Daily Market Outlook, July 25, 2023

Daily Market Outlook, July 25, 2023

Munnelly’s Market Commentary…

Asian equity markets traded higher, with Chinese stocks leading the gains. The rally in Chinese stocks came after the country's Politburo made support pledges, boosting investor sentiment. However, gains in the rest of the region were limited due to soft global PMI data and caution ahead of upcoming risk events. The Nikkei 225 index in Japan lagged, with uncertainty surrounding the upcoming Bank of Japan meeting. Reports suggested that the central bank is considering a significant increase in its 2023 inflation outlook, possibly raising it to around 2.5%.

The Hang Seng index in Hong Kong surged by 3.4%, and the Shanghai Composite index in mainland China rose by 1.9%. The gains in these markets were led by a surge in property and tech stocks, fueled by the optimistic support pledges from the Chinese Politburo. Notably, the Hang Seng Tech Index climbed by approximately 5%, and the Hang Seng Mainland Properties Index saw a double-digit percentage rise from early trading, as the Politburo's statement omitted language suggesting that homes are not for speculation.

Yesterday's UK Purchasing Managers' Index (PMI) data fell short of expectations, although the composite index remained above the 50-expansion level, indicating continued growth in the economy. Looking ahead to the Bank of England's monetary policy update next week, the data docket for the UK is now limited. Today's July CBI Industrial Trends Survey will provide an update on the manufacturing sector, which has been facing challenges not only in the UK but globally. The survey includes the results of a more comprehensive quarterly survey, and of particular interest will be the business investment intentions. This will shed light on how businesses are planning to invest in the current economic climate and may provide insights into their confidence in the recovery and future growth prospects.

European investors will focus on perspectives from managers in Germany, Europe's largest economy, they are anticipated to express decreasing optimism about the business environment. The leading survey on German business confidence, conducted by the Ifo economics institute, is expected to show a decline for the third consecutive month. Economists predict that the headline business climate index for Germany will slip to 88.0 from the June reading of 88.5, which had already declined from a mark recorded in December. The expectations component of the index, which measures business outlook for the coming six months, is also forecasted to ease to 83.0 from June's reading of 83.6. Additionally, this month's current assessment component is expected to slide to 93.0 from 93.7. These declines in the business confidence index suggest that German managers are becoming less optimistic about the economic conditions in the country in the coming months.

Stateside, US consumer confidence measures have shown a lot of volatility recently, reflecting uncertainties about the outlook for inflation and interest rates. The Conference Board's confidence measure experienced a significant increase in June, and it is expected to have risen again in July. One of the reasons for this expected increase is likely the surge in the alternative University of Michigan consumer sentiment index, which reached its highest level since mid-2020. This rise in consumer sentiment may be driven by hopes that US interest rates are nearing a peak. However, it could also have implications for the Federal Reserve's approach to future rate hikes, possibly encouraging them to proceed cautiously before ruling out further increases.

CFTC Data As Of 18-07-23

USD net spec short grew in the Jul 12-18 period amid a $IDX 1.65% slide

EUR$ +2% in period, specs +38,670 into strength, now long 178,832 contracts

$JPY -1.05%, specs +26,943 contracts, short reduced to -90,239

GBP$ +0.77%, specs +5,666 contracts now +63,729; data pre-UK CPI Wednesday

AUD$ +1.88%, specs -5,317 now -50,401 contracts; $CAD -0.46% specs -3,923

BTC -2.6% in period specs buy 694 contracts on dip, now -1,161 contracts

Note since Tuesday reporting period close the $IDX is down near 0.9%

EUR$ has dipped 0.88%, $JPY rose 2.11% after period closed leaving recent EUR & JPY buyers in the red(Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.1020-25 (375M), 1.1085 (1BLN), 1.1095-1.1100 (800M)

1.1190 (440M), 1.1225 (1.3BLN)

GBP/USD: 1.2900 (150M), 1.2935 (178M), 1.3000 (240M)

