Daily Market Outlook, July 20, 2023

Daily Market Outlook, July 20, 2023

Munnelly’s Market Commentary…

Asian equity markets had a mixed trading session, reflecting the uncertain performance in the US markets as investors processed various data releases, corporate earnings results from tech darlings Netflix and Tesla, the latter saw a decline in margins as it continues to boost discounts, while Netflix’s new password initiative failed to deliver expected revenue growth, investors were underwhelmed by both of their performance updates weighing on Nasdaq futures overnight.

The Nikkei 225 was the worst performer, declining following weaker-than-expected trade data with a contraction in imports, although the trade balance returned to a surplus for the first time in almost two years. On the other hand, the Hang Seng rose, buoyed by early strength in the property sector after the People's Bank of China eased cross-border funding for firms and financial institutions. However, the Shanghai Composite was lacklustre despite the PBoC maintaining benchmark lending rates and issuing guidelines for the promotion of the private economy.

In the Eurozone, consumer confidence has been steadily rising over the past three months, reaching its highest level since February 2022. Despite recent indicators suggesting a slowdown in Eurozone economic activity, both analysts and the consensus expect a further small increase in confidence for July.

Stateside several indicators will provide further insights into the US economic activity. The weekly jobless claims will indicate the tightness of the labour market. The June labour market report showed buoyant conditions, and recent weekly claims have surprised on the downside after a few higher readings. The June existing home sales report will offer an update on the housing sector, which has been affected by rising interest rates but is now showing tentative signs of slowing down. The July Philadelphia Fed index, while a timely update on the factory sector, tends to be too volatile to provide useful indications.

CFTC Data As Of 14-07-23

USD net spec short fell a touch in the Jul 5-11 period as $IDX slid 1.37%

Fairly serious moves among majors w/hardly any position changes

Suggest a fair amount of position replacement as specs were getting stopped

EUR$ +1.2% in period, specs -2,675 contracts into strength now +140,162

$JPY -2.84% in period after breaching 145 last wk, specs buy 738 contracts

GBP$ +1.73% as BoE seen a cointoss for +50bp Aug 3, specs +7,798 now +58,063

CHF specs relatively active -4,503 contracts now short 7,907

$CAD +0.06%, Aussie -0.06% specs sell less than 1k contracts

BTC fell a scant 0.74%, specs +221 on dip now short 1,855 contracts(Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.1110-20 (1.6BLN), 1.1190 (310M), 1.1200 (1BLN), 1.1270 (479M)

1.1300 (592M)

USD/CHF: 0.8625 (245M), 0.8735 (275M), 0.8830-35 (1BLN)

GBP/USD: 1.2775-95 (484M), 1.2945 (365M), 1.3015-30 (640M), 1.3095 (451M)

EUR/GBP: 0.8645-50 (605M), 0.8675 (903M), 0.8700 (551M), 0.8750 (364M)

AUD/USD: 0.6755-65 (554M), 0.6800-15 (2BLN), 0.6860 (227M)

NZD/USD: 0.6225 (429M), 0.6310 (1.2BLN), 0.6415 (280M)

AUD/NZD: 1.0850 (906M). USD/CAD: 1.3105 (680M), 1.3215-25 (430M)

USD/JPY: 138.75 (396M), 139.00 (271M), 140.00-10 (3.7BLN), 140.60-70 (773M)

140.90-95 (1BLN). AUD/JPY: 96.10 (250M)

Traders have been cautious about buying higher strikes in GBP/USD options, but they have not ruled out recent volatility. Implied volatility for the benchmark 1-month options has increased to 8.5, matching pre-June Bank of England peaks. After the inflation data, 1-month options were sold at 8.3, and 3-month options were given at 8.1-7.9, but deeper declines have been limited for now. There is demand for September Bank of England options, which include another CPI report before the expiration. The USD/JPY traders are likely to pay attention to Friday's Japanese CPI data, which may support current implied volatility levels and limit setbacks in options expiring after the 28 July policy announcement.

