Daily Market Outlook, February 25, 2020

A Monday market meltdown, global equities ending in the deep red as the intensifying fear of a potential global pandemic led investors to dump riskier assets for safe havens. Covid-19 cases outside of China jumped dramatically within matter of days, catching authorities off guard; countries like South Korea and Italy now scrambled to contain the virus but many deemed the measures to be a little too late.

The Dow Jones collapsed by more than 1000 pts or 3.6%, its largest single-day drop in two years, effectively wiping out its 2020 gain while the S&P 500 and NASDAQ each lost 3.4% and 3.7%. European stocks sold off sharply where main European benchmarks dropped around 3-4% and Asian markets generally suffered the same fate.

Traders bid up safer assets, leading gold to add nearly 1% to fresh multi-year high of $1659.38/ounce but sold off late in the day as rumours of Bank of International Settlement sales made the rounds . Similarly, bond yields plunged world wide; US treasuries yields slumped by 8-11bps in a single day - benchmark 10Y UST yield lost 10bps to 1.37% after briefly hitting Jun-16’s all-time low of 1.32%. Crude oils extended further losses over poor demand outlook – Brent crude dropped 3.8% to $56.30/barrel.

China officially announced to postpone the National People’s Congress although the new date has not been confirmed. China’s central bank echoed the message from President Xi that it will keep prudent monetary policy more flexible. PBoC also said it will continue to rely on targeted reserve requirement ratio policy tools to support the growth.

On the CFTC front, non-commercial and leveraged accounts moved in favour of the USD as a whole, deepening their net implied USD longs – especially against EUR and antipodeans. Interest to note also, is that GBP longs are building within the non-comm and leveraged accounts.

Little data at the start of the week. In the US, the Chicago Fed National Activity Index rose to -0.25 in Jan to indicate improvement in economic activities. The Dallas Fed Manufacturing Index rebounded from last month’s negative print to 1.2 in Feb.

Cleveland Fed President Loretta Mesta, who spoke on the economy at the NABE conference on Monday, said the worsening coronavirus outbreak represents a threat to the US economy, but not one that yet justifies any change in monetary policy. Mester, who is a voter this year on the FOMC, said she expects the US economy to keep growing healthily, driven by consumer spending that is supported by a 50-year low in unemployment.

Citi Preliminary Month End Rebalancing view: The asset rebalancing signal is stronger than the hedge rebalancing one at +1.4 hist std. dev. The FX impact is USD selling against JPY and GBP at month end

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.0800 (EUR946mn); 1.0810 (EUR408mn); 1.0825 (EUR341mn); 1.0830 (EUR405mn); 1.0835 (EUR324mn); 1.0850 (EUR569mn); 1.0875 (EUR817mn); 1.0950 (EUR601mn); 1.1000 (EUR1.3bn)

- USDJPY: 109.20 (USD546mn); 110.30 (USD295mn); 110.80 (USD450mn); 111.00 (USD267mn)

- AUDUSD: 0.6635 (AUD330mn); 0.6675 (AUD1.4bn)

Technical & Trade Views

EURUSD (Intraday bias: Bullish above 1.0870 bearish below)

EURUSD From a technical and trading perspective, bullish reversal seen Friday has flipped the daily chart bullish, contrarian players will be looking for a move back through 1.09 to encourage trend followers to further cover short positions. The somewhat lacklustre follow through yesterday will likely see a move back through 1.0830 prompting a retest of last weeks lows to test the pivotal 1.0750 monthly trendline support highlighted in Friday’s Chart of the Year.

