Daily Market Outlook, July 12, 2021

Overnight Headlines

- Following last week’s strong close to US equities, positive sentiment has continued to boost stock markets across Asia, which have started the week higher. In part, this also reflects the impact of Friday’s decision by China’s central bank (the PBoC) to reduce the reserve requirement ratio by 0.5% for most banks, which is expected to unleash around one trillion yuan of liquidity into the economy. Meanwhile, a survey of large UK businesses by Deloitte showed that almost three-quarters were expected to increase capital expenditure, aided by the Chancellor’s tax break

- Later today, UK PM Boris Johnson is expected to announce that most of the remaining restrictions across England will be lifted on the 19th July. Speaking yesterday, the UK’s minister for vaccine deployment, Nadime Zawahi all but confirmed that this would be the case, despite the continuing rise in the rate of infections across the UK.

- The premise for the move rests on the assumption that the link between infections and deaths has weakened substantially, due to the rapid rollout of vaccines across the country, and will continue to weaken further as a greater share of the population became fully immunised. In response to speculation that the gap between first and second doses would be shortened from eight to four weeks, Mr Zawahi dismissed the claims noting that the current gap offered a much better level of protection.

- The further easing in restrictions will go some way to helping the UK’s economic recovery, particularly with last week’s GDP report showing that most of the growth in May occurred in areas of the economy that benefitted the most from the relaxation in lockdown rules in that month.

- The lack of any major data releases today means that markets may remain focused on concerns of a potential slowdown in global growth. Later this week, US Fed Chair Powell’s testimony to Congress will provide a key focal point. Ahead of that, today Fed member Kashkari is due to speak at a ‘townhall’ in Minneapolis with his assessment of current economic conditions likely to attract some interest. Elsewhere, ECB council member Guindos is scheduled to speak at the OMFIF event on the outlook for monetary policy.

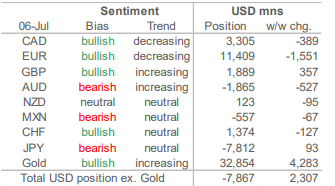

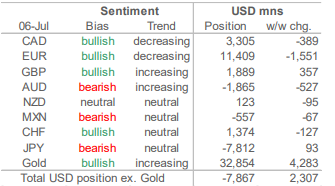

CFTC Data

- Investors Trim USD Short to Three Month Low Data in this report cover up to Tuesday Jul 6 and were released on Friday Jul 9.

- The USD short was slashed yet again in the week to Tuesday for a third consecutive week with a net reduction of USD2.3bn to USD7.8bn. The bearish position on the dollar now stands at its lowest mark since early-April, in a period over which the dollar rose by 0.5% on a broad currency basis (shortly before touching a three-month high).

- Investors only spared the JPY and GBP throughout the week as the only currencies that saw an increase in their net positions against the dollar. The pound’s net long rose by USD357mn to USD1.9bn with the increase nevertheless only chipping away at the large USD1.3bn reduction a fortnight prior.

- The sizeable JPY short was reduced slightly by USD93mn to USD7.8bn (i.e. just over 1%) compared to the USD1.8bn increase in the bearish JPY position in the previous week. In the week to Tuesday, the JPY was the second best performing major currency, predating its move to its highest level in four weeks on Thursday. The CHF, its haven peer, saw a USD127mn drop in its now USD1.4bn long.

- Speculative accounts cut their bullish position on the EUR by USD1.56bn for the largest adjustment over the week. Investors amassed both long and short contracts on the EUR, but the total number of EUR shorts now sits at its highest since March 2020, and the net USD11.4bn position is ‘only’ about USD1.4bn from the April 2021 low—around the time when the EUR traded at its lowest point since November.

- The CAD and AUD also saw relatively large moves against them as the CAD long was cut by USD389mn to USD3.3bn (i.e about a 10 % reduction) after five consecutive weeks of positioning moves in its favour. USDCAD climbed just shy of a breach of 1.25 on the last day covered by these data, a level that it eventually crossed to near 1.26 in broad gains for the dollar. The AUD short rose by USD527mn to USD1.86bn, representing the largest overall bet against the Aussie in over a year. The small NZD long fell USD95mn to USD123mn and the MXN short climbed a touch by USD67mn to USD557mn.

- Elsewhere, investors placed bets on Gold after five weeks of moves against the metal while checking their bullishness on WTI Oil with the biggest decrease in its net long since early-April amid OPEC+ uncertainty. Positioning in 10-yr US Treasury notes was practically unchanged, despite the yield on these reaching its lowest since late-Feb on the cutoff date (it fell further to 1.2479% yesterday)

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

EUR/USD 1.1800 (387M), 1.1930-35 (560M), 1.2000 (255M)

USD/JPY 109.00 (500M), 109.45-50 (430M), 110.00 (1.16BLN)

EUR/JPY 130.40 (210M). EUR/GBP 0.8630-40 (400M)

AUD/USD 0.7400 (677M), 0.7500 (688M).

Technical & Trade Views

EURUSD Bias: Bearish below 1.1950 Bullish above

Eases slightly in quiet start to the week • EUR/USD opened 1.1882 after USD eased on Friday as risk assets gained • It traded to 1.1884 before gently easing through the morning • Dovish comments by ECB President Lagarde had little impact • EUR/USD is trading at the session low at 1.1868 heading into the afternoon • Support is at 10-day MA at 1.1853 and break would shift pressure to downside • Resistance is @ 21-day MA @ 1.1911 and break would suggest a bottom in place • Key will be moves in US yields as USD correlation with yields has been inverse

GBPUSD Bias: Bearish below 1.40 Bullish above.

