Daily Market Outlook, February 24, 2020

US market sold off on Friday taking cue from lower European markets as major economies began to feel the effect of Covid-19 outbreak, proven by weaker services PMI in the US, Eurozone, UK and Japan.

Confirmed cases were creeping up in South Korea and Japan, adding to market jittery that we have yet to see the worst of the outbreak. The Dow Jones lost 227pts or 0.8% while the S&P500 and NASDAQ dropped by more than 1% in one day, leading all benchmarks to close more than 1% lower last week, marking stocks’ first weekly decline in three weeks.

Risk aversion continues to grip markets with almost all Asian equity markets starting the week lower, while gold has moved up to a seven-year high. This follows further reports which suggest that the outbreak of the COVID-19 virus has gotten worse.

Over the weekend, the IMF and G-20 finance ministers saw downside risks to the global economy persisting and warned of a global economic fallout.

Coronavirus jitters returned to markets last week ensuring that overall market sentiment increasingly switched into ‘risk off’ mode. Flows into safe-haven assets saw global government bond markets rally, pushing yields lower with 10-year US Treasury yields slipping below 1.50% for the first time since last September.

Currency markets have been less volatile but a key theme is the strength of the US dollar. The Bloomberg USD Index is back close to its 14-month range high as the dollar reached its highest level against the euro since mid-2017.

Investors piled into the relative safety of havens assets – gold price jumped 1.5% to seven-year high of $1643.41/ounce, JPY turned stronger and reversed some losses while treasuries yields slumped by 3-5bps. Crude oil fell on weaker demand outlook- Brent crude tumbled by 1.4% to settle at $58.5/barrel. .

There still seems to be little sign that the spread of the virus has peaked and China has added to the confusion by again revising its daily tally of infections. The consensus expectation continues to be that the economic impact will be similar to the 2003 SARS outbreak with potentially a large near-term hit to economic growth followed by a relatively rapid rebound. However, it will remain difficult to quantify this until the extent of the outbreak becomes clearer.

The economic impact of the coronavirus has started to emerge in business activity surveys, particularly across the Asia Pacific. Weaker activity was evident in regional trade date, while declines were noted in the February PMI reports for Japan and Australia. Further afield, the impact has so far been more limited. However, there were clear signs of supply chain disruptions linked to the virus outbreak. As a result, manufacturers across the Eurozone and the UK experienced a lengthening in suppliers’ delivery times.

For today, markets expect the February German IFO business climate survey to show declines in all the components, reflecting coronavirus-related supply chain disruptions. Further reversing some of the recent improvement in the survey balance.

In the US, outside of a couple of regional business activity surveys – Chicago (Jan) and Dallas (Feb) – the focus will be centred on voting-FOMC member Mester’s speech. In a recent interview, Mester suggested that the Fed’s policy decisions should include more detail, in a bid to try and narrow the gap between market expectations for US interest rates and the Fed’s own central view.

Meanwhile, the Bank of England’s Chief Economist Andy Haldane is due to speak this evening. His speech is titled, “The Wealth, Health and the Happiness of Nations”, which suggests the focus is unlikely to focus on the near-term outlook for policy.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.0750 (EUR374mn); 1.0775 (EUR414mn); 1.0800 (EUR331mn); 108.10 (EUR352mn); 1.0825 (EUR382mn); 1.0830 (EUR414mn); 1.0885 (EUR453mn); 1.0935 (EUR364mn)

- AUDUSD: 0.6775 (AUD347mn)

Technical & Trade Views

EURUSD (Intraday bias: Bullish above 1.0870 bearish below)

EURUSD From a technical and trading perspective, bullish reversal seen Friday has flipped the daily chart bullish, contrarian players will be looking for a move back through 1.09 to encourage trend followers to further cover short positions. A failure to follow through today will likely see a move back through last weeks lows to test the pivotal 1.0750 monthly trendline support highlighted in Friday’s Chart of the Year

GBPUSD (Intraday bias: Bearish below 1.2980 Bullish above)

GBPUSD From a technical and trading perspective, prices once again holds a test of range support below 1.29 as this area holds there is the potential for another upside attempt to test descending trendline resistance sited around 1.3050, however, a failure to recapture ground above Friday's highs will concern the nascent bullish spirits and likely see a retest of last weeks lows

