Daily Market Outlook, January 31, 2022

Daily Market Outlook, January 31, 2022

Overnight Headlines

- Fed’s Bostic: Could Do Half-Point March Hike If Needed

- Goldman Expects Five Fed Reserve Rate Hikes This Year

- US Democrats Put Build Back Better In Manchin’s Court

- Russia Sanctions Bill Closer In Senate Ahead Of Briefings

- Pentagon See Putin Still Adding Troops Around Ukraine

- US Seek N Korea Talk After Biggest Missile Test In Years

- China Manufacturing Loses Steam, Growth Risks Mount

- China Seal Off More Residential Areas, Reports 12 Cases

- BoE To Raise Rates For Second Time In Quick Succession

- UK PM Plans Brexit Bill, Putin Talk In Pivot From Scandal

- UK’s Sunak Vow To Go On With National Insurance Hike

- Italy Re-Elect President Mattarella, Government Bruised

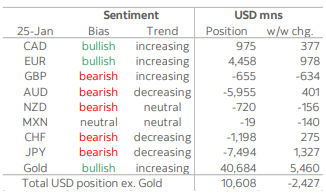

CFTC Data

- Bullish positioning in the USD fell once again in the week to Tuesday ahead of the Federal Reserve’s policy decision, according to CFTC data published today. The aggregate USD long position fell by USD2.4bn to USD10.6bn, following the prior week’s drop of USD7bn which represented the largest one-week drawdown for the USD since mid-2020. The overall bullish bet on the greenback now stands at its lowest since mid-September and at roughly half of where it stood just two weeks ago.

- This week, investors added a USD1bn bet on top of last week’s USD2.6bn move in favour of the EUR, although the adjustment followed from a 5.5k reduction in short contracts while investors only added 1.5k EUR longs. Bullish sentiment in the EUR now sits at USD4.5bn, which represents its highest point since mid-August 2021, although it remains far from the USD25bn long of one year ago. After a failed test of 1.14 in mid-month, the EUR held up decently over the period covered by the data, possibly supported by its semi-haven status amid risk-off trading. However, it has since lost ground to a new low since June 2020 that suggests next week’s CFTC data will see a deterioration in EUR positioning.

- The GBP also saw a USD2.5bn adjustment in its favour in last week’s CFTC report, but this week’s data show that investors scaled this optimism back and placed a USD634mn wager against the pound. It seems likely that speculators have added to their GBP short holdings with the pound’s move under 1.36 that preceded losses to a one-month low under 1.34 yesterday.

- The CAD’s bullish position grew by USD377mn to near the billion mark and a six-month high ahead of the BoC’s policy decision on Wednesday. Broad losses against the USD and an onhold BoC have taken USDCAD to a test of 1.28 today, which may translate into a down week for CAD positioning in next week’s report. • As the best performer over the period, the JPY saw the largest bullish positioning move across the currencies covered in this report with USD1.3bn bet in its favour. However, the adjustment still leaves the aggregate JPY short at a sizable USD7.5bn. This is roughly USD1.6bn above the next largest short, that of the AUD which was trimmed by USD401mn to USD6bn this week. The CHF, the JPY’s haven peer and the second best performing currency over the week, saw a USD275mn reduction in its bearish position that now totals USD1.1bn. Finally, investors added USD156mn to the NZD short of now USD720mn while accounts placed a USD140mn bet against the MXN that leaves the peso’s position practically neutral.

The Week Ahead

- There will be plenty of U.S. data to keep markets on edge this week after the Federal Reserve indicated they would be data-dependent in determining the scope and speed of their tightening cycle. Friday's jobs report for January is the main event.

- The market expects a 155,000 jobs increase in non-farm payrolls, the unemployment rate to remain at 3.9% and average hourly earnings to rise 5.2% year-on-year after +4.7% in December. Other key U.S. releases this week include ISM manufacturing and non-manufacturing, final Markit PMIs, factory orders and ADP jobs.

- Euro zone final January PMIs lead a busy week for European data. The market will also pay close attention to flash inflation data from the EZ and Germany. Other key data includes EZ Q4 GDP, unemployment and retail sales, and German industrial orders. PMI surveys will be the only data of note out of the UK this week.

- Japan released industrial production and retail sales data for December early Monday; jobs and final PMIs are due later in the week. China is closed all week for the Lunar New Year holidays.

- Australia data includes final December retail sales, building approvals and trade. New Zealand has trade and jobs data due. Canada's main releases are November GDP, January PMI and employment data.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

- USDJPY - 117.00 1.14bn (C). 115.00 1.35bn (911m C). 114.00 1.11bn (990m P).

- EURUSD - 1.1390/1.1400 899m. 1.1370 578m. 1.1220/30 416m. 1.1100 1.32bn (P).

- GBPUSD - 1.3400 524m.

- AUDUSD - 0.7300/20 718m.

- NZDUSD - 0.6650 403m.

- EURCHF - 1.0500 429m. 1.0400 748m. 1.0300 2.04bn (P). 1.0250 420m.

- EURSEK - 10.55 431m. 10.46 769m. 10.40 492m.

- USDCNH - 6.35 520m.

Technical & Trade Views

EURUSD Bias: Bearish below 1.15 Bullish above

- Edges higher on EUR/USD buying in Asia

- EUR/USD opened 1.1147 after closing unchanged on Friday

- After a quiet start - it grinded higher in the back of EUR/JPY demand

- It based at 1.1139 and it is at session high at 1.1161 into the afternoon

- EUR/JPY has moved up 0.33% to close to 129.00 in Asia

- EUR/USD is trending lower with 5, 10 & 21-day MAs in a bearish formation

- A break above the 10-day MA at 1.1265 is needed to ease downward pressure

- The objective of the move is the 76.4 of 1.0636/1.2349 at 1.1040

GBPUSD Bias: Bearish below 1.36 Bullish above.

- Optimism to begin the week, charts undermine

- +0.1% towards the top of a 1.3388-1.3414 range with the USD softer, risk bid

- UK businesses scale back pay plans despite higher inflation

- BoE very likely to raise rates, but guidance key and a tough call

- Charts; 5, 10 & 21 day moving averages fall - 21 day Bollinger bands expand

- Momentum studies slip, negative setup suggests further losses, USD pivotal

- 1.3300, 76.4% December-January rise is initial significant support

- Break above 1.3500 10 day moving average would end downside bias

- Asymmetric risk for sterling this week

USDJPY Bias: Bullish above 114.50 Bearish below

- USD/JPY bid in Asia as US yields base, JPY crosses follow

- USD/JPY bid in Asia as US yields base, on better risk mood

- Nikkei +1% @26,981, yields on Tsy 10s @1.793%, 1.771% low NY Friday

- USD/JPY 115.23 early to 115.59 EBS before steadying

- Some Japanese exporter, other offers 115.50+, trail up

- Bids on dips from Japanese importers, investors, especially from @115.00

- Large, $1.4 bln in option expiries today between 114.95-115.05 strikes

AUDUSD Bias: Bearish below 0.7250 Bullish above

- Moves higher in Asia as shorts pare back

- AUD/USD opened 0.6990 after falling 0.53% on Friday

- After trading at 0.6986 it tracked higher once Tokyo arrived

- AUD/JPY demand pushed the cross up 0.33% and underpinned AUD/USD

- AUD/USD traded as high as 0.7017 and is around 0.7010 into the afternoon

- It is trending lower with resistance at the 10-day MA at 0.7125

- The next level of decent support is @ the 50% of 0.5510/0.8007 move @ 0.6758

- RBA decision tomorrow is the next event risk for AUD

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!