Daily Market Outlook, July 21, 2023

Daily Market Outlook, July 21, 2023

Munnelly’s Market Commentary…

Asian equity markets were a mixed bad overnight following the negative sentiment from Wall Street, particularly from the Nasdaq 100, which had its second-worst day of the year due to tech earnings disappointment and rising yields, weighing on investor sentiment.The Nikkei 225 also started the day with a slump but recovered slightly as participants digested somewhat ambiguous CPI data. The data mostly met expectations but showed a slight acceleration in both headline and core inflation. Meanwhile, the Hang Seng rose modestly and the Shanghai Composite remained flat. These indices were supported by further efforts from China to boost the economy. The NDRC released policies aimed at stimulating electronics products consumption and promoting automobile consumption, helping to maintain positive sentiment in the region.

Next week will be significant for central bank meetings, with the U.S. Federal Reserve, European Central Bank (ECB), and Bank of Japan (BoJ) all scheduled to meet. Investors will closely watch the outcomes of these meetings, especially in the context of potential policy tweaks. There is speculation that the BoJ may make imminent policy adjustments during its meeting. Inflation in Japan remained above the central bank's target of 2% for the 15th consecutive month in June. However, the inflation gains matched a median market forecast, suggesting that the central bank's efforts to achieve sustained inflation may still face challenges. As central banks play a crucial role in shaping economic policies and financial markets, the outcomes of these meetings are expected to have an impact on global investor sentiment and market dynamics.

CFTC Data As Of 14-07-23

USD net spec short fell a touch in the Jul 5-11 period as $IDX slid 1.37%

Fairly serious moves among majors w/hardly any position changes

Suggest a fair amount of position replacement as specs were getting stopped

EUR$ +1.2% in period, specs -2,675 contracts into strength now +140,162

$JPY -2.84% in period after breaching 145 last wk, specs buy 738 contracts

GBP$ +1.73% as BoE seen a cointoss for +50bp Aug 3, specs +7,798 now +58,063

CHF specs relatively active -4,503 contracts now short 7,907

$CAD +0.06%, Aussie -0.06% specs sell less than 1k contracts

BTC fell a scant 0.74%, specs +221 on dip now short 1,855 contracts(Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.1100 (581M), 1.1150 (525M), 1.1175-80 (354M), 1.1200-05 (627M)

USD/CHF: 0.8625 (200M), 0.8715 (300M). GBP/USD: 1.2970 (277M)

EUR/GBP: 0.8600 (651M), 0.8640 (200M), 0.8695-0.8700 (551M)

AUD/USD: 0.6700 (862M). AUD/NZD: 1.0900 (1BLN)

USD/CAD: 1.3145-55 (1.1BLN)

USD/JPY: 140.00 (608M), 140.50 (439M). EUR/JPY: 154.00 (300M)

Options Market Positioning

The demand for U.S. dollar put options has weakened, and foreign exchange (FX) implied volatility has reached its peak for the time being as the dollar experiences a mild recovery. However, the options market is anticipating increased FX volatility around the July 26 Federal Open Market Committee (FOMC) policy decision. Even though markets are pricing in a final 25bps interest rate hike in the current cycle, related implied volatility gains are not ruling out the possibility of heightened FX volatility. For EUR/USD, the 1.13 barriers seem secure as demand for topside strike options decreases, and premiums for EUR put/USD call options show some recovery. In USD/JPY, there is interest in a large 140.00 strike before Thursday's 10 am New York cut, but further gains may be challenging until after Friday's Japanese CPI release. The one-week expiry will also include the Bank of Japan's (BoJ) policy announcement on July 28. Unless there is a significant CPI beat, any implied volatility gains related to the BoJ's dovish rhetoric might be seen as opportunities to sell.

