Daily Market Outlook, February 5, 2020

Fatalities from the new coronavirus has climbed towards 500, but the market seems to be showing some signs of relief that the death toll so far remains mostly contained in China and specifically in the Hubei province. China’s Caixin services PMI fell to a 3‑month low of 51.8, but remained above 50.

President Trump was upbeat about the US economy in his State of the Union address on the eve of his expected impeachment acquittal. In terms of a Democrat challenger in the November election, the partial count of the Iowa caucus showed Pete Buttigieg in first place, while frontrunner and former Vice President Joe Biden came fourth.

Global stocks staged a relief rally on Tuesday as markets took respite in the PBOC’s 1.7 trillion yuan ($242.7b) stimulus injection via reverse repos to counter Coronavirus outbreak related economic slowdown. The Shanghai Composite Index (+1.3%) managed to recoup some losses following a sharp selloff in the previous session.

Tracking higher Asian and European markets, major US indexes gained 1.5-2% overnight, their largest one day gains in months; Nasdaq climbed to an all-time high. Treasuries yields rose 5-7bps as investors exited safe havens assets. Gold prices continued to retreat by 1.5% to $1552.92/ounce, but crude oil futures failed to regain footing despite a return of risk sentiment and lost around 1%; Brent crude closed at $53.96/barrel on Tuesday. The greenback partially weakened, recording mixed performance across the FX board.

RBA hold rate unchanged: The RBA left cash rate unchanged at 0.75%, ending weeks of speculations over the central bank’s potential response to the recent devastating wildfire crisis. RBA said that there have been signs that the slowdown in global growth is coming to an end, and global growth is expected to be “a little stronger” this year and next. It however cautioned the continuing US-China trade uncertainty as well as the new coronavirus outbreak which is having a significant effect on the Chinese economy. RBA expects GDP growth to be around 2.75% in 2020 and 4% in 2021, a step up from past two years’ growth rates.

“Bushfires and coronavirus outbreak will temporarily weigh on domestic growth”, but consumption is expected to pick up gradually. Unemployment rate is expected to remain around 5.1% for some time before slipping below 5% in 2021 while CPI inflation is to be around 2% in the near term. RBA also reiterated how the easing of policy last year had helped supporting growth and returning inflation back to its medium term target rate. It concluded by saying that the decision to hold rate steady was made as interest rates have already been “reduced to a very low level” and it recognised “the long and variable lags in the transmission of monetary policy”. It is reasonable to expect that an extended period of low interest rates will be required in Australia. RBA maintained its dovish stance, adding that it “remains prepared to ease monetary policy further if needed to support sustainable growth in the economy, full employment and inflation.

Defense boosted US factory orders recovered at year end: The headline factory orders rebounded to increase 1.8% MOM in December (Nov: -1.2% revised) following a newly revised loss in the previous month. Breakdown shows that durable good orders recovered by 2.4% MOM (Nov: -3.1%) mainly driven by a surge in defense aircrafts. Core capital orders, a key gauge of US business investment however dropped by 0.8% MOM (Nov: 0.0%) following a flatline reading.

Eurozone factory prices continued to fall: Eurozone producer prices index was unchanged in December (Nov: +0.1%), leaving the PPI index to record a smaller drop of 0.7% YOY (Nov: -1.4%). December print marks the index’s fifth consecutive month of annual decline, extending its current state of deflation at Eurozone factories amidst a manufacturing downturn.

The afternoon focus will be on a number of US data releases, most notably January ADP employment and ISM non-manufacturing reports. The ADP was unexpectedly strong in December (202k) look for a more moderate gain in private sector jobs, which would be broadly in line with the past year’s average. Official labour market data due on Friday.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.0900 (EUR501mn); 1.1050 (EUR384mn); 1.1100 (EUR351mn)

- GBPUSD: 1.2975 (GBP637mn); 1.3000 (USD369mn)

- USDJPY: 108.50 (USD912mn); 108.80 (USD358mn); 109.00 (USD1.8bn); 109.10 (USD801mn); 109.75 (USD300mn)

- AUDUSD: 0.6700 (AUD979mn); 0.6800 (AUD618mn)

Technical & Trade Views

EURUSD (Intraday bias: Bullish above 1.1050 Bearish below)