Overnight Newswire Updates of Note

Japan's Nikkei Slides As Chip Stock Rout Eclipses Auto Share Gains

Australian Employment Rises Further As Labour Market Stays Strong

China Leaves Lending Benchmarks Unchanged, As Expected Thursday

China Mulls Mortgage Easing To Spur Home Buying In Big Cities

China Ramps Up Yuan Support With Fixing, Borrowing Measure Tweak

Bank of America Cuts China 2023 GDP Forecast To 5.1% From 5.7%

Japan’s Balance Of Trade Swings To Surprise Surplus In June

BoJ Watchers See Ueda Standing Pat Now, Tweaking YCC By October

ECB's Stournaras: Next Week's Interest Rate Hike Would Be Enough

Bank Of England's Ramsden Calls For Faster QE Gilt Unwind

China's State Banks Seen Selling Dollars Offshore To Slow Yuan Declines

SocGen: PBoC’s Yuan Fixing Manoeuvring May Not Reverse Sentiment

Nikko Asset Shifts To Bullish Yen Slant As Ueda Bides His Time

Crypto Altcoins Resume Their Rise; Bitcoin Hovers Around $30,000

Oil Steadies As Slump In US Stockpiles Offsets Demand Concerns

Asian Stocks Mixed Thursday As US Futures Slip; Yuan Rises

