Daily Market Outlook, February 6, 2020

The US market rallied overnight as traders looked past the potential economic impact of the current Coronavirus outbreak and focused on upbeat US data. China is to cut tariffs by as much as 50% on USD 75bln of US goods effective February 14th.

China reported total coronavirus cases were now at 28018 and total death toll at 563 as of Feb. 5th. China announced it would halve tariffs on some goods imported from the US in a move expected to bolster market sentiment that has been hit by the coronavirus epidemic.

The S&P500 and NASDAQ gained 1.1% and 0.43% respectively to notch their all-time record high while the Dow Jones added 1.7% in one single day. Global equities had also enjoyed substantial gains earlier of the day with key indexes in both Europe and Asia all ended on higher notes.

Treasury yields extended further climbs of 3-6bps as sentiment brightened - 10Y UST yields closed 5bps higher at 1.65%. On the commodity front, gold futures was little changed at 1,556.02/ounce while crude oils recovered strongly and locked in more than 2% gain – Brent crude settled at $55.28/barrel.

President Trump was acquitted along party lines in his Senate impeachment trial as widely expected.

US ADP job gain job beat expectation at 291k: The US private sector added a whopping 291k news jobs in January according to the latest ADP National Employment report, smashing analysts’ estimate of 157k and was its largest increase since May-2015. Job gains came primarily from the services sector (+237k), whereas the goods producing sector added a mere 54k jobs of which manufacturing went up by 10k and construction gained 47k. The latest report again confirmed that the US labour market is super tight, suggesting that the official NFP job report due Friday could surprise to the upside as well.

Resilient and strengthening US services sector: The ISM non manufacturing index came in stronger at 55.5 in January (Dec: 54.9) reaffirming the strength in US services sector at the start of the new year. January expansion reflects the surge in production and new orders while other categories generally recorded smaller gains. Respondents across industries appeared optimistic over growth and sales outlook; however some said that the labour market remained a challenge, the other mentioned that they would closely monitor the Coronavirus outbreak in China.

IHS Markit Service PMI was revised upward from 53.2 to 53.4 in January (Dec: 52.8), aligning itself with the ISM index to confirm the current solid state of the services sector.

US annual trade deficit narrowed for the first time in six years thanks to the trade war with China: US December trade deficit widened to $48.9b (Nov: -$43.7b revised) as higher MOM imports growth outpaced a lacklustre gain in exports at year end. For the full year of 2019, it recorded a smaller annual trade gap of $616.8b (2018: -$627.7b), marking its first shrinkage in six years as trade deficit had been widening since 2015. The annual goods deficit with China narrowed by 17.6% to $345.6b (2018: -$419.5) after hitting a record high in 2018, reflecting a 16% drop in imports of Chinese goods and a 11% fall in exports to China as both countries were engaged in a trade dispute for the entire year. On a separate note, mortgage applications rose 5.0% last week (previous: +7.2%), a smaller increase despite lower rates.

Eurozone services PMI remains solid at start of the year: Eurozone IHS Markit services PMI was revised up from 52.2 to 52.5 in January (Dec: 52.8) according to a final reading that indicate a little change in services activity in the Eurozone at the start of the year. January’s print again proved that the services industry remains a vital pillar to support growth as the manufacturing sector is still mired in downturn. On a separate note, Eurozone retail sales slipped 1.6% MOM in December (Nov: +0.8% revised) on the back of a broad-based decline, leaving the annual gain in retail sales at a smaller 1.3% YOY (Nov: +2.3%).

UK services rebounded strongly in January: The IHS Markit/CIPS Services PMI was revised from 52.9 to 53.9 in January (Dec: 50.0) in a final reading, indicating that the services sector started the year on solid footing as the removal of Brexit uncertainties following December general election helped business to return to growth.

Japan services sector returned to growth: The Jibun Bank Japan Services PMI rose to 51.0 in January (Dec: 49.4) after a contraction at year end, to signal a rebound in business activity, led by a rising output, new orders and employment.