EURUSD From a technical and trading perspective, the spike through 1.1050 was satisfied by bids below as yesterday's lows support look for a test of offers and stops above 1.11. A breach of 1.1030 would suggest a false upside break and a retest of bids and stops below 1.10

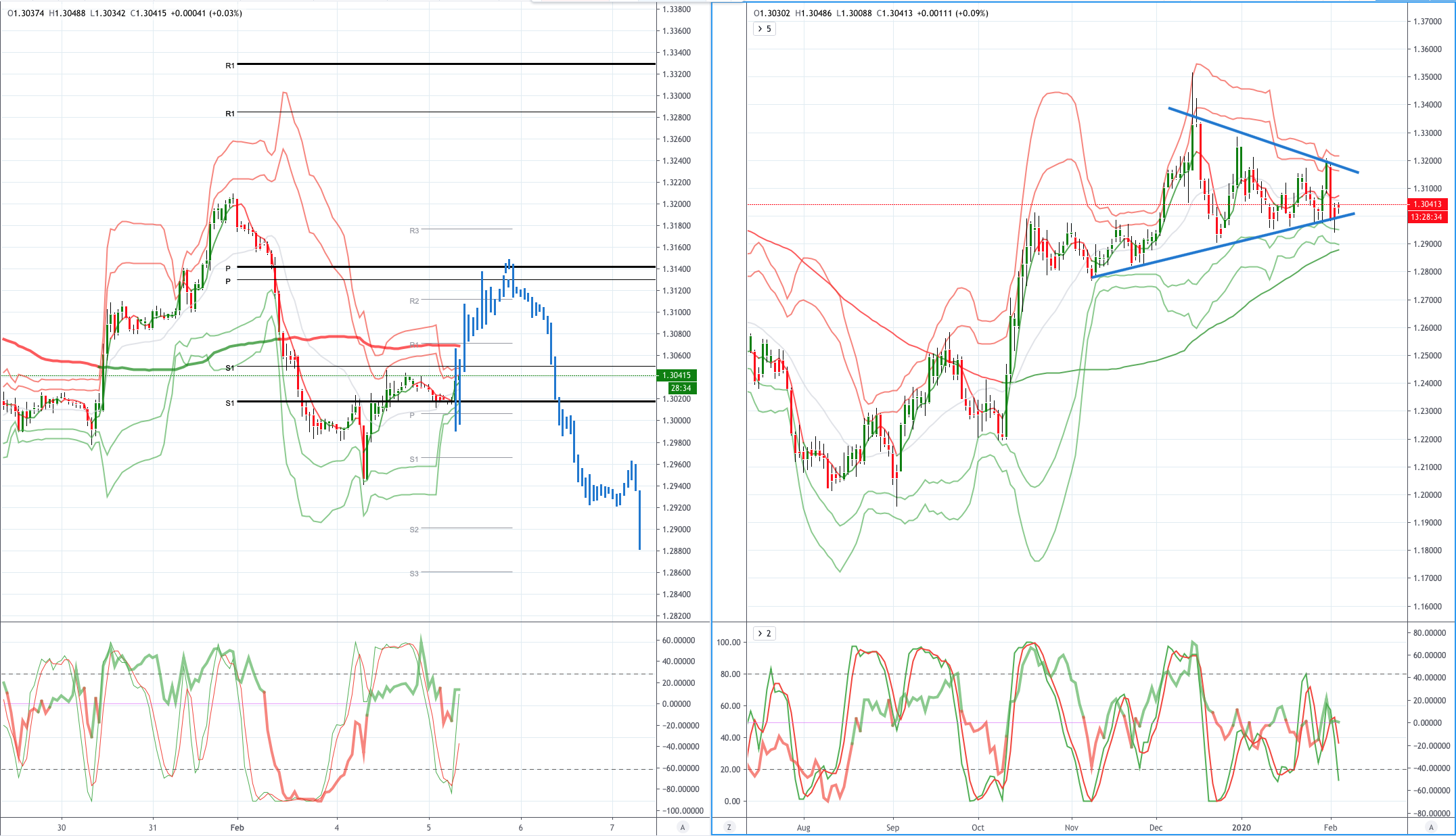

GBPUSD (Intraday bias: Bearish below 1.3160)

GBPUSD From a technical and trading perspective, the failure below 1.31 confirmed another false upside break and return to test range support below 1.30 as 1.3160 act as resistance look for a test of the yearly pivot towards 1.29