Foreign Investors Sidestep China In Rush Into Asian Stocks

Apple Tests ‘Apple GPT,’ Develops Generative AI Tools To Catch OpenAI

Tesla Q2 Margins Fall As It Boosts Discounts To Drive Demand

Netflix Tops Wall Street Forecasts With Password Limits, Ad Option

IBM Misses Second-Quarter Revenue Estimates As IT Spending Cools

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

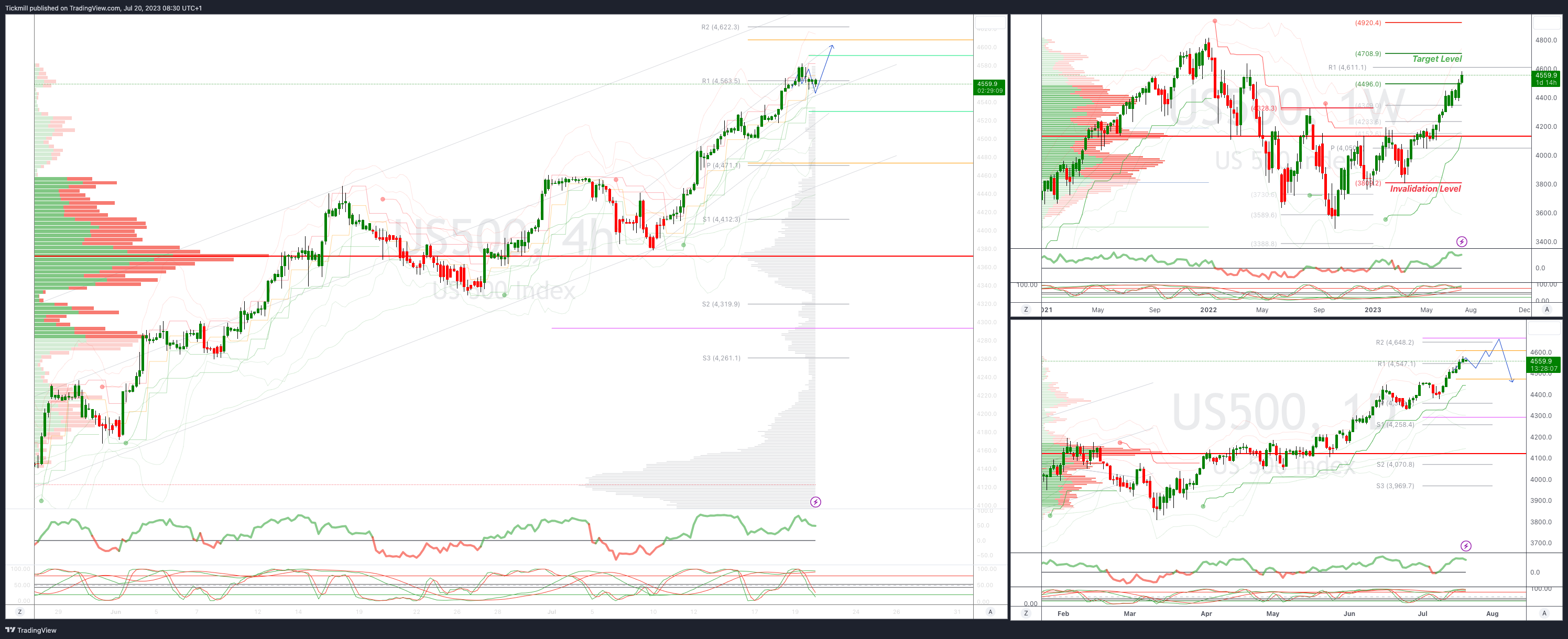

SP500 Intraday Bullish Above Bearish Below 4540

Below 4520 opens 4460

Primary support is 4370

Primary objective is 4630