Overnight Newswire Updates of Note

Asian Shares Fall After US Tech Falters, Dollar And Yields Hold Gains

Japan’s Inflation Speeds Up As BoJ Prepares To Update Price View

BoJ Won't Tweak YCC In July, Say 77% Of Economists - RTRS Poll

Japan Bond Investors See Turbulence That Defies Ueda’s View

China’s Backing Will Ease Pressure For Yuan To Drop, Report Says

China Lending Rate May Drop Further In Q3 If PBoC Cuts RRR - Paper

ECB’s High-For-Longer Rate Plan Fails To Convince Economists

US Pres Biden Creates Debt-Limit Team To Find Ways Of Ending Standoffs

Dollar Firms, Yen Steady After Japan Inflation Holds Above BoJ Target

Oil Heads For Fourth Weekly Advance As Liquidity Declines

Asia Stocks Mixed As Tech Drops On TSMC, Hong Kong Gains

Nasdaq 100 Reshuffle Adds Twist To $2.4 Trillion Options Event

TSMC Falls Most In Five Months After Outlook Cut, Arizona Delay

Capital One Financial Beats Profit Estimates On Higher Interest Income

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

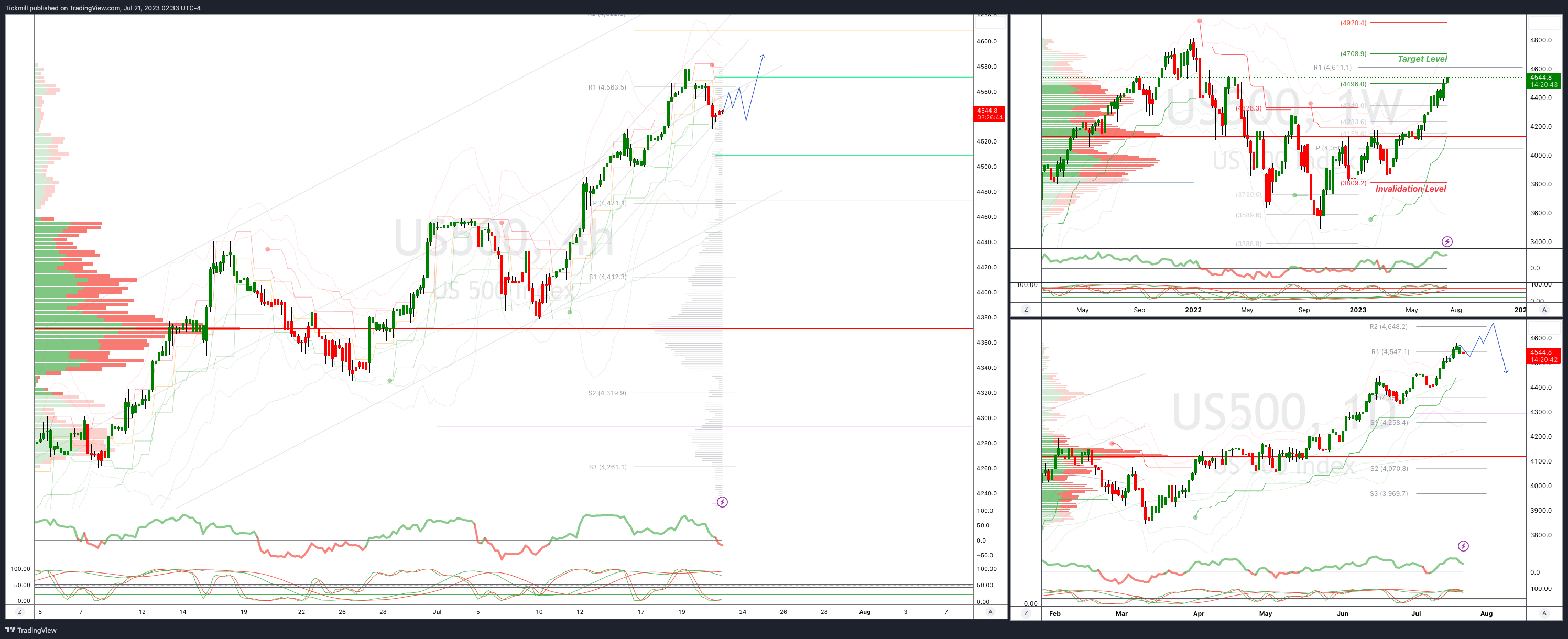

SP500 Intraday Bullish Above Bearish Below 4530

Below 4520 opens 4460

Primary support is 4370

Primary objective is 4630

20 Day VWAP bullish, 5 Day VWAP bullish

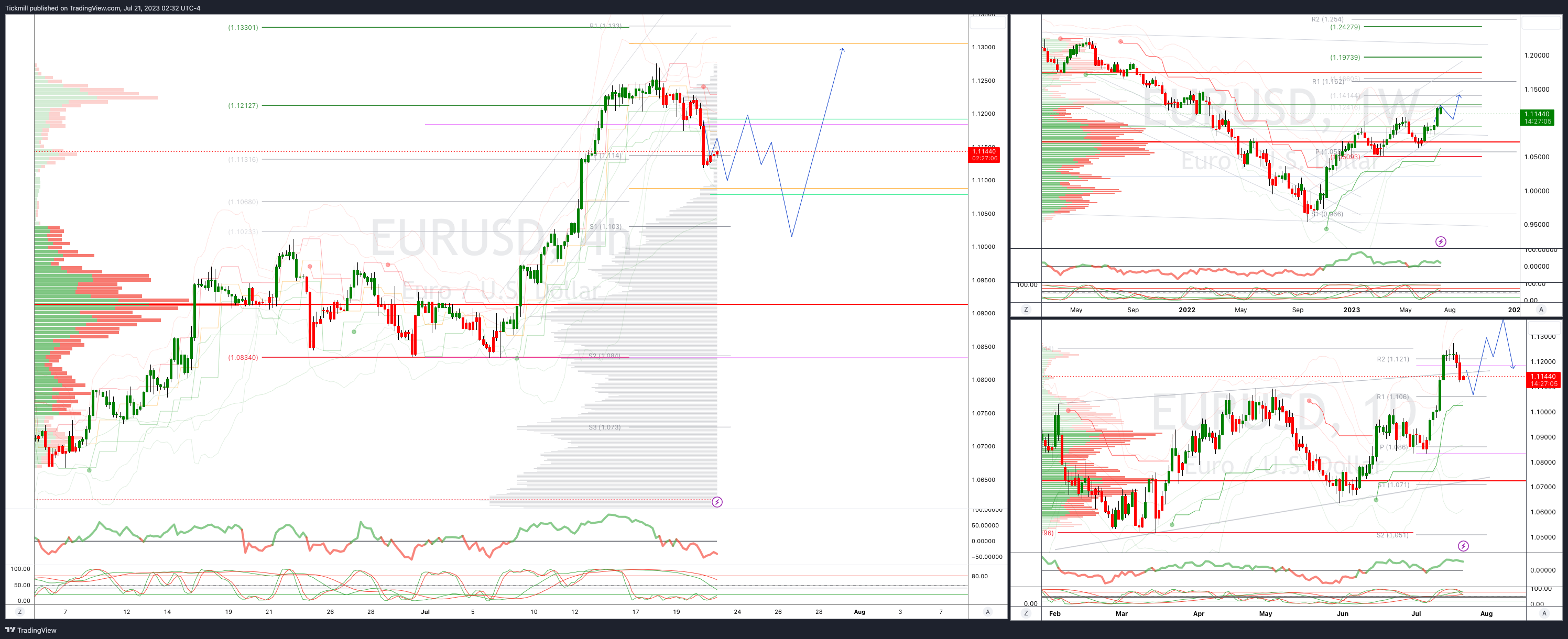

EURUSD Intraday Bullish Above Bearsih Below 1.12

Below 1.1150 opens 1.1050

Primary support is 1.10

Primary objective is 1.13