AUD/USD: 0.6660-70 (1BLN), 0.6685 (700M), 0.6715 (1.1BLN), 0.6770 (1.1BLN)

USD/CAD: 1.3200-10 (1.2BLN)

USD/JPY: 140.00 (626M), 140.40 (658M), 141.00 (456M), 141.70 (350M)

EUR/JPY: 155.00 (350M), 157.50 (200M)

Options Market Positioning

FX option volatility risk premiums remain elevated as the U.S. dollar recovers lost ground ahead of this week's central bank decisions from the United States, Eurozone and Japan. One-week expiry options have been influenced by the Federal Reserve and European Central Bank decisions, contributing to the initial boost in implied volatility. Additionally, with the inclusion of the Bank of Japan in the one-week expiry, there have been significant gains in Japanese yen (JPY) related implied volatility and premiums for JPY calls over puts. This indicates that the market is not ruling out potential easing by the Bank of Japan, despite official rhetoric suggesting otherwise. The entire implied volatility curve for EUR/USD remains above recent lows, and risk reversals have recovered some downside strike premium. However, the barrier at 1.1300 remains challenging for EUR/USD to break through.

Overnight Newswire Updates of Note

US Stock Futures Little Changed After Dow Notches 11-Day Rally

President Biden To Veto GOP-Backed Bills Over Spending Cuts

