Daily Market Outlook, February 9, 2024

Daily Market Outlook, February 9, 2024

Munnelly’s Market Minute…“SPX Tips Over 5k”

Many Asian markets observe holidays today, with those open displaying mixed but relatively minor fluctuations. Anticipation surrounds potential further stimulus measures in China. A European Central Bank official remarked that this year could see interest rate cuts if no adverse events occur, yet cautioned that market expectations may be overstated. In contrast, Bank of England's Haskel, who recently voted for a rate increase, voiced a desire for more evidence regarding the reduction of inflation risks.

Looking ahead, the data docket is sparse, with no significant data releases in the UK. The release of December Italian industrial production this morning offers insight into next week's data for the entire Eurozone. Recent outputs from major economies within the region have been varied, with France witnessing a robust increase, while Germany experienced a notable decline, and Spain saw a more modest decrease. Despite significant pressure on the factory sector in the Eurozone, consensus expectations suggest a rebound in Italian output following a substantial fall in November.

Stateside, no notable new data releases are scheduled for today. However, the release of new seasonal adjustment factors for 2023 US CPI inflation is expected. Although typically not considered significant news by markets, Federal Reserve Chair Powell highlighted their importance last week, noting their impact on the inflation outlook. While the adjustment won't affect the overall inflation rate for the year, it could influence the inflation profile throughout the year, similar to the 2022 update, which showed less moderation in inflation than previously thought late in the year. Such an outcome for 2023 may reinforce Fed policymakers' caution regarding lowering US interest rates.

Overnight Newswire Updates of Note

ECB’s Kazaks Says Bets On Spring Rate Cuts Look Optimistic

BoE's Haskel Wants More Evidence That Inflation Risks Are Waning

Biden Calls Israel's Gaza Response 'Over The Top'

Biden Is Looking Beyond Tariffs To Keep Chinese ‘Smart Cars’ Out Of The

Putin Says Russia Has No Interest In Attacking Poland Or Latvia

BoJ’s Ueda: Chances Are High For Accommodative Conditions To Stay

IMF Urges BoJ To End Bond Yield Control, Huge Asset Buying

RBA Keeping Options Open Regarding Further Rate Increases, Bullock Says

Bitcoin Hovers Near One-Month High On ETF Inflows, Looming Halving

S&P 500 Reaches 5,000 To Mark Record For US Stocks

FAA Mandates Boeing 737 MAX Rudder Loose Bolt Inspections

Mercedes, Stellantis Battery Firm Nears EUR4.4 Bln Debt Deal

SoftBank Set For Biggest Two-Day Rally Since 2020 As Arm Surges

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0850 (EU2.79b), 1.0900 (EU2.08b), 1.0700 (EU1.15b)

USD/JPY: 147.50 ($1.43b), 148.65 ($1.1b), 148.50 ($1.07b)

USD/CAD: 1.3350 ($1.38b), 1.3300 ($1.09b), 1.3400 ($765.7m)

USD/CNY: 7.2115 ($1.25b), 7.1500 ($1.14b), 7.0000 ($920m)

AUD/USD: 0.6500 (AUD689.5m), 0.6605 (AUD660.1m), 0.6510 (AUD570.7m)

GBP/USD: 1.2725 (GBP331.6m), 1.2560 (GBP329.8m)

USD/BRL: 4.7250 ($750m), 4.5750 ($750m)

FX options continue to experience low volatility, keeping implied volatility, inspiration, and trade volumes low. Traders are hoping for a spark in FX volatility from Tuesday's U.S. CPI data, but are struggling with the daily time decay costs of holding options that expire afterwards. Market focus remains on data and central bank meetings for clearer policy signals, while realised and implied volatility are expected to stay at two-year lows. Strong U.S. data may lead to market pricing adjustments to the Fed's rate cut predictions, potentially fueling USD recovery but not guaranteeing rapid acceleration or increased volatility. Those seeking limited USD gains may consider cheaper USD call options with reverse-knock-out triggers. The JPY was the only notable mover, falling after BoJ Dep Gov Uchida's comments, but lacking volatility and failing to generate renewed option interest.