20 Day VWAP bullish, 5 Day VWAP bearish

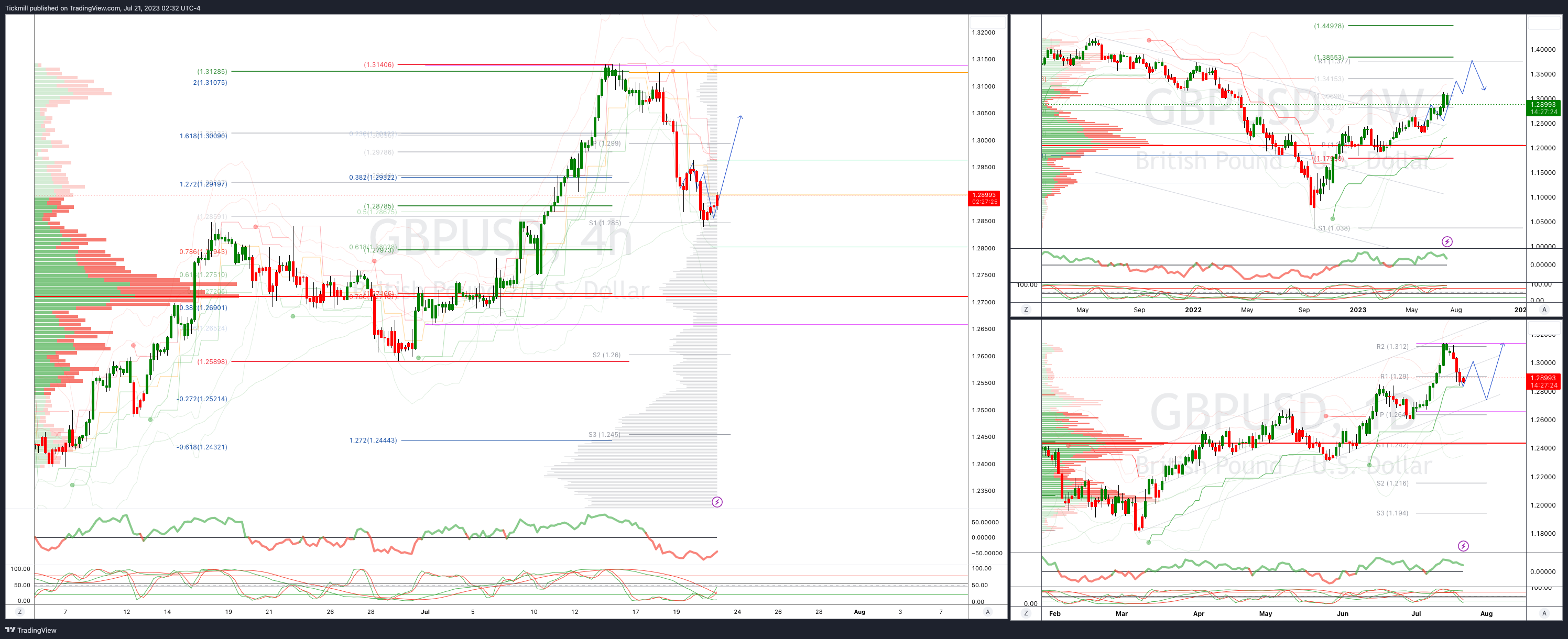

GBPUSD: Intraday Bullish Above Bearish Below 1.2850

Below 1.2830 opens 1.2710

Primary support is 1.26

Primary objective 1.3850

20 Day VWAP bullish, 5 Day VWAP bearish

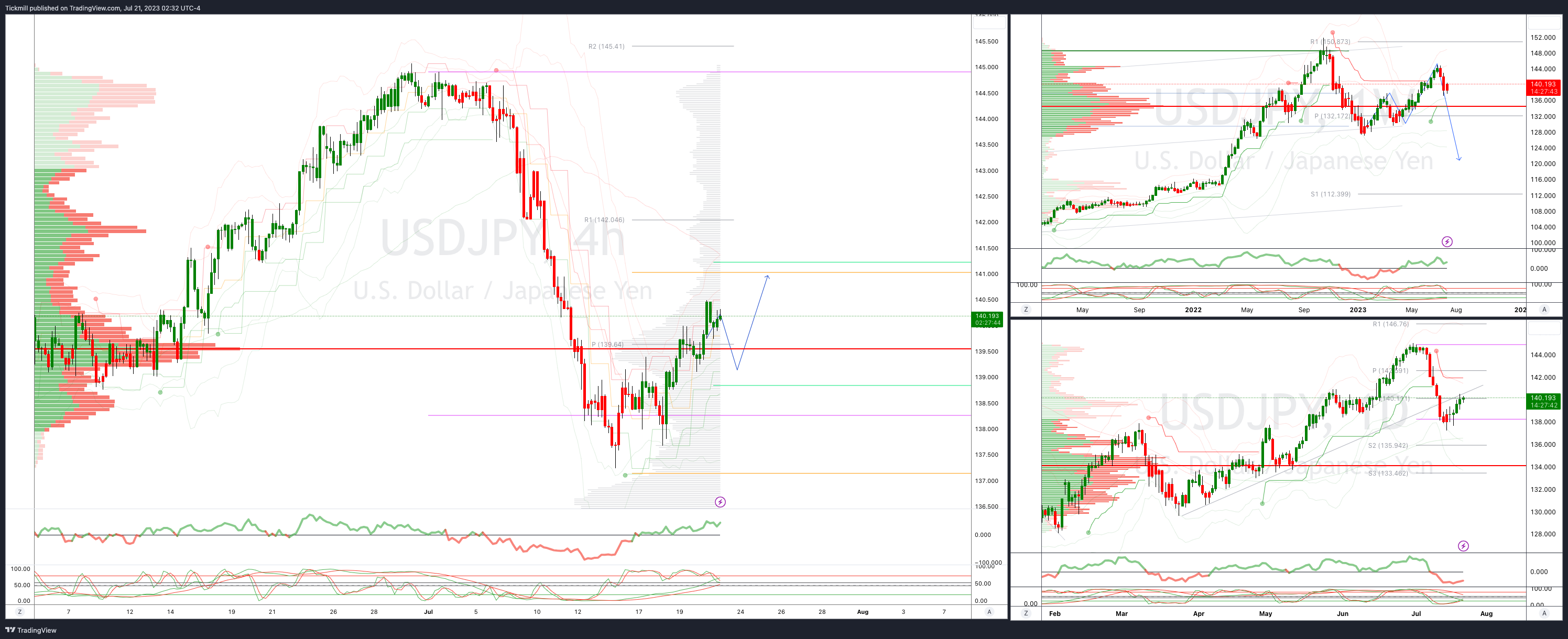

USDJPY Bullish Above Bearish Below 139.60

Above 139.60 opens 141.80

Primary resistance 142

Primary objective is 136.20

20 Day VWAP bearish, 5 Day VWAP bullish