China To Increase Policy Adjustments Amid Tortuous Recovery

Chinese State Banks Seen Selling US Dollars To Prop Up Yuan

BoJ To Stick With Easing As Markets See Clock Ticking On YCC

Russia Escalates Attacks On Danube In Risk For Ukraine Grain

Oil Nears Three-Month High As China Move To Bolster Growth

Euro Staggers With Trades Wary Of Hawkish ECB, Dollar Gains

JPMorgan Sticks To Stock Selloff Bets As Market Defies Gloom

FDIC Warn Banks Over Errors In Reporting Uninsured Deposits

Apple Face $1Bln Lawsuit By Apps Developers Over Store Fees

Bayer Cut Outlook Amid Persistent Slump In Prices For Roundup

Adidas Expect Narrowing Losses After Selling Some Yeezy Shoes

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

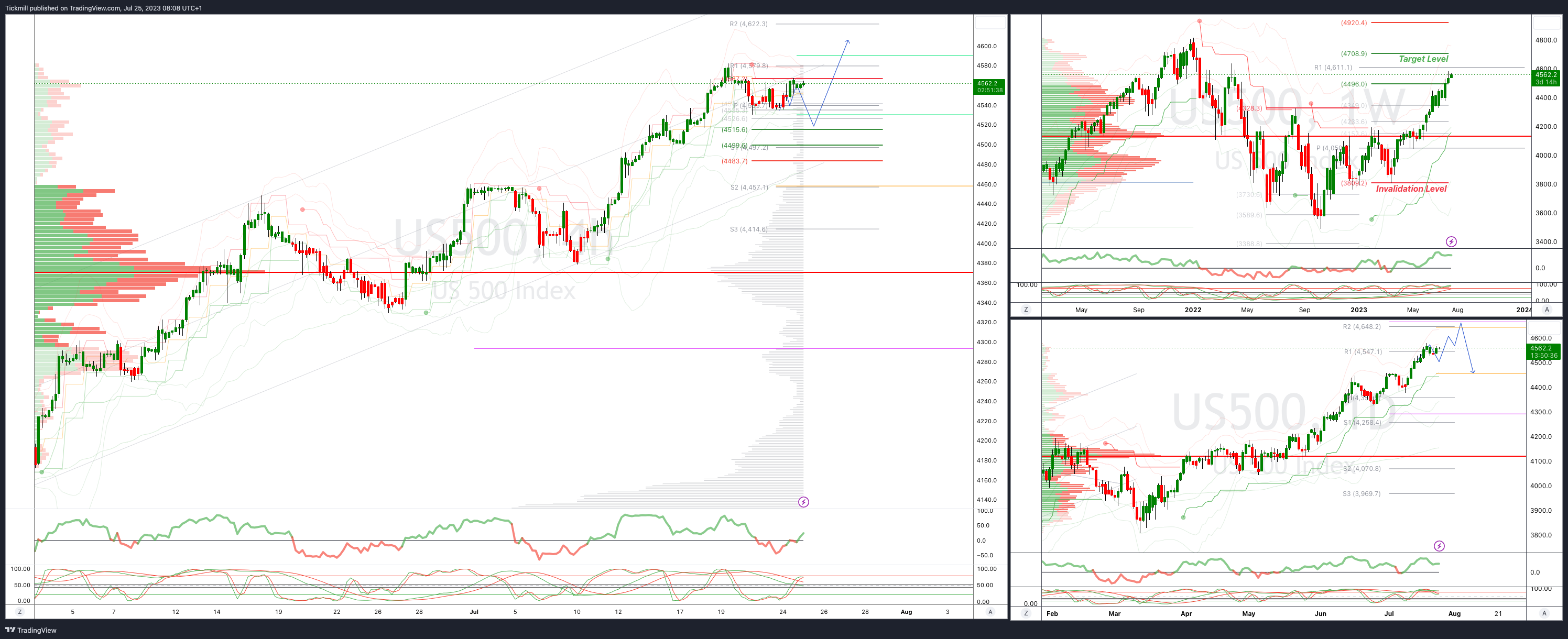

SP500 Intraday Bullish Above Bearish Below 4570

Below 4530 opens 4512

Primary support is 4370

Primary objective is 4630

20 Day VWAP bullish, 5 Day VWAP bullish

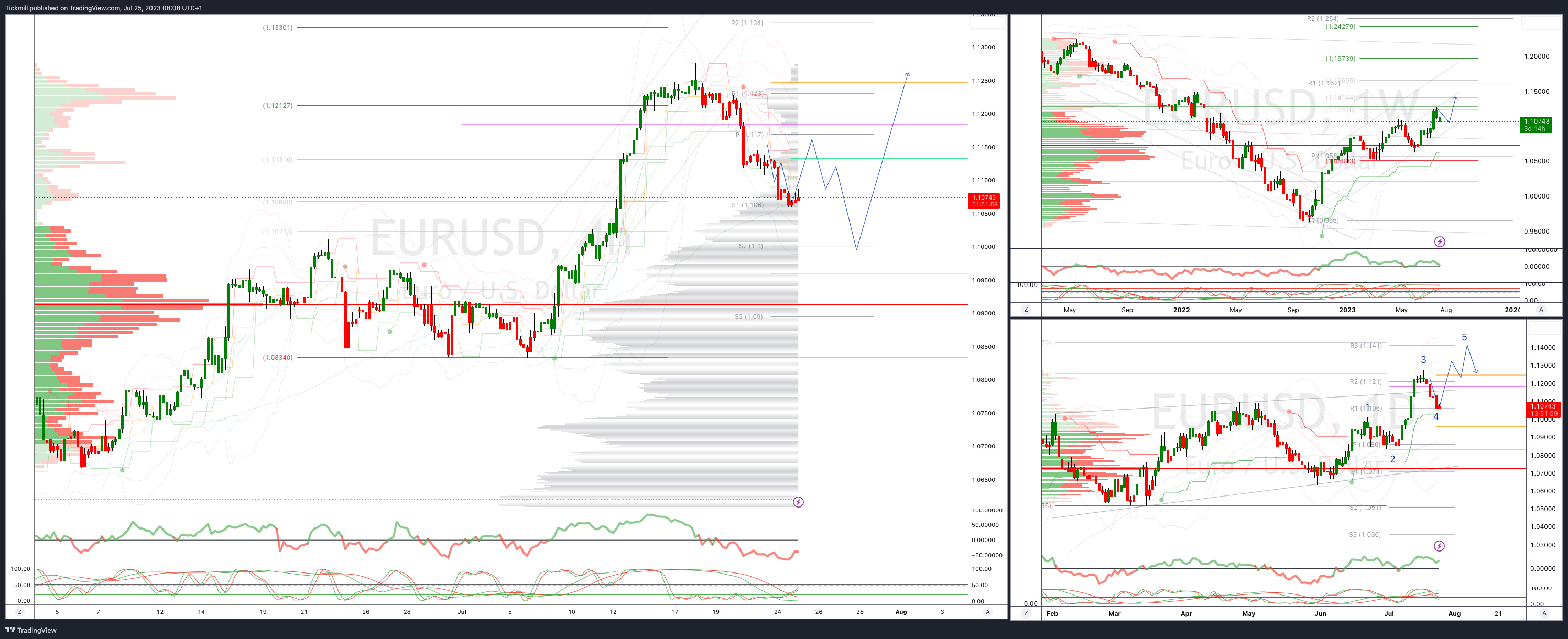

EURUSD Intraday Bullish Above Bearsih Below 1.1130

Below 1.1050 opens 1.0955

Primary support is 1.10

Primary objective is 1.13

20 Day VWAP bullish, 5 Day VWAP bearish

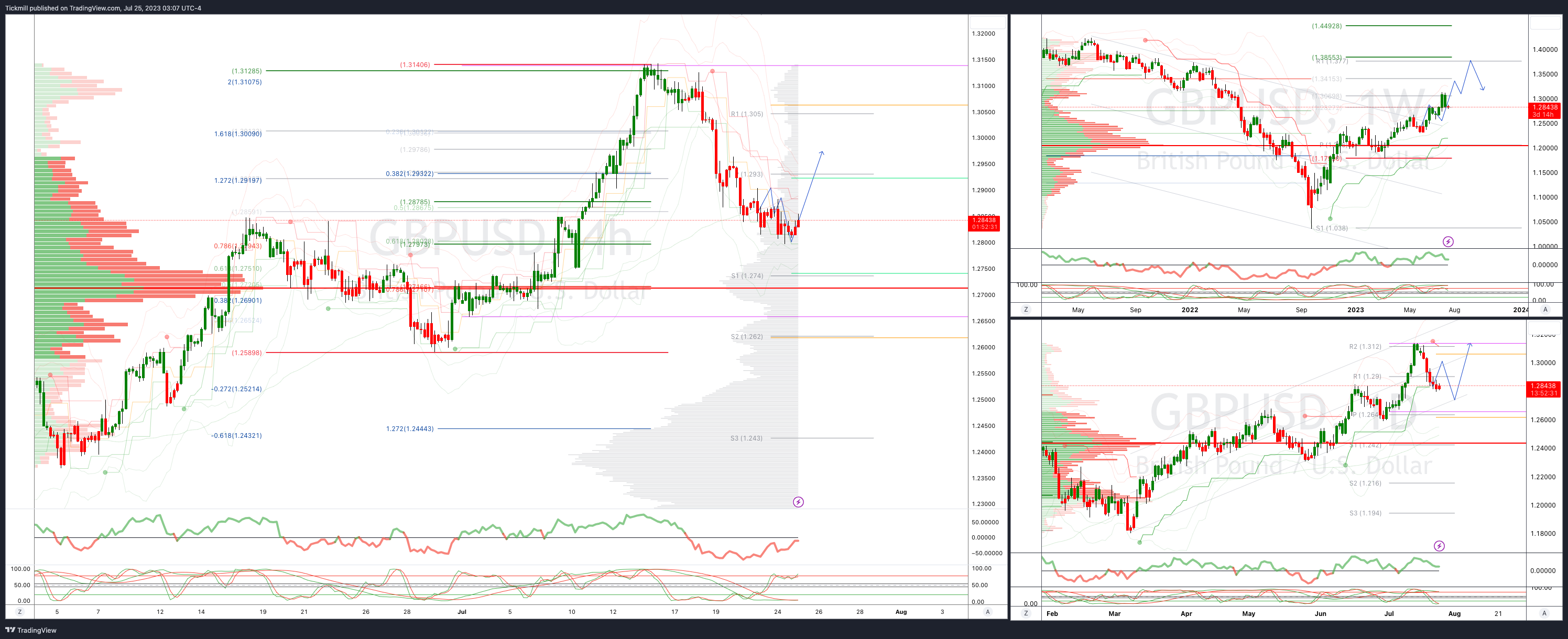

GBPUSD: Intraday Bullish Above Bearish Below 1.2850

Below 1.2830 opens 1.2710

Primary support is 1.26

Primary objective 1.3850