Remains bid in Asia but upside seen limited for now • GBP bid in Asia, towards the top of recent ranges but upside seen limited • Cable 1.3885-1.3911, high tad above 1.3909 Friday, some offers 1.3900+ • Tech resistance at gradually descending 100-DMA at 1.3944 • Weak GDP data and BoE likely on hold to help cap upside • GBP/JPY bid, in 152.54154.15 Ichi cloud, between 152.28/153.70 100/55-DMAs

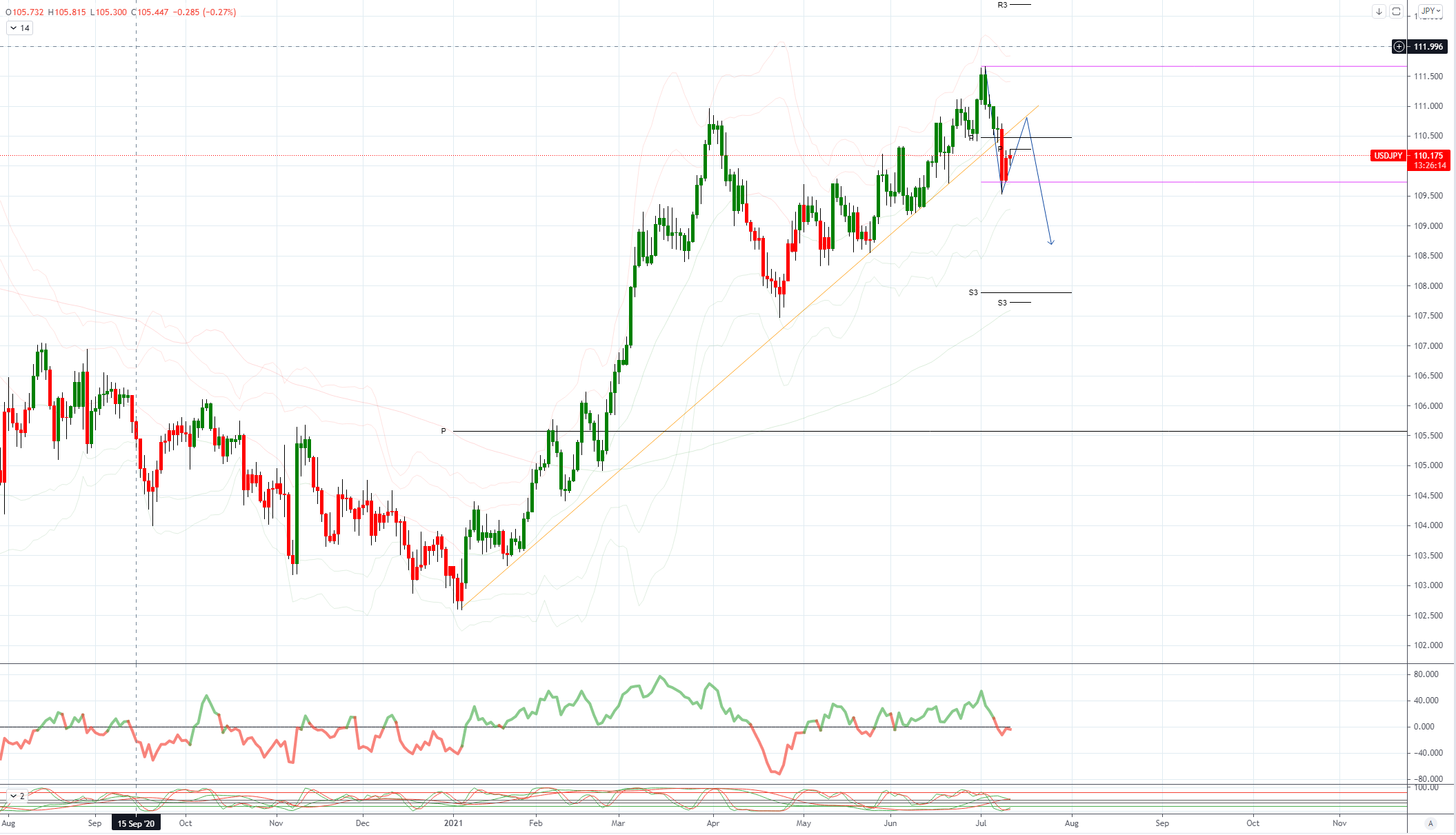

USDJPY Bias: Bullish above 109 Bearish below

JPY crosses buoyant, risk-on but upside limited • USD/JPY, JPY crosses buoyant with risk on but upside limited for now • Nikkei +2.3% @28,580, recouped most of losses last week • US yields up a leg too but still relatively low, Treasury 10s @1.355% • USD/JPY base seen around ascending 55-DMA down at 109.75 • Massive, $1.1 bln 110.00 option expiries provide some gravitational pull • Offers towards 110.50, flat Ichi daily kijun 110.42 ahead • EUR/JPY 130.67-86, GBP/JPY 152.79-153.24, AUD/JPY 82.18-58 • Despite better risk mood, specs hesitant to get back in on long side

AUDUSD Bias: Bearish below .76 Bullish above

Holds around 0.7470 after early dip • AUD/USD opened 0.7490 after it rose 0.83% Friday when risk assets rallied • It traded to 0.7495 early before sellers ahead of 0.7500 capped • AUD/USD drifted down to 0.7469 and is trading 0.7470/75 into the afternoon • Market a bit wary of the gains in risk on Friday, as growth concerns persist • Rise in Delta variant COVID infections a source of concern • AUD/USD buyers tipped at 0.7445/50 with support at Friday's low at 0.7410 • Sellers are eyed ahead of 0.7600 with the 10-day MA at 0.7490

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!