Modest increase in China services business activity: The Caixin services PMI for China slipped to 51.8 in January (Dec: 52.5) to signal a softer rise in services activity at the start of the year. New foreign orders were offset by slower domestic new order. The survey hasn’t taken into consideration the Coronavirus outbreak that has only intensified for the past two weeks.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.0900 (EUR501mn); 1.1050 (EUR384mn); 1.1100 (EUR351mn)

- GBPUSD: 1.2975 (GBP637mn); 1.3000 (USD369mn)

- USDJPY: 108.50 (USD912mn); 108.80 (USD358mn); 109.00 (USD1.8bn); 109.10 (USD801mn); 109.75 (USD300mn)

- AUDUSD: 0.6700 (AUD979mn); 0.6800 (AUD618mn)

Technical & Trade Views

EURUSD (Intraday bias: Bullish above 1.1050 Bearish below)

EURUSD From a technical and trading perspective, the breach of 1.1030 suggests a false upside break and a retest of bids and stops below 1.10, a failure below 1.0980/60 would be significant development exposing binds and stops below 1.09

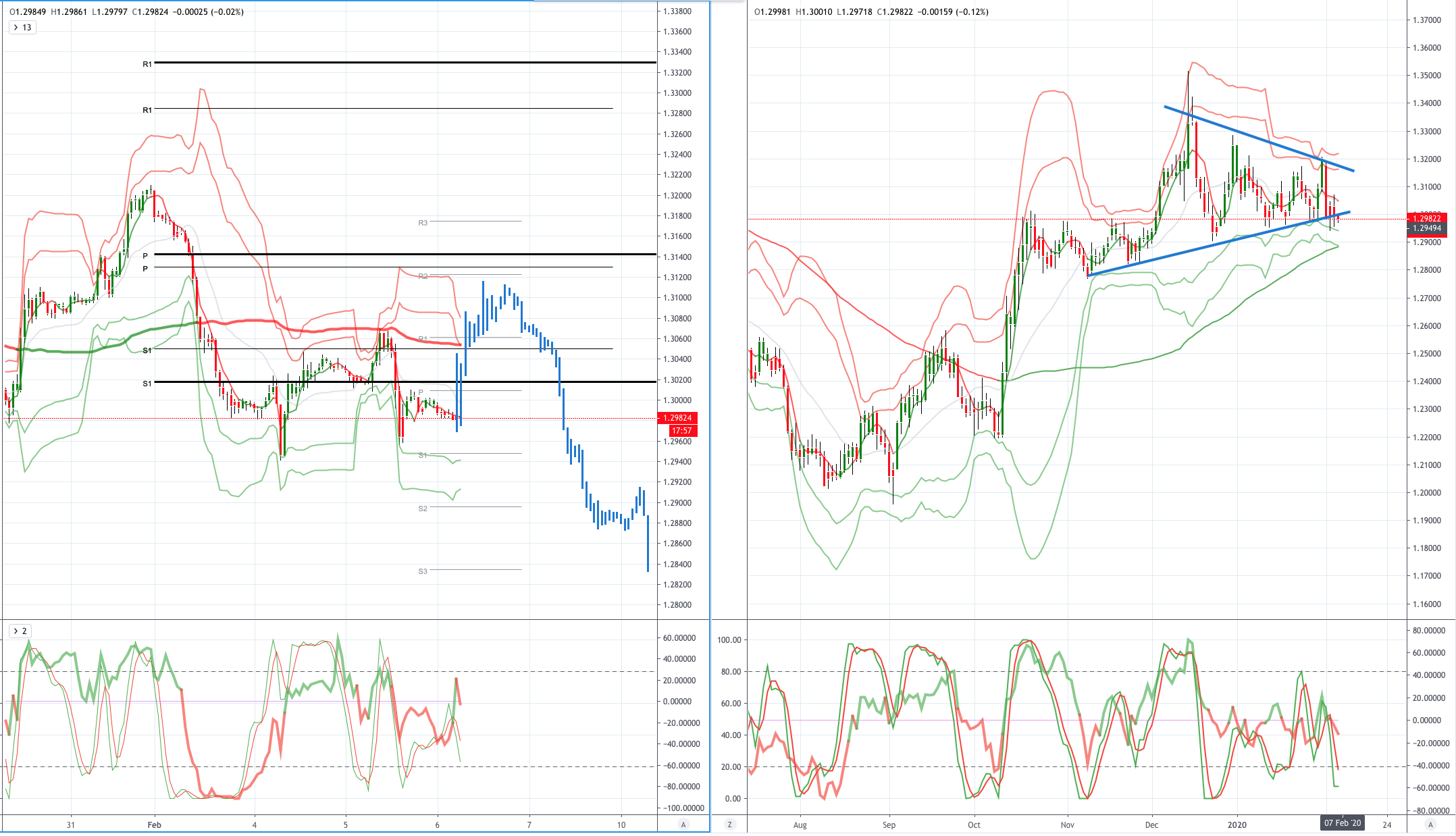

GBPUSD (Intraday bias: Bearish below 1.3160)