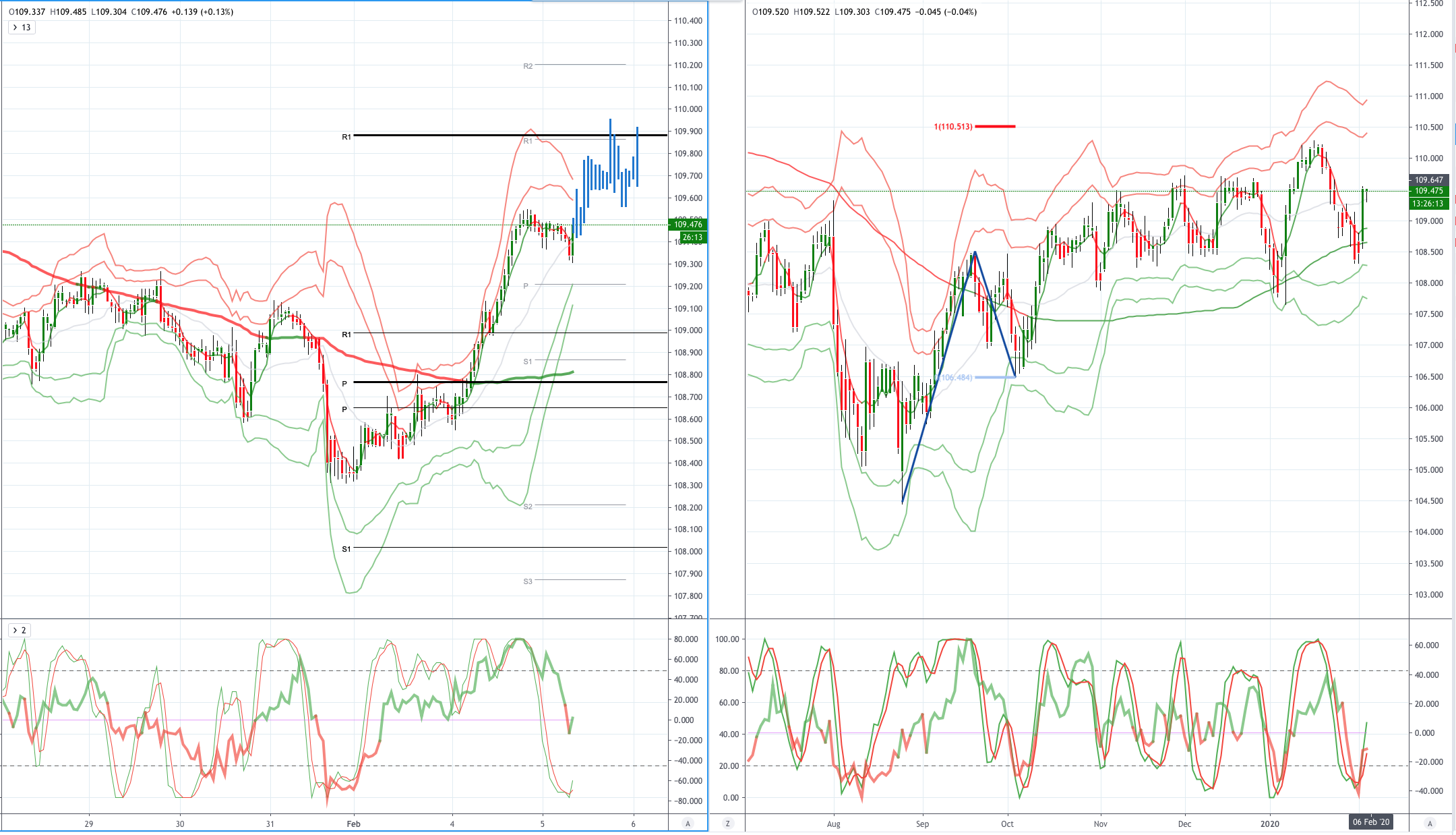

USDJPY (intraday bias: Bullish above 108.60)

USDJPY From a technical and trading perspective, the day only a close back through 108.80 suggests a reversal in sentiment and target a retest of 109.50 offers and stops.. With yesterday's sustained drive higher as 109.20 caps corrections look for a test of offers and stops to 110.00