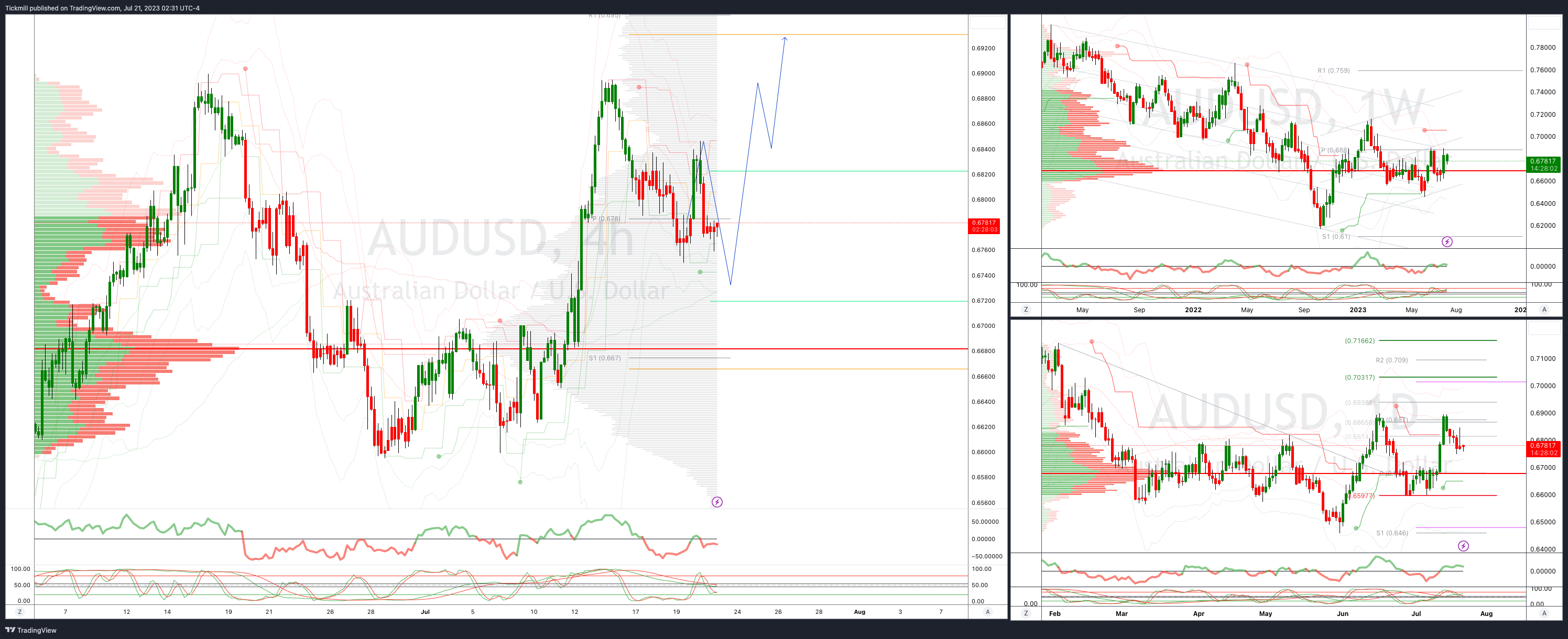

AUDUSD Intraday Bullish Above Bearish Below .6800

Below .6795 opens .6750

Primary support is .6448

Primary objective is .7000

20 Day VWAP bearish, 5 Day VWAP bullish

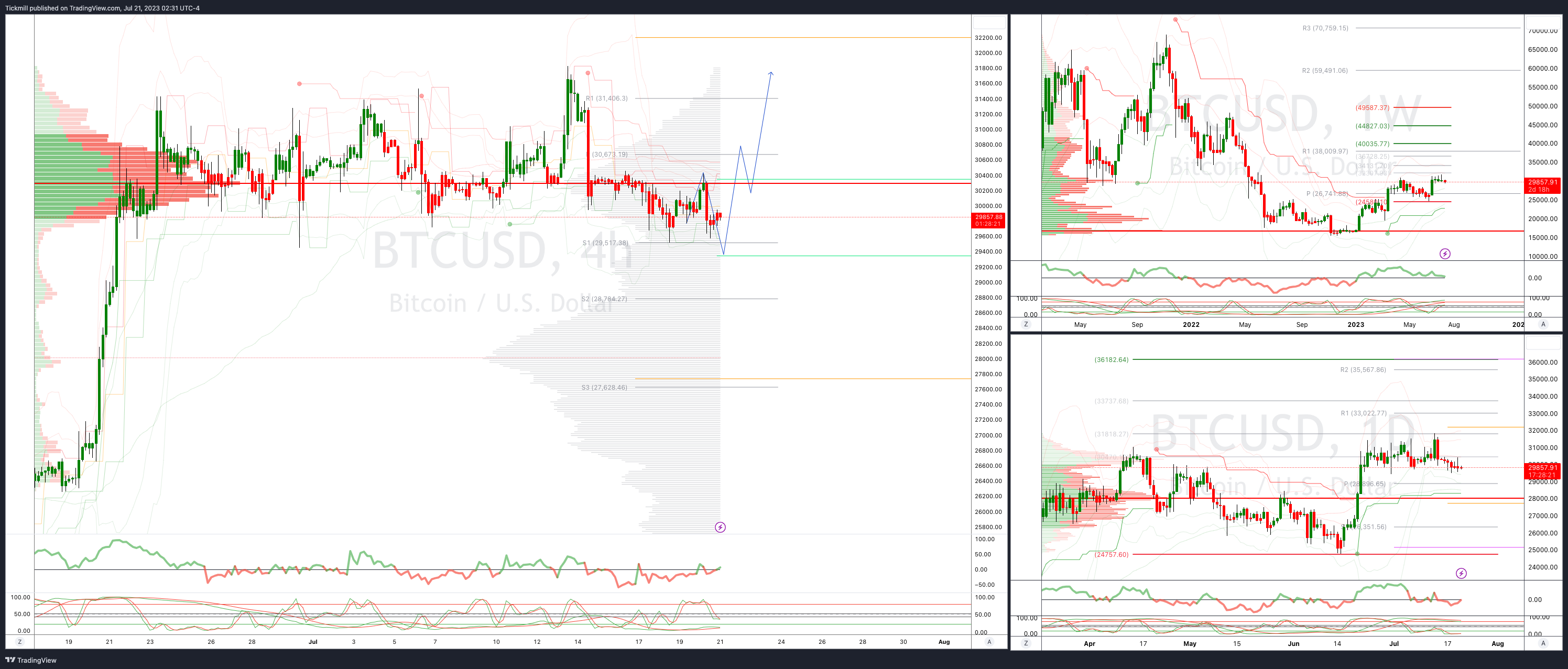

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28600

Primary support is 28400

Primary objective is 32750

20 Day VWAP bullish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!