20 Day VWAP bullish, 5 Day VWAP bearish

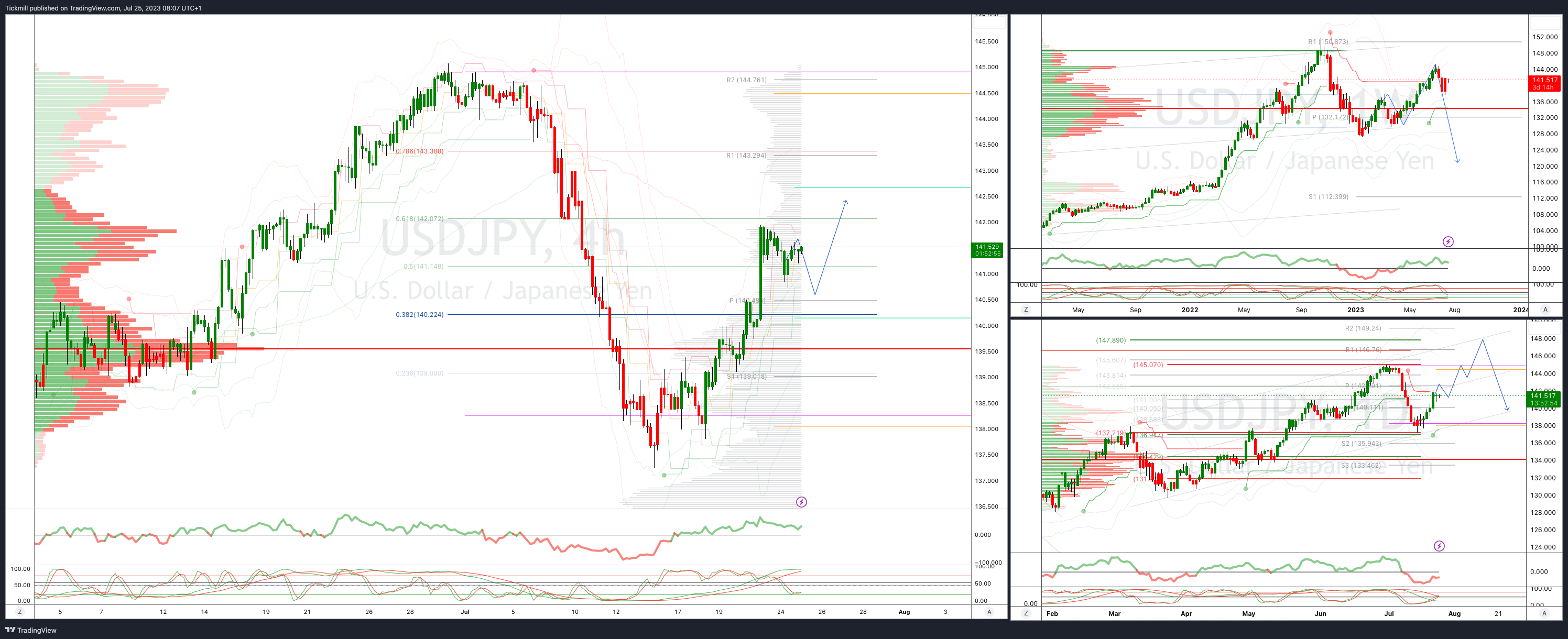

USDJPY Bullish Above Bearish Below 139.60

Above 143.50 opens 145

Primary resistance 143.40

Primary objective is 136.20

20 Day VWAP bearish, 5 Day VWAP bullish

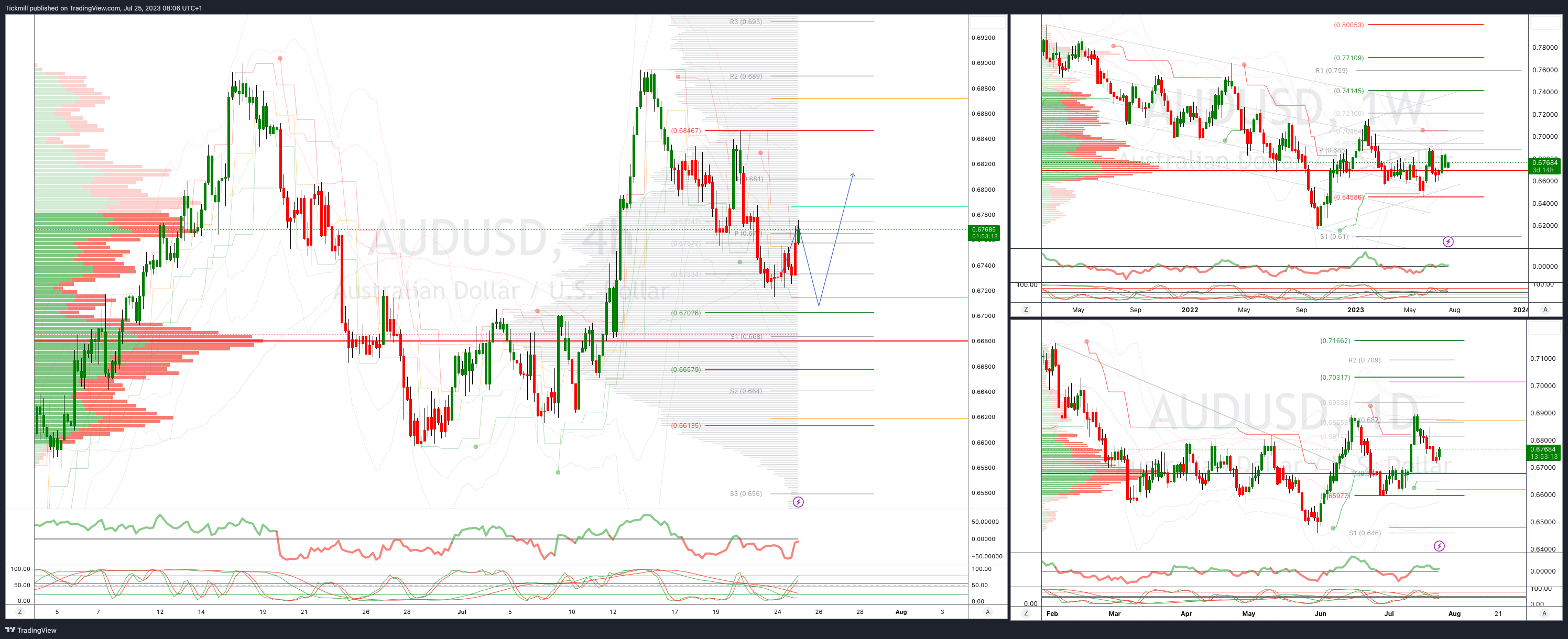

AUDUSD Intraday Bullish Above Bearish Below .6800

Below .6795 opens .6700

Primary support is .6448

Primary objective is .7000

20 Day VWAP bearish, 5 Day VWAP bearsih

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28600

Primary support is 28400

Primary objective is 32750

20 Day VWAP bullish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!