20 Day VWAP bullish, 5 Day VWAP bullish

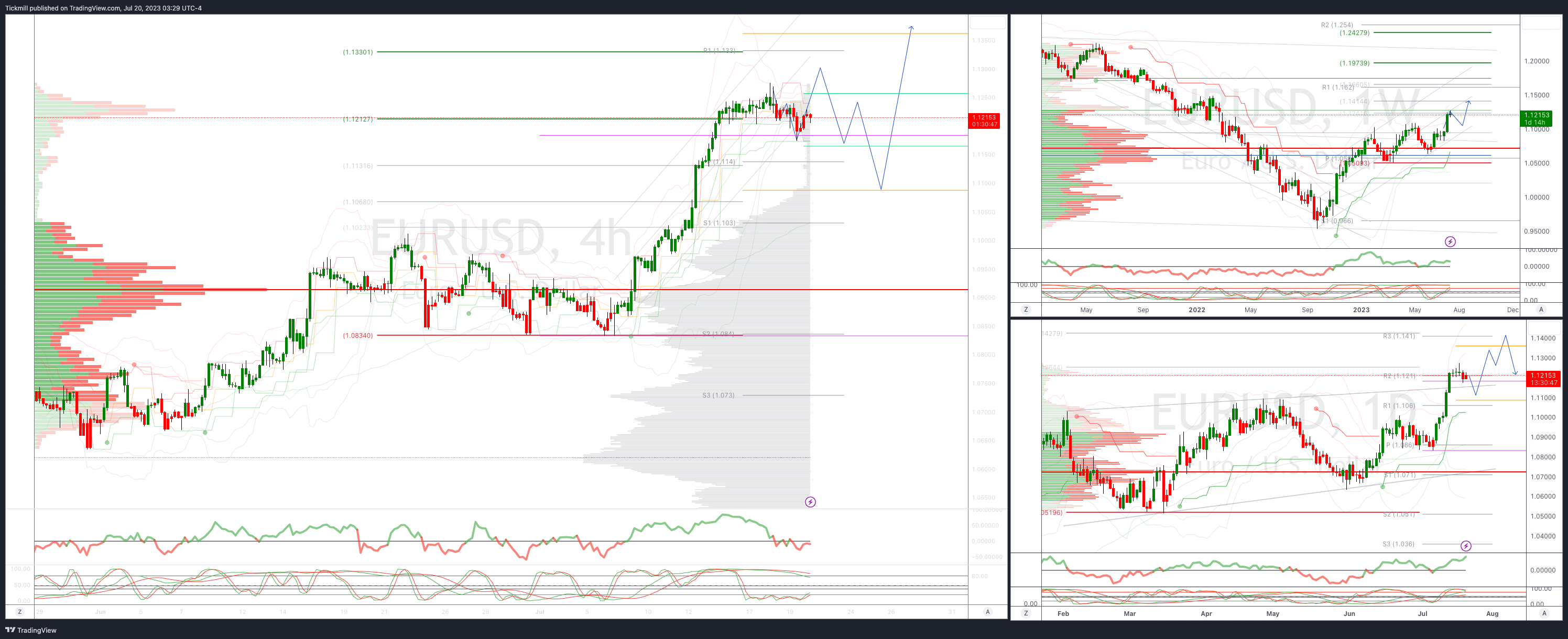

EURUSD Intraday Bullish Above Bearsih Below 1.12

Below 1.1150 opens 1.1050

Primary support is 1.10

Primary objective is 1.13

20 Day VWAP bullish, 5 Day VWAP bearish

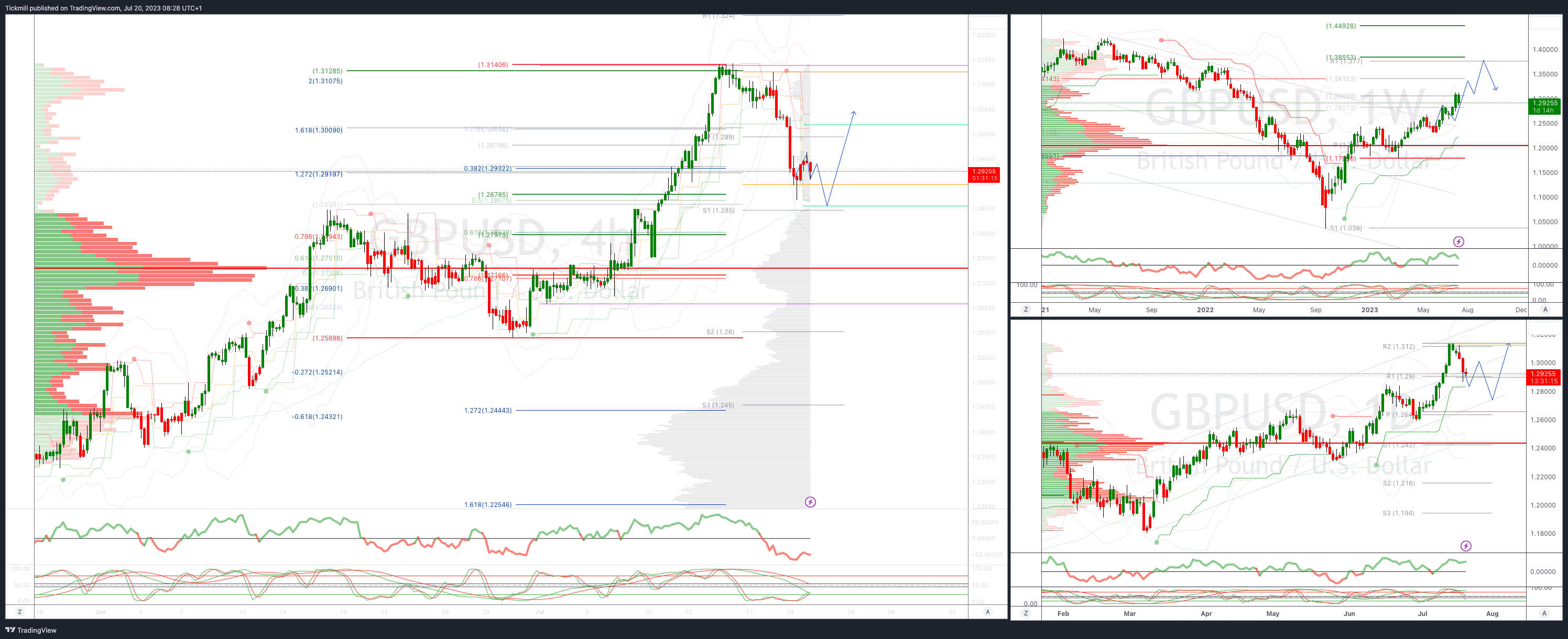

GBPUSD: Intraday Bullish Above Bearish Below 1.30

Below 1.2830 opens 1.2710

Primary support is 1.26

Primary objective 1.3850

20 Day VWAP bullish, 5 Day VWAP bullish

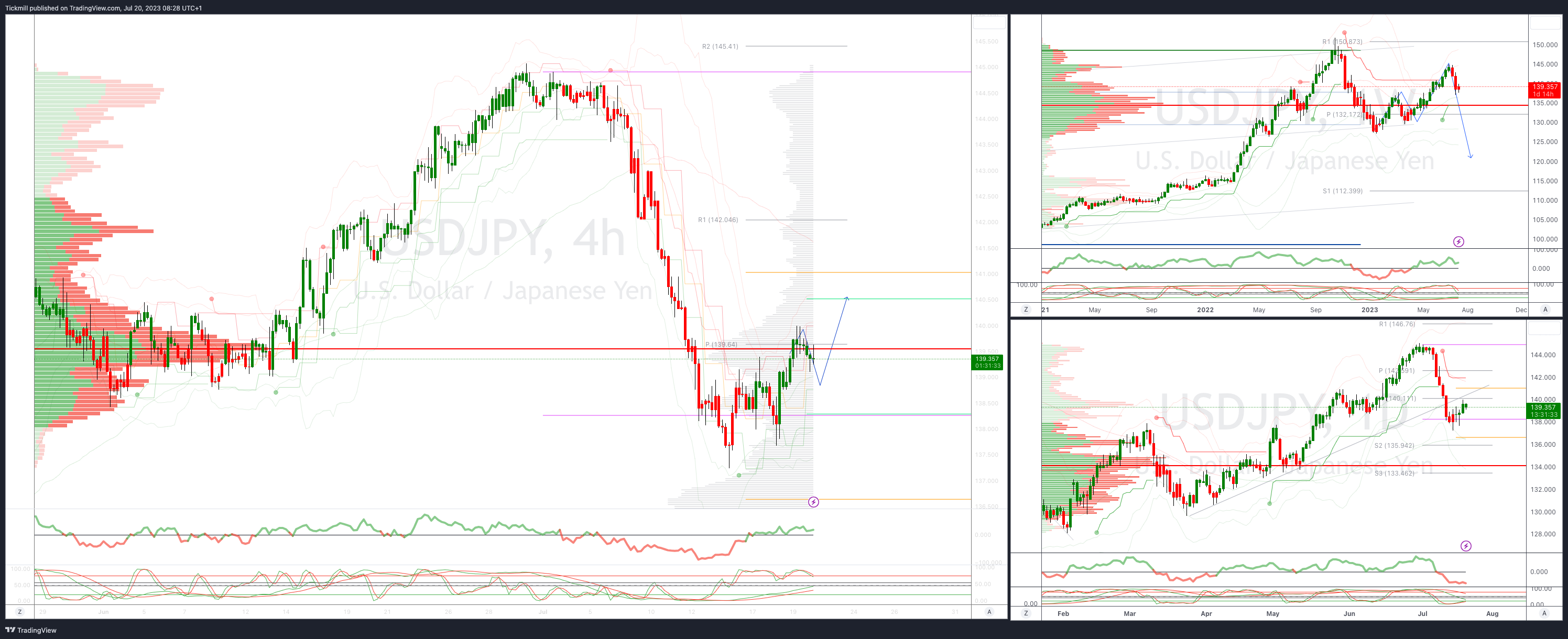

USDJPY Bullish Above Bearish Below 139.60

Above 139.60 opens 141.80