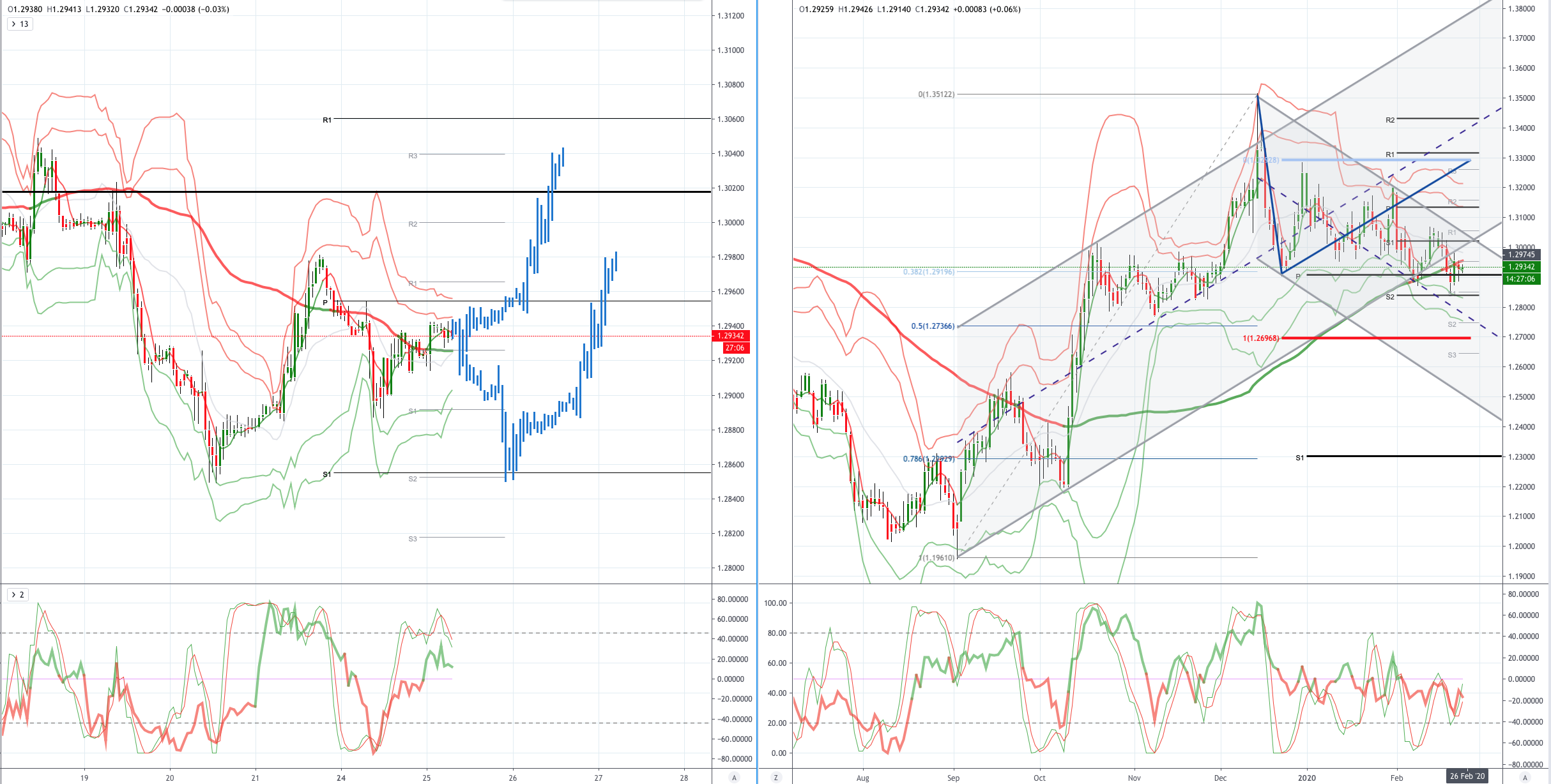

GBPUSD (Intraday bias: Bearish below 1.2980 Bullish above)

GBPUSD From a technical and trading perspective, prices once again holds a test of range support below 1.29 as this area holds there is the potential for another upside attempt to test descending trendline resistance sited around 1.3050, however, a failure to recapture ground above Friday's highs will concern the nascent bullish spirits and likely see a retest of last week's lows before another basing attempt

USDJPY (intraday bias: Bullish above 111.00 Bearish below)

USDJPY From a technical and trading perspective, test of bids and stops to 110.50 prompts a recovery attempt from bulls, however, as 111.10 caps upside attempts look for a more sustained test of bids back towards 110, a failure to find support here will suggest a false upside break and open a move to test support back at 109.50