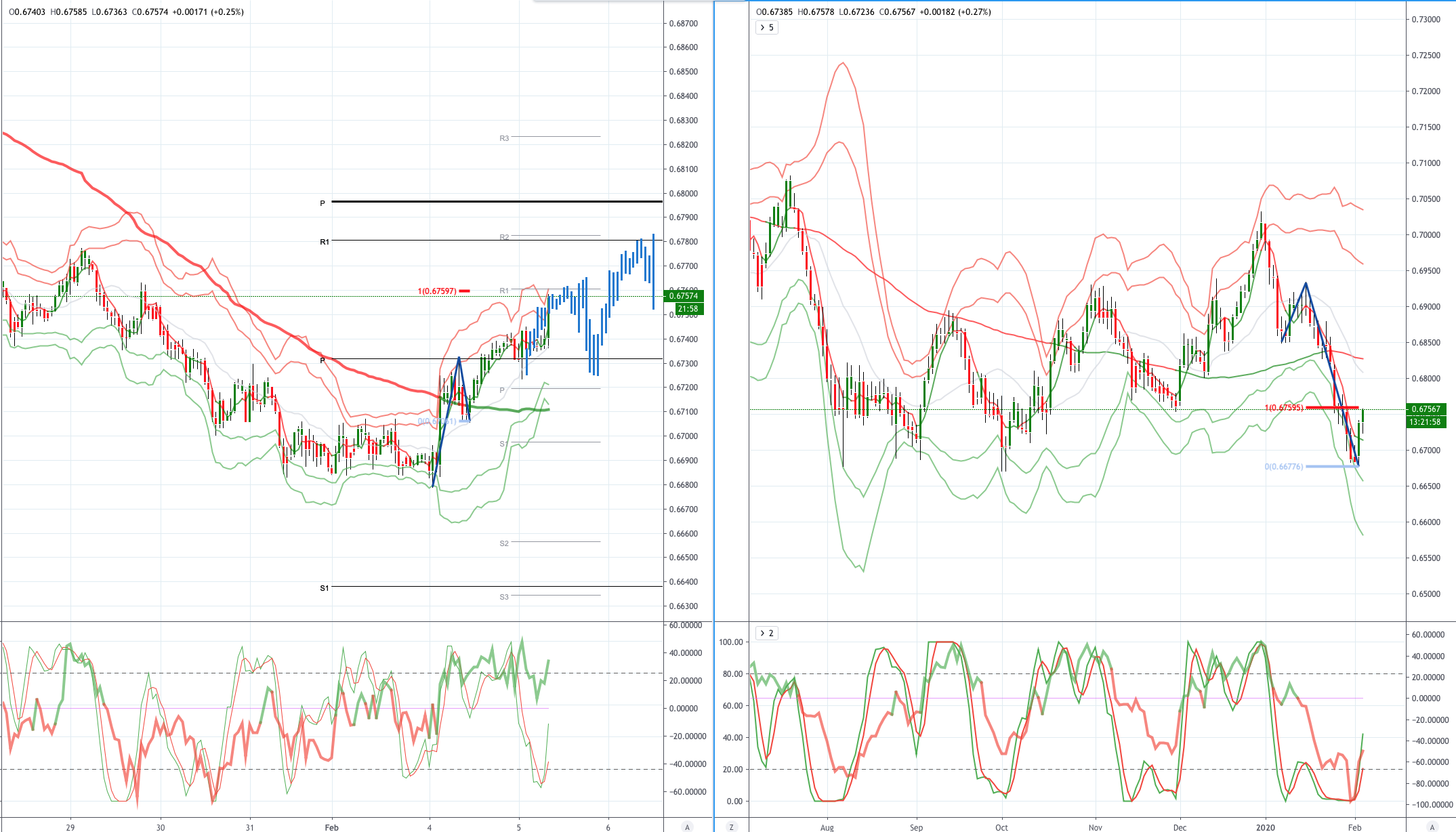

AUDUSD (Intraday bias: Bullish above .6720 Bearish below)

AUDUSD From a technical and trading perspective, .6680 yearly first support pivot point attracts bids overnight, a daily close above .6720 will flip the daily charts bullish and open a test of offers towards .6800 and stops above, the key upside hurdle is the symmetry swing and equidistant swing resistance sited ay .6760.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!