CFTC Data As Of 2/02/24

USD bearish neutral -5,618

CAD neutral neutral -178

EUR bullish neutral 12,034

GBP bullish neutral 2,711 218

AUD bearish increasing -3,849

NZD neutral neutral -64

MXN bullish neutral 2,343

CHF bearish neutral -566

JPY bearish increasing -6,813

Technical & Trade Views

SP500 Bullish Above Bearish Below 4975

Daily VWAP bullish

Weekly VWAP bullish

Below 4970 opens 4950

Primary support 4840

Primary objective is 5025

EURUSD Bullish Above Bearish Below 1.0830

Daily VWAP bullish

Weekly VWAP bearish

Above 1.109 opens 1.10

Primary resistance 1.0950

Primary objective is 1.0650

GBPUSD Bullish Above Bearish Below 1.2660

Daily VWAP bullish

Weekly VWAP bearish

Above 1.27 opens 1.2770

Primary resistance is 1.2785

Primary objective 1.2570 - Target Hit New Pattern Emerging

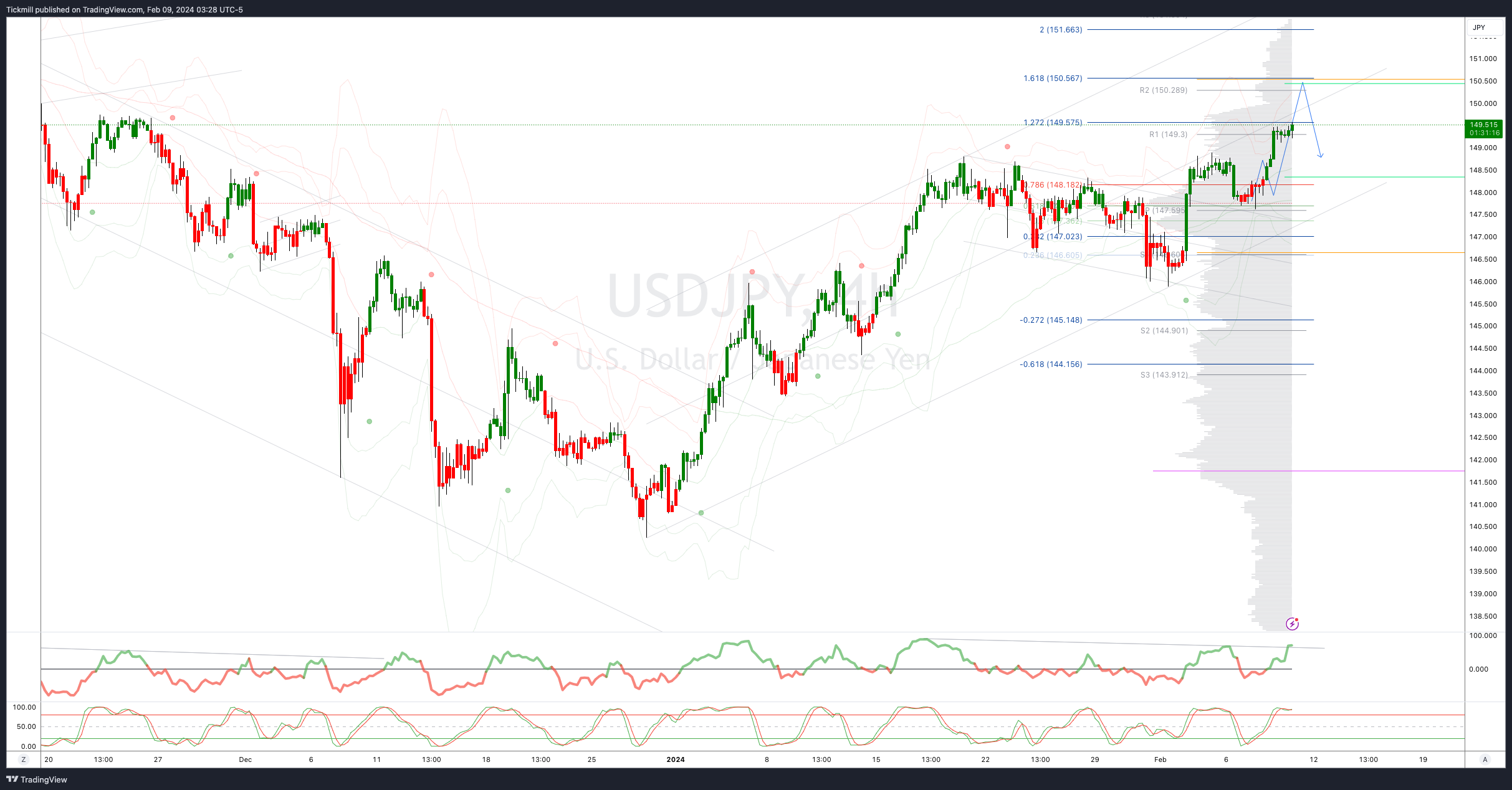

USDJPY Bullish Above Bearish Below 147.50

Daily VWAP bullish

Weekly VWAP bullish

Below 146 opens 145.50

Primary support 143.50

Primary objective is 149.50

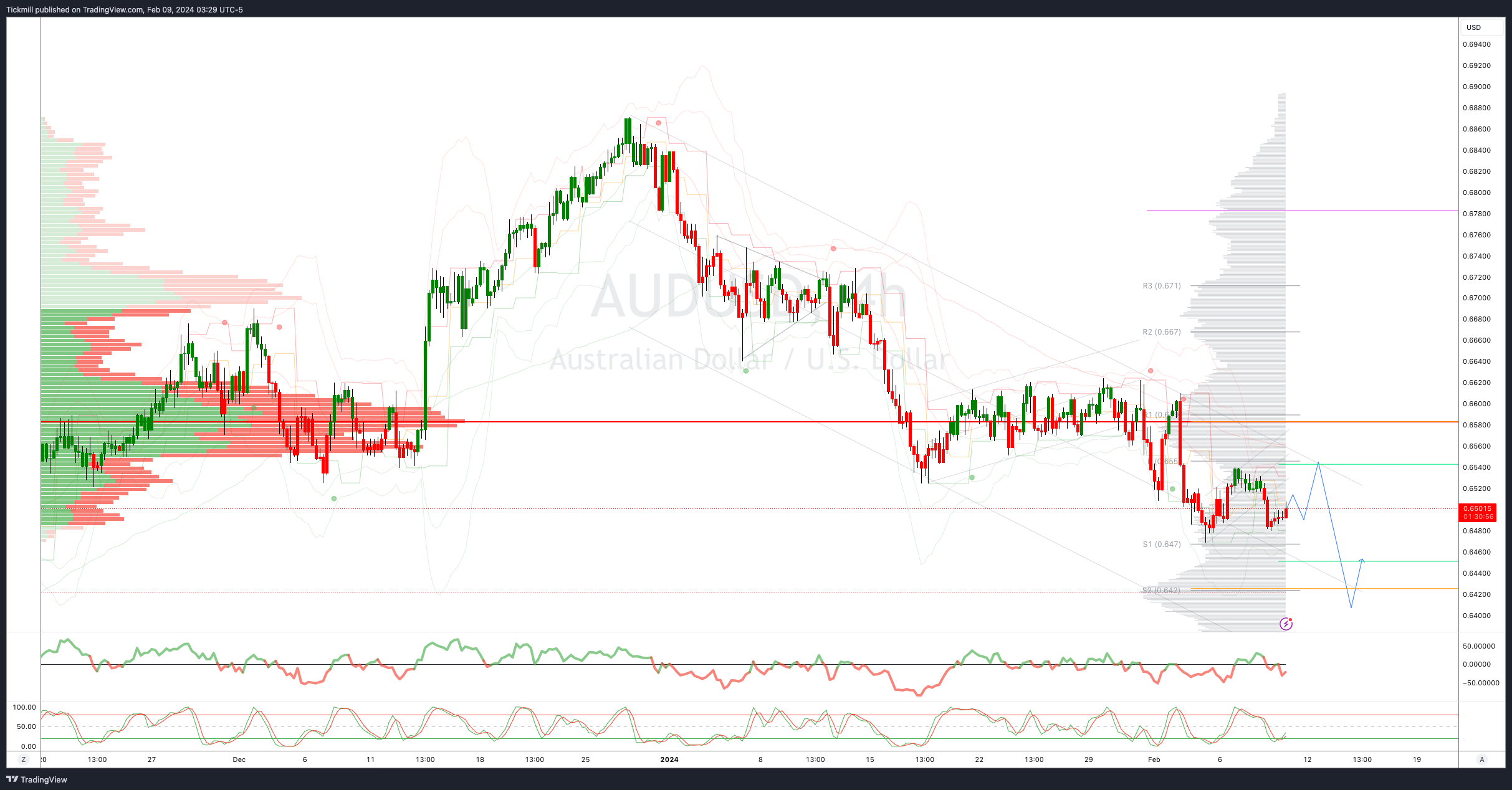

AUDUSD Bullish Above Bearish Below .6650

Daily VWAP bearish

Weekly VWAP bearish

Below .6500 opens .6420

Primary support .6525

Primary objective is .6260

BTCUSD Bullish Above Bearish below 43850

Daily VWAP bullish

Weekly VWAP bullish

Above 43600 opens 44700

Primary resistance is 44700

Primary objective is 44700 - Target Hit New Pattern Emerging

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!