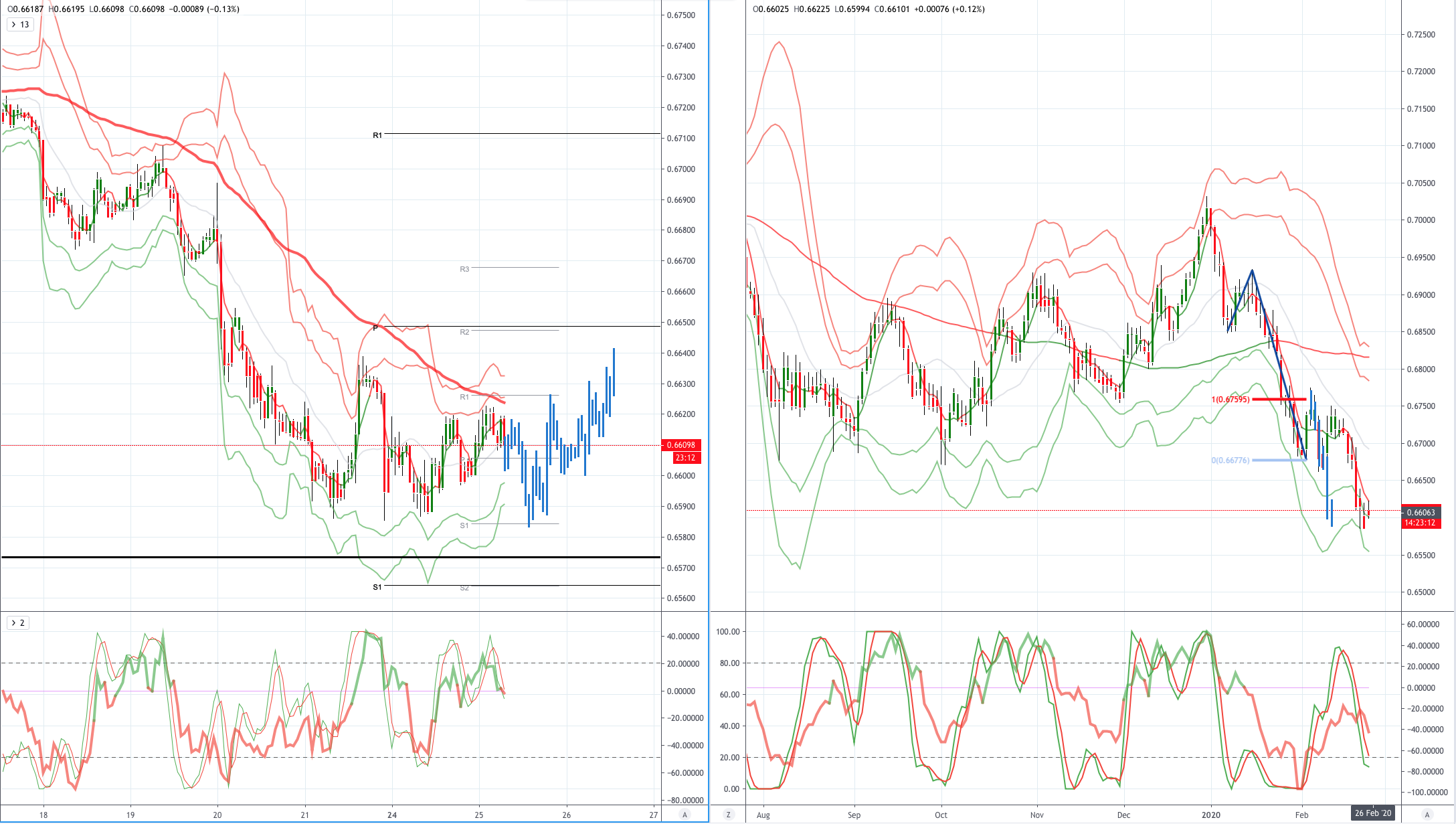

AUDUSD (Intraday bias: Bearish below .6650 Bullish above)

AUDUSD From a technical and trading perspective the equality target down to .6600 has been achieved, anticipate the potential for some profit taking around current levels, as .6570 supports we may witness an attempt to base here for a retest of offers back towards .6650

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!