GBPUSD From a technical and trading perspective, the failure below 1.31 confirmed another false upside break and return to test range support below 1.30 as 1.3160 act as resistance look for a test of the yearly pivot towards 1.29

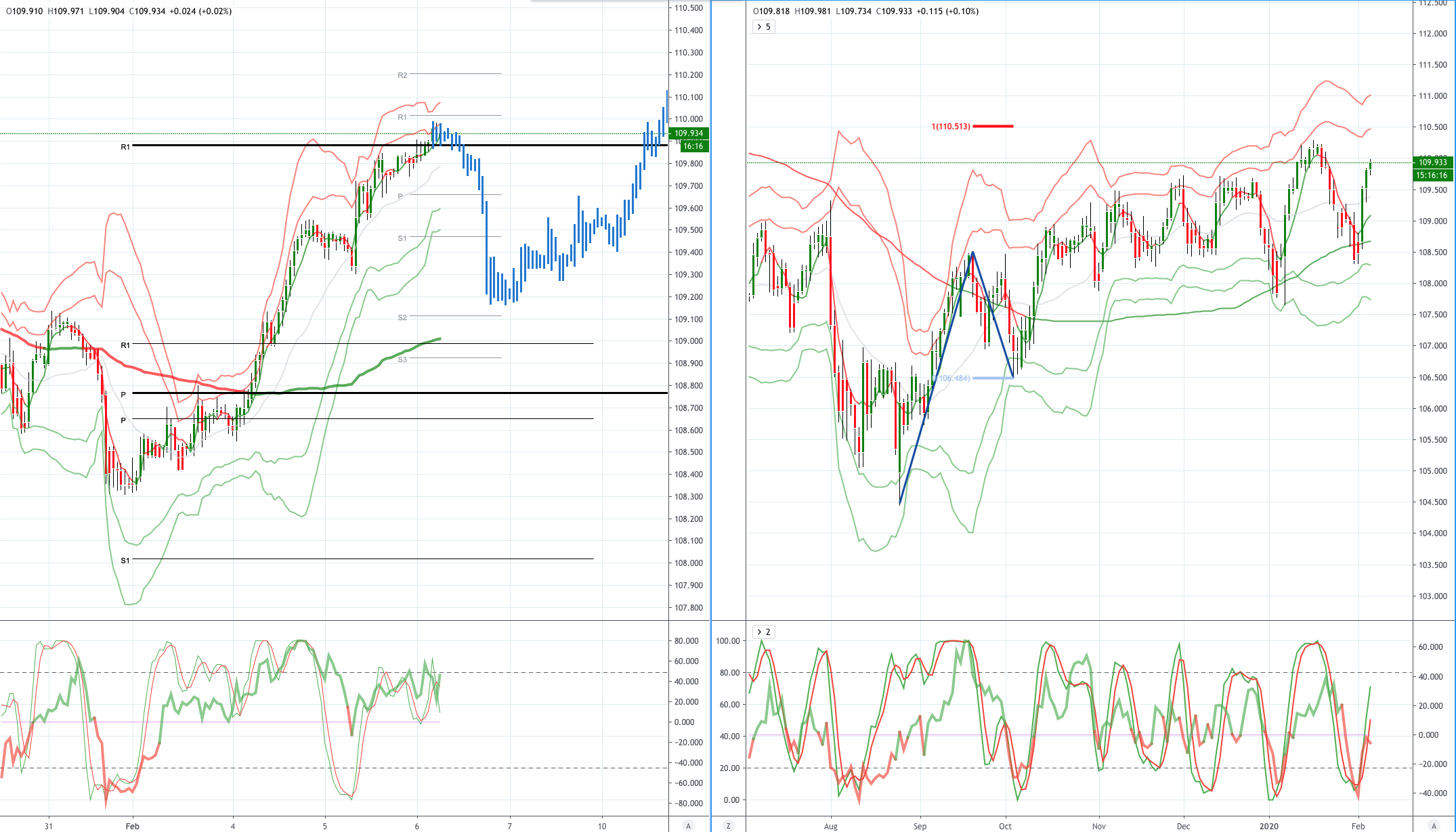

USDJPY (intraday bias: Bullish above 108.60)

USDJPY From a technical and trading perspective, the day only a close back through 108.80 suggests a reversal in sentiment and target a retest of 109.50 offers and stops. With the sustained grind higher as 109.20 caps corrections look for a test of offers and stops to 110.50

