Daily Market Outlook, February 3, 2020

Having been closed for more than two weeks, the Chinese market opened sharply lower with major indices in China down by around 8%, as traders were given their first chance to react to the coronavirus. In a bid to support the financial system, Chinese authorities embarked on various measures, centred on cuts to short-term lending rates in a bid to inject liquidity into the system.

Concerns about the spread of coronavirus continue to dominate and the number of confirmed cases has passed the reported total during the 2003 SARS outbreak. Both US Fed Chair Powell and the BoE’s Carney noted last week that their institutions were monitoring the economic effects. It is difficult to put a number on the likely effect until its extent is known. In 2003, China GDP initially fell sharply (by 2ppts between Q1 and Q2) but then rebounded quickly.

In the wake of the UK leaving the EU, the focus is now on the negotiations on the future trading relationship. Later today, the EU’s chief negotiator, Michel Barnier, will present a draft mandate for the negotiations with the UK, setting out the EU’s position for the talks. Reports suggest he is expected to warn that a quota and tariff free trade agreement is unlikely unless there is alignment to EU standards. UK PM Johnson is also due to speak today (11:00GMT), setting out his red lines for the discussions. One of which is rumoured to be a pledge not to align to EU rules after Brexit.

The Reserve Bank of Australia (RBA) will provide its latest policy update early tomorrow. Until recently, markets thought there was a significant probability that it would use the opportunity to cut rates. However, following stronger-than-expected employment and inflation data it is now expected to leave policy on hold. Nevertheless, the RBA is likely to maintain an easing bias and may cite the recent bushfires and the coronavirus as downside risks.

US inflation remained benign in December: The latest personal outlay report shows that US personal income rose a mere 0.2% MOM in December (Nov: +0.4% revised), again reaffirming the lack of income growth in recent months that explains a modest rise in personal consumption expenditure (PCE) or personal spending (+0.3% MOM vs +0.4% revised). Meanwhile, the core PCE price index, the Federal Reserve’s preferred inflation gauge recorded 0.2% MOM (Nov: +0.1%) and 1.6% YOY (Nov: +1.5% revised) increases, still markedly below the central bank’s 2% target that reflects a lack of inflationary pressure in the economy.

Resilient US consumer sentiment: The University of Michigan Consumer Sentiment Index rose slightly to 99.8 in January (Dec: 99.3), close to the index’s cyclical peak levels despite “overall slow pace of economic growth”, “renewed military engagements in the Mideast, an impeachment trial in the Senate, and a fast spreading coronavirus”. University of Michigan attributed the remarkable resilience to “record low unemployment, record gains in income and wealth, as well as near record lows in inflation and interest rates”.

Little growth in Eurozone 4Q GDP; muted inflation in December: Eurozone real GDP growth came in at a mere 0.1% QOQ in 4Q (3Q: +0.3% revised), according to a flash reading, a pull-back from the newly revised 0.3% rate observed in 3Q. The reading was a tad softer than a Bloomberg consensus estimate of 0.2% QOQ and was the slowest this year. Compared to the same period last year, the economy expanded 1.0% YOY (2Q: +1.2%) and leaving the full-year 2019 growth at 1.2% (2018: +1.9%), its slowest since 2013 during the tailend of the Eurozone sovereign debt crisis, as a manufacturing downturn weighed on the bloc’s economy for most part of last year. On separate note, the flash HICP inflation rate went up to 1.4% YOY in January (Dec: +1.3%), its quickest growth in nine months, thanks to the higher prices of food, alcohol & tobacco and mainly a surge in energy cost (+1.8% vs +0.2%). The core HICP reading, a gauge of underlying inflation however slipped to 1.1% YOY (Nov: +1.3%) due to the pullback in services inflation, again reflecting the loss of momentum in Eurozone’s underlying inflation.

China PMIs to worsen in February: The official NBS PMI for the manufacturing sector slipped back to the neutral zone of 50.0, matching consensus estimate, indicating no change in factorie activities in the first month of 2020, just ahead of the Lunar New Year celebration and prior to the preventive measures taken by the Chinese government to curb the spread of the new coronavirus. Actions include extending the New year holiday to 10 February of which businesses are barred from resuming work and a travelling ban that prevent the mobility in and out of the city of 11million people. Wuhan and the surrounding region of Hefei and Jiangsu are major manufacturing hubs in China and the temporary halt in businesses would no doubt drag down February manufacturing numbers. Services PMI meanwhile beat expectations at 54.1 in January (Dec: 53.5) and would likely see a much weaker showings this month as locals avoided public spaces in general while major airlines suspended flights to China and foreigners were strongly encouraged to avoid travelling to the country.

