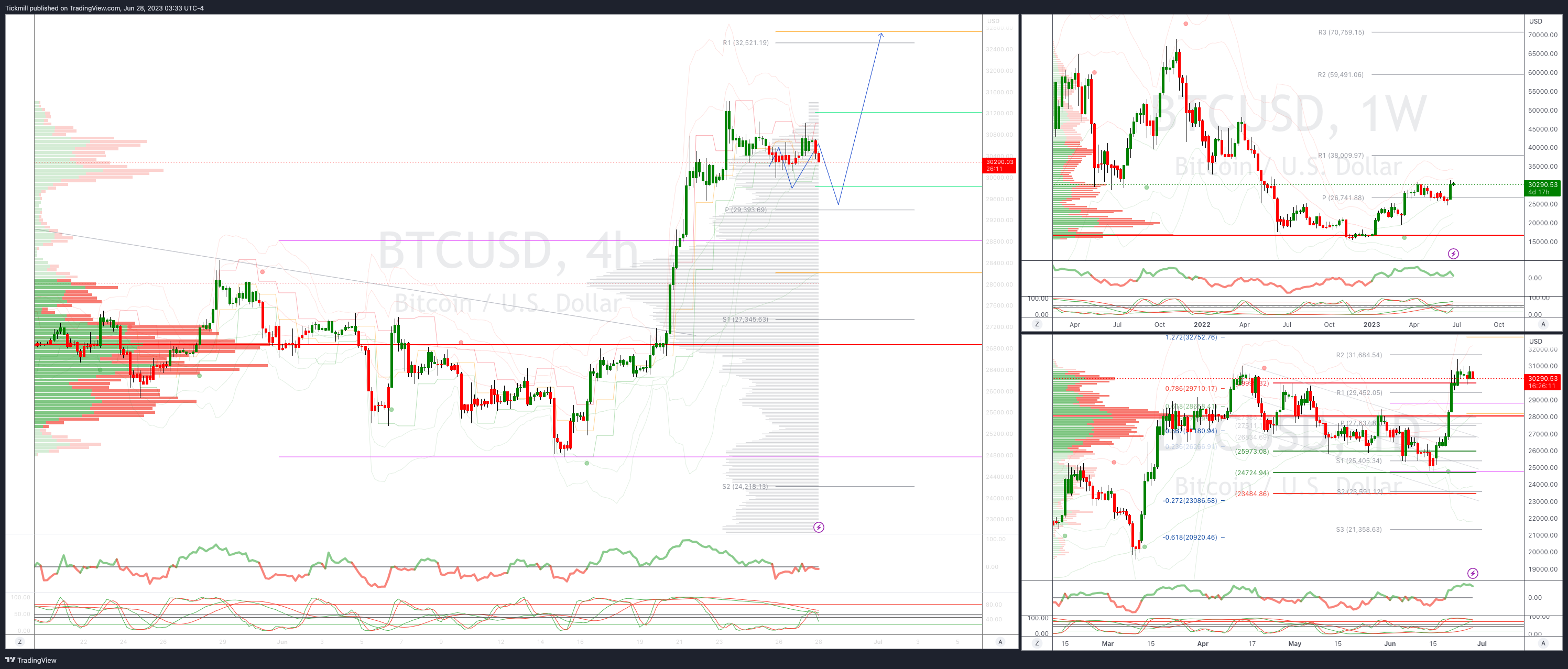

BTCUSD Intraday Bullish Above Bearish below 29500

Below 28000 opens 26900

Primary resistance is 27400

Primary objective is 32750

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!