Primary resistance 142

Primary objective is 136.20

20 Day VWAP bullish, 5 Day VWAP bullish

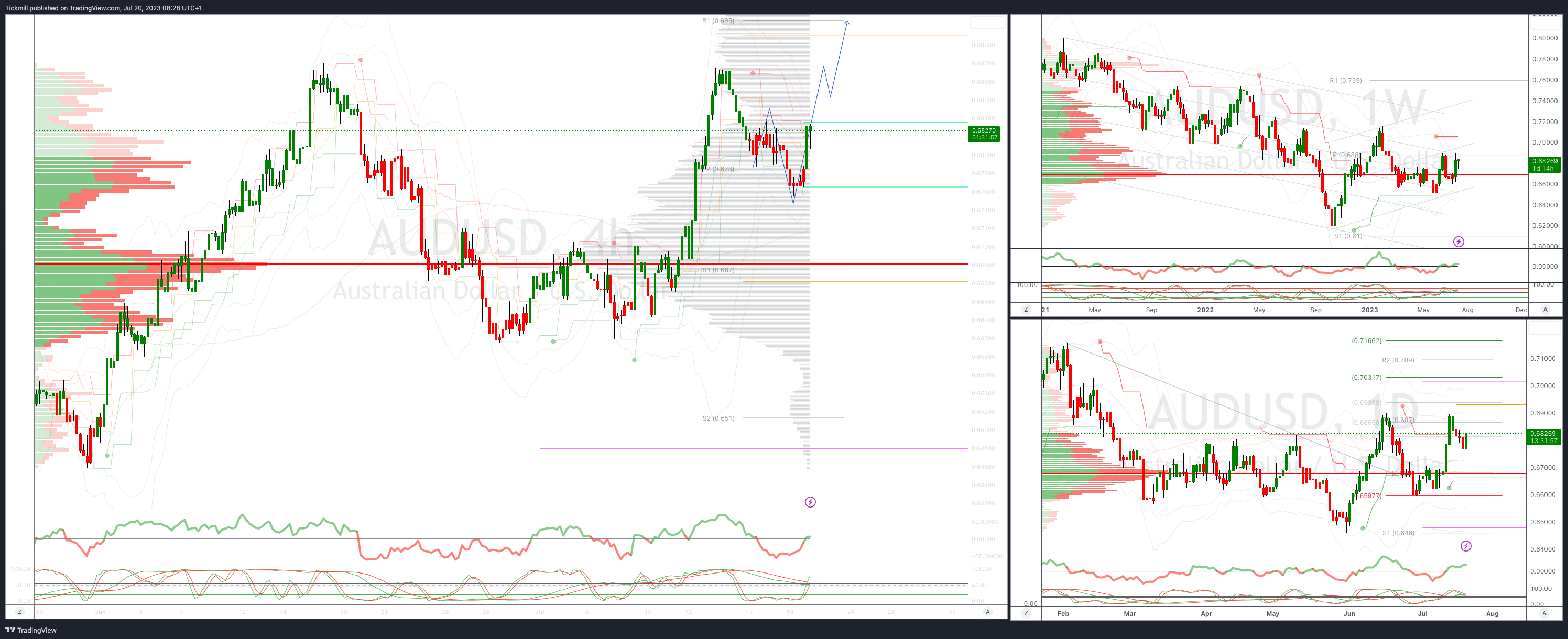

AUDUSD Intraday Bullish Above Bearish Below .6800

Below .6795 opens .6750

Primary support is .6448

Primary objective is .7000

20 Day VWAP bearish, 5 Day VWAP bullish

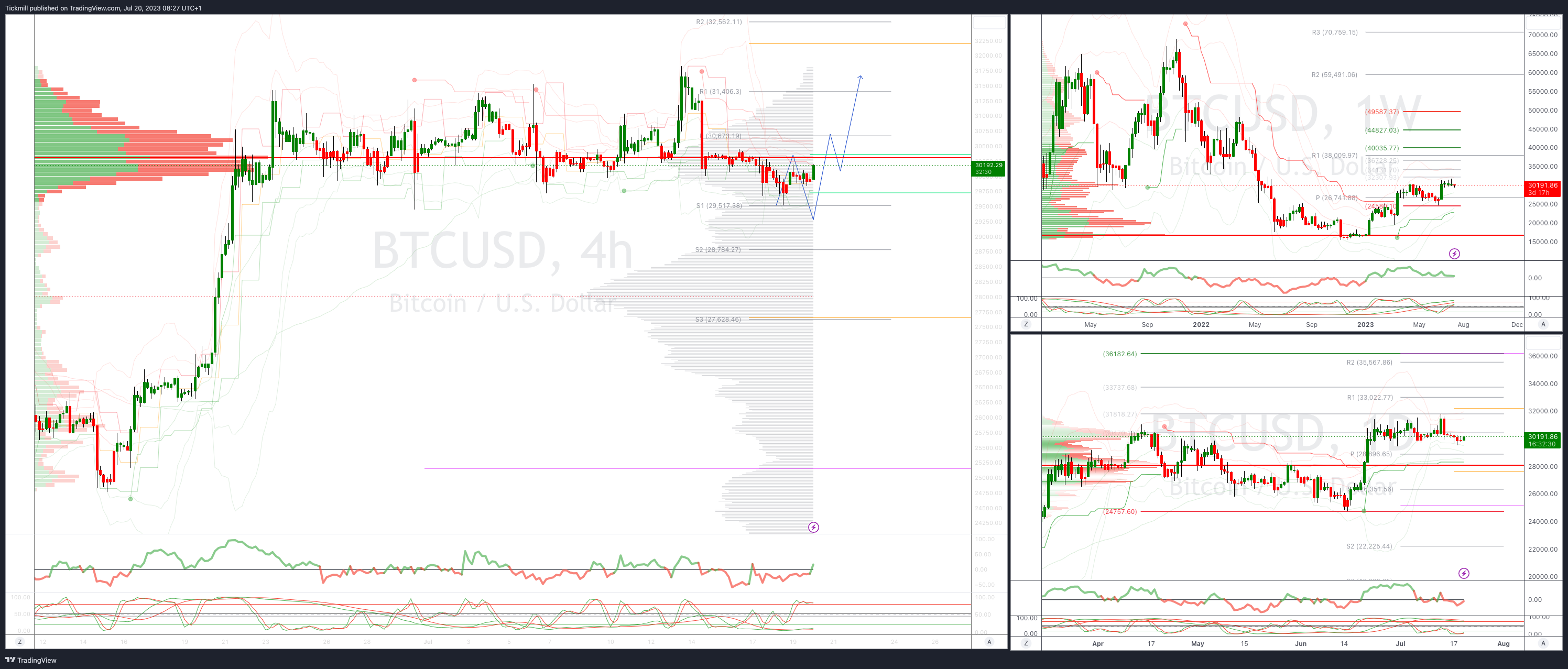

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28600

Primary support is 28400

Primary objective is 32750

20 Day VWAP bullish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!