Australia manufacturing in deeper downturn in new year: The Performance of Manufacturing Index slipped by nearly 3pts to 45.4 in January (Dec: 48.3), deeper into the contraction territory to indicate a decline in Australia’s manufacturing activity. The lower headline reading was a result of the continuous fall in production, new orders and deliveries in recent months. AiG attributed the downturn to “the combined impact of global trade disruptions, slow local consumption, the residential construction downturn, drought and the ongoing bushfire crisis”.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1075 (EUR530mn); 1.1100 (EUR512mn)

- GBPUSD: 1.3000 (GBP724mn); 1.3100 (GBP393mn); 1.3200 (GBP308mn); 1.3210 (GBP239mn); 1.3250 (GBP368mn); 1.3330 (GBP422mn)

- USDJPY: 108.75 (USD270mn)

- AUDUSD: 0.6750 (AUD799mn); 0.6800 (AUD1.9bn)

Technical & Trade Views

EURUSD (Intraday bias: Bullish above 1.1050)

EURUSD From a technical and trading perspective, the daily close today back through 1.1050 prompted further short covering into the end of the month as anticipated. As 1.1050 now acts as support look for a test of offers and stops above 1.11. A breach of 1.1040 would suggest a false upside break and a retest of bids and stops below 1.10

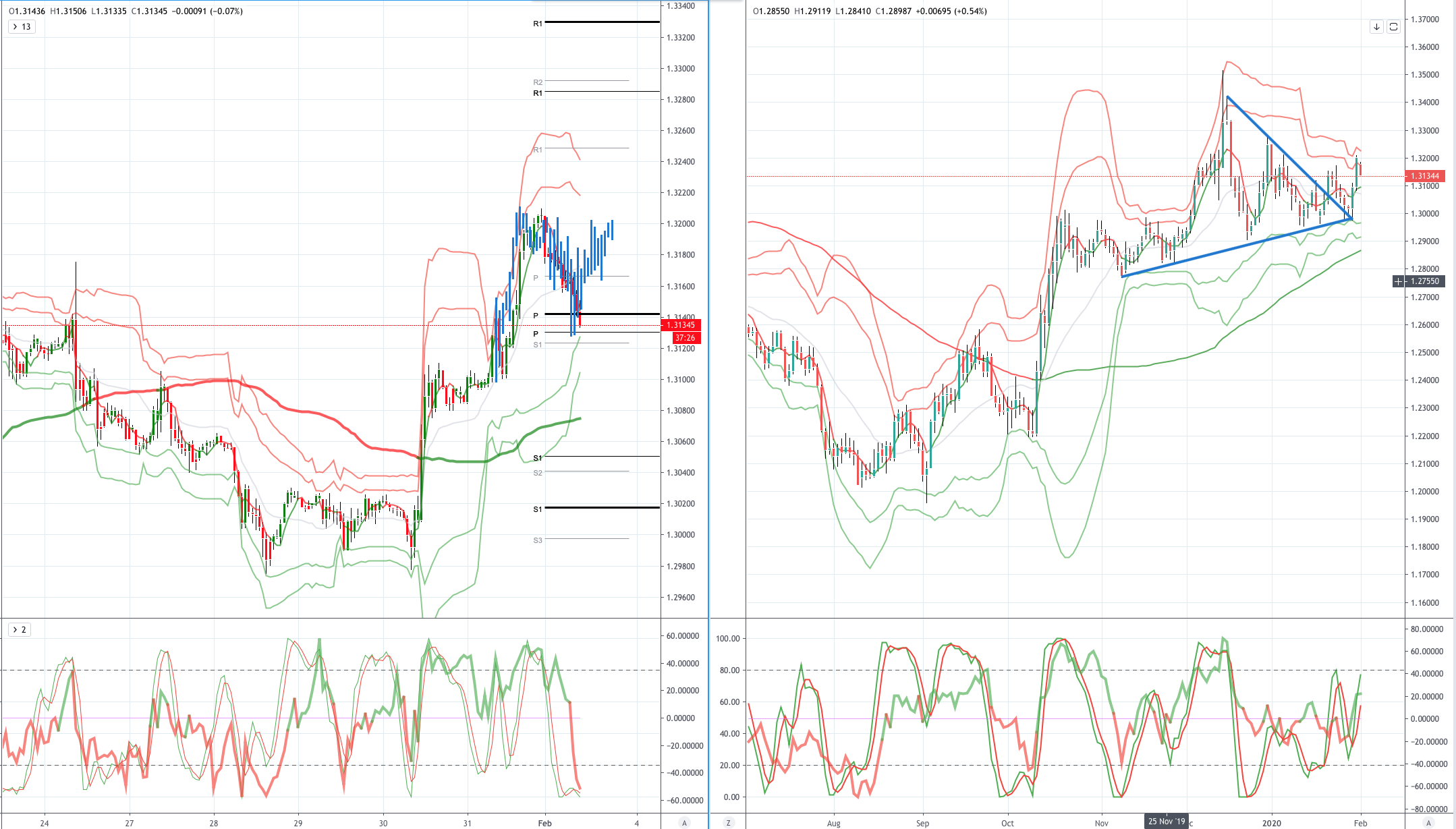

GBPUSD (Intraday bias: Bullish above 1.3100)