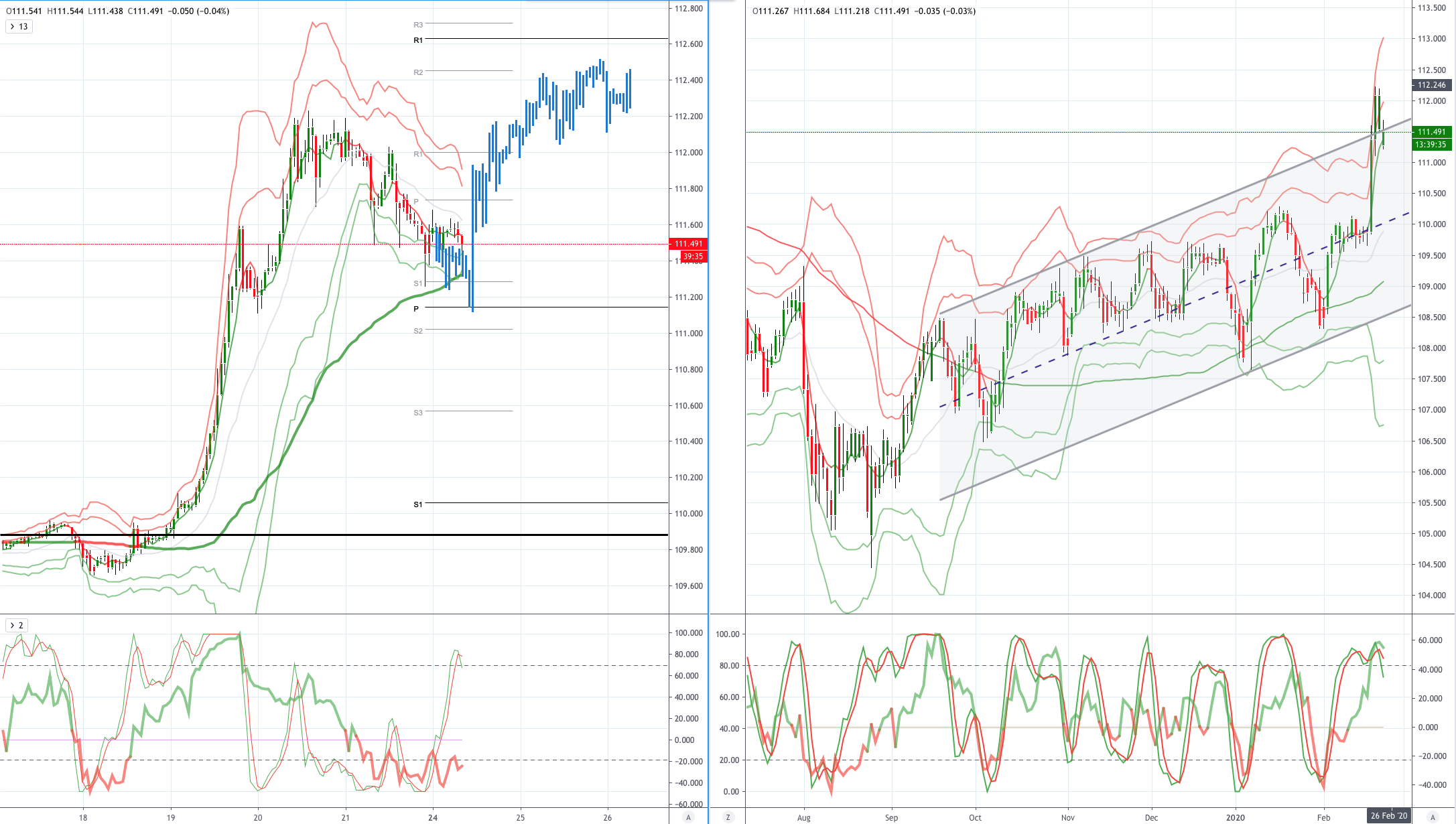

USDJPY (intraday bias: Bullish above 111.00 Bearish below)

USDJPY From a technical and trading perspective, test of offers and stops to 110.50 saw little to know resistance offered, yesterday's surge now targets a test of offers and stops above 112.50, would anticipate that this area will likely see profit taking emerge and the potentially for a correction to retest bids back towards 111.00

AUDUSD (Intraday bias: Bearish below .6640 Bullish above)

AUDUSD From a technical and trading perspective the equality target down to .6600 has been achieved, anticipate the potential for some profit taking around current levels, as .6570 supports we may witness an attempt to base here for a retest of offers back towards .6650

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!