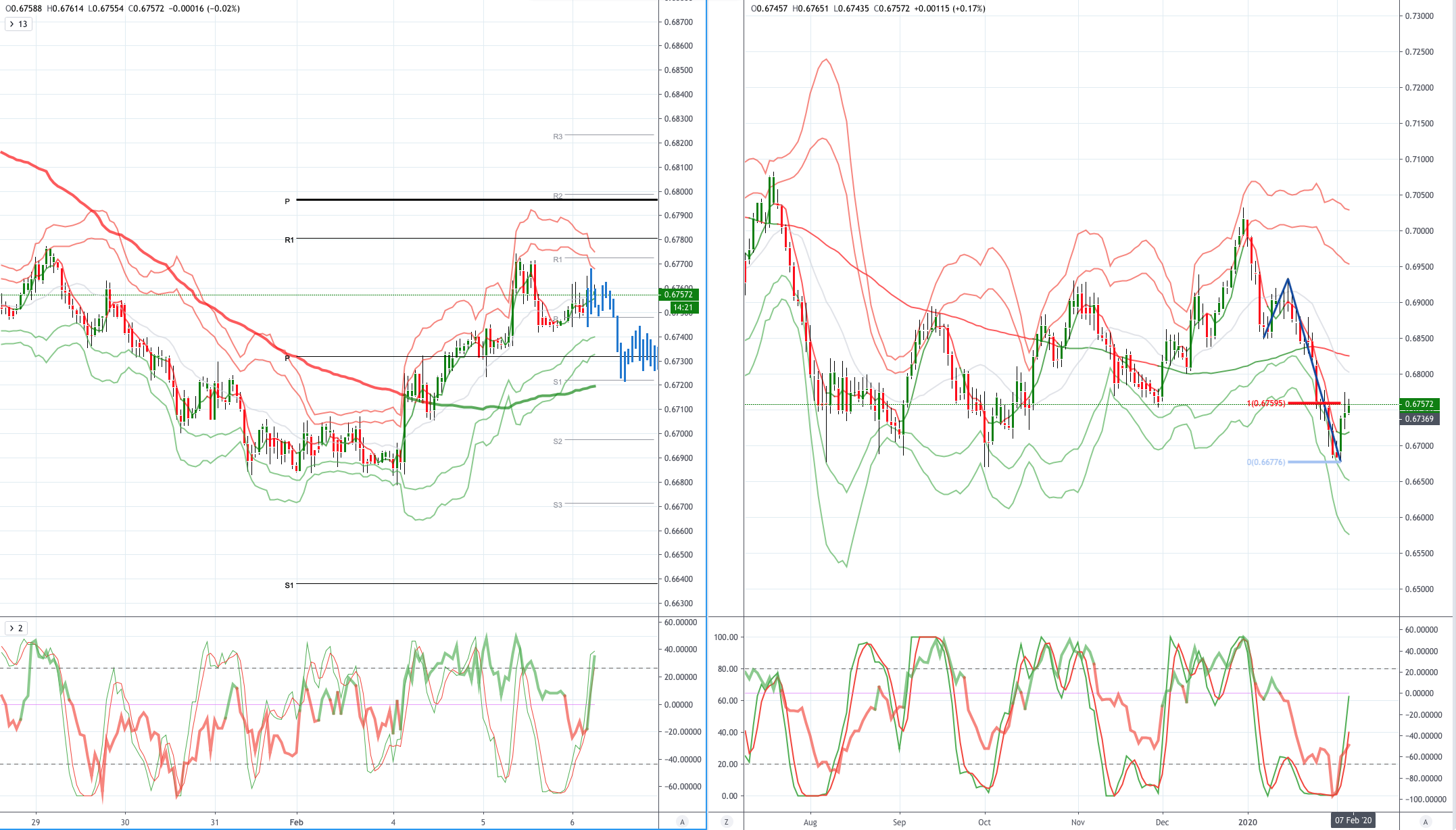

AUDUSD (Intraday bias: Bullish above .6720 Bearish below)

AUDUSD From a technical and trading perspective, .6680 yearly first support pivot point attracts bids overnight, a daily close above .6720 will flip the daily charts bullish and open a test of offers towards .6800 and stops above, the key upside hurdle is the symmetry swing and equidistant swing resistance sited ay .6760/80. No close above pivotal resistance is a concern for bulls, without a close above this resitance swing lows are vulnerable for retest

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!