GBPUSD From a technical and trading perspective, the daily close above 1.3075 flipped the daily charts bullish and as anticipated was the catalyst for further short covering into the month end. With the expected initial test of offers and stops above 1.32 to acting as intraday resistance. A failure today below 1.31 would suggest another false upside break and return to the 1.30/1.32 range

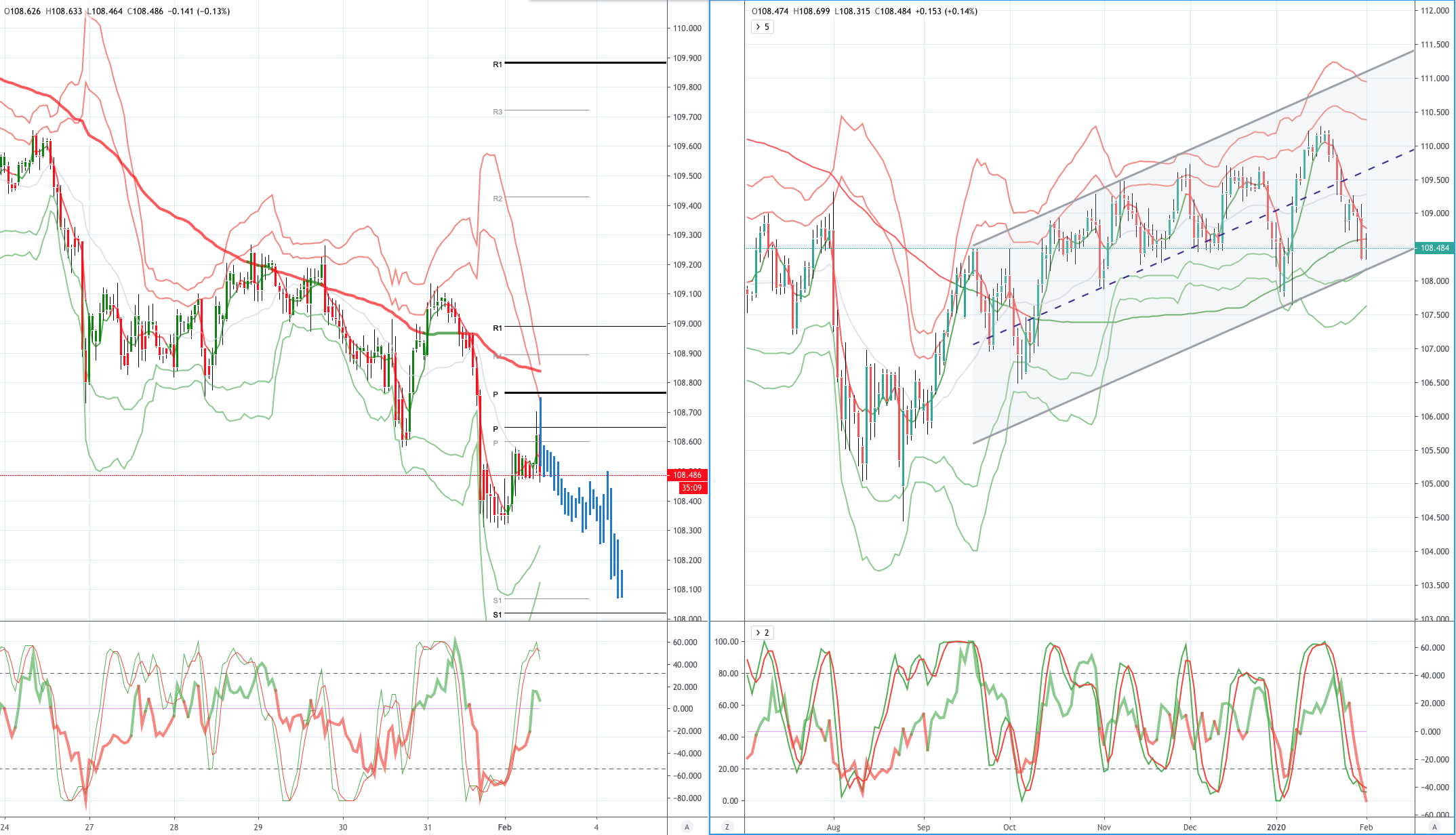

USDJPY (intraday bias: Bearish below 108.60)

USDJPY From a technical and trading perspective, as 108.60 caps upside attempts look for a test of bids and stops below 108. On the day only a close back through 108.80 would suggest a reversal in sentiment and target a retest of 109.50 offers and stops.

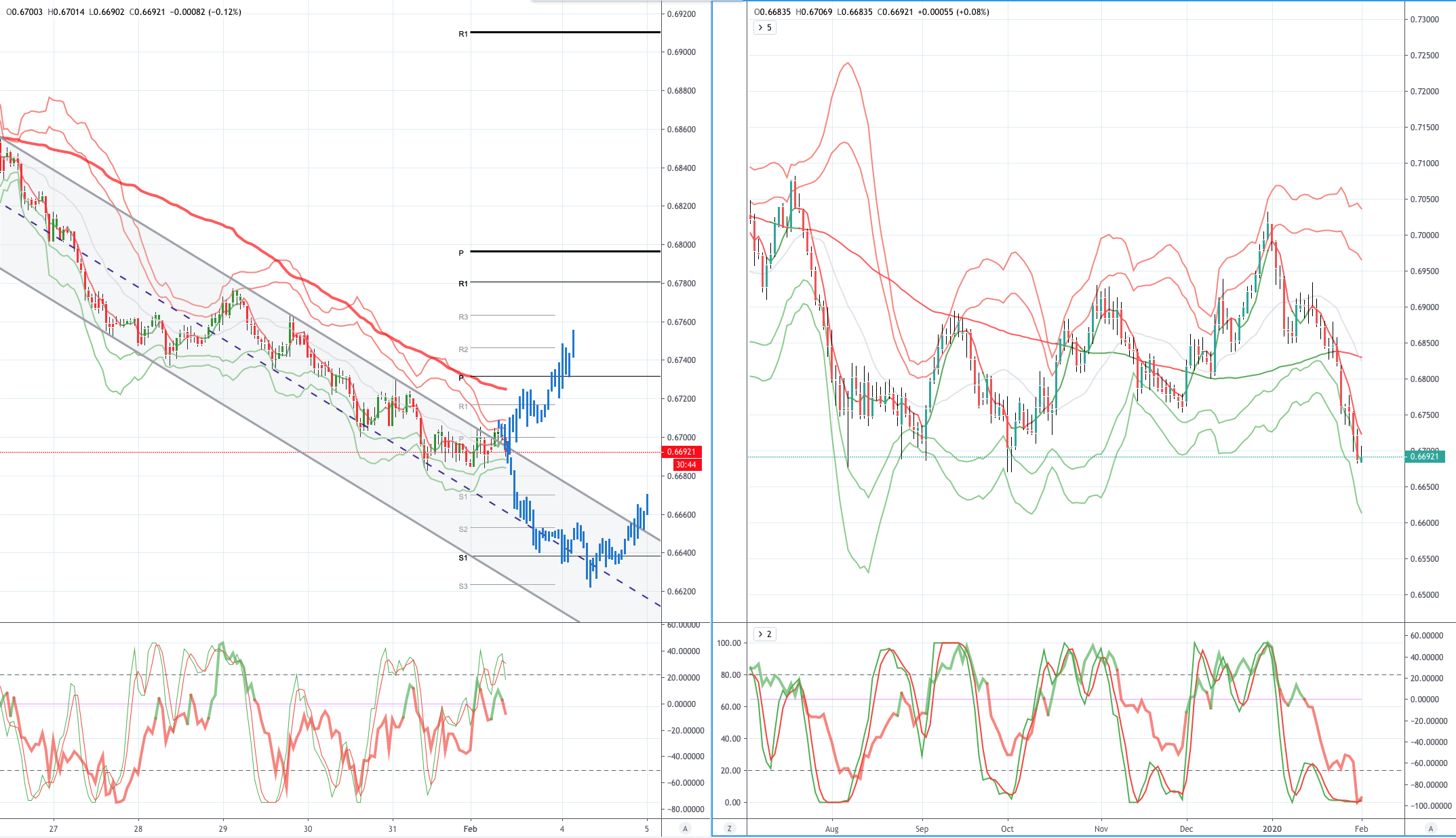

AUDUSD (Intraday bias: Bearish below .6720)

AUDUSD From a technical and trading perspective, the failure below .6730 has opened the a test of bids to .6700 and stops below. As .6720 now acts as resistance, a test of 2019 lows to .6770 is in the cards, a close below here opens .6620 as the next downside objective.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!